Course Prefix/Number: Course Syllabus

advertisement

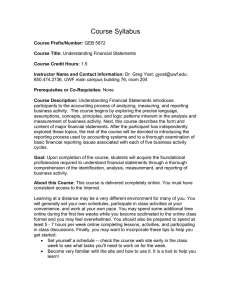

Course Syllabus Course Prefix/Number: GEB 5872 Course Title: Understanding Financial Statements Course Credit Hours: 1.5 Instructor Name and Contact Information: Dr. Greg Yost; gyost@uwf.edu; 850.474.2736, UWF main campus building 76, room 204 Prerequisites or Co-Requisites: None Course Description: Understanding Financial Statements introduces participants to the accounting process of analyzing, measuring, and reporting business activity. The course begins by exploring the precise language, assumptions, concepts, principles, and logic patterns inherent in the analysis and measurement of business activity, Next, this course describes the form and content of major financial statements. After the participant has independently explored these topics, the rest of the course will be devoted to introducing reporting process used by accounting systems and to a thorough examination of basic financial reporting issues associated with each of five business activity cycles. Goal: Upon completion of the course, students will acquire the foundational proficiencies required to understand financial statements through a thorough comprehension of the identification, analysis, measurement, and reporting of business activity. About this Course: This course is delivered completely online. You must have consistent access to the Internet. Learning at a distance may be a very different environment for many of you. You will generally set your own schedules, participate in class activities at your convenience, and work at your own pace. You may spend some additional time online during the first few weeks while you become acclimated to the online class format and you may feel overwhelmed. You should also be prepared to spend at least 5 - 7 hours per week online completing lessons, activities, and participating in class discussions. Finally, you may want to incorporate these tips to help you get started: • Set yourself a schedule -- check the course web site early in the class week to see what tasks you'll need to work on for the week. • Become very familiar with the site and how to use it. It is a tool to help you learn! • • Team up with your classmates to discuss class assignments and questions you might have. Check the “Classlist” link ? for biography info and email addresses. Ask questions when you need answers. If you have problems, contact your instructor ASAP! Topics: 1. Introduction to Accounting as an Information System 2. Business Activity – Actions, Reactions and Earnings Result 3. The Cycles of Business Activity 4. Financial Statements 5. The Financing Cycle – Effect on Financial Statements 6. The Capital Investing Cycle - Effect on Financial Statements 7. The Operating Cycle - Effect on Financial Statements 8. An Experience in Building Financial Statements Student Learning Outcomes: 1) Recognize accounting as an information system (Topic 1) • Define business activity • Define financial reporting • Distinguish between assets, liabilities, equity, revenue and expense • Recognize the basic accounting equation Explain the nature of accounting information (Topic 1) • Define the role and fundamental concepts that underlie accounting • Describe the users of accounting information • List the four major financial statements • Discuss the limitations of accounting information Differentiate between the forms (organizational structures) and functions of business activity (Topic 1) • Describe the four different legal forms (organizational structures) of a business • Discuss the tax implications of each form • Describe the impact financial information has on the business functions of economics, finance, management and marketing 2) Identify the effects and results of business activity (Topic 2) • Summarize the premise that all business activity is characterized by exchanges consisting of an action and reaction • Describe how business exchanges result in increases or decreases in assets, liabilities and/or equity • Identify when a change in equity results in a revenue or expense • Describe how business actions and reactions focus on the issues of classification, timing and valuation 3) Describe the five basic cycles of business activity (Topic 3) • Discuss the business activities that take place within a business cycle • Describe how business cycles are interrelated 4) Differentiate between the purpose and content of the balance sheet, income statement and statement of cash flow (Topic 4) • Describe how the five business activities impact a business’ financial position • Describe the balance sheet as a tool for making economic decisions and solving problems Discuss the Income Statement as a profitability model (Topic 4) • Describe how the five business activities impact a business’ profitability • Describe the income statement as a tool for making economic decisions and solving problems Discuss the Cash Flow statement as a liquidity model (Topic 4) • Describe how the five business activities impact a business’ liquidity • Describe how profitability differs from liquidity • Describe the importance of Cash Flow analysis as a tool for making economic decisions and solving problems 5) Identify the financial statement effects of financing activity (Topic 5) • Describe the effects of acquiring capital • Describe the effects of servicing debt • Describe the effects of distributing capital 6) Identify the financial statement effects of capital investing activity (Topic 6) • Differentiate among the various types of