Accountancy Program Accreditation Maintenance Report Oregon State University

advertisement

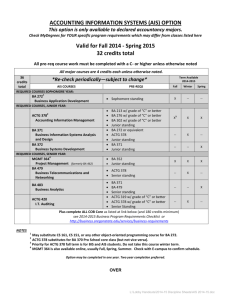

Oregon State University Accountancy Program Accreditation Maintenance Report College of Business November 2009 Professor Roger Graham 204 Bexell Hall roger.graham@bus.oregonstate.edu 541 737 4028 This document was made possible through the assistance of Malcolm LeMay, Kishani Kalupahana, members of the Accounting Faculty and members of the Accounting Circle. |P age 1 Accountancy Program Assurance of Learning |P age 2 1. Learning Goals and Objectives Mission Statement The mission of the Accountancy Degree Program in the College of Business at Oregon State University is to educate accounting students for professional careers and to establish a foundation for life-long learning. Vision Statement Learning Goals Upon graduation our students will be professionally competent, have professional values and exhibit professional behaviors. 1. Professionally Competent Professional competence relates to knowledge and skills for careers in a. financial accounting practices, b. managerial accounting practices, c. information technology in financial systems, d. tax, and e. auditing. The Accountancy Program in the College of Business at Oregon State 2. Have Professional Values University will be known by Professional values relate to employers for the quality of its a. integrity and stewardship, graduates as demonstrated by b. service to the community professional preparation for a c. life-long learning variety of accounting career tracks. 3. Exhibit Professional Behaviors (revised 8/17/2008) Professional behaviors include a. communication skills b. teamwork skills c. leadership skills |P age 3 Learning Objectives 1. Professionally Competent Financial Accounting a. prepare financial statements in accordance with appropriate standards b. interpret the business implications of financial statement information Managerial Accounting a. prepare accounting information for planning and control and for the evaluation of products, projects and divisions b. judge product, project, divisional and organizational performance using managerial accounting information Information Technology in Financial Systems a. identify organizational information technology components and risks that can effect financial systems and prescribe appropriate controls Tax a. prepare business and individual tax returns in accordance with the appropriate authorities b. analyze transaction data and tax authorities for purposes of tax planning and decision making Auditing a. design an audit program to frame the various elements of planning, testing and reporting phases of an audit in the context of the overall audit objective, engagement risk assessment, and internal controls b. apply auditing concepts to evaluate the conformity of financial statements with appropriate auditing standards. c. analyze internal controls and interpret assessment of engagement risk 2. Professional Values a. value integrity and stewardship b. value service to the community and to the accounting profession c. value life-long learning 3. Professional Behaviors a. communicate complex ideas in writing and through oral presentations b. work effectively in diverse team settings c. effectively coordinate and motivate a group to achieve its best output ACTG 318 External Reporting I ACTG 319 External Reporting II ACTG 417/517 Advanced Accounting ACTG 321 Cost Management I ACTG 422 Cost Management II ACTG 378 Accounting Information Management ACTG 420 Accounting Information Systems Analysis & Design ACTG 325 Introduction to Tax ACTG 425 Advanced Tax ACTG 427 Assurance and Attestation Services ACTG 429 Topics in Accounting Credit Hours ACTG 317 Accounting Processes and Controls 2: Alignment of curricula with adopted goals (spreadsheet). 4 4 4 4 4 4 4 4 4 4 4 4 Learning Outcome Coverage 1. Professional Competencies Financial Accounting: interpret the business implications of financial statement information Financial Accounting: prepare financial statements in accordance with appropriate standards H (4) H (4) H (5) H (5) H (4) H (4) H (4) H (5) H (5) H (4) Management Accounting: prepare accounting information for planning and control and for the evaluation of products, projects and divisions Management Accounting: judge product, project, divisional and organizational performance using managerial accounting information H (3) H (3) H (4) H (4) Accounting Information Systems: H (4) information technology components and risks that can effect financial systems and prescribe appropriate controls Tax: prepare business and individual tax returns in accordance with the appropriate authorities Tax: analyze transaction data and tax authorities for purposes of tax planning and decision making H (5) L (3) H (3) H (3) L (2) H (4) H (4) M (2) Auditing: design an audit program to frame the various elements of planning, testing and reporting phases of an audit in the context of the overall audit objective, engagement risk assessment, and internal controls Auditing: apply auditing concepts to evaluate the conformity of financial statements with appropriate auditing standards Auditing: analyze internal controls and interpret assessment of engagement risk |P age 4 L (3) H (3) M (2) H (3) M (2) H (3) M (2) Team work: Notes: |P age 5 ACTG 317 Accounting Processes and Controls ACTG 318 External Reporting I ACTG 319 External Reporting II ACTG 417/517 Advanced Accounting ACTG 321 Cost Management I ACTG 422 Cost Management II ACTG 378 Accounting Information Management ACTG 420 Accounting Information Systems Analysis & Design ACTG 325 Introduction to Tax ACTG 425 Advanced Tax ACTG 427 Assurance and Attestation Services ACTG 429 Topics in Accounting Credit Hours 4 4 4 4 4 4 4 4 4 4 4 4 Learning Outcome Coverage 2. Professional Values Integrity: M (2) Service to the public: M (2) M (2) H (2) Life-long Learning: M (2) M (2) H (2) Writing: M (3) L (2) M (4) M (4) M (4) M (2) L (3) H (4) M (2) 3. Professional Behaviors M (3) M (3) Presentations: M (3) L (3) M (3) M (4) M (4) 3: Identification of assessment instruments and measures The accountancy program uses a variety of methods to assess accounting program learning objectives. a. Selection The accountancy program accepts only students with GPAs above 2.75 in their required prebusiness courses. The GPA selection criterion validates the ability of students in the accountancy program to achieve competence. The accounting faculty meet and review the entrance requirements each year. All accounting faculty and students commit to the accountancy program code of ethics. b. Exit Survey An exit survey is administered to all Accountancy students in ACTG 427, the final course in the accounting program. c. Performance-based Assessment of professional competencies is performance based. We use first day of class exams and questionnaires to assess competencies from prerequisite courses and to reinforce priormaterial learning. For example, we give a first-day exam in ACTG 417, Advanced Accounting, to assess the learning in the financial accounting intermediate series ACTG, 317, ACTG 318, and ACTG 319. The intermediate series are the prerequisite courses for ACTG 417. d. Embedded Assessment of professional behavior competencies is course embedded. For example, representative samples of student writing are collected in ACTG 318, ACTG 319 and ACTG 325. Presentation skills are assessed in ACTG 427. e. Other Methods Other assessment methods include: 1. Internship Evaluation 2. CPA Exam performance over time, 3. Participation in tax and financial case competitions f. Coordination of Assessment Activities Assessment activities are coordinated at the annual accounting faculty retreat. At the retreat the accounting faculty discuss and coordinate learning goals and objectives and recommend changes to accounting courses, the accounting program, and to the assessment process. |P age 6 g. Assessment Timeline “The collection process should be systematic across AACSB review cycles; however, a school may choose to not measure student performance annually on every learning goal. Normally, learning goals should be assessed at least twice within each review cycle.” 