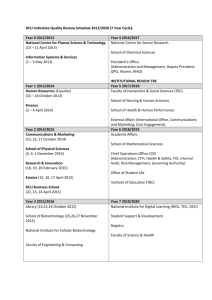

Contingency Allocation for Large Infrastructure Projects Using @ Risk 11/11/11

advertisement

Contingency Allocation for Large Infrastructure Projects Using @ Risk 11/11/11 Presented By Francisco Cruz, PMP, PMI-RMP Mitul Parikh, PE, PMP PMA Consultants Agenda • • • • Overview of PMA The Case for Risk Analysis Risk Analysis Approach for Large Infrastructure Projects Final Remarks Slide 2 PMA - Clients Slide 3 Risk Assessment Experience Over 250 cost & schedule risk assessments conducted across five continents for on & offshore drilling and production facilities, refining and chemical plants, pharmaceutical and solar manufacturing facilities, power and co-gen plants, and infrastructure projects Slide 4 (i.e., tunnels, airports, bridges, and ports) The Case - Key Observations What are the three most common causes of cost overruns? Material Price Escalation 60% 55% Poorly Defined Scope Industrial Relations Others 57% 36% 34% 21% 17% 15% Achieving Productivities 6% Lack of Approvals D i Design C Creep Time Delay 19% Achieving Productivities 57% Weather 32% Design Creep Poorly Defined Scope Contractual Disputes 36% Time Delay What are the three most common causes of delays? Lack of Approvals 40% Contractual Disputes Weather * Material Price Escalation 4% g Process Commissioning 2% 13% 2% Others 26% 19% * KPMG 2008 Global Construction Survey According to the Bent Flyvbjerg’s Flyvbjerg s Study on Large Projects Projects, • 9 out of 10 projects have cost overrun; • Overrun is found across the 20 nations and five continents. • Overrun is constant for the 70-year period covered by the study; cost estimates have not improved over time. Slide 5 * Cost Estimate Classification Matrix Class Degree of End Usage Expected Accuracy Range Project Definition V 0% to 2% Concept Screening -50% a +100% IV 1% tto 15% St d or Feasibility Study F ibilit -30% 30% a +50% 50% III 10% to 40% Budget Authorization or Control -20% a +30% II 30% to 70% Control or Bid/Tender -15% a +20% I 70% to 100% Check Estimate or Bid/Tender -10% a +15% Source: AACEI RP 18R-97 200 50 80 90 130 115 Rough Order of Magnitude Budget Authorization Definitive 100 Ud (Actual) Slide 6 Alarming Data Source: Flyvbjerg, B. - Survival of the Unfittest, 2009 Inaccuracy is constant for the 30-year period covered by the study; forecasts have not improved over time Source: Halcrow Fox, 2000 Slide 7 Projects with Undesired Cost-Benefit Cost Benefit Ratio Source: CATO Institute, Tax & Budget Bulletin, No. 17, 2003; FHWA - Predicted and Annual Impacts of New Starts Project – 2007; Flyvbjerg, Flyvbjerg B. B - Survival of the Unfittest Unfittest, 2009 • Characteristics. • Explanations. 1. Overestimate Benefits 1. Technical 2. Underestimate Cost 2. Psychological (Planning Fallacy and Optimism Bias) 3. Minimize Environmental Impact 4. Maximize Social Benefit 3. Political-Economic Underestimated Costs + Overestimated Benefits = Funding Slide 8 Projects with Good CostBenefit Ratio Source: FHWA - Predicted and Annual Impacts of New Starts Project – 2007 Slide 9 Organizational Vision Scope Integrated Project Deliveryy Cost Risk Analysis is not a Discrete Event Schedule Risk Slide 10 Life-cycle Risk Analysis Project Approval Preliminary & Detailed Planning Execution Closure Total Project Risks Risks Amount att Stake St k Amount at Stake Typical Risk Events per Phase Unavailable Subject j Matter Experts Poor Definition of Problem Unclear Obj ti Objectives Buy-in (by Competitive Bidding) No Risk Management g Plan Hasty Planning Poor Specifications Unclear Scope of Work No Management Support Poor Role Definition Inexperienced Team Unskilled Labor Material Availability A ailabilit Strikes, Weather Scope Changes Changes in Schedule Regulatory Requirements OSHA / EPA Compliance Poor Quality Unacceptable to Client As-Built Changes Cash Flow Problems Source: “Project Management … a Systems Approach to Planning, Scheduling & Controlling”, 7th edition Harold