capital • Differentiate between the two types of capital assets • Describe the effects of acquiring capital assets • Describe the effects of the passage of time on capital assets • Describe the effects of disposing of capital assets 7) Identify the financial statement effects of operating activity (Topic 7) • Identify the three activity cycles comprising operating activity • Describe the effects of acquiring and/or using current assets • Describe the effects of employing human resources • Describe the effects of generating and collecting earnings 8) Demonstrate the ability to identify business activity and its effects on financial statements (Topic 8) • Analyze business activity and identify the effect on assets, liabilities, equity, revenue and/or expense • Apply business activity effects/results to the appropriate financial statements Texts: Required text: The course text (Accounting for Business Activity: Its Meaning and Implications ) is embedded in the online materials available in the weekly sessions. Therefore, there is no text to purchase. Recommended texts: None Required Materials: You must have consistent access to: The course Elearning site via the Internet Your Student Email Account Grading / Evaluation: Testing and weekly participation activities demonstrate student proficiency and expertise in the topics listed above. Students will complete activities related to the student learning outcomes. Midterm Exam – 30% Multiple choice questions covering topics 1-4. Final Exam – 50% Open ended questions on your ability to analyze transactions and identify specific effects on each financial statement. Class Participation 20% Submission of session assignments. Submissions are evaluated on correctness and completeness. Solutions do not have to be totally correct, but they must reflect what I would consider an honest effort. Submissions that are incomplete and/or that reflect little understanding of major ideas will not receive credit. Each assignment is worth approximately three percent of your final grade. Partial credit is not awarded for assignments. Late submissions will not be accepted. Special Technology Utilized by Students: This course is totally online. All instructional content and interaction takes place over the WWW. In addition to baseline word processing skills and sending/receiving email with attachments, students will be expected to search the internet and upload / download files. In addition, students may need one or more of the following plug-ins: • • • • • • Adobe Acrobat Reader: http://www.adobe.com/products/acrobat/readstep2.html PowerPoint Viewer: http://microsoft.com/downloads/details.aspx?FamilyId=D1649C22B51F-4910-93FC-4CF2832D3342&displaylang=en Windows Media Player: http://www.microsoft.com/windows/windowsmedia/download/ Quicktime Player: http://www.apple.com/quicktime/download/ Real Player: http://forms.real.com/netzip/getrde601.html?h=207.188.7.150&f=windows/RealOnePlayer V2GOLD.exe&p=RealOne+Player&oem=dl&tagtype=ie&type=dl Macromedia Flash Player: http://macromedia.com/shockwave/download/download.cgi?P1_Prod_Version=Shockwa veFlash Expectations for Academic Conduct/Plagiarism Policy: Academic Conduct Policy: (Web Format) | (PDF Format) | (RTF Format) Plagiarism Policy: (Word Format) | (PDF Format) | (RTF Format) Student Handbook: (PDF Format) ASSISTANCE: Students with special needs who require specific examination-related or other course-related accommodations should contact Disabled Student Services (DSS), dss@uwf.edu, (850) 474-2387. DSS will provide the student with a letter for the instructor that will specify any recommended accommodations. See next page for detailed schedule Course Schedule and Assignments Directions: Print this page for a comprehensive checklist of all assignments due for GEB 5872 Dates Session Title Requirements 3. 4. Complete Bio Info Participate in the What Did Dr. Yost Really Mean? Discussion Complete Study Guide Complete Participation Activity 1 Read Chapter 4 1. 2. Complete Study Guide Complete Participation Activity 2 Read Chapter 5 1. 2. 3. Complete Study Guide Participate in Ice Cube Discussion Complete Ice Cube Questions, Post Discussion 1. 2. 3. Complete Study Guide Complete Participation Activity 4 Complete Questions for Discussion, Post in Dropbox 1. 2. 5/115/15 Session 1 - Introduction to Accounting as an Information System Read Chapters 1, 2, 3 5/165/20 Session 2 - Business Activity – Actions, Reactions and Earnings Result 5/215/25 5/265/31 5/316/1 Session 3 - Business Activity – The Cycles of Business Activity Session 4 - Financial Statements Midterm Examination Read Chapters 6, 7, 8 Chapters 1-8 6/`16/5 Session 5 - The Financing Cycle – Read Chapter 10 Effect on Financial Statements 6/66/10 Session 6 - The Capital Investing Cycle - Effect on Financial Statements 6/116/15 Session 7 - The Operating Cycles Read Chapters 12, - Effect on Financial Statements 13, 14 6/166/18 6/196/20 Read Chapter 11 Session 8 - An Experience in Building Financial Statements Final Examination Assignments Complete 40 Question Multiple Choice Exam Available May 31 and June 1 ; DUE NO LATER THAN 9pm CST on June 1 1. 2. 3. Complete Study Guide Participate in Questions Discussion Complete Questions for Discussion, Post in Discussion 1. 2. Complete Study Guide Complete Questions for Discussion, Post in Dropbox 1. 2. Complete Study Guide Complete Questions for Discussion, Post in Dropbox Complete 10 Question Practice Final Exam Chapters 1-14 Complete Final Exam Available June 19 and 20 ONLY; DUE NO LATER THAN 9pm CST on June 20