Contests with Many Heterogeneous Agents ∗ S´ergio O. Parreiras Anna Rubinchik

advertisement

Contests with Many Heterogeneous Agents∗

Sérgio O. Parreiras†

Anna Rubinchik‡

May 2006

Abstract

We study tournaments with many ex-ante asymmetric contestants.

The asymmetry is either with respect to the agents’ distribution of

valuations for the prize or with respect their risk-aversion (CARA)

parameter. We characterize equilibria in monotone strategies and

show that tournaments with many asymmetric agents are qualitatively distinct. First, in tournaments with two asymmetric (or many

symmetric) participants, an agent always exerts some effort with positive probability. In contrast, with many asymmetric participants,

an agent might not exert any effort at all, even if there is a positive

probability that he has the highest valuation among all contestants.

Secondly, in tournaments with two asymmetric (or many symmetric)

agents, equilibrium effort densities are always decreasing. This prediction is at odds with experimental evidence that shows the empirical

density might be increasing at high effort levels. With many asymmetric agents, however, the increasing bid density is consistent with

an equilibrium behavior.

JEL Classification: D44, C72, D82

Key words:all-pay auctions, tournaments, asymmetric bidders

∗

We would like to thank participants of the International Conference of Game Theory; the World Game Theory Congress, seminar participants at Duke University, UNC

at Chapel Hill, EPGE-FGV-RJ, Queen’s University, University of CO at Boulder. Gary

Biglaiser, Jim Friedman, Jennifer Lamping, Vijay Krishna, Eric Maskin, Humberto Moreira, Claudio Mezzetti provided useful remarks. We are also grateful to Bernard Lebrun

for sending us his working paper.

†

Department of Economics, UNC at Chapel Hill, sergiop@unc.edu

‡

Department of Economics, CU at Boulder, Anna.Rubinchik@colorado.edu

1

1

Introduction

It is hard to imagine an area of human activity that does not involve

contests. Students striving to be the best in their class, employees awaiting

promotion, sportsmen fighting for a gold medal, researchers competing for

grants, R&D firms racing to capture monopoly profits — all can be viewed as

players in games with a single winner. Typically, the rest of the participants

are losers, who have to absorb the cost of the invested effort. This is the

scenario we consider in this paper.

Casual observation suggests that often participants of such contests can

be roughly divided into two main categories: those who invest a minimal

effort, being reasonably sceptical about the possibility of winning, and the

others who fight with all their might to win the prize — drop-outs and

workaholics, as Muller and Schotter (2003) call them. This phenomenon has

some empirical support. In experiments with six subjects, whose valuations

for the prize are uniformly distributed, (Muller and Schotter 2003, Noussair

and Silver 2005) demonstrate that empirical distribution of effort is bimodal,

with one mode located near the lowest observed level and another one near

the highest effort level compatible with rational play.1 Following Muller and

Schotter (2003), we call the former the drop-out and the latter – the race-tothe-bottom effect.

These findings might seem puzzling in the view of the existing all-pay auction literature. In a setting with two contestants, as in Amann and Leininger

(1996), equilibrium effort density is always decreasing. The same is true for

symmetric models with many contestants, as in Gavious, Moldovanu, and

Sela (2002). We show that with more than two participants who either (1)

have different (CARA) risk-aversion parameters and the same distribution

of valuations for the prize, or (2) are risk neutral and have their valuations

distributed differently, the race-to-the-bottom effect (i.e., the local mode at

high effort levels) can be explained. Thus, introducing asymmetry might

qualitatively change the density of equilibrium effort levels. In particular, a

1

Besides a linear specification for the cost of effort/bidding, Muller and Schotter (2003)

also consider non-linear costs of effort/bidding, getting similar qualitative results. From

the theoretical point of view, the assumption of linear costs entails no loss of generality

N

because, bids can always be re-scaled in order to satisfy this assumption. If (bi )i=1 is

N

an equilibrium strategy profile for the model with non-linear costs then (c ◦ bi )i=1 is an

equilibrium for the model with linear costs, as long as, the cost function c is continuous

and strictly increasing.

2

“weak” contestant facing “stronger” rivals might very often either put in a

negligible effort, or — at the other extreme — work very hard. Stronger yet,

in our set-up equilibrium effort density might be increasing at the top. In

addition, case (2) is consistent with a complete drop-out behavior. An agent

who is perceived to have a lower (in the first-order stochastic dominance

sense) distribution of valuations may choose to always exert zero effort in

equilibrium regardless of his valuation. This is true even though there is a

positive probability that his valuation is the highest, hence the equilibrium

allocation is not always efficient in this case. Both of these qualitative features are in contrast with the two-agent or symmetric-agent models, which

generate a monotonically decreasing effort density and where every agent

exerts some effort with positive probability.

One might expect risk aversion to explain the drop-out and race-to-thebottom effects. In a symmetric model, Fibich, Gavious, and Sela (2004)

show that, indeed, a small increase in risk-aversion makes low-valuation contestants exert less effort and high-valuation contestants exert more effort in

comparison with the risk-neutral benchmark. A small perturbation of the

risk-neutral model, however, does not change the qualitative features of the

equilibrium effort (bid) distribution: in particular, the distribution of effort

remains always decreasing for small degrees of risk-aversion. Moreover, we

show that no matter how risk averse the contestants are, their equilibrium

effort density is decreasing, if all of them have identical attitudes towards risk

with preferences represented by the constant absolute risk aversion function

(CARA).

In sum, risk-aversion per se, at least in the CARA case, is incapable of

explaining the local mode of high effort. Key ingredients to account for raceto-the-bottom effect are heterogeneity of the contestants (differences in risk

attitudes or in distributions of abilities/value for the prize) and there being

more than two contestants.

We show that the equilibrium distribution of effort in an asymmetric,

but only two-player contest is also decreasing. In accord with this finding is

the available experimental evidence by Kirchamp (2005) showing a negligible

race-to-the-bottom effect in two-player contests.

One might view the existing models as accounting for the drop-out effect,

because the equilibrium effort densities are typically infinitely high at zero.

In these models, however, the complete drop-out effect (zero effort for all

valuations) is ruled out. With two agents, if an agent always exerts zero

3

effort, the competitor will try to exert a ‘minimal’ effort level.2 In turn, one’s

best-response to the ‘minimal’ effort is to exert a positive effort. Therefore, an

agent always choosing no-effort when he faces only one rival, is incompatible

with an equilibrium.3 Also, the complete drop-out can never arise in an

equilibrium with many ex-ante symmetric contestants because the symmetric

equilibrium is unique.4

Incorporating the ex-ante asymmetry without loosing tractability is, by

itself, another attractive feature of our model. In a variety of actual contests participants differ in their desire to win, and this can be easily detected by their rivals at the very start. In the examples we have mentioned,

contestants — no doubt — use commonly observable characteristics of the

rivals to infer their valuations for the prize. The characteristics (e.g., background, previous experience, gender, age) differ across individuals, so, naturally, such environments are asymmetric. However, the precise values are

usually hard to induce, and some residual uncertainty often remains. Hence,

conditional on observable characteristics of an individual, her valuation is

still non-deterministic in the eyes of the others. In line with most of the

literature on the subject, we assume that contestants’ beliefs about the value

associated with winning by a particular individual can be reduced to a probability distribution, which is commonly shared by all. In other words, any

two contestants share a common prior about distribution of value for the

prize held by any third contestant.

