CONTENT REVIEW OF FINANCIAL SKILLS MODULE OVERVIEW OF BASIC BOOKKEEPING

advertisement

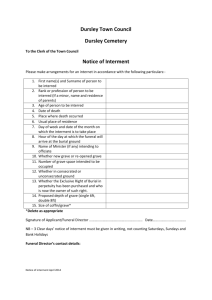

CONTENT REVIEW OF FINANCIAL SKILLS MODULE FLORIDA BUREAU OF FUNERAL AND CEMETERY SERVICES STATE EXAMINER TRAINING PROGRAM OVERVIEW OF BASIC BOOKKEEPING This section will contain information about: Transactions Journal General Ledger Record Keeping Accounting Transactions Objective: To review the basics of a funeral home or cemetery typical transactions, related journals, general ledger and resultant financial statements. We will also review the unique aspects of record-keeping for cemeteries and funeral homes which tend to be quite complex for the size of the typical operation. There are certain records that must be maintained by funeral homes and/or cemeteries that are unique to the industry. This is because of the importance of meeting the requirements of the sales contract as it was arranged at the time of sale, and because those who may be handling the future arrangements may not be the same people who made the initial arrangements. The accounting transactions for a typical sale can be much more complicated than for other businesses, and will be illustrated in this section. Record Keeping Requirements The necessity to retain documentation relating to funeral and final disposition transactions will vary according to the type of facility, the nature of the transaction, and the type of information involved. Permanent records should be retained for interment spaces and interments performed, records of interment right ownership and final disposition, and records relating to the cremation process. The following is a list of items limited to record keeping considerations arising from funeral service and cemetery transactions specifically related to contracts and final disposition. Permanent records should be kept for: • • • • • Each interment space sold. Instructions for final disposition of human remains Authorizations for cremations. Each interment performed. Data on each memorial installed in the cemetery. There are other important aspects to maintaining records, such as: • • • Copies of all prepaid contracts and a record of prepaid contract trust fund deposits and withdrawals should be retained for a specified time period following performance or cancellations of the contract. At need contracts should be retained for a specified time period following performance. The State regulatory authority should have reasonable access to examine required records to determine compliance.