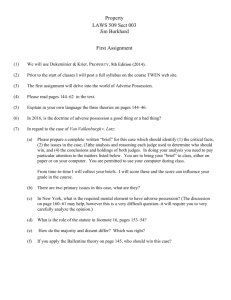

A P I :

advertisement