2008-2009 2009-2010 2010-2011 2011-2012 2012-2013 Professionally Competent Professionally Competent Professionally Competent Professional Values Professional Values Professional Values Professional Behaviors Professional Behaviors Professional Behaviors |P age 7 h. Points of Assessment . Normal Schedule of Classes Area First Year – Junior Financial Second Year - Senior Fall Winter Spring Fall ACTG 317 ACTG 318 ACTG 319 ACTG 417 Cost ACTG 321 Tax Winter ACTG 422 ACTG 325 ACTG 425 Auditing AIS Spring ACTG 427 ACTG 378 Topics ACTG 420 ACTG 429 Electives (shaded) Points of Assessment (Bolded) 1. Professional Competencies ACTG 318: External Reporting 1 ACTG 417: Advanced Accounting ACTG 321: Cost Accounting ACTG 420: Advanced AIS 2. Professional Behaviors ACTG 318: External Reporting 1 ACTG 319: External Reporting 2 ACTG 427: Assurance and Attestation Services 3. Professional Values ACTG 427: Assurance and Attestation Services Internships Exit Survey |P age 8 4. Collection, analyzing and dissemination of assessment information a. The Exit Survey The exit survey is administered to all Accountancy students in ACTG 427, the final course in the accounting program. The survey corresponds to the Accountancy Program’s learning objectives. The cover page of or the survey includes: Accountancy Program Assurance of Learning As part of our continual improvement process for the accountancy program we assess achievement of program-level learning outcomes from multiple sources – classroom measures, external evaluators (business constituents and recruiters), faculty, and you, the accounting student. Mission Statement: The mission of the Accountancy Degree Program in the College of Business at Oregon State University is to educate accounting students for professional careers and to establish a foundation for life-long learning. Vision Statement: The Accountancy Program in the College of Business at Oregon State University will be known by employers for the quality of its graduates as demonstrated by professional preparation for a variety of accounting career tracks. Learning Goals: Upon graduation our students will be professionally competent, have professional values and exhibit professional behaviors. |P age 9 Spring 2009 (n=34) Upon completion of the accountancy program curriculum, to what extent are you capable of: Extremely Moderately Not at all 7 6 5 4 3 Preparing financial statements in accordance with appropriate standards? 12% 35% 35% 12% Interpreting the business implications of financial statement information? 6% 47% 35% 12% Preparing accounting information for planning and control and for the evaluation of products, projects and divisions? 9% 35% 32% 24% Judging product, project, divisional and organizational performance using managerial accounting information? 9% 32% 41% 15% 3% 6% 32% 29% 26% 6% Preparing business and individual tax returns in accordance with the appropriate authorities? 3% 26% 44% 24% 3% Analyzing transaction data and tax authorities for purposes of tax planning and decision making? 6% 29% 35% 21% 6% Designing an audit program to frame the various elements of planning, testing and reporting phases of an audit in the context of the overall audit objective, engagement risk assessment, and internal controls? 9% 38% 26% 24% 3% Applying auditing concepts to evaluate the conformity of financial statements with appropriate auditing standards? 18% 47% 26% 9% Analyzing internal controls and interpreting assessment of engagement risk? 18% 50% 24% 9% Professionally Competent Financial Accounting Managerial Accounting IT in Financial Systems Identifying organizational information technology components and risks that can effect financial systems and prescribe appropriate controls? Tax Auditing | P a g e 10 2 1 Upon completion of the accountancy program curriculum, to what extent are you capable of: Extremely Moderately 7 6 5 4 71% 24% 3% 3% 41% 24% 26% 9% 53% 29% 12% 6% Communicating complex ideas in writing? 24% 35% 29% Communicating complex ideas through oral presentations? 18% 32% 35% 29% Not at all 3 2 26% 3% 3% 32% 12% 6% 44% 18% 3% 41% 24% 6% Professional Values Integrity and Stewardship Applying the values of integrity and stewardship to the accounting profession? Service to the Community Applying the value of service to the community to the accounting profession? Life-long Learning Applying the value of life-long learning? Professional Behaviors Communication Skills Teamwork Working effectively in diverse team settings? Leadership Effectively coordinating and motivating a group to achieve its best output? Accounting Faculty Discussion The accounting faculty met and discussed these results at the annual faculty retreat. While not reading too much into the results of this self evaluation, the faculty are encouraged by the general overall confidence accounting students have in their technical skills as the majority of responses are 5 and above. Financial accounting scores highest although the feeling was that the higher scores in that area reflect a greater exposure by the students to financial accounting. The faculty feel that greater exposure to the four other technical categories is warranted (Managerial, IT, Tax and Auditing). In this context the faculty discussed the book Why Students Don’t Like School? (Daniel T. Willingham 2009 Jossey-Bass), in particular, pages 87 -90 subtitled Practice Makes Memory Long Lasting. The faculty agreed that if possible, we should explore the possibility of changing some elective courses into required courses. We are particularly encouraged by the responses in the professional values categories. | P a g e 11 1 b. Performance-based Assessment i. Financial Accounting Professional Competencies We assess financial accounting learning outcomes on the first day of class in ACTG 318, ACTG 321 and ACTG 417. ACTG 318 allows assessment early in the accountancy program and after completion of ACTG 317. At this point, students should have a conceptual understanding of relationships between the financial statements and a fundamental understanding of economic transactions. Students should be able to apply their understanding of economic transactions, accounting processes and financial statements. ACTG 417 allows assessment after student’s completion of the intermediate series (ACTG 317, ACTG 318, ACTG 319). At this point students should have a solid understanding of accounting processes, accounting reports, economic transactions and financial statements. Students should also have a solid understanding of the conceptual framework and have the ability to account for economic events. Students should be able to apply their understanding of economic transactions and accounting procedures to