Related literature. Apart from the contributions mentioned above, we

will briefly mention some of the related others, clearly, not even attempting

to provide an adequate survey of the literature on tournaments and all-pay

auctions. Contests under complete information about individual valuations

with several participants were analyzed by Hillman and Riley (1989) and

Baye, Kovenock, and de Vries (1996): apart from knife-edge cases, the two

individuals with the highest values for the prize enter the competition, while

the rest drop out. Although the full-information models might account for a

complete drop-out effect, it is hard to interpret the results as generating the

race-to-the-bottom effect. Besides, as follows from the examples mentioned

at the outset, it might be desirable — from a positive perspective — to leave

some uncertainty about rivals’ preferences in the model.

2

The best response function is not well defined in this case.

In all statements, ‘equilibrium’ stands for ‘equilibrium in non-decreasing strategies’.

4

By Parreiras and Rubinchik-Pessach (2006), in the symmetric setting, equilibrium

strategies are continuous. Uniqueness follows from Proposition 11, in the Appendix.

3

4

In all the literature known to the authors dealing with contests under

incomplete information, either the contestants are ex-ante identical, or there

are only two participants. The latter case with independent valuations was

studied by Amann and Leininger (1996), who, in particular, demonstrated

that distribution of effort of one of the contestants might have a mass point at

zero, thus, generating the drop-out effect. Lizzeri and Persico (1998) analyzed

a two-person contest with affiliated signals. Contests with ex-ante identical

participants whose valuations are affiliated were examined (in addition to

the contributions mentioned earlier) by Krishna and Morgan (1997). The

incomplete information case with many symmetric participants independent

signals was extended by Gavious, Moldovanu, and Sela (2002) to allow for

non-linear cost of effort, and by Fibich, Gavious, and Sela (2004) to allow

for a small degree of risk-aversion.

With the exception of the models that allow for affiliated signals (Krishna

and Morgan 1997, Lizzeri and Persico 1998) all the previous incomplete information all-pay auctions models are nested within our model. Moreover,

the mixed strategy equilibrium of complete information models (Hillman

and Riley 1989, Baye, Kovenock, and de Vries 1993, Baye, Kovenock, and

de Vries 1996, Che and Gale 1998) can also be described by our Proposition

1 for any strictly positive effort level.

We present the model next, characterize the equilibrium in Section 2.1,

providing sufficient conditions for its uniqueness in Section A.4, and formulate our main results in Section 3. Proofs omitted in the text are collected

in the Appendix.

2

The Model

There are N ≥ 2 individuals competing for a prize. The prize is allocated

to the contestant who demonstrates the top performance or achieves the best

result. We assume that one’s performance fully reflects own effort. Simply

put, effort is observable. The contestants have different values associated

with receiving the prize, that is, the desire to win,5 varies across participants.

The payoff to the winner, say, contestant k, who exerts costly effort b ≥ 0, is

uk (vk − b + w)

5

For the risk-neutral model, i’s valuation for the prize, vi , may also be interpreted the

reciprocal of i’s marginal cost of effort, or simply, as a measure of i’s ability.

5

while the losers get uj (w − b), j 6= k, where w > 0 is the initial wealth

of a contestant, substantial enough, so that a contestant is never resourceconstrained in choosing an effort (bid), the value of which is always bounded

by v i , her highest possible valuation of the prize, w > maxi v i . We assume

the contestants are weakly risk averse with ui : R → R+ , twice differentiable,

strictly increasing and concave.

Before deciding on one’s effort, each contestant becomes aware of the own

desire to win, v. Based on the observed characteristics a rival, i, one forms

a probabilistic prior with respect to the value, vi , that the rival attaches

to winning, the value, which is viewed as a random variable, Vi , by all the

contestants but i. Naturally, then, in the eyes of all contestants, values of the

rivals are distributed independently, but not necessarily identically, Vi ∼ Fi

on [v, v i ].

We assume that each Fi is differentiable and that its derivative, the probability density function, fi , is continuous and is bounded away from zero for

all v ∈ [v, v i ].6

To choose an optimal level of effort, or, simply, a bid, b, any contestant i

has to maximize the payoff that will result from placing that bid,

Πi (b|vi ) = Wi (b; b−i ) ui (vi − b + w) + (1 − Wi (b; b−i ))ui (w − b) ,

(1)

where Wi (·) is the probability of winning, which, in particular, is driven by

the effort levels chosen by the others, that is, their strategies.

A strategy for individual i is a Lebesgue–measurable function that maps

valuations into effort levels, bi : [v, v i ] → R+ . We restrict attention to equilibria in which contestants with higher valuations for the prize expend (weakly)

higher effort, or, simply, bid higher. Existence of a Bayes-Nash equilibrium

in non-decreasing strategies follows from Athey (2001, Theorem 7, p. 881).

Moreover, if a contestant bids above zero, her strategy is strictly increasing in a Bayes-Nash equilibrium in non-decreasing strategies, as follows from

Lemma (2) in the Appendix. This observation enables us to formulate inverse bid functions that associate bid b with the valuation of the contestant

who places that bid. Clearly, in an asymmetric environment these functions

might vary by contestant.

Let the generalized inverse bid function of contestant i be denoted by

6

The last assumption is used for the proof of equilibrium uniqueness, but can be relaxed

for the rest of the analysis. Later we consider examples in which the assumption is dropped.

6

φi (b), R → [v, v i ]

φi (b) ≡ max (v, sup {v : bi (v) ≤ b}) , i = 1, . . . , N.

The generalized inverse bid satisfy the following properties: it agrees

with the inverse bid b−1

whenever the latter is well-defined; it is constant at

i

any point of discontinuity (jump) of the bid function, and it returns v for

any bid b strictly below the lowest equilibrium bid; it is continuous;7 and

it is differentiable almost everywhere since it is a bounded, non-decreasing

function. Finally, given these functions we can determine,

Gi (b) ≡ Prob [bi (Vi ) ≤ b] = Fi (φi (b)),

the probability that contestant i bids at or below b. Then the probability

of winning by contestant i who bids b can be expressed as the product of

cumulative distributions of equilibrium bids,

Y

Wi (b) ≡

Gj (b).

j6=i

2.1

Equilibrium

Fix the bidding behavior of all the contestants, but i. To maximize the

payoff (1) , contestant i with valuation vi should choose b ≤ vi to equate the

marginal benefit and the marginal cost from bidding b (if such value b exists),

M Bi (b) = M Ci (b) ,

M Bi (b) ≡ [ui (vi − b + w) − ui (w − b)] Wi′ (b)

M Ci (b) ≡ u′i (w − b) (1 − Wi (b)) + u′i (vi − b + w)Wi (b)

(2)

where the marginal probability of winning is

XY

Wi′ (b) =

Gk (b)gj (b).

j6=i k6=i,j

Remark 1 Since contestants are weakly risk-averse, M Bi (b) − M Ci (b) is

strictly increasing in vi for b > 0. In other words, Πi (b|vi ) satisfies the strict

single-crossing property.

7

Lemma 3 in the Appendix, section A.2.

7

If the marginal benefit is below marginal cost for any choice of b ∈ (0, vi ],

then contestant i with valuation vi should drop out, that is, choose bi (vi ) = 0.

To characterize an equilibrium, therefore, we need to identify the set of

active participants. For this purpose, given an equilibrium strategy profile,

for any effort level b > 0, we define the set of contestants who choose this

effort level, for some realizations of their valuations,

J (b) = {j ∈ {1, .., N } |∃vj ∈ [v, v j ] : bj (vj ) = b} .

