Measuring Historical Volatility

advertisement

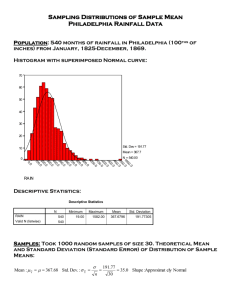

Measuring Historical Volatility Louis H. Ederington University of Oklahoma Wei Guan University of South Florida St. Petersburg August 2004 Contact Info: Louis Ederington: Finance Division, Michael F. Price College of Business, University of Oklahoma, 205A Adams Hall, Norman, OK 73019, USA. Phone: (405) 325-5591 Wei Guan: College of Business, University of South Florida St. Petersburg, 140 Seventh Avenue, St. Petersburg, FL 33701, USA. Phone: (727)-553-4945 Comments may be sent to the authors at lederington@ou.edu or wguan@stpt.usf.edu. Measuring Historical Volatility Abstract The adjusted mean absolute deviation is proposed as a simple-to-calculate alternative to the historical standard deviation as a measure of historical volatility and input to option pricing models. We show that when returns are approximately log-normally distributed, this measure forecasts future volatility consistently better than the historical standard deviation. In the markets we examine, it also forecasts as well or better than the GARCH model. Measuring Historical Volatility In pricing options, anticipated volatility over the life of the option is the crucial unknown parameter. While sophisticated volatility estimation procedures, such as GARCH, are popular among finance researchers, these require econometrics software which is difficult for the average undergraduate student or casual options trader to obtain or master so have not found their way into most derivatives texts. Instead, almost all derivatives textbooks instruct students to use historical volatility, specifically the historical standard deviation, over some recent period as the volatility input.1 Of course implied volatility provides an alternative (and theoretically better) estimate of future volatility but for option pricing purposes, this measure suffers from an obvious chicken and egg problem in that to calculate implied volatility requires the option price and to calculate the appropriate price requires a volatility estimate. Hence, the historical standard deviation of log returns is the volatility estimator touted in most textbooks and most commonly reported on options websites. One well-known short-coming of the historical standard deviation as an estimator of future volatility is that only the information in past returns is considered, ignoring other possible information sets, like knowledge of future scheduled events that might move the markets such as a quarterly earnings report or an upcoming meeting of the Fed’s Open Market Committee.2 Another well-known potential problem is that all past squared return deviations back to an arbitrary date are weighted equally in calculating the standard deviation and all observations before that date are ignored (Engle, 2004, and Poon and Granger, 2003). Evidence on volatility clustering and persistence indicates that more recent observations should contain more information regarding volatility in the immediate future than older observations. Accordingly, more sophisticated models, such as GARCH and the exponentially weighted moving average model utilized by Riskmetrics, employ weighting schemes in which the most recent squared 1 return deviations receive the most weight and the weights gradually decline as the observations recede in time.3 While the GARCH weighting scheme in which the most recent squared return deviation receives the greatest weight and the weights decline exponentially is theoretically more appealing than that of the historical standard deviation in which all observations are weighted equally back to an arbitrary cutoff point, evidence is mixed on whether GARCH actually forecasts better. In a comprehensive review of 39 studies comparing the historical standard deviation (or variance) and GARCH, Poon and Granger (2003) report that 17 find that GARCH forecasts better while 22 find that the historical standard deviation (or variance) forecasts better. We see another potential drawback to the historical standard deviation: that since the historical standard deviation and variance are functions of squared return deviations, they could be dominated by outliers. For example, in the S&P 500 market over the period from 7/5/67 to 7/11/02, the 1% largest daily return deviations account for 24.5% of the total squared return deviations. Suppose daily returns from one month (specifically 20 trading days) are used to forecast volatility over the next month. 