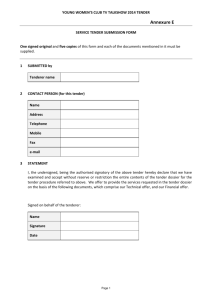

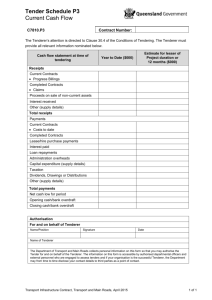

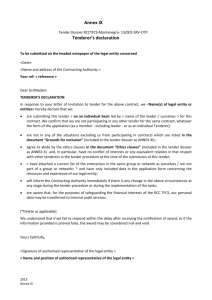

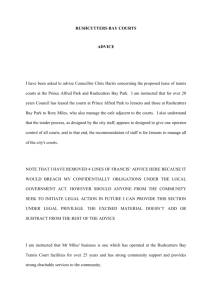

TENDER DOCUMENT PROFESSIONAL SERVICES

advertisement