prepare financial statements. Financial accounting competencies are also assessed in ACTG 321after completion of ACTG 318 along with assessment of some management accounting competencies. At this point, students should have a solid conceptual understanding of relationships between the financial statements and a solid understanding of economic transactions. Students should be able to apply their understanding of economic transactions, accounting processes and financial statements. Our process of assessment has two benefits. First our process allows collection of data related to prior courses. We use the assessment data to improve our courses and program. Second, our process allows us to prepare students for their current course. The first day assessment tools are designed to emphasize material that the current course will build upon. ACTG 318 We assess learning outcomes in ACTG 317 at the beginning of ACTG 318. The assessment tool used in ACTG 318 is designed to measure our students’ ability to conceptualize the processes involved in financial accounting, construct and follow through with a financial reporting process, and transform knowledge of economic events into summary financial statements. Process On the first session, we distribute Harvard Case #9-902-401 -00, Maria Hernandez & Associates, to students for them to work in class. The Harvard case involves a small business start-up. The business begins with loans and personal contributions followed by a few months’s operating transactions. Students are asked, through two fundamental questions, to report on the financial status of the business. The two questions are: Question 1: How would you have reported on operations of Maria Hernandez & Associates through August 31, 2004, and Question 2: How would you report the status of the business on August 31, 2004? | P a g e 12 We first evaluate performance on the two questions by assessing how students were able to conceptualize, structure, and apply an appropriate recording model to find solutions to the two questions. Student performance is then evaluated based on the correctness of their solution. Assessment Results – ACTG 318 1. Professional Competence: Conceptualization and Application Good 16 23% Conceptualize OK Relationships and Apply an Weak Appropriate Approach Poor 36 51% 17 24% 2 2% 74% 26% Explanation of rubrics: Students should approach solving the case by building upon the initial balance sheet equation. Students used three related devices: (1) journal entries, (2) T-accounts, and (3) increasing and decreasing accounts to track transactions and economic events over time. Good: Students showed a structured approach that integrated transactions into the accounting equation format. Students applied knowledge of the earnings process to expand the accounting equation to include revenue and expense accounts. Examples: #’s 1, 2, 3 OK: Students showed a structured approach that integrated transactions into the accounting equation format but in a less efficient manner. For example students may not have applied knowledge of the earnings process to expand the accounting equation to include revenue and expense accounts. Examples: #’s 4, 5, 6 Weak: Students showed an unstructured approach. Transactions are treated independent of the accounting equation. Examples: 3’s 7, 8 Poor: Examples: #’s 9, 10, 11 2. Professional Competence: Prepare Reports Explanation of rubrics: The rubrics here are self explanatory. Competence: Prepare an Appropriate Financial Performance Report Correct 18 25% Minor Errors 28 39% Major Errors 9 13% 16 23% None | P a g e 13 64% 36% Competence: Prepare an Appropriate Financial Status Report Good 16 23% Minor Errors 26 38% Major Errors 27 39% Not finished 3 3% 61% 42% Accounting Faculty Discussion The accounting faculty met and discussed these results at the annual faculty retreat. The accounting faculty are encouraged by the approaches taken to solving the Harvard Case. The faculty concluded that students are for the most part learning conceptualization and application tools appropriate to the study of accountancy. The faculty discussed the importance of repetition in accounting learning as well as the importance of a summary “capstone” exercise during the last class session. Specific suggestions to strengthen student learning include: • • • continue to emphasize connections to the accounting equation throughout the course, emphasize the relationships between the financial statements when discussing individual financial statements, and prepare a final module for the course that emphasizes integration of the statements These suggestions will be implemented fall term 2009. ACTG 417 We assess learning outcomes in the financial accounting intermediate series at the beginning of ACTG 417. The assessment tool used in ACTG 417 is designed to measure our students’ understanding of the conceptual framework, their ability to account for representative economic transactions, and their ability to prepare summary financial statements. Process On the first session, we distribute an eight question exam to students for them to work in class. The eight exam questions are categorized into three areas: (1) the conceptual framework, (2) transaction analysis and journal entries, and (3) preparation of an income statement. Conceptual Framework: Questions 1-3: 1. What is the primary objective of financial accounting according to FASB Concepts Statement # 1? 2. According to FASB Concepts Statement No.2 there are two primary qualities of information that contribute to the primary objective. The two qualities are relevance and reliability. Briefly define these two terms as they relate to financial accounting. 3. Accounting to FASB Concepts statement No. 2 there are two secondary characteristics that contribute to the primary objective. The two characteristics are consistency and comparability. Briefly define these two terms as they relate to financial accounting Transaction Analysis and Journal Entries: Questions 4-7 | P a g e 14 4. A firm sells for $2,000 on account inventory that it had acquired for $1,200. Prepare the two journal entries to record this economic event. 5. A firm acquires a long-term asset on April 1 for $2,000 cash. The asset is expected to last 3 years with zero salvage value. Prepare the journal entry on April 1 and the journal entry at year end December 31. Assume straight line depreciation. 