Chapter 12: AD in Open Economy

advertisement

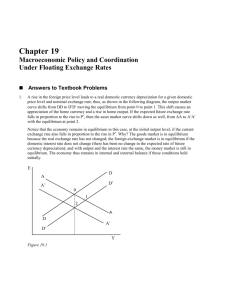

Chapter 12: AD in Open Economy The Mundell-Fleming model: IS-LM for the small open economy Causes and effects of interest rate differentials Arguments for fixed vs. floating exchange rates The aggregate demand curve for the small open economy Ch. 12 AD in Open Economy slide 0 The MundellMundell-Fleming Model Key assumption: Small open economy with perfect capital mobility. r = r* Goods market equilibrium---the IS* curve: Y C (Y T ) I (r *) G NX (e ) where e = nominal exchange rate = foreign currency per unit of domestic currency Ch. 12 AD in Open Economy slide 1 The IS* curve Y C (Y T ) I (r *) G NX (e ) e e NX Y IS* Y Ch. 12 AD in Open Economy slide 2 1 NX(e) NX(e) A weaker dollar (low e) increases net exports. In recent months the trend in NX in the US has reversed (weak $) Below: x: Euro-USD exchange rate y: changes in real net exports, 1999-2007 50 40 30 20 10 0 -10 0.8 0.9 1 1.1 1.2 1.3 1.4 -20 -30 -40 -50 Ch. 12 AD in Open Economy slide 3 The LM* curve M P L (r *,Y ) e LM* Y Ch. 12 AD in Open Economy slide 4 Equilibrium Y C (Y T ) I (r *) G NX (e ) M P L (r *,Y ) e LM* IS* Ch. 12 AD in Open Economy Y slide 5 2 Floating & fixed exchange rates Floating exchange rates, e is allowed to fluctuate in response to changing economic conditions. Fixed exchange rates, the central bank trades domestic for foreign currency at a predetermined price. We now consider fiscal, monetary, and trade policy: first in a floating exchange rate system, then in a fixed exchange rate system. Ch. 12 AD in Open Economy slide 6 Fiscal policy under flexible e Y C (Y T ) I (r *) G NX (e ) M P L (r *,Y ) e LM 1* e2 At any given value of e, a fiscal expansion increases demand, shifting IS* to the right. Ch. 12 e1 IS 2* IS 1* Y1 AD in Open Economy Y slide 7 Lessons about fiscal policy In a small open economy with perfect capital mobility, fiscal policy does not affect GDP “Crowding out” • closed economy: Fiscal policy crowds out investment by causing the interest rate to rise. • small open economy: Fiscal policy crowds out net exports by causing the exchange rate to appreciate. Ch. 12 AD in Open Economy slide 8 3 Mon. policy under flexible e Y C (Y T ) I (r *) G NX (e ) M P L (r *,Y ) e An increase in M shifts LM* right because Y must rise to restore eq’m in the money market. LM 1*LM 2* e1 e2 IS 1* Y1 Y2 Ch. 12 AD in Open Economy Y slide 9 Lessons about monetary policy Monetary policy affects output by affecting the components of aggregate demand: closed economy: M r I Y small open economy: M e NX Y Expansionary mon. policy shifts demand from foreign to domestic products. Thus, the increases in income and employment at home come at the expense of losses abroad. Ch. 12 AD in Open Economy slide 10 Trade policy under floating exchange rates Y C (Y T ) I (r *) G NX (e ) M P L (r *,Y ) e At any given value of e, a tariff or quota reduces imports, increases NX, and shifts IS* to the right. LM 1* e2 e1 IS 2* IS 1* Y1 Ch. 12 AD in Open Economy Y slide 11 4 Lessons about trade policy Import restrictions cannot reduce a trade deficit. Even though NX is unchanged, there is less trade: – the trade restriction reduces imports – the exchange rate appreciation reduces exports Less trade fewer ‘gains from trade.’ Import restrictions on specific products save jobs in the domestic industries that produce those products, but destroy jobs in export-producing sectors. Import restrictions create “sectoral shifts,” which cause frictional unemployment. Ch. 12 AD in Open Economy slide 12 Fixed exchange rates CB stands ready to buy or sell the domestic currency at a predetermined rate. CB shifts the LM* curve as required to keep e at its preannounced rate. This system fixes the nominal exchange rate. In the long run, when prices are flexible, the real exchange rate can move even if the nominal rate is fixed. Ch. 12 AD in Open Economy slide 13 Fiscal policy under fixed e Under floating rates, a fiscal expansion would raise e. To