UPDATED ECONOMIC AND FISCAL OUTLOOK

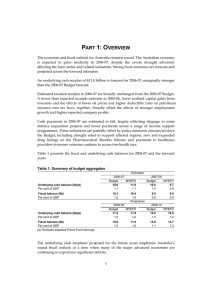

advertisement