6. A firm issues a $10,000 face value semi annual four year 10 percent bond when the required rate of return equals 12 percent. Prepare the journal entry to record the issue of the bond and the entry to record the first interest payment. Assume the bond was issued at an interest payment date. 7. As a long term investments at the beginning of the fiscal year, Florists International purchased 30% of Nursery Supplies, Inc’s 8,000 shares for $560,000. The fair value and book value of the shares were the same at the time of the purchase. During the year, Nursery Supplies earned net income of $40,000 and distributed dividends of $1.25. At the end of the year the fair value of the shares is $540,000. Prepare appropriate journal entries from the purchase through the end of the year as prescribed by the equity method. Preparation of a Financial Report 8. Prepare a multi-step income statement with your answers to questions 4-7. Assessment Results – ACTG 417 Professional Competence: Conceptual Framework We evaluate performance on the conceptual framework questions 1-3 based on student’s ability to communicate an understanding of the concepts. The three questions encompass five parts. Therefore scores were tabulated based on the number of concepts correctly described. Communicate Conceptual Framework Excellent 0 0% Good 3 12% OK 9 36% Weak 6 25% Poor 7 28% 48% 52% Explanation of rubrics: Excellent: Students correctly communicated understanding all five concepts. Good: Students correctly communicated understanding of four of the five concepts. OK: Students correctly communicated understanding of three of the five concepts. Weak: Students correctly communicated understanding of two of the five concepts. Poor: Students correctly communicated understanding of no more than one of the five concepts. Professional Competence: Transaction Analysis and Journal Entries We evaluate performance on the transaction analyses and journal entries questions 4-7 based on student’s ability to set up, calculate, and journalize the transactions. Although the four questions have multiple parts, they are evaluated as single questions, and for a correct problem solving | P a g e 15 approach rather than strict correctness. For example, question 6 was evaluated based on whether students considered present value. Results are compiled by question and overall Good Competence: Transaction Analysis and Journal Entries Poor Question 4 15 60% 10 40% Question 5 18 72% 7 28% Question 6 2 8% 23 92% Question 7 2 8% 23 92% 37 37% 63 63% All Professional Competence: Preparation of a Report Explanation of rubrics: The rubrics here are self explanatory. Competence: Prepare an Appropriate Income Statement 10 40% Minor Errors 3 12% Major Errors 5 20% None 7 28% Correct 52% 48% Accounting Faculty Discussion The accounting faculty met and discussed these results after fall term 2008 and prior to ACTG 318 winter term 2009. The faculty concluded that students for the most part will benefit from more reinforcement of the conceptual framework during the intermediate accounting series, particularly in ACTG 318 and ACTG 319. The faculty also recommended that a new approach to learning bond and investment accounting was needed in ACTG 318 and ACTG 319. The faculty discussed the importance of repetition during the intermediate series to reinforce the conceptual framework. The faculty also recommended a “capstone” exercise during the last class sessions of ACTG 318 and ACTG 319 to connect the recording of transactions to the financial statements. Specific suggestions to strengthen student learning include: • • • • tie course material to the conceptual framework throughout ACTG 318 and ACTG 319, ensure greater learning of bond accounting in ACTG 318 by focusing on the calculation of bond values using calculators and present value formulas rather than present value tables. ensure greater learning of investment equity method accounting in ACTG 319 by focusing on the relative importance of investments. prepare a final module for each course that emphasizes integration of the statements. Suggestions 1,2, and 4 were implemented into ACTG 318 winter term 2009. Suggestions 3 and 4 were implemented into ACTG 319 spring term 2009. Assessment of learning in ACTG 417 will occur again during fall term 2009. | P a g e 16 ii. Managerial Accounting Competencies ACTG 321 We assess financial accounting learning outcomes in the intermediate series through ACTG 318 and managerial accounting at the principles level at the beginning of ACTG 321. The financial accounting assessment tool used in ACTG 321 is designed to measure our students’ understanding of the conceptual framework, their ability to account for representative economic transactions, and their ability to prepare summary financial statements. The management accounting assessment tool used is designed to measure our students’ preparation for in-depth study of managerial accounting. Process During the first class session, we distribute a five question exam to students for them to work in class. Typically two questions relate to financial accounting, one question relates to financial reporting and two questions relate to managerial accounting. Students in different course sections receive slightly different exams. Therefore the number of actual questions exceeds five. Here we discuss assessment during Spring term 2008 and Spring term 2009. Spring 2008 financial accounting questions (data provided in exam): 1. Calculate cost of goods sold under the FIFO and LIFO cost flow assumptions. 2. Calculate a future balance in property plant and equipment. 3. Calculate a future balance in accounts receivable. Spring 2008 concept question: 1. Define the matching principle. Spring 2008 managerial accounting questions: 1. Calculate breakeven. 2. Determine appropriate product or sales mix. 3. Prepare a simple budget. Spring 2009 financial accounting questions (data provided in exam): 1. Calculate Cost of Goods sold under the FIFO and LIFO cost flow assumptions. 2. Calculate depreciation for property plant and equipment. 3. Calculate the recorded cost of a long-lived asset and the accrual of wages. Spring 2009 concept question: 1. Define the matching principle. Spring 2009 financial reporting questions: 1. Categorize balance sheet items. 2. Categorize cash flow statement items 3. Categorize income statement items Spring 2009 managerial accounting questions: 1. Calculate cost. 2. Determine appropriate product or sales mix. | P a g e 17 Assessment Results – ACTG 321 Professional Competence: Financial Accounting We evaluate performance on the financial accounting questions based on student’s ability to correctly set up, work and express solutions to the questions. Results are compiled by question and overall. The rubric good implies at least 50% correct answers. Good 2008 Competence: Financial Accounting Inventory 72 81% 17 19% Depreciation – net PPE 18 72% 7 28% Accounts Receivable 33 87% 5 13% 123 81% 29 19% Good Poor All 2009 Competence: Financial Accounting Poor Inventory 58 85% 10 15% Depreciation – net PPE 58 85% 10 15% Acquisitions and Accruals 24 100% 0 13% All 140 88% 20 12% Professional Competence: Conceptual Framework We evaluate performance on the conceptual framework question based on student’s ability to communicate an understanding of the concept. Good 2008 Communicate Conceptual Framework Matching | P a g e 18 61% Good 2009 Communicate Conceptual Framework 54 Matching 19 71% Poor 35 39% Poor 8 29% Professional Competence: Managerial Accounting We evaluate performance on the management accounting questions based on student’s ability to correctly set up, work and express solutions to the questions. Results are compiled by question and overall Good 2008 Poor Competence: Breakeven 57 64% 32 26% Management Accounting Sales/Product Mix 18 26% 66 74% Budget 11 58% 8 42% All 86 45% 106 55% 2009 Good Poor Competence: Costing 13 81% 3 19% Management Accounting Sales/Product Mix 40 59% 28 41% All 53 63% 31 37% Professional Competence: Financial Reports Good Poor Balance Sheet 25 93% 2 Cash Flow Statement 10 63% 6 37% Income Statement 12 50% 12 50% All 47 70% 20 30% 2009 Competence: Financial Reports Concepts 4% Accounting Faculty Discussion The accounting faculty met and discussed these results at the annual faculty retreat. As regards financial accounting competencies the faculty felt that the results support decisions presented earlier in this document. As regards managerial accounting competencies, the faculty concluded that students