It is important to keep in mind that, in contrast with the symmetric model,

this set might not include all the contestants for some b > 0. In other words, it

might happen in an equilibrium that the contestants choose different bidding

intervals. It not hard to see, however, that for any bid b in the support

of equilibrium bids there should be at least two contestants who, for some

realization of their valuations, choose to bid b, in other words the set J (b)

always contains at least two elements.

By definition, if contestant j’s highest equilibrium bid, bj , is strictly below

b, then Gj (b) = 1.

If satisfied with equality, the system of the first order conditions (2) can

be re-arranged in the following form,

X gj (b)

= Si (b) , i ∈ J (b) , b > 0;

Gj (b)

j6=i

(3)

where gj (b) ≡ fj (φj (b))φ′j (b) is the probability density function of the bids

placed by contestant i and

Si (b) ≡

M Ci (b)

> 0.

Wi (b) (ui (vi − b + w) − ui (w − b))

(4)

Also, in an equilibrium it has to be the case that if contestant i with

valuation vi exerts effort b, then vi = φi (b) .

By inspecting the first order conditions (3) , one can easily notice that

the right hand side, Si (b) , does not involve effort density functions for any

contestant, so the system of equations (3) is linear in gi (b) for any b > 0.

The following proposition provides a solution to the system in terms of bid

densities. These conditions are necessarily satisfied in an equilibrium.

8

Proposition 1 For almost all bids,8 b > 0, the system of first order conditions (3) can be represented as

!

P

Gi (b)

Sj (b) − (K(b) − 2)Si (b) , i ∈ J (b)

(K(b)−1)

gi (b) =

(5)

j∈J(b)\{i}

0,

otherwise

where K(b) = #J (b) is the number of contestants with a type who bids b.

This representation of the necessary conditions simplifies the problem of

finding an equilibrium in an asymmetric environment. Indeed, the derivative

′

gi (b)

of contestant i (when it exists)

of the inverse bid density, φi (b) = fi (φ

i (b))

is expressed in terms of own and rivals’ inverse bid densities, φj (b) , that

determine the corresponding terms Sj (b). Notice the term

X

∆Si (b) ≡

Sj (b) − (K(b) − 2)Si (b)

j∈J(b)\{i}

is negative only if M Ci (b) > M Bi (b), that is, only when it is not optimal

for contestant of type vi to bid b. Moreover, as noticed before, K (b) ≥ 2.

Thus, the density is well defined.

Observe that necessary conditions (5) do not assure that bid functions

bi (vi ) are continuous in an equilibrium. An earlier version of this paper,

Parreiras and Rubinchik-Pessach (2006), uses arguments of Lebrun (1999)

to provide a set of sufficient conditions for the continuity of equilibrium

strategies for the risk-neutral case. Along with the continuity, conditions (5)

coupled with the condition bi (v i ) = bi fully determine a unique solution, see

argument in the Appendix, section A.4. Clearly, in those cases, necessary

conditions (5) fully characterize the equilibrium.

The system (5) can be solved for equilibrium inverse bids. In general,

only numerical solutions can be obtained. Nevertheless, Parreiras (2006)

derives closed-form solutions for the case in which valuations are distributed

uniformly with the contestant-specific support. Moreover, we can use the sign

of the expression ∆Si (b) to construct an indicator of individual participation.

This enables us to derive the results in Section 3.1.2, describing sufficient

conditions for a complete drop-out of some contestants. Finally, and – most

8

More exactly, (5) holds for all b > 0 where the inverse bid functions are differentiable

and the set of active contestants, J(b), is constant in some neighborhood of b.

9

importantly – characterization (5) provides a way to demonstrate our main

results resting on the shape of the effort density, in particular, the sign of its

derivative at the top bid. We identify cases in which that sign is positive, that

is, some of the contestants intensify their efforts provided their valuation is

close enough to the top, thus providing a rationalization for the phenomena

demonstrated experimentally by Muller and Schotter (2003) and Noussair

and Silver (2005), — the phenomena that can not be explained within models

with either symmetric or two-contestant environments.

3

Qualitative Predictions

3.1

3.1.1

Participants and Drop-outs

Partial Drop-Outs

We start by examining partial drop-out, when the contestant is inactive

provided the own valuation is too low, but starts bidding positive amount

for high enough valuations. Description of the equilibrium bid distribution

at zero is a clear indicator of the (partial) drop-out behavior, which is used

to derive the following result.

Let n be the number

S of active contestants, that is, those who might place

a positive bid, n = # b>0 J (b).

Proposition 2 All active contestants choose zero as their lowest bid, bi (v) =

0 for all i. If v > 0 then either

1. All but one, n − 1, active contestants choose zero bid with positive

probability or

2. None of the active contestants does, so that Gi (0) = 0, and all are

infinitely more likely to choose the lowest bid than any other bid, that

is, limbց0 gi (b) = +∞ for all i.

Proposition 2 asserts that there is no equilibrium in which the lowest bid is

strictly positive. Moreover, only two scenarios are possible. First, exactly n−

1 of the active contestants bid zero if the valuation is sufficiently low, that is,

they drop-out with positive probability. Secondly, all the active contestants

bid a positive amount whenever their valuation is strictly positive, but anyone

is infinitely more likely to ‘drop-out’ than to exert any given positive effort

10

level in an equilibrium. Clearly, this last scenario is the only one possible in

a symmetric environment.

This finding suggests robustness of the result by Amann and Leininger

(1996) demonstrating possibility of drop-out behavior in the model with two

contestants. Also, drop-out behavior happens with positive probability under

complete information (Baye, Kovenock, and de Vries 1996).9

3.1.2

Complete Drop-Out

It is known that either in symmetric or two-contestant asymmetric environments, the highest ability individual exerts the highest equilibrium level of

effort. In contrast, asymmetric environments with more than two contestants

may give rise to a complete drop-out behavior, that is, in equilibrium a contestant exerts zero effort regardless of his valuation.

When contestants are risk-neutral, personal valuation attached to the

prize can be alternatively viewed as a reciprocal of one’s cost of effort, or

just as individual ability.

The following proposition states that when all the contestants are riskneutral and are likely to have high abilities; and among them there is a

contestant, say i, whose highest possible ability is substantially below the

average; and moreover, all the highest-ability types of the rivals exert the

highest equilibrium effort level, then contestant i should not participate in

the contest at all, no matter how able he is (or how much he desires the

prize). That is, contestant i should always exert zero effort level regardless

of his ability.

Proposition 3 Assume that contestants are risk-neutral. If

1. For all j, Fj weakly first-order stochastically dominates U [0, v j ];

2. There is an i such that the inequality v −1

i >

9

P

v −1

j

N −2

j6=i

holds;

In those equilibria, contestant j may never exert effort in (0, ej ) while exerting zero

effort and an effort above ej with positive probability. Note that in that case an equilibrium

strategy is a map from the values to a distribution over the set of bids and for the bids

belonging to the support of a contestant’s mixed strategy, so condition (2) should be

satisfied (with the probability of winning re-defined correspondingly). However, as the

first-order conditions of contestant i may not hold with equality in a neighborhood of

zero, which is the lowest equilibrium bid, the proof of Proposition 2 can not be employed,

∂

as under incomplete information, ∂b

Π(b|φi (b)) = 0 for all b ≥ 0.

11

3. For all j 6= i, φj (b) = v j ;

Then bi (v) = 0 for all v ∈ [v, v i ].

Notice that, since the smallest type is the same for all agents, v, the

agent does not participate despite the fact that there always exists a positive

probability that his ability is higher than the abilities of all the others.

The proposition can also be read as saying that for a fixed level of i’s

ability, say vi > v, the agent is not going to exert any effort, if the other

agents’ perceive him as having a ‘lower’ distribution of abilities (and it is

common knowledge), while the agent is going to exert effort, if the the other

agents’ perceive him as having a ‘higher’ distribution.