81.8% of the months will contain no observations from this 1% tail while 18.2% will contain 1 or more. The 24.5% figure implies that, if the underlying distribution does not change, the standard deviation for months that contain one observation in the 1% tail will tend to be 60% higher than that for months with none. Consequently, if a month with an observation in the 1% tail precedes a month with none, the forecast standard deviation will tend to be much too high. One way to avoid giving extreme observations undue weight is to use a longer period to measure the historical standard deviation. For instance, one might use returns over the last year instead of over the last month. The problem with this approach is that volatility tends to cluster. Specifically high (low) volatility one week, or month tends to be followed by high (low) 2 volatility the succeeding week or month. Measuring historical volatility over a long period, such as a year, smooths out the clusters and loses the information in recent volatility. An alternative proposed by Andersen and Bollerslev (1998) and others which gives less weight to extreme observations without lengthening the data period is to switch from daily to intraday data. For instance, if the trading day is 6 hours in length, switching from one month of daily return observations to one month of hourly return observations increases the number of observations 6 times and cuts the weight on any one observation to one sixth the weight on daily observations. For GARCH type models, Andersen and Bollerslev (1998), Andersen et al (1999), and Andersen et al (2003) report considerably improved volatility estimates using such intraday data. However, intraday data is not readily available to students and traders, is costly, and is more difficult to handle. Authors of derivative texts apparently feel volatility estimates based on intraday data are not usually a viable or cost effective alternative since they do not tout this approach and their example calculations of historical volatility invariably use daily data. In our view, a possible alternative based on daily data which is less sensitive to extreme observations while keeping the sample period short enough to reap the benefits of volatility clustering is to measure the historical standard deviation in terms of absolute, instead of squared return observations. Specifically, we propose using the historical mean absolute return deviation, instead of the historical standard deviation to measure historical volatility and forecast future volatility. Relatively, extreme observations are simply less extreme when measured in absolute rather than squared terms. Moreover, the mean absolute return deviation, is easily calculated using rudimentary statistical software such as EXCEL. The major drawback of the mean absolute deviation is that it is distribution specific. That is, unlike the sample standard deviation, the relation between the mean absolute deviation and the population standard deviation differs between normal, beta, gamma, and other distributions. However, since the primary use of historical volatility is as an input into the Black-Scholes 3 formula, which assumes log returns are normally distributed, basing the historical volatility estimate on a log-normal distribution is a natural choice and imposes no additional assumption in this application. Nonetheless, whether the historical standard deviation or the historical mean absolute return deviation provides a better volatility forecast will likely depend on how closely the actual distribution of returns approximates a normal distribution. This question is explored below. In this paper, we compare the ability of the historical mean absolute return deviation and the historical standard deviation to forecast future volatility (measured as the standard deviation of ex-post log returns) across a wide variety of markets, including the stock market, long and short-term interest rates, foreign exchange rates and individual equities. Except for the Eurodollar market at long horizons (and occasionally the Yen/Dollar exchange rate), the mean absolute deviation forecasts future volatility better than the historical standard deviation in all markets at almost all horizons. Not surprisingly, the major exception, Eurodollars, is the market which is furthest from normality. We also compare the mean absolute deviation volatility forecasts with those generated by a GARCH(1,1) model. Their relative forecast ability seems to partially depend on how one measures forecast accuracy. By one of our two measures, the mean absolute deviation clearly dominates, by the other measure neither dominates. Since the GARCH model requires specialized software, while the mean absolute deviation can be calculated using simple spreadsheet software, such as EXCEL, and the mean absolute deviation forecasts as well or better in most cases, there seems to be little payoff to the added expense and effort of GARCH type models. The remainder of the paper is organized as follows. In the next section, we explain the adjusted mean absolute deviation measure of volatility and our measures of forecast accuracy. 4 Our data sets are described in section 2. Results are presented in 3 and section 4 concludes the paper. 