Benefit Choice Options Period State of Illinois

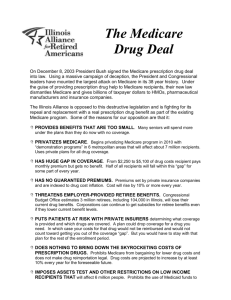

advertisement