Some intuition for this result can be gained from the following observation. Lowering the upper bound of i’s valuation (and smoothly updating

his density, fi ) increases marginal probability of winning for the rivals, and

thus, their M B for low values of b (M Ci (b) = 1 in the risk-neutral case),

thus intensifying competition for participants with low abilities, but that decreases the chances of i to win, and, therefore, his expected profit, making

him better-off not participating if his v i and, thus, his probability of winning,

is low enough.

This proposition can be also used for cases in which a subgroup of the

agents never bid. In other words, the proposition can be applied to rule

out participation of several contestants. For example, when valuations are

uniformly distributed, Parreiras (2006) characterizes the set of agents who

never exert effort as a function of the primitives of the model.

Example 1 Let N = 3 and assume individual abilities are uniformly distributed, that is, Fi (v) = αvi for 0 ≤ v ≤ vi , and let α1 = 6 and α2 = 3. If

α3 < 2, the third agent drops-out completely, b3 (v) ≡ 0.10

Notice that when v3 = 1.5, agent 3 has one out of eight chance of having

the highest valuation, but he is only going to exert positive effort when the

others perceive him as being sufficiently ‘strong’, that is, when α3 > 2. Figure

1 depicts the agents’ payoffs as α3 increases from 1 to 8.

The next proposition shows that complete drop-out is inconsistent with an

equilibrium (in the risk-neutral case) for contestants whose highest possible

10

We refer the reader to the working paper version of this paper, Parreiras and

Rubinchik-Pessach (2006), or also Parreiras (2006) for the complete characterization of

the equilibrium and payoffs in the uniform case.

12

1.5

Π1

0.5

0

2

3

4 α 5

6

7

8

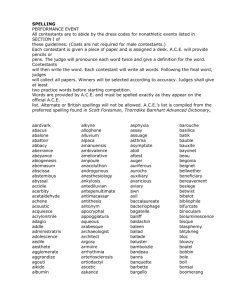

Figure 1: The players’ payoffs as functions of α3

ability is the same. In particular, even if contestant i has an arbitrarily ‘low’

distribution of abilities, say, in the first-order stochastic dominance sense, it

is not enough to yield a complete drop-out, moreover, i will bid in the same

interval as his ‘stronger’ rival j, if the distributions of abilities of the two

have common support. Hence, common-knowledge that the agent’s highest

possible ability, v i , is different from the others, is crucial for the complete

drop-out result.

Proposition 4 Assume that the contestants are risk-neutral and assume valuations of contestants i and j have common support, that is, v i = v j . If

bi (v i ) = b, then bj (v j ) = b.

3.2

Workaholics

In the introduction we mentioned that the two-contestant model and the

symmetric model with many contestants, that were analyzed in the previous

literature, can be tackled within the current framework. Let us start with

these cases to assert that neither of them can generate workaholic behavior.

Indeed, the effort density is monotonically decreasing for each contestant

under symmetry or if there are two players only, simply meaning that higher

efforts are chosen less frequently by all participants.

Proposition 5 Assume that contestants are risk-neutral and at least one

of the following conditions is satisfied: (1) the distribution of abilities is

13

the same for all contestants (symmetric model); (2) there are only two contestants. Then, the equilibrium bid probability density function of any contestant is non-increasing.

We can even strengthen the previous finding by allowing the agents to

be risk averse. Provided the distribution of valuations is the same for all

and their risk attitudes are the same as well (and satisfy CARA), higher

efforts are still more rare in equilibrium, thus, eliminating the second mode

of the distribution of bids discussed in the experimental literature. The same

result is true in the presence of only two contestants with potentially different

coefficients of risk aversion.

Proposition 6 Assume contestants’ utility functions exhibit constant absolute risk aversion and the distribution of valuations is the same for all.

Also, assume that at least one of the following conditions is satisfied: (1) the

risk-aversion parameter is the same for all contestants; (2) there are only

two contestants. Then, the equilibrium bid probability density function of

any contestant is non-increasing.

In contrast, in the presence of asymmetry competition for the prize might

become fierce. We start with the risk-neutral case in which distributions of

abilities differ across contestants, e.g., some might be perceived as ‘strong’

opponents, while the others are viewed as ‘weak.’ Interestingly enough, it is

the ‘weak’ contestant — the rivals of whom dismiss almost completely the

possibility of her having a high value for the prize, or of her being of the

top ability, — it is she who might race to the bottom. The ex-ante weak

contestant will do so, provided her ability is, in fact, very high, or close

to be the highest — exactly the case almost entirely “overlooked” by her

opponents. Provided they are competing mainly among themselves, almost

ignoring their weak rival (when placing high bids), it is in the interest of that

weak contestant to exert high effort as the chance of winning from doing

so for her is sufficiently high. Of course, the rivals are fully aware of the

equilibrium strategy of the weak contestant, but in their eyes the likelihood

of their opponent being very able and aggressive is sufficiently small, thus,

for each of the strong contestants, standing against other strong rivals is

relatively more important, and they, indeed, almost ignore the presence of

the weak. That is the core intuition behind the following proposition.

14

Proposition 7 Assume contestants are risk-neutral and there are more than

two contestants. In addition, assume all contestants are bidding in the same

interval. Then, there are distributions of valuations such that some contestants’ effort density is increasing at high effort levels, so that whenever

for some contestant i

1

1 X 1

−

>v

fi (v) N − 2 j6=i fj (v)

(6)

we have gi′ (b) > 0.

The next example illustrates this proposition. By Proposition 4, it is

sufficient to have the participants’ abilities lie within a common interval

in order to satisfy assumption requiring common bidding interval. Finally,

condition (6) requires one of the contestants, i, to be of the highest ability

‘rare enough,’ let us refer to this person as ‘underdog.’ In the example,

the underdog is contestant

1, for whom f1 (v) = 0, while fj (v̄) = 1, so

P

limv→v̄ fi1(v) − N 1−2 j6=i fj1(v) = ∞.

Example 2 All three contestants are risk neutral, their abilities assume values within interval [0, 1]. Player 1’s ability is distributed F1 (v1 ) = 2v1 − v12

and the ability of player j ∈ {2, 3} is distributed uniformly, Fj (vj ) = vj .

To formulate the equilibrium in this example we define auxiliary function

Q : [0, 1] −→ [0, 1] that maps the value of bidder one, v, into the type of

bidders 2, 3, who bid the same bid as the first bidder.

Q (v) =

1 e2

.

v 2 e2/v

(7)

Its inverse Q−1 exists and, it is differentiable in (0, 1].11

4(v−1)

2

3 exp

v

32 − 8v − 4v − v

Lemma 1 The strategies b1 (v) =

and bj (v) =

32

v3

b1 (Q−1 (v)), j ∈ {2, 3} are a Bayes–Nash equilibrium for the contest game of

Example 2.

11

The function Q is a bijection because limv→0 Q(v) = 0, Q(1) = 1 and Q′ > 0.

15

It follows, the bid density of player 1 is

g1 (b) =

f1 (φ1 (b)) φ′1 (b)

f1 (φ1 (b))

φ1 (b)5

= ′

=

exp

b1 (φ1 (b))

2

4

−4 ,

φ1 (b)

which is increasing for high effort levels, as its derivative,

φ1 (b)4

4

4

′

′

g1 (b) = φ1 (b)

exp

−4 5−

,

2

φ1 (b)

φ1 (b)

evaluated in a neighborhood of b is positive, since φ′1 > 0 and φ1 (b) = 1.