for the most part are prepared for the start of ACTG 321 given their only preparation was a principles course. The faculty further agreed that the adjustment to the financial accounting courses to prepare a final module that emphasizes integration should also apply to all areas including cost/managerial and tax. This adjustment will occur for ACTG 321 in spring 2010. . | P a g e 19 iii. Accounting Information Systems Professional Competencies ACTG 420 allows assessment of retention of Information Technology (IT) concepts students are exposed to in ACTG 378. Students should be able to appropriately conceptualize business processes (particularly financial transaction processes) to facilitate analysis of risk and to identify controls. Successful students will be able to break a process into steps; associate those steps with responsible agents; identify information related to the events; recognize related risks; and prescribe relevant controls. Related skills include the ability to create a flowchart with swimlanes and information components, the categorization of controls, and the ability to understand well-designed relational data structures. We assess retention of IT risk and control outcomes at the beginning of ACTG 420. The assessment tool is designed to measure our students’ ability to decompose processes to facilitate analysis of risk and identify controls. Process At the beginning of the term, students are given a short case description from materials provided with Accounting Information Systems: A Business Process Approach by Jones and Rama. Students are asked to identify events, create a flowchart, identify risks, identify relevant controls, and create a simple database structure to support the process. Answers are to be assessed as Excellent, Good, OK, Weak, or poor for indications of the following skills: 1. Is the event list appropriate? Was the process decomposed into events appropriate for analysis of controls? Were triggering events correctly identified? Were events named usefully with a verb indicating the action taken? 2. Does the flow chart faithfully represent the identified events and involved agents, indicate the sequence of events, and depict related information? 3. Did the student formulate risks? Were the risks reasonable? The answers demonstrated an understanding of the concepts likelihood and exposure. 4. Were relevant controls identified? Were the appropriately classified as preventive, detective, corrective, or compensating? 5. Did the accompanying data design identify needed data elements and usefully organize them? These assessment criteria correspond to the concepts as presented in ACTG378. | P a g e 20 Results Fourteen students were assessed in the spring of 2009. Students who did not give an answer for a question were scored as “Poor” even though it may have been a matter of time spent completing other questions. 1. Appropriately identify key process events Excellent 5 36% Good 4 29% OK 3 21% Weak/Poor 0 100% Excellent results identified new events only when a new agent became responsible or when there was a delay for an intervening event, named events starting with a specific verb, specified triggers that were when activity began not when the previous activity ended. The most common errors were identifying too many events or using non-verb naming conventions. These flaws would make it harder to identify and assess controls for the process. 2. Flow Charting Excellent 5 36% Good 5 36% OK 2 14% Weak 1 7% Poor 1 7% 86% 14% Excellent flowcharts matched with the event list, showed sequence with arrows, and included icons depicting several tables of stored information, e.g., customers, products, and inventory. 3. Risk Formulation | P a g e 21 Excellent 4 29% Good 0 OK 5 36% Weak 2 14% Poor 3 21% 64% 36% The question asks students to list several related risks. For each risk they were to “describe the exposure and likelihood”. In an excellent answer, all identified risks were formulated as negative events and the concepts likelihood and exposure were demonstrated. OK answers formulated one or more risks as something other than a negative event. Weak answers ignored exposure and likelihood or implied an incorrect understanding of the concepts. 4. Control identification and classification Excellent 6 43% Good 2 21% OK 3 21% Weak 1 7% Poor 2 14% 79% 21% Excellent answers included controls relevant to the risks identified by the student and correct assignment of those risks to categories. Missing or weak categorization still received an OK. 5. Data design Excellent 2 21% Good 3 21% OK 5 36% Weak 4 29% Poor 0 71% 29% Students could still receive an OK on this question despite poorly designed tables so long as they separated entities and include identifiers. Accounting Faculty Discussion The accounting faculty met and discussed these results at the annual faculty retreat. The faculty are again encouraged by the level of student competence although noting that risk assessment is an area that may benefit from increased attention and development within the course. The faculty were unclear on whether the risk issue was appropriately addressed with the assessment instrument. Suggestions included separating risk into its components of exposure and likelihood in separate questions. That could distinguish students who do not know from those who may have simply not read the whole question. It may be that more students understood these concepts but did not provide evidence. Further, a focus on risk components was suggested for winter 2009. | P a g e 22 c. Embedded Assessment i. Writing Writing assignments (research memos) are assigned in the financial accounting courses ACTG 318, ACTG 319, and ACTG 417, the tax courses ACTG 325 and ACTG 425, the auditing course ACTG 427 and the topics elective course ACTG 429. Embedded assessment of writing occurs in ACTG 318, ACTG 319 and ACTG 417. Writing was assessed in ACTG 319 after Spring term 2008 and after Winter term 2009 in ACTG 318. Writing assessment for ACTG 417 is scheduled for Fall term 2009. We apply the writing assessment rubrics derived from Anderson and Mohrweis (2008)1. Performance Criteria Format Grammar & Mechanics Extent and Quality of Research Citation & Documentation Content Analysis Understanding of Concepts 1 Strong – Exceeds Expectations OK – Meets Expectations Weak – Below Expectations Memo prepared in an extremely professional manner per May & May and with appropriate sections and headings. Few, if any errors throughout in use of Standard English rules of grammar, spelling, punctuation, capitalization, and usage Memo prepared in an reasonably professional manner per May & May and with appropriate sections and headings Not more than a few errors throughout in use of Standard English rules of grammar, spelling, punctuation, capitalization, and usage but did not affect overall clarity Adequate level of research appropriate to the issue at hand Memo not prepared in an professional manner per May & May and with appropriate sections and headings Above average level of research – shows genuine interest in Researching the issue at hand. Correctly and clearly incorporated source material into the paper, documented sources accurately and correctly Accomplished purpose of the memo directly and completely in an exceptional manner. All major alternatives thoroughly supported by specific, accurate, relevant data Showed clear understanding of business or accounting concepts No more than a few