Kerzner, PhD Slide 11 Implementing A Risk Management Practice - Nurture • Well defined review, qualitative and quantitative processes Qualitative Risk Assessment Schedule Development, Estimate Review Quantitative Risk Analysis • Increasing standardization in templates, procedures, style • Clear recipe to integrate Risk Components • Stricter adherence to organization project management standards • Project Managers actively seek Recommended Project Cost &S Schedule h d l Contingencies C ti i risk support Slide 12 Implementing A Risk Management Practice - Mature Risk Management Planning • Migration to project risk assessment life cycle Review Process Risk Monitoring & Control Project Communication Summarize • Increasing standardization in templates, procedures, style • New risk components being integrated Risk Identification & Prioritization • Continued adherence and feedback to organization project management standards • Risk management inherent to Risk Response Planning Risk Quantification project management culture • Risk practice scalable to project size Slide 13 Benefits to Project Delivery Project j Document Review Clarity in Scope Assumptions. Qualitative Assessment Better Estimates. Recognition and transparency in project challenges. Better Schedules. Focus on project agenda. Improved Project Controls Brainstorming and innovative solutions. Quantitative Analysis y Risk based, documented project contingencies. SMART support pp to p project j change management. Early risk warnings and mitigation strategies. Risk Register is a Project Team’s Team s tool. tool Key stakeholders to the table. Slide 14 Schedule & Cost Risk Analysis Process Qualitative Risk Analysis OPRA™ Critical & “Risk-sensitive” s se s e sequences Project Risks & Uncertainty SRA Range Summarize Simulate Prioritize Review Simulate Model Identify RMP Summary Sequences Sequences, Probabilistic Branching Durations of Critical Activities Model Identify Project Scope, Estimate Issues, Project Assumptions, CPM & GPM Schedules, Possible Risks & Response Plans Estimates E Execution ti Pl Plans & Strategy Range CRA @Risk™ Cost Breakdown, Variables, & Distributions Develop Ranges for Variables: Scope, Price, Productivity, & Duration Reports, Graphics, Options to R Respond d tto risks Quantitative Risk Analysis Slide 15 Identify Risks Qualitative Risk Assessment Scope Price Schedule Productivity Technology Selection Design Options Level of Definition Equipment Design Environmental Onsite/Offsite Site Layout Demolition Market Conditions Equipment Vendors Materials Labor Rates Exchange Rates Engineering Rates Indirect/Overhead Construction Equipment Release of Work / Approval Periods Procurement Periods Equipment/Material Delivery Work Area Restrictions Coordination with j Other Projects External Constraints Vendor/Contractor Resources Near Operating Areas Workforce Quality Labor Productivity Turnaround Timing Contract Strategy Weather Conditions Manpower Density Shift Work/Overtime Other Contracting Strategy Joint Ventures Communication Permitting Political Influences Slide 16 Qualitative Risk Assessment Risk Management Planning R i Review Process Risk Monitoring & Control Project Communication Summarize Risk Response Planning Risk Identification & Prioritization Risk Quantification Slide 17 Risk Thresholds Figure 1: Defined Conditions for Probability Scales of a Risk Probability Low Medium High Very High 0% – 10% 11% to 30% 31% to 50% 51% to 70% >70% Figure 2: Defined Conditions for Impact Scales of a Risk on Major Project Objectives Project Objective Very Low Very Low Low Medium Cost Insignificant Cost Increase <2% of TPC 2 7% 2-7% Increase Time 0-2 Week Time Increase 3-6 Week Time Increase Scope Scope S Decrease Barely Noticeable Quality Quality Degradation Barely Noticeable High Cost 8 15% 8-15% Increase Very High Cost >15% 15% Cost Increase 7-12 Week Time Increase 13-18 Week Time Increase >18 Week Time increase Minor Areas of Scope Affected Major Areas of