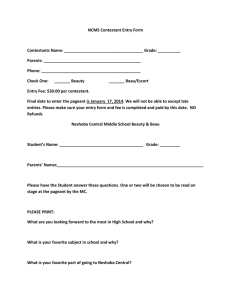

We use a parametric plot, [x(v), y(v)] = [b1 (v), g1 (b1 (v))], to display the

graph of the bid density of player 1 without solving explicitly for φ1 (b). The

density increases for high effort levels, chosen in equilibrium by player 1, in

case he has high ability.

0.56

0.54

0.52

Density

0.5

0.48

0.46

0.3

0.35

0.4

0.45

0.5

0.55

Bids

Figure 2: The bid density, g1 (b), evaluated at high bids.

16

Next result demonstrates that if the contestants differ by their attitudes

towards risk, similar conclusion to that in Proposition 7 can be obtained.

Here a weak contestant — in this case the contestant who is more risk averse

— faces stronger rivals, who are, say, risk-neutral. In this case, we show that

the weaker one intensifies her effort at higher valuations.

Proposition 8 Assume contestants’ utility functions exhibit constant absolute risk aversion and the distribution of valuations is the same for all.

Also assume there are more than two contestants.

Then there exist parameters such that some contestant’s effort density

function is increasing at high effort levels, say, if all contestant but contestant

1 are risk neutral and contestant 1 is sufficiently risk averse, ρ1 > v2 (N1 −2) ,

then g1′ b̄ > 0.

The underlying intuition is similar to the one for the risk-neutral case:

bidding is risky, as losers are not compensated; so a risk-averse agent chooses

to bid at the top more frequently, as it ‘almost assures’ the prize. He can

‘afford’ bidding high, if own value is sufficiently high, thus the increase in

frequency at the top. If this effect is sufficiently unimportant to the rivals

(there are many of them), it prevails in equilibrium.

Interestingly, if we look at a general case with risk-averse (not necessarily

CARA) contestants, the ‘weak’ agent is always more likely to choose high

effort levels.

Proposition 9 Assume contestant i is strictly more risk averse than contestant j and the highest equilibrium effort level of all contestants

is the same,

b. Then there exists δ > 0 such that for all 0 < ε < δ, Gi b − ε < Gj b − ε

and Gi (ε) < Gj (ε).

The second claim also implies that a more risk-averse contestant is less

likely to exert low effort levels, that is, at the tails of the effort distribution,

this contestant is more aggressive than his less risk-averse rival. At first

glance, this result appears similar to the findings of Fibich, Gavious, and

Sela (2004), who showed that the bidding behavior is more ‘aggressive’ in

the symmetric equilibrium with moderately risk-averse agents as compared

to that in the symmetric equilibrium with risk-neutral agents, thus, providing

comparative statics for a symmetric model. Notice however, that Proposition

9, compares the behavior of two different agents with arbitrary degrees of

17

risk-aversion at any given equilibrium. This result generates a prediction that

(other things being equal) it is risk aversion of a participant that might drive

her higher-than-average effort (say, among contestants with the near-the-top

desire to win).

The more aggressive behavior of a ‘weaker’ contestant is no longer true

in the risk-neutral framework. In this case, a contestant with the first-orderdominated distribution of abilities is more timid than his stronger rivals.

More formally, i is weaker than j, if the distribution of abilities Fj strictly

first-order stochastically dominates Fi , or Fj ≻ Fi , so that Fj (v) < Fi (v) for

all v ∈ (v, v), where [v, v] is the common support of the two distributions.

Proposition 10 If agents are risk-neutral and the distributions Fi and Fj

have the same support, [v, v], then Fj ≻ Fi implies Gj ≻ Gi .

In particular, it follows that a weaker contestant is choosing lowest effort

more often and highest effort less often than a stronger one. It is important

to remember that although the weak contestant is more likely to exert top

effort than an intermediate one, as his effort density is increasing, it is still

below the (possibly decreasing) effort density of a strong contestant.

4

Conclusions

We have characterized equilibria in winner-take-all contests with many

heterogeneous contestants. Our methodology can also be applied to the Warof-Attrition contests: the characterization in Proposition 1 still holds when

Si is modified accordingly to reflect the marginal cost of bidding, M Ci (b) ≡

u′i (w − b) (1 − Wi (b)).

We show that contests with many heterogeneous agents are qualitatively

distinct from contests with only two agents and from contests with homogeneous agents.

First, we show that when a contestant is perceived to be ‘weak’ by his

‘strong’ rivals, the contestant may choose to exert zero effort regardless of his

value for the prize — even when there is a non-negligible probability that the

contestant has the highest value for the prize. Parreiras (2006) builds on the

possibility of complete drop-out to investigate a model where agents invest

in human capital and hence, the distributions of valuations are endogenous.

Secondly, we have shown that ‘weak’ contestants might bid very aggressively provided their valuation for winning is close to the top. Indeed, if all

18

contestants are risk neutral and if all of them, except one, believe that their

weak rival (‘underdog’) is very unlikely to have a high valuation for the prize

or be of a high ability, their equilibrium behavior will be almost unaffected

by the presence of the underdog, at least at the top valuations, that is, they

will compete mainly against each other. However, in case the underdog does

have a high ability, he has a decent chance of winning by exerting top effort,

and so he does, in equilibrium. Ironically, it is the pessimistic belief about

the abilities of this contestant, the belief shared by his rivals, that endows

the high-ability underdog with the informational rent making the race to the

bottom worthwhile.

Also we show that a sufficiently risk averse (CARA) contestant facing

enough risk neutral rivals will bid aggressively at the top and, as in the

previous case, her bid density will be increasing at the top valuations.

Having suggested a possible explanation of the past experimental evidence, our results offer directions for future experimental investigations.

References

Amann, E., and W. Leininger (1996): “Asymmetric All-Pay Auctions

with Incomplete Information: The Two Player Case,” Games and Economic Behavior, 14, 1–18.

Athey, S. (2001): “Single Crossing Properties and The Existence of Pure

Strategy Equilibria In Games of Incomplete Information,” Econometrica,

60, 861–889.

Baye, M. R., D. Kovenock, and C. G. de Vries (1993): “Rigging the

Lobbying Process: An Application of the All-Pay Auction,” The American

Economic Review, 83(1), 289–294.

(1996): “The All-Pay Auction With Complete Information,” Economic Theory, 8, 291–305.

Che, Y. K., and I. L. Gale (1998): “Caps on Political Lobbying,” American Economic Review, 88(3), 643–51.

Fibich, G., A. Gavious, and A. Sela (2004): “All-Pay Auctions With

Weakly Risk-Averse Bidders,” Tel-Aviv University.

19

Gavious, A., B. Moldovanu, and A. Sela (2002): “Bid Costs and

Endogenous Bid Caps,” Rand Journal of Economics, 33(4), 709–722.

Hillman, A. L., and J. G. Riley (1989): “Politically Contestable Rents

and Transfers,” Economics and Politics, 1, 17–39.

Kirchamp, O. (2005): “Less fighting than expected – experiments with

Wars of Attrition and All-Pay Auctions,” Manheim University.

Krishna, V., and J. Morgan (1997): “An Analysis of the War of Attrition

and the All-Pay Auction,” Journal of Economic Theory, 72, 343–362.

Lebrun, B. (1999): “First Price Auctions in The Asymmetric N Bidder

Case,” International Economic Review, 40(1), 125–142.

Lizzeri, A., and N. Persico (1998): “Uniqueness and Existence of Equilibrium In Auctions With A Reserve Price,” Games and Economic Behavior, 30, 83–114.