clarity problems incorporating source material or in documenting sources accurately and correctly Accomplished purpose of assignment in a capable manner Major topics covered but supporting details somewhat lacking in specificity, accuracy, or relevance Showed Partial Understanding of Concepts More than a few errors throughout in use of Standard English rules of grammar, spelling, punctuation, capitalization that made the memo unclear of difficult to read. Limited level of research or research not directly related to the issue at hand. Frequently incorporated source material unclearly of documented sources inaccurately or incorrectly Accomplished purpose of assignment only partially or indirectly Little or no supporting data or data presented was not relevant, specific or accurate Showed Unclear Understanding or Indicated Concepts not Understood Anderson, J.S., and L.C. Mohrweis, 2008, Using Rubrics to Assess Accounting Students’ Writing, Oral Presentations, and Ethics Skills, American Journal of Business Education – Fourth Quarter. pp 85-94 | P a g e 23 Spring 2008 ACTG 319 Part 1 Performance Criteria Strong – Exceeds Expectations OK – Meets Expectations Weak – Below Expectations Format, Grammar & Mechanics 81% 16% 3% Extent and Quality of Research 85% 0 15% Content Understanding of Concepts 52% 46% 2% Content - Analysis 11% 31% 58% Performance Criteria Strong – Exceeds Expectations OK – Meets Expectations Weak – Below Expectations Format 95% 5% 0 Grammar & Mechanics 98% 2% 0 Content – Analysis #1 8% 56% 36% Content – Analysis #2 5% 86% 9% Content – Analysis #3 12% 74% 14% Content – Analysis Combined 8% 70% 22% Spring 2008 ACTG 319 Part 2 | P a g e 24 Winter 2009 ACTG 318 Performance Criteria Strong – Exceeds Expectations OK – Meets Expectations Weak – Below Expectations Format 79% 18% 3% Grammar & Mechanics 46% 36% 18% Citation & Documentation 48% 28% 24% Content - Analysis 40% 57% 3% Accounting Faculty Discussion The accounting faculty met and discussed these results at the annual faculty retreat. The faculty noted the improvement in content analysis skills over the two courses. The faculty discussed the appropriateness of the approach used across the curriculum as it pertains to writing skills. Writing assignments (memorandums) begin with an emphasis on format and then progress to emphasize analysis. The faculty reiterated their support for this approach and it appears the assessment of writing reflects the approach. The faculty noted that tax writing may be qualitatively different than the writing required in financial accounting. The faculty agreed that writing assessment will be expanded to the tax courses. The faculty discussed a suggestion by Accounting Circle member George Graves that writing in the accounting profession is typically done within strict time constraints. The faculty agreed that instruction of time-constrained writing will be implemented into ACTG 319 spring 2010. | P a g e 25 ii. Oral Presentations Oral presentations are assigned in the attestation course ACTG 427. Oral presentations were assessed in ACTG 427 during Spring term 2009 and after Winter term 2009 in ACTG 318. Writing assessment for ACTG 417 is scheduled for Fall term 2009. We apply the oral assessment rubrics derived from Anderson and Mohrweis (2008)2. 1. Organization 2. Content 3. Delivery 4. Projection Exceeds Expectations - Logical flow - Purpose and support information easily understood - Demonstrated thorough understanding of topic, audience and flow Meets Expectations - Some incidences with lack of logical flow and incomplete understanding of topic was evident - Purpose was sometimes difficult to discern - Support information was not easily understood - Accomplished assignment - Accomplished assignment directly and completely in an in a capable manner exceptional manner - Major topics covered but - All major topics covered supporting data lacks and supported by relevant specificity, accuracy, or data relevance - Exhibited high level of - Uneven levels of enthusiasm enthusiasm and confidence and confidence exhibited -Responded fully and - Some questions were accurately to questions answered more effectively - Generated audience interest than others and interaction - Pace, volume, and - Pace, volume, and enunciation enhanced the enunciation were acceptable presentation but did not enhance the presentation 5. Non-Verbal - Eye contact, gestures, and movement were used effectively - Eye contact, gestures, and movement occasionally distracted from the presentation 6. Technology - Visuals were clear and professional - Visuals reinforced the presentation - No spelling or grammatical errors -Visuals used distracting slide design (template, font, clip art) - At least one spelling or grammatical error 2 Below Expectations - Inadequate or illogical flow - Ill-defined or no discernable purpose - Support information was unclear or incorrect - Lacked basic understanding of topic, audience and flow - Accomplished assignment only partially or indirectly - No supporting data; or data that was presented was not relevant or accurate - Exhibited extremely low level of enthusiasm and confidence - Was not able to effectively answer questions - Projection consistently detracted from presentation; speech was too slow/fast, could not be heard, used fillers such as uhm, incorrect pronunciation - Non-verbals consistently detracted from presentation (read from notes, monitor or screen; made no eye contact; no/excessive movement, stood behind podium or in front of screen) - Visuals were unclear, unattractive, or unprofessional - Did not support presentation and contained several spelling and/or grammatical errors Anderson, J.S., and L.C. Mohrweis, 2008, Using Rubrics to Assess Accounting Students’ Writing, Oral Presentations, and Ethics Skills, American Journal of Business Education – Fourth Quarter. pp 85-94 | P a g e 26 7. Appearance - Highly professional attire and demeanor enhanced credibility of speaker - Acceptable professional attire and demeanor 8. Visual Aids (if any) - Used visuals extremely effectively to clarify, simplify, or emphasize numerical data or main points - Visuals were appropriately numbered, labeled, had sources noted, and were mentioned in the text - Used visuals fairly effectively to clarify, simplify, or emphasize numerical data or main points - Most visuals were appropriately numbered, labeled, had sources noted, and were mentioned in the text - Unprofessional attire and demeanor - Seated presenters exhibited distracting behavior during presentation - Used visuals ineffectively - Many visuals did not clarify, simplify, or emphasize numerical data or main points - Many visuals were not numbered nor fully labeled, had no sources noted, or were not mentioned in the text Oral presentations in ACTG 427 require research, analysis and role playing. Typical roles include: Auditor Role Take the position that there an independence issue exists. Justify with the appropriate authoritative guidance (i.e. AICPA Professional Standards, SEC Regs, SOX Acts, etc….) Managers Role Take the position that an independence issue does not exist. State management’s position and justification/ reasoning for wanting to take this position. SEC Facilitate the discussion of the case while questioning them to understand the case.. Three oral presentations are required with each subsequent presentation dealing with a more complex issue. | P a g e 27 Spring 2009 ACTG 427 Case Presentation I