Federal Reserve Bank of Chicago Cyclical Dumping and US Antidumping Protection: 1980-2001

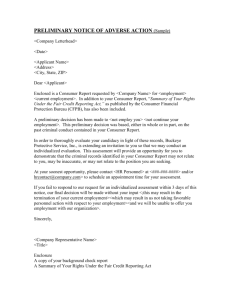

advertisement