Muller, W., and A. Schotter (2003): “Workaholics and Drop Outs in

Optimal Organizations,” NY University.

Noussair, C., and J. Silver (2005): “Behavior in All-Pay Auctions with

Incomplete Information,” Games and Economic Behavior, online release.

Parreiras, S. O. (2006): “Winner-Take-All Contests with Endogenous

Human Capital Formation,” UNC at Chapel Hill.

Parreiras, S. O., and A. Rubinchik-Pessach (2006): “Contests with Heterogeneous Agents,” CORE Discussion Paper 2006/04,

http://www.core.ucl.ac.be/services/psfiles/dp06/dp2006 4.pdf.

20

A

A.1

Auxilliary Results

Monotonicity Of Equilibrium Bid Functions

Let b be a Nash equilibrium profile in non-decreasing strategies. For

any Borel set A ⊂ R, Q

define µGi (A) = Pr[bi (Vi ) ∈ A] and µWi (A) =

Pr[maxj6=i bj (Vj ) ∈ A] = j6=i Gj (A).

That is, µGi (respectively µWi ) is the measure associated to the cumulative

probability distribution function, Gi (respectively Wi ).

Lemma 2 The measure µGi has no atoms at b > b.

Proof. If a positive mass of types of contestant i bids b then limeրb Wj (e) <

Wj (b) < Wj (b + δ) for any δ > 0 because of the tie braking rule – when a tie

happens, the object is randomly allocated, with equal probabilities, among

all contestants who exert the highest effort level. As a result, the left and

right derivatives ‘explode’, that is, Wj′ − (b) = Wj′ + (b) = +∞. Therefore,

the type of, say contestant j, who bids b in equilibrium will be strictly better

of by raising its bid marginally above b. The marginal cost of raising the bid,

M C(b) = u′j (w − b) (1 − Wj (b)) + u′j (vj − b + w)Wj (b) increases discontinuously, yet it remains bounded while the marginal benefit of increasing the

bid is unbounded, M B(b) = [uj (vj − b + w) − uj (w − b)] Wj′ (b) .

As a result of the above lemma, when v > φi (0), bids must be strictly

increasing and so the inverse bid functions are strictly increasing.

A.2

Continuity of The Generalized Inverse Bids

Lemma 3 For any contestant i, φi is continuous.

Proof. If φi were discontinuous at b > b then Gi would have an atom at b

contradicting Lemma 2. Hence, we must establish that φ is right continuous

at b. Suppose that φi fails to be right continuous at any b – that is, there is

a δ > 0 such that φi (b) < φi (b) + δ < φi (b + ε) for any ε > 0. In other words,

type φi (b) + δ bids strictly above b and strictly below b + ε for any ε > 0,

which is a contradiction.

A.3

The Lowest Equilibrium Bid

Lemma 4 For all i = 1, . . . , N , bi (v) = 0.

21

Proof. Assume that for bi (v) = β > 0. Since the equilibrium is monotone,

the probability contestant j 6= i wins by bidding at or below β is zero. As

a result, either bj (v) = 0 or bj (v) ≥ β. In sum, Gj (β) = Gj (0) for j 6= i

(Gi (β) = Pr[bi (V ) < β] since Gi is non-atomic). Now, if Gj (β) = Gj (0) > 0,

for all j 6= i, then Wi (β − ε) = Wi (β) for some ε > 0. Therefore, bidding

β − ε yields a higher payoff than bidding β. On the other hand, when

Gj (β) = Gj (0) = 0, for some j, then Wi (β) = 0 and so, bidding zero yields

a higher payoff than bidding β.

A.4

Uniqueness

Let φ(b) = (φ1 (b), . . . , φ2 (b)) and write,

Q

Q

u′i (w − b) 1 − j6=i Fj (φj ) + u′i (φi − b + w)

F

(φ

)

j

j

j6=i

Q

Si (b, φ) ≡

.

j6=i Fj (φj ) (ui (φi − b + w) − ui (w − b))

Proposition 11 Assume that: for all i, bi is continuous, fi is continuous

and uniformly bounded above zero in its support, [v, v]; then, the system of

differential equations,

"

#

Q

X

F

(φ

)

∂

j

j

j6=i

φi =

Sj (b, φ) − (N − 2)Si (b, φ) , i = 1, . . . , N ,

∂b

fi (φi )

j6=i

has a unique solution that satisfies the terminal condition, φ(b) = (v, . . . , v).

Proof. There is a neighborhood of b, φ(b) such that the system satisfies

the Lipschitz condition because, for all i: fi is continuous and bounded away

from zero and;

Si is continuous in (b, φ) and bounded in a small neighborhood

of b, φ(b) . Consequently, the solution φ(b) is locally (restricted to this

neighborhood) unique.

Furthermore, as long as φi (b) > v for all i, there is a neighborhood of

(b, φ(b)) where the Lipschitz condition is satisfied. Therefore, φ(b) can be

further extended by continuity, in a unique way, from b to b where, b is

defined as the largest b < b such that there is at least one contestant, say k,

such that φk (b) = v. Lemma 4 above establishes that b = 0 and that allow us

to pin-down the value of b using the condition, φk (0) = v. It is important to

notice that there is no guarantee that the above unique solution corresponds

to an equilibrium. For example, it is conceivable that φ′ (b) < 0 for some b

22

and i. One needs to prove that all contestants are active in order to show that

the above solution corresponds to an equilibrium, that is, J(b) = {1, . . . , N }

for any b ∈ (0, b). Indeed, since for any contestant i, v i = v, Proposition

4 implies that bi (v) = b. In addition, since strategies are continuous (by

assumption) and strictly increasing, for any b ∈ (0, b) and any i, there is v

such that bi (v) = b.

B

B.1

Main Results

The System of First Order Conditions

Recall the bidding strategies of the contestants are denoted by bi : [v, v i ] →

R+ . For every bid b ≥ 0 denote the set of active contestants at b, that is,

contestants that choose this bid for some of their type realizations:

J (b) = {j ∈ {1, .., N } |∃vj ∈ [v, v i ] : bj (vj ) = b} ,

and write K(b) = #J(b) for the cardinality of J, the number of active contestants at b.

Proof of Proposition 1. Consider contestant i ∈ {1, .., N } . Fix the strategies of other contestants, thereby determining set J (b) \{i} for any b. If at

some given b > 0 condition

X Y

[ui (vi − b + w) − ui (w − b)]

Gk (b)gj (b)+

j∈J(b)\{i} k6=i,j

− [u′i (vi − b + w) − u′i (w − b)]

Y

Gj (b) − u′i (w − b) ≤ 0, i ∈ J(b) (8)

j∈J(b)\{i}

is satisfied with equality, then let bi (vi ) = b. Otherwise, bi (vi ) = 0.

As we restrict attention to non-decreasing strategies, the highest bid of

contestant i is the optimal bid for the highest type of that contestant, bi (v i ) =

bi . In addition, there are at least two contestants, k, l whose

highest types

place the highest equilibrium bid, bk = bl = maxi∈{1,..,N } bi . Then for any

b ∈ (0, bk ], K(b) ≥ 2.

Secondly, for b ∈ bi ([v, v i ])\ {0}, the system (8) is satisfied as equality.

Rewrite it as

X gj (b)

= Si (b) ,

G

j (b)

j6=i

23

for i ∈ j ∈ {1, .., N } |bi > 0 . Recall,

Wi (b) u′i (vi − b + w) + (1 − Wi (b)) u′i (w − b)

> 0,

Wi (b) (ui (vi − b + w) − ui (w − b))

Y

Wi (b) =

Gj (b).