keep e from rising, the central bank must sell domestic currency, which increases M and shifts LM* right. Ch. 12 AD in Open Economy e LM 1*LM 2* e1 IS 2* IS 1* Y1 Y2 Y slide 14 5 Monetary policy under fixed e An increase in M would shift LM* right and reduce e. To prevent the fall in e, the central bank must buy domestic currency, which reduces M and shifts LM* back left. e LM 1*LM 2* e1 IS 1* Y Y1 Ch. 12 AD in Open Economy slide 15 Trade policy under fixed e A restriction on imports puts upward pressure on e. To keep e from rising, the central bank must sell domestic currency, which increases M and shifts LM* right. e LM 1*LM 2* e1 IS 2* IS 1* Y Y1 Y2 Ch. 12 AD in Open Economy slide 16 Differentials in the MM-F model r may differ from r*. Why? country risk: borrowers might default on loan repayments Lenders require higher r to compensate them for this risk. expected exchange rate changes: Ee)<0 borrowers must pay a higher r to compensate lenders for expected currency depreciation. r r * where is a risk premium. Substitute back into IS* and LM* equations: Y C (Y T ) I (r * ) G NX (e ) M P L (r * ,Y ) Ch. 12 AD in Open Economy slide 17 6 The effects of an increase in (flexible) IS* shifts left r I LM* shifts right r (M/P )d, so Y must rise to restore e LM 1*LM 2* e1 money market eq’m. e2 Y1 Y2 Ch. 12 IS 1* IS 2* Y AD in Open Economy slide 18 The effects of an increase in The fall in e: domestic currency less attractive. The increase in Y :boost in NX (from the depreciation) greater than the fall in I (from the rise in r ). BUT Y could not rise if: CB prevents depreciation reducing M (question: what would happen under fixed e ?) Depreciation boosts import prices so to increase the price level (which would reduce the real money supply) Consumers respond to higher riskholding more money. Ch. 12 AD in Open Economy slide 19 Floating vs. Fixed Exchange Rates Argument for floating rates: allows monetary policy to be used to pursue other goals (stable growth, low inflation) Arguments for fixed rates: avoids uncertainty and volatility, making international transactions easier disciplines monetary policy to prevent excessive money growth & hyperinflation Ch. 12 AD in Open Economy slide 20 7 Which system is best? FIXED Preferable if shocks come from the money market (LM) FLEXIBLE Preferable if shocks come from the goods market (IS) or from abroad (r*) Preferable if large importer If prices move slowly, less of exporter of primary costly to move e in response products to shock that requires adjustment in the real exchange rate. Preferable if borrower from abroad. Ch. 12 AD in Open Economy slide 21 The impossible trinity Free capital flows + Independent monetary policy USA Independent monetary policy + Fixed rates China Fixed exchange rate + Free capital flows Hong Kong Ch. 12 AD in Open Economy slide 22 MundellMundell-Fleming and the AD curve Previously, we examined the M-F model with a fixed price level. To derive the AD curve, consider impact of a change in P in the M-F model. We now write the M-F equations as: (IS* ) (LM* ) Y C (Y T ) I (r *) G NX (ε ) M P L (r *,Y ) (Earlier, we could write NX as a function of e since e and move in same direction when P is fixed.) Ch. 12 AD in Open Economy slide 23 8 Deriving the AD curve Why AD curve has negative slope: P (M/P ) IS* LM shifts left P NX P2 Y Ch. 12 LM*(P2) LM*(P1) 2 1 Y2 Y1 Y2 Y1 Y P1 AD Y AD in Open Economy slide 24 From the short run to the long run If Y1 Y , then there is downward pressure on prices. Over time, P will move down, causing (M/P ) LM*(P1) LM*(P2) 1 2 IS* P Y1 Y LRAS Y P1 SRAS1 NX P2 SRAS2 Y AD Y1 Ch. 12 Y Y AD in Open Economy slide 25 Large: between small and closed Many countries - including the U.S. - are neither closed nor small open economies. A large open economy is in between the polar cases of closed & small open. Consider a monetary expansion: • Like M • Like M Ch. 12 in a closed economy, > 0 r I (though not as much) in a small open economy, > 0 NX (though not as much) AD in Open Economy slide 26 9