A A: E F

advertisement

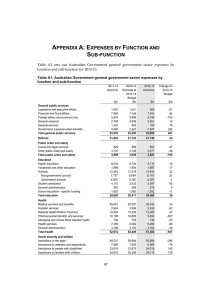

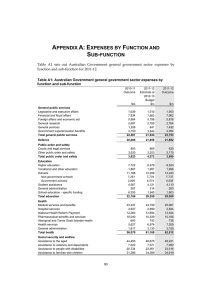

APPENDIX A: EXPENSES BY FUNCTION AND SUB-FUNCTION Table A1 sets out Australian Government general government sector expenses by function and sub-function for 2008-09. 87 Appendix A: Expenses by Function and Sub-function Table A1: Australian Government general government sector expenses by function and sub-function 2007-08 Outcome $m 2008-09 Estimate at 2009-10 Budget $m General public services Legislative and executive affairs Financial and fiscal affairs Foreign affairs and economic aid General research General services Government superannuation benefits Total general public services 961 6,102 3,881 2,146 925 2,600 16,615 819 5,946 4,972 2,722 761 2,689 17,910 728 6,331 4,763 2,237 995 2,142 17,197 Defence 17,670 18,745 19,190 950 2,556 3,506 1,012 2,675 3,687 981 2,578 3,558 Education Higher education Vocational and other education Schools Non-government schools(a) Government schools Student assistance(b) General administration School education - specific funding(a) Total education 6,850 1,554 9,163 6,085 3,078 472 5 389 18,433 6,747 1,829 10,677 6,336 4,342 562 94 1,592 21,502 7,013 1,881 11,416 7,210 4,206 1,532 38 721 22,601 Health Medical services and benefits Hospital services Health care agreements Pharmaceutical services and benefits Aboriginal and Torres Strait Islander health Health services General administration Health assistance to the aged Total health 19,089 1,791 9,968 8,593 500 2,876 764 816 44,397 20,629 2,947 10,563 9,332 517 3,947 1,331 107 49,373 20,767 3,023 10,505 9,210 523 3,720 1,291 107 49,146 Social security and welfare Assistance to the aged Assistance to veterans and dependants Assistance to people with disabilities Assistance to families with children(b) 35,454 6,395 14,368 28,528 40,314 6,891 17,286 38,770 40,367 6,902 17,229 38,381 Public order and safety Courts and legal services Other public order and safety Total public order and safety 88 2008-09 Outcome $m Appendix A: Expenses by Function and Sub-function Table A1: Australian Government general government sector expenses by function and sub-function (continued) 2007-08 Outcome Social security and welfare (continued) Assistance to the unemployed and the sick Common youth allowance Other welfare programs Aboriginal advancement nec General administration Total social security and welfare Housing and community amenities Housing Urban and regional development Environment protection Total housing and community amenities 2008-09 Outcome $m 2008-09 Estimate at 2009-10 Budget $m 4,371 2,026 2,464 1,418 2,818 97,842 5,168 2,359 9,163 2,183 2,781 124,915 5,098 2,504 9,235 1,703 3,163 124,581 1,646 164 1,100 3,216 166 1,029 3,430 139 1,511 $m 2,910 4,410 5,080 Recreation and culture Broadcasting Arts and cultural heritage Sport and recreation National estate and parks Total recreation and culture 1,320 1,267 450 171 3,207 1,372 1,055 359 211 2,997 1,495 1,092 339 180 3,107 Fuel and energy 5,361 6,280 5,806 Agriculture, forestry and fishing Wool industry Grains industry Dairy industry Cattle, sheep and pig industry Fishing, horticulture and other agriculture General assistance not allocated to specific industries Rural assistance Natural resources development General administration Total agriculture, forestry and fishing 57 110 69 165 353 48 120 50 169 269 46 118 55 164 256 456 1,343 766 516 3,834 98 1,164 785 565 3,267 102 1,006 388 587 2,723 Mining, manufacturing and construction 1,410 1,921 1,911 Transport and communication Communication Rail transport Air transport Road transport Sea transport Other transport and communication Total transport and communication 534 186 141 2,853 239 177 4,129 519 498 174 5,286 282 230 6,989 509 254 167 5,490 289 232 6,941 89 Appendix A: Expenses by Function and Sub-function Table A1: Australian Government general government sector expenses by function and sub-function (continued) 2007-08 Outcome Other economic affairs Tourism and area promotion Total labour and employment affairs Vocational and industry training Labour market assistance to job seekers and industry Industrial relations Immigration Other economic affairs nec Total other economic affairs Other purposes Public debt interest Interest on Australian Government's behalf Nominal superannuation interest General purpose inter-government transactions General revenue assistance States and Territories Local government assistance Assistance to other governments Natural disaster relief Contingency reserve(c) Total other purposes 2008-09 Outcome $m 2008-09 Estimate at 2009-10 Budget $m 207 4,506 999 195 5,463 1,343 192 5,040 1,359 1,896 508 1,102 1,213 5,926 2,129 689 1,302 1,380 7,037 1,859 546 1,276 1,275 6,507 3,544 3,544 6,011 3,938 3,938 6,432 3,946 3,946 6,715 45,277 45,433 45,248 42,627 1,798 852 28 8 54,868 42,382 2,384 667 398 -793 55,408 41,682 2,854 713 312 0 56,222 $m Total expenses 280,109 324,443 324,569 (a) Since the 2009-10 Budget, some expenses relating to non-government schools have been reclassified from the School Education — Specific Funding sub-function to the Non-Government Schools sub-function. (b) Since the 2009-10 Budget, the Education Tax Refund has been reclassified from the Assistance to Families with Children sub-function to the Student Assistance sub-function. (c) Asset sale related expenses are treated as a component of the Contingency Reserve. 90