Si (b) ≡

j6=i

The system of equations is linear in

gj (b)

Gj (b)

that allows us to solve it as follows:

gj (b)

=

Gj (b) i∈J(b)

0 1 ···

1 0 · · ·

where M = .. ..

..

. .

.

1 ... 1

M −1 (Si (b))i∈J(b) ,

1

1

.. ,

.

0

Note that the inverse of the K by K matrix

− (K − 2)

1

1

− (K − 2)

1

..

..

K −1

.

.

1

...

Therefore, gi (b) =

B.2

Gi (b)

(K(b)−1)

(9)

(10)

M , with K ≥ 2 is

···

1

···

1

.

..

..

.

.

1 − (K − 2)

S

(b)

−

(K(b)

−

2)S

(b)

for b ∈ B.

i

j∈J(b)\{i} j

P

Participation Results

Proof of Proposition 2. First, the lowest effort should be zero by the

Lemma 4. Clearly, there should be at least one contestant that does not

choose b = 0 with a strictly positive probability. Call this contestant k. If

there are only two active contestants, the proposition reduces to Lemma 5

of Amann and Leininger (1996, p. 6). Let’s then assume that there are at

least 3 active contestants and moreover, to simplify notation and without

any loss of generality, we shall assume all contestants are active. Consider

a pair of active contestants i, j distinct from k. For these contestants, their

respective winning probability approaches zero as b → 0 in the presence

24

of contestant k. By definition of winning probability, we have the following

identity Wi (b)Gi (b) = Wj (b)Gj (b), so

Gj (b)

Wi (b)

W ′ (b)

= lim

= lim i′

bց0 Gi (b)

bց0 Wj (b)

bց0 Wj (b)

lim

where the last equality follows from the L’Hôpital’s Rule.

Notice that even when Gi (0) > 0, the first order condition holds with

equality for type φi (0). Thus, using the first order conditions, (2)

Wi′ (b)

u′i (w)

uj (φj (0) + w) − uj (w)

=

< ∞,

′

bց0 Wj (b)

ui (φi (0) + w) − ui (w)

u′j (w)

lim

since φi and φj are right continuous, φi ≥ v, φj ≥ v and, v > 0 by assumption.

As a result,

u′i (w)

uj (φj (0) + w) − uj (w)

Gj (b)

=

< ∞.

bց0 Gi (b)

ui (φi (0) + w) − ui (w)

u′j (w)

lim

(11)

It follows that only two scenarios are possible. First, both bid distributions

might have an atom at zero, Gi (0) > 0, Gj (0) > 0 or secondly, it might

happen that i and j start bidding at zero, so that Gi (0) = Gj (0) = 0. For

a given choice of k and i, since the choice of j (distinct from i and k) can

be made arbitrarily, either n − 1 contestants choose zero bid with positive

probability or none does.

In the case where, Gi (0) = 0 for all i, the first-order conditions imply

the marginal winning probabilities are be strictly greater than zero, Wi′ (0) =

u′i (w−b)

> 0. The last observation coupled with the fact that, for all

ui (v−b+w)−ui (w−b)P

Q

′

b > 0, Wi (b) = j6=i k6=i,j Gk (b)gj (b), implies that, at least for some j 6= i,

the density gj must ‘explode’ at zero. Otherwise, if all densities were finite at

zero, we would have Wi′ (0) = 0, which is not possible. Furthermore, if at least

one density ‘explodes’, all densities must ‘explode’ as well. Using L’Hôpital’s

g (b)

G (b)

Rule again, for any i, limbց0 gji (b) = limbց0 Gji (b) < +∞, we conclude that

limbց0 gj (b) = +∞, if and only if, limbց0 gi (b) = +∞.

Proof of Proposition 3. In the case where the contestants are risk neutral

the system

T of first order conditions admits the following solution for almost

all b ∈ N

i=1 bi ([v, v i ])

P Gk (b)

Gi (b)

k6=i φk (b) − (N − 2) φi (b)

Q

gi (b) =

,

(12)

(N − 1) j6=i Gj (b)

25

indeed, in this case Si (b) = vi Q 1 Gj (b) .

j6=i

As Fj first-order stochastically dominates U [0, v j ] for all j, it follows

Pj6=i Fj (φj ) P v−1

P G (b)

φj

i j

< j6N=−2

, which implies that j6=i φjj(b) < (N − 2) v1i , and,

that

N −2

therefore, the highest ability type of contestant i will not bid b > 0 since his

first-order condition is negative, so bi (v i ) = 0. Moreover, since the equilibrium is monotone, bi (v) = 0 for all v.

Proof of Proposition 4.

If bj (v j ) = β < b and bi (v i ) = b then, by

revealed preferences, it must be that v j Wj (β) − bj (v j ) ≥ v j − b = v i − b >

v i Wi (β) − bj (v j ) > v i Wj (β) − bj (v j ) = v j Wj (β) − bj (v j ) since Wj (bj (v j )) 1 =

Wi (β)Gi (β); but this result is a contradiction.

B.3

Ex-ante Asymmetry

Proof of Propositions 5 and 7.

When all the contestants have identical distributions, equation (12) reads:

g (b) =

G(b)

φ(b)

(N − 1)G (b)

N −1

=

1

(N − 1)φ (b) G (b)N −2

.

Note that both φ and G are increasing in b, so g must be decreasing in b.

Allowing for different distributions and setting N = 2, equation (12) give

us,

gi (b) =

Gj (b)

φj (b)

Gj (b)

=

1

,

φj (b)

so the density for i = 1, 2 is decreasing as well. This completes the proof of

Proposition (5) . Next,

gi′

(b) =

P

k6=i

i (φi (b))

k (φk (b))

− (N − 2)gi (b) φi (b)−G(φi (b)/f

gk (b) φk (b)−G(φk (b)/f

2

2

i (b))

k (b))

Q

(N − 1) j6=i Gj (b)

(b)

XY

− (N − 2) Gφii(b)

Gk (b)gj (b).

−

2

Q

j6

=

i

k6

=

i,j

G

(b)

(N − 1)

j6=i j

Gk (b)

k6=i φk (b)

P

26

Then

gi′ b

v − 1/fk (v)

v − 1/fi (v)

gk (b)

− (N − 2)gi (b)

2

v

v2

k6=i

1 1X

−

gj (b)

N − 1 v j6=i

1

=

N −1

X

Also,

gj (b) =

!

1

, for all j,

(N − 1)v

so

gi′ b

1

=

(N − 1)2 v 2

X

1

=

(N − 1)2 v 2

N −2 X 1

−

− (N − 2)v

fi (v)

f

k (v)

k6=i

(v − 1/fk (v)) − (N − 2) (v − 1/fi (v)) − (N − 1) v

k6=i

!

which is positive if fi (v̄) is sufficiently small (relative to fk (v̄)).

Proof of Proposition 10. Notice that Fj ≻ Fi implies the weak inequality

fi (v) ≤ fj (v), to simplify this proof, we assume the strict inequality, fi (v) <

fj (v).

1. Assume that Gi and Gj cross or are tangent at some point in the interior

of support of equilibrium effort levels, b∗ ∈ (0, b). In this case, it follows

that Gi (b∗ ) = Gj (b∗ ) together with Fj ≻ Fi imply that φi (b∗ ) < φj (b∗ ).