Scope Affected Scope S Reduction Unacceptable to PA Project P j t Does D not Satisfy Original Intent at Completion Only Most Demanding Specs Not Met Degradation Requires PA Approval Quality Reduction Unacceptable to PA Major Re-work Required to Complete Project Project team defines thresholds to classify risks and reduce subjectivity Slide 18 Prioritization • Probability & Impact Matrix (P/I) Probability VH 5.00 H 4.00 M 3.00 L 2.00 VL 1.00 5.00 4.00 3.00 2.00 1.00 1.00 VL Probability-Impact Score Legend High = > 9 Med = 5 - 9 Low = 1 - 4 10.00 8.00 6.00 4.00 2.00 2.00 L Threats 15.00 12.00 9.00 6.00 3.00 3.00 M I Impact t 20.00 16.00 12.00 8.00 4.00 4.00 H 25.00 20.00 15.00 10.00 5.00 5.00 VH Tolerance is used to define Ri k appetite Risk tit off the organization • Tolerance Thresholds Slide 19 Risk Register Sample S l Risk Ri k Register R i t used d tto prioritize i iti risks i k and d subsequently b tl input i t in the quantitative model. Slide 20 Quantitative Risk Analysis Risk M Management t Planning Review Risk Monitoring & Control Process Project j Communication Risk Identification & Prioritization Summarize Risk Response Pl Planning i Risk Q Quantification tifi ti Slide 21 Schedule Validation NetPoint - GPM Alternative to CPM Slide 22 Ranging Considerations Quantitative Risk Assessment • Do the potential outcomes fit the normal, triangular or beta distribution function? • Would a different distribution function be better, such as discrete/uniform or compound? • Does the deterministic schedule duration or the cost estimate ti t truly t l representt th the “most likely” outcome for that y activity? Slide 23 Schedule Risk Analysis Primavera Risk Analysis Include only y schedule driven Risks in the model. Slide 24 Schedule Risk Analysis Distribution Graph – Used to determine probabilistic completion dates for a given percentile. Data Finish Date of : Entire Plan Schedule Distribution Plot 892 100 Hits 80 60 40 20 0 17/06/2017 100% 29/01/2020 95% 23/09/2019 90% 31/07/2019 85% 08/07/2019 80% 14/06/2019 75% 21/05/2019 70% 01/05/2019 65% 10/04/2019 60% 21/03/2019 55% 01/03/2019 50% 19/02/2019 45% 31/01/2019 40% 17/01/2019 35% 31/12/2018 30% 13/12/2018 25% 26/11/2018 20% 06/11/2018 15% 15/10/2018 10% 13/09/2018 5% 31/07/2018 0% 15/02/2018 Cumulative Frrequency Entire Plan : Finish Date Analy sis Iterations: 1000 Statistics Minimum: Maximum: Mean: Bar Width: 15/02/2018 29/01/2020 21/02/2019 month Highlighters g g 50% 80% - Determinis... Deterministic (03... 80% 90% 19/02/2019 892 <1% 14/06/2019 31/07/2019 30/10/2018 Distribution st but o (sta (startt o of interval) te a ) Deterministic Date – 02/03/2017 P90 Date – 07/31/2019 Slide 25 Schedule Risk Analysis Tornado Diagram – Duration Cruciality (Correlation of Activity Duration & Criticality to Project Duration) Large Infrastructure Program - Probabilitic Schedule Duration Cruciality A155 - Preparation of 100% Design Documents 57% A240 - Select D/B Team & Execute Contract 43% A730 - Switch Traffic to Final Alignment 42% A160 - Designer Incorporates Review Comments 33% A140 - Review & Accept DDP Report A710 - Erect segments West 22% 14% A150 - Preparation & Review of 90% Design Documents 12% A410 - Set-up Casting Yard & Forms 12% A420 - Cast Segments East 12% Slide 26 Schedule Risk Analysis Tornado Diagram – Risks (Prioritized based on degree of influence on the project) Large Infrastructure Program - Probabilitic Schedule Duration Sensitivity REN4 - Environmental permits may not be received by Q1 2012 57% RC20 - Restricted Work Hours may delay construction 40% RD2 - Procurement Process could take longer than 8 months 32% RD11 - FHWA Design Exception for substandard geometry may not be received b... 31% RD9 - Cash Collection may not be temporarily stopped in toll Lanes 17% RD3 - Program amy not bet fully defined by Q1, 2012 RD1 - Design Package for Design Build may take longer than expected RD4 - Field Inspections may show considerable distress on main Structure 14% 11% 