H. P. Wolfe Chair in Accounting Review Document Summer 2006

advertisement

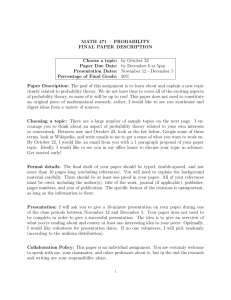

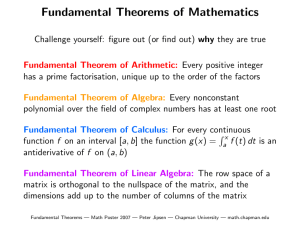

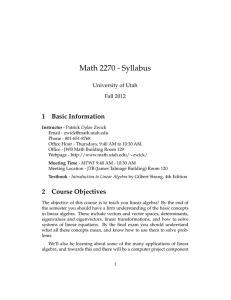

H. P. Wolfe Chair in Accounting Review Document Summer 2006 This document is prepared as part of the review for the Wolfe chair. It is meant to be a brief discussion of some activities over the past six years, and, as such, follows the review document prepared for the same purpose in 2000. The first part reviews some published papers, the ideas therein, and their interaction with classroom activities. The second part is a discussion of some academic activities involving national or international organizations. One published paper is “Inferring Transactions from Financial Statements,” in Contemporary Accounting Research with Arya, Glover, Schroeder, and Strang. As double entry accounting is a big linear system, the historical development of linear algebra was closely related to accounting. For example, Arthur Cayley (of the fundamental Cayley-Hamilton theorem for square matrices) wrote a book entitled “The Principles of Double Entry Bookkeeping.” Recently, the scholarly connections between the two disciplines have weakened. Sadly, instructive developments in linear algebra (like what Strang terms the fundamental theorem of linear algebra) have not been used to think about accounting problems. Nor has accounting been used as a practical application in linear algebra curricula. The “Inferring…” paper was part of an effort to reconnect the two disciplines. It is important that the project included Gil Strang, a mathematician from MIT who has written popular linear algebra textbooks. Briefly, the central problem under consideration in the paper is to infer transactions which produced given financial statements. The answer is likely not unique (or may not even exist), but all possible solutions can be represented using the four subspaces of a double entry accounting incidence matrix. Furthermore, all the subspaces have convenient and suggestive accounting interpretations. The ideas from the paper, though not all the technical details, have been the basis for lectures and projects in AMIS 624 and 829. The exercise is to take a set of published financial statements and reconstruct all possible summary journal entries. It seems to me very difficult to engage in this exercise without learning something about the entity under consideration, or accounting, or typically both. When using Enron’s financial statements, for example, illuminating though cynical insights are available. The “Inferring…” paper was static in the sense that time played no fundamental role. A serious study of linear algebra, however, pays attention to dynamic systems and the particular insights available from an eigenvalue representation. Likewise, of fundamental importance in accounting is how stocks and flows march through time in a systematic way. These issues are explored in “Depreciation in a Model of Probabilistic Investment” in the European Accounting Review (with Arya, Glover, and Schroeder). The basic idea is that accounting stocks and flows reproduce a general dynamic system with some unknown parameters. Accounting numbers can yield efficient (best linear unbiased) estimates of the unknown parameters. The trick is to carefully exploit the connection between accrual rates and the eigenvalues underlying the dynamic system. Furthermore, when done correctly, accounting has the desirable property of capturing a history of information in two current numbers – a stock and a flow. Because of the technical nature of the results, it has taken while to get them in a form appropriate in an accounting curriculum. Enclosed are syllabi from courses taught at Florida; the dynamic problem is examined in ACG 6888. Finally, I would like to say some words about another line of inquiry: quantum information in physics. If accounting is an information science, it behooves us to be seriously aware of the contributions and problems of other information sciences in the University. Physics, in particular, has made fundamental progress by framing physical problems as information problems. (There are some words about this in my part of the discussion piece in Accounting Horizons, 2000). A serious study takes serious time. So far I have invested in the rough equivalent of two years of course work in quantum mechanics. Two papers have been published and are 2 listed on the vita. Another more recent effort will be presented at the accounting theory conference at Carnegie Mellon University in August. Of the many ideas in physics, let me briefly sketch one which may have implications for how we think about a common accounting problem. The problem is what should be the level of aggregation to accumulate and report information? For example, do we get individual reports, or aggregate to the divisional or firm-wide level? Nature is remarkably efficient at using interactions among subatomic particles to generate productive outcomes. Measurement is an integral part of the process: to capture the most interaction effect requires measuring at the aggregate, not the individual, level. The economic analog seems sensible; when positive cooperation is an important effect, it is efficient to measure an aggregate output, rather than putting cooperation at risk by measuring each individual separately. While the idea is not complicated, quantum physics supplies elegant mathematics, axiomatic development, and information based analyses. All of which are essential, or at least desirable, for serious accounting work. (As an aside, Nature apparently uses a double entry notion – called entanglement – to conduct the measurement exercise.) It might also be mentioned that computation based on the quantum axioms has the potential to change, in a fundamental way, information processing in an economic setting. These ideas are addressed in the classroom. See, for example, the syllabus for ACG 6387 which is included. In 2002 I served as the program chair for the annual meeting of the American Accounting Association held August 14-17 in San Antonio, Texas. The theme of the conference was “Reinvigorating Accounting Scholarship.” Over 700 papers were submitted, approximately half of which were presented in over 100 concurrent sessions. Several innovations were instituted. 2002 was the first time the submission/review process was entirely electronically based. Also, we introduced two-tier pricing to encourage early 3 submissions. There were, for the first time, a number of interdisciplinary sessions consisting of papers from different sections of the AAA. We also instituted “make your own” sessions available to members on a first come first served basis. There was a significant curriculum innovation project, and I addressed a plenary session on the general topic of the future of accounting curricula. Since 2004 I have served as vice-president and director of research for the American Accounting Association. The job includes serving on the AAA executive committee which has budgetary and personnel oversight responsibilities for the organization. I served as the distinguished visiting lecturer in accounting at Carnegie Mellon University July 8-12, 2002. I delivered lectures on different topics including the elegance of the double entry system and its linear algebra properties. There was also a lecture on classical information theory including proofs of both the noiseless and noisy channel capacity theorems of Claude Shannon. Other lectures covered coding theory, including secret codes, and the implications of quantum computation on the future of secret codes. In June 2004 I was the plenary speaker at the European Institute for Advanced Studies in Management convention in Frankfurt, Germany. The topic was the elegance of the double entry system. I attempted to illuminate standard accounting activities involving financial statements by showing how the activities were examples of three important theorems in applied mathematics: the theorem of the separating hyperplane, a duality theorem, and a projection theorem. 4