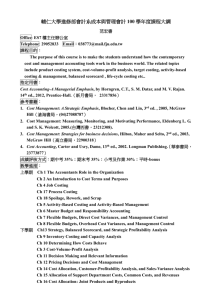

Chapter 9 Cost Accounting For Service Businesses and the Balanced Scorecard

advertisement

Chapter 9 Cost Accounting For Service Businesses and the Balanced Scorecard 1 Learning Objectives LO1 Perform job order costing for service businesses. LO2 Prepare budgets for service businesses. LO3 Apply activity-based costing for a service firm. LO4 Compare the results of cost allocations using simplified costing versus activity-based costing. LO5 Prepare a balanced scorecard for various business entities. 2 Characteristics of a Service Business Little or no inventory. Labor costs often comprise three-fourths or more of the total costs. As of June 2009, service businesses employed roughly 85% of U.S. non-farm workers and this percentage is expected to grow. 3 Job Order Costing for Service Businesses When the amount and complexity of services provided varies substantially from customer to customer, a job order costing system should be used, just as the manufacturers of differentiated products use such a system. 4 Job Order Cost Sheet The basic document used to accumulate costs for a service business. Indicates labor time, labor rate, and the total cost for each labor category worked. Because direct labor cost is the single largest cost to the firm, the amount of direct labor cost determines the amount of overhead charged to each job. 5 Budgeting for Service Businesses Revenue budget. Labor budget. Overhead budget. Other direct expenses budget. Budgeted income statement. 6 Activity-Based Costing in a Service Firm Firms that use activity-based costing attempt to shift as many costs as possible out of the indirect cost pool and into direct cost pools that can be specifically traced to individual jobs. Remaining costs are separated into homogeneous cost pools and allocated to individual jobs via separate allocation bases for each pool. 7 Allocations Using Simplified Costing Versus Activity-Based Costing Activity-based costing is worthwhile to implement when different jobs use resources in different proportions. Should be a cost/benefit decision as to whether to implement a more sophisticated costing system. 8 Simplified Job Costing for a Law Firm Client A Client B Professional labor cost: 50 hours X $50 $2,500 75 hours X $50 $3,750 Professional support: 50 hours X $25 1,250 75 hours X $25 Total 1,875 $3,750 $5,625 9 Activity-Based Costing for a Law Firm Client A Client B Partner labor cost: 40 hours X $100 $4,000 5 hours X $100 $500 Associate labor cost: 10 hours X $37.50 375 70 hours X $37.50 2,625 Legal support: 50 professional hours X $20 1,000 75 professional hours X $20 1,500 Secretarial support: 40 partner hours X $25 1,000 5 partner hours X $25 Total 125 $6,375 $4,750 10 The Four Categories of a Balanced Scorecard Financial Customer Internal Business Processes Learning and Growth 11 Financial Return on Investment (ROI) Operating Income Gross Margin Percentage Revenue from New Products 12 Customer Number of New Customers Market Share Percentage of Products Returned Customer Satisfaction Surveys 13 Internal Business Processes Percentage of On-Time Deliveries Percentage of Defect-Free Units Produced Time Taken to Replace Defective Products Time From Receipt of Order to Shipment 14 Learning and Growth Employee Turnover Number of Employee Suggestions Percentage of Employees Trained in New Processes Percentage of Compensation Based on Employee/Team Performance 15 Guidelines for a Good Balanced Scorecard To be effective the performance measures must be consistent with the company strategy. There should not be too many performance measures. Employees should be able to understand and have control over the performance measures by which they are evaluated. 16