9% Slide 27 Schedule Risk Analysis Distribution Analyzer y - Helps p determine impact p of each risk on project p j schedule Distribution Analyzer Removing RD1 - Finish Date Removing RC14 - Finish Date Removing RC23 - Finish Date Removing RD2 - Finish Date Variation:13 Variation:128 Variation:19 Variation:144 Removing RC20 - Finish Date Removing REN4 - Finish Date Variation:111 Variation:73 Variation:82 Removing RD9 - Finish Date Removing RD11 - Finish Date All Risks - Finish Date 100% Variation:175 Variation:5 Variation:54 Variation:85 Variation:119 Variation:25 Variation:59 60% Variation:72 Variation:127 40% 20% 0% 22/ 09/ 2017 31/ 12/ 2017 10/ 04/ 2018 19/ 07/ 2018 27/ 10/ 2018 04/ 02/ 2019 15/ 05/ 2019 23/ 08/ 2019 01/ 12/ 2019 10/ 03/ 2020 18/ 06/ 2020 26/ 09/ 2020 Slide 28 04/ 01/ 2021 C u m u lative P ro b ab ili ty 80% Cost Risk Analysis • Palisade’s @ @Risk Model • Use only Cost driven risks in this analysis C t Ri Cost Risk kU Uncertainty t i t V Variables i bl • The following items can vary from the deterministic estimate based on the estimator’s interpretation of the Contract Documents • Quantity / type of material / Price • Construction Means & Methods • Labor & Equipment Productivity Slide 29 Typical Risk Assessment Exclusions • Changes in contracting strategy • Force Majeure, such as war or terrorist activities (work suspensions due to hurricanes included) • Drastic change in market conditions • Major scope changes g facility y operation p disruptions p • Significant • Strikes • Impact of Politics Slide 30 Cost Risk Analysis Insert Ranges (Risks & Estimate) & Define Distribution Slide 31 Cost Risk Analysis Simulation Settings Slide 32 Cost Risk Analysis Simulate Slide 33 Cost Risk Analysis Analyze Results Tornado Charts (Regression & Correlation Coefficients) Slide 34 Cost Risk Analysis Total Cost Distribution Graph Slide 35 Risk Based Contingency Schedule Based Cost Contingency from OPRA Overall Project Completion Variability (Probabilistic Dates‐ Deterministic Dates) Deterministic Contingency =(Probabilistic Date ‐ Deterministic Date) X Indirect Costs (i.e., $10,000/day) ‐ P10 587 $ 5,870,000 Most Likely ‐ P50 746 $ 7,460,000 P90 908 $ 9,080,000 OPRA – Oracle Primavera Risk Analysis Slide 36 Risk Based Contingency Cost Based Contingency from @Risk Overall Project Completion Total cost Risk Based cost contingency Deterministic Estimate $ 250,000,000 ‐ P10 $ 265,277,700 $ 15,277,700 Most Likely ‐ P50 $ 273,829,600 $ 23,829,600 P90 $ 283,200,200 $ 33,200,200 Slide 37 Integrated Cost & Schedule Risk Results C t D Cost Driven i C Contingency ti = $33 $33,200,000 200 000 Schedule Overrun = P90 Date – Deterministic Date = 908 d days Overhead/Financial Expenses - $ 10,000/day Schedule Based Cost Contingency = 908 X 10,000 = $9,080,000 Total Risk Based Contingency C = Schedule S C Contingency + C Cost C Contingency Total Risk Based Contingency (P90) = $ 42,280,000 Slide 38 Multi-Year Capital Forecasting Pre-Risk Assessment Capital Allocation 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Total Construction $0 $0 $25,000 $60,000 $65,000 $80,000 $20,000 $0 $0 $0 $250,000 Inflation $0 $0 $1,500 $5,400 $7,800 $12,000 $3,600 $0 $0 $0 $30,300 Total Direct Costs $0 $0 $26,500 $65,400 $72,800 $92,000 $23,600 $0 $0 $0 $280,300 Engineering Staff $7,000 $11,800 $13,000 $1,180 $1,180 $950 $950 $0 $0 $0 $36,060 Project Management Staff $3,000 $3,000 $8,000 $4,000 $5,000 $5,000 $5,000 $0 $0 $0 $33,000 Subtotal Staff Costs $10,000 $14,800 $21,000 $5,180 $6,180 $5,950 $5,950 $0 $0 $0 $69,060 Administrative Costs $200 $296 $420 $104 $124 $119 $119 $0 $0 $0 $1,381 Project Contingency $816 $1,208 $3,834 $5,655 $6,328 $7,846 $2,374 $0 $0 $0 $28,059 Total Indirect Costs $11,016 $16,304 $25,254 $10,938 $12,632 $13,915 $8,443 $0 $0 $0 $98,500 Total Project Cost $11,016 $16,304 $51,754 $76,338 $85,432 $105,915 $32,043 $0 $0 $0 $378,800 Total Project Cost (Cum) $11,016 $27,320 $79,073 $155,412 $240,843 $346,758 $378,800 $378,800 $378,800 $378,800 $378,800 Direct Costs Indirect Costs Empirical Contingency Allocation All figures should be multiplied by $1000 Slide 39 Multi-Year Capital Forecasting Post-Risk Assessment Capital Allocation Cost Categories 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Total Construction $0 $0 $30,000 $50,000 $54,000 $62,000 $24,000 $20,000 $10,000 $0 $250,000 Inflation $0 $0 $1 800 $1,800 $4 500 $4,500 $6 480 $6,480 $9 300 $9,300 $4 320 $4,320 $4 200 $4,200 $2 400 $2,400 $0 $33 000Risk $33,000 Total Direct Costs $0 $0 $31,800 $54,500 $60,480 $71,300 $28,320 $24,200 $12,400 $0 Based Contingency $283,000 Allocation Engineering Staff $7,000 $11,800 $13,000 $1,180 $1,180 $950 $950 $950 $950 $0 $37,960 Project Management Staff $3,000 $3,000 $8,000 $4,000 $5,000 $5,000 $5,000 $5,000 $5,000 $0 $43,000 Subtotal Staff Costs $10,000 $14,800 $21,000 $5,180 $6,180 $5,950 $5,950 $5,950 $5,950 $0 $80,960 Administrative Costs $200 $296 $420 $104 $124 $119 $119 $119 $119 $0 $1,619 Project Contingency $800 $900 $4,500 $6,080 $9,500 $12,000 $3,500 $3,000 $2,000 $0 $42,280 Total Indirect Costs $11,000 $15,996 $25,920 $11,364 $15,804 $18,069 $9,569 $9,069 $8,069 $0 $124,859 Total Project Cost $11,000 $15,996 $57,720 $65,864 $76,284 $89,369 $37,889 $33,269 $20,469 $0 $407,859 Total Project Cost (Cum) $11,000 $26,996 $84,716 $150,580 $226,863 $316,232 $354,121 $387,390 $407,859 $407,859 $407,859 Direct Costs Indirect Costs * Analysis represents a pre-mitigated analysis Additional Overhead Expenses All figures should be multiplied by $1000 Slide 40 Post Mitigated Analysis • Post-mitigated analysis can be used to: • Track the progress of mitigation in successive iterations of risk analyses to help re re-cast cast appropriate contingency levels • Perform what-if analyses on to determine the affect of specific mitigation steps and help the Team evaluate prudent measures for risk response Slide 41 Risk Monitoring & Control Risk Management Planning Review Process Risk Monitoring & Control Project Communication Risk Identification Summarize Ri k R Risk Response Planning Ri k Risk Quantification Slide 42 Risk Monitoring and Control • Often project risk assessments end up being expert-facilitated discrete events. • Project P j t tteams never ttake k ownership hi off risk i k monitoring and control. • Risk monitoring and control must become integral to project change management for a truly successful risk management process process. Slide 43 Risk Monitoring and Control * The results in the above chart are for illustration purposes only. They do not reflect current risk activity Contingency Management Contingency Rundown Chart R Remaining Contingency ($ Thousands) $25,000 Contingency Rundown Plan Contingency Rundown Actual $20,000 $15,000 $10,000 $5,000 $6 900 $6,900 $0 $5,100 Financial Period * Constantly monitored and revised as indicated by organization policy Slide 45 Final Remarks • Quantitative Risk Assessment should be performed at different stages of the project to revalidate the contingency. • Management M could ld have h a contingency i d drawdown d plan l b based d on their organization’s governance policy. • Risk Assessment helps owners devise better procurement strategies. • Risk Assessment can help an organization allocate proper amount of capital for a project and reduce project overruns Slide 46 References • Survival S i l off th the U Unfittest: fitt t Wh Why th the W Worstt IInfrastructure f t t G Gets t Built B ilt – And What We Can Do About It, Oxford Review of Economic Policy, vol. 25, no. 3, 2009, pp. 344-367 • FHWA – Risk Assessment and Allocation for Highway Construction Management • Palisade @Risk Webinar – Project Cost Analysis by Javier Ordonez, PhD • Schedule Risk Analysis – David Hulett • Integrated Cost - Schedule Risk Analysis – David Hulett Slide 47 Questions ? Slide 48 Contact Information Francisco Cruz Senior Engineer fcruz@pmaconsultants.com Mitul Parikh Senior Engineer mparikh@pmaconsultants.com Slide 49