Payrol Payroll Records Specialist l Records Specialist

advertisement

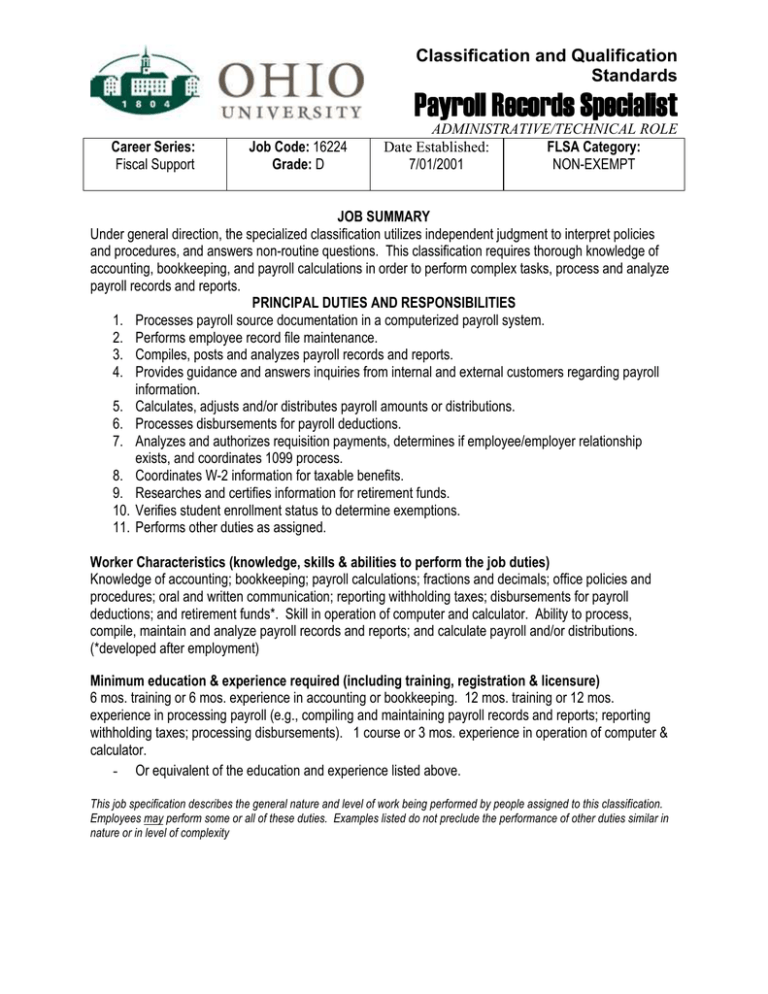

Classification and Qualification Standards Payroll Payroll Records Specialist Career Series: Fiscal Support Job Code: 16224 Grade: D ADMINISTRATIVE/TECHNICAL ROLE Date Established: FLSA Category: 7/01/2001 NON-EXEMPT JOB SUMMARY Under general direction, the specialized classification utilizes independent judgment to interpret policies and procedures, and answers non-routine questions. This classification requires thorough knowledge of accounting, bookkeeping, and payroll calculations in order to perform complex tasks, process and analyze payroll records and reports. PRINCIPAL DUTIES AND RESPONSIBILITIES 1. Processes payroll source documentation in a computerized payroll system. 2. Performs employee record file maintenance. 3. Compiles, posts and analyzes payroll records and reports. 4. Provides guidance and answers inquiries from internal and external customers regarding payroll information. 5. Calculates, adjusts and/or distributes payroll amounts or distributions. 6. Processes disbursements for payroll deductions. 7. Analyzes and authorizes requisition payments, determines if employee/employer relationship exists, and coordinates 1099 process. 8. Coordinates W-2 information for taxable benefits. 9. Researches and certifies information for retirement funds. 10. Verifies student enrollment status to determine exemptions. 11. Performs other duties as assigned. Worker Characteristics (knowledge, skills & abilities to perform the job duties) Knowledge of accounting; bookkeeping; payroll calculations; fractions and decimals; office policies and procedures; oral and written communication; reporting withholding taxes; disbursements for payroll deductions; and retirement funds*. Skill in operation of computer and calculator. Ability to process, compile, maintain and analyze payroll records and reports; and calculate payroll and/or distributions. (*developed after employment) Minimum education & experience required (including training, registration & licensure) 6 mos. training or 6 mos. experience in accounting or bookkeeping. 12 mos. training or 12 mos. experience in processing payroll (e.g., compiling and maintaining payroll records and reports; reporting withholding taxes; processing disbursements). 1 course or 3 mos. experience in operation of computer & calculator. - Or equivalent of the education and experience listed above. This job specification describes the general nature and level of work being performed by people assigned to this classification. Employees may perform some or all of these duties. Examples listed do not preclude the performance of other duties similar in nature or in level of complexity