Performance Criteria Strong – Exceeds Expectations OK – Meets Expectations Weak – Below Expectations Organization 70% 25% 5% Content 65% 30% 5% Delivery 70% 30% 0% Projection 90% 10% 0% Non-Verbal n/a n/a n/a Technology 60% 40% 0% Appearance 50% 30% 10% Visual Aids 75% 20% 10% Spring 2009 ACTG 427 Case Presentation II Performance Criteria Strong – Exceeds Expectations OK – Meets Expectations Weak – Below Expectations Organization 60% 20% 10% Content 60% 35% 5% Delivery 65% 35% 5% Projection 90% 10% 0% Non-Verbal n/a n/a n/a Technology 60% 40% 0% Appearance 50% 30% 10% Visual Aids 75% 20% 10% | P a g e 28 Spring 2009 ACTG 427 Case Presentation III Performance Criteria Strong – Exceeds Expectations OK – Meets Expectations Weak – Below Expectations Organization 85% 15% 0% Content 75% 25% 0% Delivery 75% 25% 0% Projection 90% 10% 0% Non-Verbal n/a n/a n/a Technology 60% 40% 0% Appearance 65% 30% 5% Visual Aids 80% 15% 5% Spring 2009 ACTG 427 Case Presentation IV Performance Criteria Strong – Exceeds Expectations OK – Meets Expectations Weak – Below Expectations Organization 85% 15% 0% Content 75% 25% 0% Delivery 70% 30% 0% Projection 90% 10% 0% Non-Verbal n/a n/a n/a Technology 60% 40% 0% Appearance 55% 20% 25% Visual Aids 80% 15% 5% | P a g e 29 Accounting Faculty Discussion The accounting faculty met and discussed these results at the annual faculty retreat. The faculty are encouraged by the skills shown by the students. Larry Brown suggested that a key measure of competence should be whether a professional would allow the presenter to represent the professional in front of a client. The faculty agreed to prepare rubrics for such evaluation to be used when visiting professionals observe student presentations. | P a g e 30 d. Other Assessment i. Internship Evaluation We collect additional input on professional values competencies from the supervisors of our students with summer internships (other input comes from the exit survey). During summer 2009, supervisors from the Portland area offices of Moss Adams, KPMG, PWC and Deloitte were asked to evaluate their OSU summer interns. Eight OSU accounting students were evaluated. The evaluations did not require identification of the accounting interns and so to some extent the evaluations are anonymous. The evaluation involves the following rubrics adapted with permission from copyrighted material belonging to Oregon Health Sciences University - Dietetic Internship Program. Ethical Conduct – Familiarity with Accounting Codes of Ethics and consistently demonstrating ethical conduct. (The Institute of Management Accountants, The Institute of Internal Auditors and the American Institute of CPAs codes of ethics feature nearly identical rules for ethical conduct.) (Circle one statement below) Accounting intern fails to exhibit qualities of accounting ethics, or fails to correct an incidence of non-compliance after it is discussed. Intern usually complies with accounting ethics. Failings are corrected with the next opportunity. Intern demonstrates at every opportunity an understanding of accounting ethics. Intern models professional behavior as stated in accounting codes of ethics. Integrity – Accepting responsibility for his/her actions and demonstrating honesty, sincerity, truthfulness, and fairness in all activities related to accounting. (Circle one statement below) Accounting intern fails to show honesty, truthfulness, fairness and sincerity. Intern admits mistakes but tends to rationalize them or deflect responsibility to others. Intern demonstrates at every opportunity a commitment to honesty, sincerity, truthfulness, and fairness, and takes corrective action as needed. Intern serves as an example of integrity, taking complete responsibility for his/her actions. Respect for Diversity – Interacting and communicating well with others regardless of race, ethnicity, or other personal characteristics. Consideration for other viewpoints and various approaches to the same problem. (Circle one response below) Accounting intern fails to act with consideration for individuals of different back grounds and/or fails to recognize differences that clients and colleagues may bring to an interaction. Intern fails to recognize diversity in a given situation, but learns from this and applies this in subsequent interactions Intern demonstrates consideration for diversity, taking time to learn about different ethnic and/or other groups prior to interaction with them Intern works easily with a wide variety of individuals and is considerate of different opinions and backgrounds. Commitment to Excellence - Being emotionally and/or intellectually bound to a superior performance in professional endeavors. (Circle one response below) Accounting intern fails to show commitment to excellence. | P a g e 31 Intern strives to achieve good performance, but fails to put in a consistent effort to achieve superior performance. Intern demonstrates at every opportunity a commitment to excellence and indicates that he/she is thoughtful about ways to improve performance further. Intern serves as an example of excellence in all aspects of the Internship Program. Leadership – Generally able to work independently and to provide guidance in group efforts. (Circle one response below) The intern fails to show ability to work without instruction and waits for others to act or speak up first. The intern attempts to guide group projects or other efforts on occasion but falls short of reaching the desired goals and/or fails to accept responsibility for the group effort. Intern guides group efforts in most situations, and attains desired goals. Intern consistently volunteers for guiding group efforts in a variety of settings, accepts responsibility for the group effort and is regarded as an expert. Problem Solving/Critical Thinking – The intern is able to utilize available data, to demonstrate reasoning that integrates facts, informed opinions and observations to solve workplace problems appropriately. (Circle one response below) Data collection and resultant problem solving frequently demonstrates inaccuracies and/or inadequacies Data collection and resultant problem solving occasionally demonstrates inaccuracies and/or inadequacies. Intern corrects errors and improves problem solving at the next opportunity Basic data collection and analysis is consistently appropriate, accurate, and complete. Intern is able to consider alternative solutions to problems. Intern incorporates all pertinent techniques to intelligently complete data collection and analysis. Able to reach appropriate conclusions with complex problems. Commitment to Education/Lifelong Learning – Looks for opportunities that optimize learning activities and/or meet specific personal goals for professional growth. (Circle one statement below) Intern fails to use information resources and other tools to maximize the learning opportunities of the internship. The intern consistently seeks answers from preceptors or other staff rather than going to original sources. Intern usually uses available resources to answer questions that come up in a typical rotation or activity, however he/she needs encouragement to do so. Intern readily seeks answers and clarification of questions that arise in the typical workday from accepted references and resources. Intern uses the resources available and seeks opportunities beyond the rotation site to improve and expand the knowledge base. Time Management – Effectively manages