Moreover, from Gi (b∗ ) = Gj (b∗ ), φi (b∗ ) < φj (b∗ ), and the characterization of the effort densities (12), it follows that gi (b∗ ) < gj (b∗ ). In sum,

Gi and Gj can not be tangent at any b ∈ (0, b) and moreover, if Gi and

Gj cross then Gj must intersect Gi from below.

2. At the boundaries of the support of the equilibrium effort levels, 0

and b, the distributions of effort may be tangent. In particular, a

direct inspection of (12) reveals that the they are tangent at b, that

is, Gi (b) = Gj (b) = 1 and gi (b) = gj (b), where b = bi (v) = bj (v) as

established by Proposition 4. These equalities and the expression for

the derivative of the effort density, (5), yield gi′ (b) ≥ gj′ (b), if and only

if, fi (v) ≤ fj (v). But, Fj ≻ Fi implies fi (v) ≤ fj (v). Moreover, by

27

!

(13)

assumption fi (v) < fj (v) and therefore gi′ (b) > gj′ (b). As a result, there

is an δ > 0 such that for any ε < δ, gi (b − ε) < gj (b − ε). This last

result implies that Gi (b − ε) > Gj (b − ε). Put simply, also at the top

b, Gj must intersect Gi from below.

The conclusions of 1 and 2 above imply that Gi and Gj can never intersect

in the interior of the support and, Gi is always above Gj .

B.4

Different Attitudes Towards Risk

Proof of Propositions 6 and 8. In the model with CARA agents, ui (x) =

exp(−ρi x)

. To avoid cumbersome notation, we present the proof for the

ρi

case in which all the agents bid in the same interval. For this environment,

(4) becomes,

−

u′i (w − b) (1 − Wi (b)) + u′i (vi − b + w)Wi (b)

Wi (b) (ui (vi − b + w) − ui (w − b))

ρi

1

=

− Wi (b) ,

Wi (b) (1 − e−ρi φi (b) )

Si (b) =

(14)

so, by proposition 1,

Gi (b)

gi (b) =

N −1

X

!

Sj (b) − (N − 2) Si (b) =

j6=i

Gi (b)

=

(N − 1)

(

− (N − 2)

X

j6=i

1

− Wj (b)

1 − exp (−φj ρj )

1

− Wi (b)

1 − exp (−φi ρi )

ρj

Wj (b)

ρi

Wi (b)

(15)

When N = 2, this reduces to:

gj (b) =

ρi

− ρi Gj (b) , i 6= j

1 − exp(−ρi φi (b))

(16)

Since both φ(·) and Gj (·) are increasing in b, it follows that gj is decreasing

in b. This proves half of Proposition 6.

When agents are symmetric with respect to risk aversion parameter, that

is, when ρi = ρ for all i ∈ {1, .., N }, then in a symmetric equilibrium, inverse

28

bids are the same, φi = φ, and so is the effort density, gi = g for all i ∈

{1, .., N } . Then (15) reduces to:

g (b) =

ρ

ρG (b)

−

.

N

−2

[1 − exp(−ρφ(b))] (N − 1)G

(b) N − 1

(17)

Once more, since both φ(·) and G(·) are increasing in b, it follows that g is

decreasing in b. This concludes the proof of Proposition 6.

To prove Proposition 8 we present conditions under which the density of

effort is increasing in a neighborhood of the highest equilibrium effort. For

than note that by (14)

Si′

ρi

(b) = −

Wi (b)2 1 −

∂Wi (b)

∂b

1

exp(ρi φi (b))

ρ2i

−

Wi (b)

∂φi (b)

∂b

exp (ρi φi (b)) 1 −

1

exp(ρi φi (b))

2 .

Given the definition of the winning probability of contestant i and (18),

XY

G k b gj b =

Wi′ b =

j6=i k6=i,j

X

=

j6=i

Also, by definition of gi , we have

gj b = Si b .

∂φi (b)

∂b

=

gi (b)

,

f (v̄)

Si′ b = − (exp (ρi v̄)) Si2

using the identity,

1

1−

we have

Si′

ρi

Si (b)+ρi

therefore,

!

gi b

1+

f (v̄)

= exp (ρi v̄) ,

!

gi b

b =− 1+

Si b + ρi Si b .

f (v̄)

29

By first order conditions (3) ,

X

gj′ b

j6=i

= Si′ b +

X

gj b

j6=i

!2

!

gi b

= Si b − 1 +

S i b + ρi S i b

f b

!

gi b

S i b + ρi + ρi

= −Si b

f b

2

It follows that

(N − 1) g2′ b

= −S1 b

(N − 2) g2′ b + g1′ b = −S2 b

Therefore,

g1′ b

!

g1 b

S 1 b + ρ1 + ρ1 < 0

f b

!

g2 b

S 2 b + ρ2 + ρ2

f b

!

g2 b

S 2 b + ρ2 + ρ2

= −S2 b

f (v̄)

!

g1 b

(N − 2)

S1 b

S 1 b + ρ1 + ρ1

+

(N − 1)

f (v̄)

ρi exp(−ρi v̄)

Note that if ρ2 = 0, then S2 b = limρi →0

= v̄1 , also g2 b =

1 − exp(−ρi v̄)

S1 (b)

, so

(N −1)

g1′

(N − 1)

g1 b

b

= S1 b S1 b

+ ρ1

(N − 2)

f (v̄)

!

!

g1 b

1

+1 − 2

,

f (v̄)

v̄ (N − 2)

which is positive,

providedN is large enough or ρ1 is sufficiently big. Indeed,

S1 b = ρ1 1−e1−ρ1 v̄ − 1 > 0 and the term it multiplies is at least as high

(

)

1

as ρ1 − v2 (N −2) .

30

Note also, that ρ1 and N being high does not prevent the first contestant

from participating, as his effort density at the top is still positive (recall Si b

is decreasing in ρi )

(N − 2)

S2 b

1

g1 b = S 2 b −

S1 b ≥

=

≥ 0,

(N − 1)

(N − 1)

v̄ (N − 1)

which is consistent with him bidding at the top. This concludes the proof.

Proof of Proposition 9.

1. To prove the first assertion,

let us evaluate the necessary conditions (5)

b = b, noting that Wi b = 1 for all i,

#

"

X

1

(18)

Sj b − (N − 2)Si b

gi (b) =

N − 1 j6=i

′

ui v − b + w

Si b =

(19)

ui v − b + w − u i w − b

Without loss of generality wecan normalize the

utility functions of i

′

′

and j such that ui v − b + w = uj v − b + w and ui v − b + w =

uj v − b + w . As i is more risk averse than j, ui is a concave transformation of uj , so after

ui (x) ≤ uj (x) for any x,

the transformation

in particular, ui w − b < uj w − b . It follows that Si b < Sj b ,

so gi (b) > gj (b), as required.

2. By (11),

u′i (w)

uj (v + w) − uj (w)

Gj (b)

=

bց0 Gi (b)

ui (v + w) − ui (w)

u′j (w)

lim

Normalizing the Bernoulli functions, again, such that u′i (w) = u′j (w)

and ui (w) = uj (w), and given that i is strictly more risk averse, ui (v +

Gj (b)

w) < uj (v + w), so limbց0

> 1, as required.

Gi (b)

31

C

The Example

It suffices to establish that the

inverse bid functions satisfy the following system of differential equations:

Sketch of the Proof of Proposition 1.

φ1 (b)

(2 − 2φ1 (b))φ2 (b)2

2 − φ1 (b)

φ′2 (b) =

φ1 (b)φ2 (b)

φ′1 (b) =

It is easy to show that using the identities Q(φ1 (b)) = φ2 (b) and bj (φj (b)) = b,

j = 1, 2. The complete proof is available on request.

32