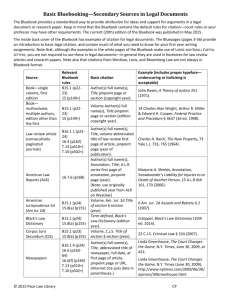

COMMENTS

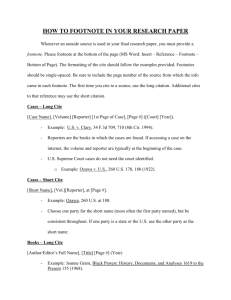

advertisement