Ricardo plc

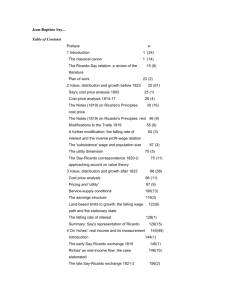

advertisement