his/her time to achieve rotation goals in an efficient manner without compromising quality and care. (Circle one statement below) Intern demonstrates a poor concept of time management, and is unable to set priorities. Frequent unexplained absences, late to meetings and facilities. Intern has occasional unexplained absences and tardiness to meetings and facilities. Intern improves in ability to handle workload and corrects concerns regarding timeliness at the next opportunity. Intern is punctual and able to effectively handle assigned workload. Solicits prior approval for any time off, including appointments, meetings, etc. Intern able to handle larger than average workload, and has outstanding ability to manage time. Intern actively seeks out additional learning experiences. Perfect attendance and punctuality. Communication – The intern communicates in a respectful, timely, and appropriate manner with faculty, staff, and mentors. (Circle one statement below) The intern fails to communicate with faculty, staff, and mentors. Communication is disrespectful, untimely, or inappropriate. | P a g e 32 The intern usually communicates effectively. When miscommunication occurs, the intern is quick to correct his/her actions and improves communication at the next opportunity. The intern communicates effectively in respectful, timely, and appropriate manner. The intern consistently communicates in an exemplary manner and serves as a model of excellence in communication. Interdisciplinary Team Collaboration/Trust – Cooperates with others in a work group to define and accomplishes common goals in a manner that inspires confidence in one’s expertise and one’s dedication to the group and to common goals. (Circle one statement below) Intern fails to participate in team meetings or to fulfill his/her commitment to projects in the work group when presented the opportunity. Intern participates in team conferences and projects as directed. Contributions to conferences or projects are slow and/or occasionally inaccurate, but are forthcoming with support. Intern readily contributes to team conferences and/or projects with support. All information is presented accurately. Intern initiates accurate input at team conferences and contributes to team projects as an expert. Appearance – Maintains a clean, well-groomed professional appearance and presentation so as to reflect a positive professional image. (Circle one statement below) Intern presents with an untidy appearance, unprofessional, does not adhere to dress code of the institution and/or inappropriate mannerisms with minimal attempt to take corrective action. Appears unconfident in approaching staff. | P a g e 33 Intern occasionally presents with unprofessional demeanor or dress. When instructed to take corrective action, the intern does so at the next opportunity. Tries to appear confident in abilities and knowledge. Intern is mature in presentation and confidence. Appears in dress appropriate to the workplace. Intern shows exceptional maturity, professionalism, and grooming that are consistent with the highest ideals of the profession. Professionally assertive in workplace situations, norms and expectations. The responses are summarized below (n=8) Inappropriate Weak Acceptable Appropriate Values Values Values Values Ethical Conduct 100% Integrity 100% Respect for Diversity 75% 25% Commitment to Excellence 12.5% 87.5% Leadership 75% 25% Problem Solving/Critical Thinking 50% 50% Commitment to Education/Lifelong Learning 50% 50% 87.5% 12.5% 87.5% 12.5% Time Management Communication 12.5% Interdisciplinary Team Collaboration/Trust 100% Appearance 75% 25% Accounting Faculty Discussion The accounting faculty met and discussed these results at the annual faculty retreat. The faculty are encouraged by the results although noting the limited number of students evaluated. The faculty discussed ways to expand the use of the rubrics. The faculty agreed to see if the Accounting Program could be expanded to include a capstone course. The capstone course would be designed to emphasize critical thinking skills and writing. One reviewer’s response to the responses: “Thanks, I appreciate your sharing these results. I find it interesting and not too surprising that ‘problem solving / critical thinking’ shows up as an opportunity. Historically, in my experience, that area is an opportunity across the country. | P a g e 34 When interns and college students ask me what attributes they should concentrate on developing in terms of what prospective employers are looking for, I typically reply critical thinking skills and intellectual curiosity.” | P a g e 35 ii. CPA Exam Performance Over Time Oregon State University graduates placed third on the exam in the State of Oregon in 2008, 2007 and 2006 and second in 2003 and 2001. 2008 CPA Exam Results Oregon State University National FAR 46% 49% AUD 52% 49% REG 54% 49% BEC 54% 48% All 37% 39% None 26% 33% Some 37% 28% N 120 85,362 2007 CPA Exam Results Oregon State University National 53% 47% 56% 48% 51% 48% 61% 45% 34% 27% 21% 43% 45% 30% 106 77,196 2006 CPA Exam Results Oregon State University National 56% 45% 58% 44% 63% 42% 61% 44% 46% 29% 26% 40% 28% 31% 108 69,257 53% 43% 60% 44% 55% 41% 66% 44% 44% 29% 19% 41% 38% 30% 80 61,884 32% 19% 34% 22% 29% 19% 29% 22% 9% 6% 37% 56% 54% 38% 59 44,513 2005 CPA Exam Results Oregon State University National 2004 CPA Exam Results Oregon State University National FAR = Financial Accounting and Reporting AUD = Auditing and Attestation REG = Regulation BEC = Business Environment and Concepts 2008 The State of Oregon had passing percentages for first time candidates on all four subjects higher than the national average The State of Oregon ranked fifth highest of all states on BEC The State of Oregon ranked fifth highest of all states on AUD 2007 The State of Oregon had passing percentages for first time candidates on all four subjects higher than the national average 2006 Oregon State University was 6th in the nation on REG The State of Oregon ranked third highest of all states on AUD The State of Oregon had passing percentages for first time candidates on all four subjects higher than the national average | P a g e 36 2005 Oregon State University was fifth in the nation on BEC The State of Oregon ranked highest of all states on FAR The State of Oregon ranked fifth highest of all states on REG The State of Oregon ranked second highest of all states on BEC The State of Oregon ranked second highest of all states on AUD The State of Oregon ranked eighth highest on first-time candidates passing all sections The State of Oregon had passing percentages for first time candidates on all four subjects higher than the national average 2004 The State of Oregon ranked eighth highest on first-time candidates passing all sections The State of Oregon had passing percentages for first time candidates on all four subjects higher than the national average The State of Oregon ranked fourth highest of all states on REG iii. Participation in Tax Competitions Oregon State University accounting students placed first in the Bernstein-Porter University of Washington Masters in Tax Program Tax Case completion in 2008, the first year we sent a team to compete. Our students placed second in 2009. Also during 2009, we participated for the first time in PWC’s XTax competition and fielded nine teams. We have been selected to host the competition again fall 2009. | P a g e 37 | P a g e 38