5 1. Measuring and Forecasting Volatility Let Rt = ln(Pt/Pt-1) represent daily returns on a financial asset.4 The historical standard deviation over the last n days is measured as: (1) , the return deviation, and : is the expected return. Often : is replaced by the where sample mean and accordingly the r2 are divided by n-1, rather than n. The latter procedure implicitly assumes that the expected return over the coming period equals the mean return in the n-day period used to estimate STD(n). Given the low auto-correlation in returns there is no justification for such an assumption and Figlewski (1997) shows that better forecasts are normally obtained by setting :=0. In our calculations, we set : equal to the average daily return over the entire data period. Since volatilities are normally quoted in annualized terms, the sum of the squared daily return deviations is multiplied by 252, the approximate number of trading days in a year. As seen in equation 1, this volatility estimator assigns each squared past return deviation, , after time t-n a weight of 1/n while observations before t-n receive a weight of zero. An issue in applying this procedure is choosing the cutoff date n. While setting the length of the period used to calculate historical volatility, n, equal to the length of the forecast period, s, is a common convention, Figlewski (1997) finds that forecast errors are generally lower if the historical variance is calculated over a longer period. Accordingly, we consider a variety of sample period lengths and designate the length of the sample on which STD is based with (n). For example, STD(20) indicates the annualized standard deviation of log returns over the last twenty trading days. 6 Our alternative measure of historical volatility is the adjusted mean absolute return deviation over the same n days. The (unadjusted) mean absolute return deviation is: (2) However, in this unadjusted form, MAD(n) is a biased estimator of the population standard deviation. While STD converges to F as sample size increases,5 MAD converges to F/k where k depends on the distribution. If the distribution is normal, (Stuart and Ord, 1998). If the data follow another distribution, k takes another value. Consequently, we use the adjusted mean absolute deviation defined as: (3) This yields an unbiased estimator of F if the rt are normally distributed. Like STD(n), AMAD(n) is annualized by multiplying by the square root of 252. In the early part of the 20th century there was debate among statisticians about the relative merits of STD and MAD as measures of volatility but use of the sample standard deviation dominated since it is a consistent estimator of F regardless of the data distribution and Fisher showed that it is more efficient for normal distributions. Nonetheless, it has been argued by Staudte and Sheather (1990), and Huber (1996) among others that MAD is more robust, i.e., that it yields better estimates if the data are contaminated. In this paper, STD(n) and AMAD(n) are compared in terms of their ability to forecast actual volatility over various future horizons, s, corresponding to likely option times to expiration. We (like all other studies in this area) measure this realized volatility as the standard deviation of daily log returns over the period s. Specifically, 7 (4) Note that STD(n) and AMAD(n) are both evaluated using the same measure of ex post volatility, RLZ(s), the measure used in virtually all previous studies of forecasting ability. We use two measures of the ability of STD(n) and AMAD(n) to forecast RLZ(s). The first is the root mean squared forecast error: (5) where F(n)t designates STD(n)t or AMAD(n)t. The second is the mean absolute forecast error: (6) In this paper our main interest is which of these two simple volatility estimators, STD(n) and AMAD(n), which are easily explained to and calculated by undergraduates, forecasts realized volatility better. However, we are also interested in how AMAD(n) and STD(n) compare with the more sophisticated ARCH-GARCH models proposed by academic researchers. By far the most popular of the ARCH-GARCH models is Bollerslev’s original, the so-called GARCH(1,1) model: (7) where vt represents the (unobserved) conditional variance at time t. Consequently, we also measure how well this model forecasts actual volatility using RMSFE and MAFE.6 8 2. Data and Procedures We compare the volatility forecasting ability of these three models for four financial assets with highly active options markets: the S&P 500 Index, the 10-year Treasury Bond rate, the 3-month Eurodollar rate, and the Yen/Dollar exchange rate. We also collect data for five equities chosen from those in the Dow-Jones Index: Boeing, GM, International Paper, McDonald’s, and Merck. Daily return data for the five equities for the period 7/2/62 to 12/31/02 were obtained from CRSP tapes as were prices for the S&P 500 index. Daily interest rate and exchange rate data were obtained from Federal Reserve Board files for the periods: 1/2/6212/31/03 for the 10 year bond rate, and 1/1/71-12/31/03 for the Eurodollar rate and the Yen/Dollar exchange rate. Using the three procedures, STD(n), AMAD(n), and GARCH, we forecast volatility over horizons, s, of 10, 20, 40, and 80 market days or approximately two weeks, one month, two months, and four months. Similarly, STD(n) and AMAD(n) are measured over historical periods, n, of 10, 20, 40, and 80 market days. The GARCH procedure requires estimation of the parameters " and $. This is done using 1260 daily return observations or approximately five years of daily data. Consequently, our estimation periods for RLZ for the three models begin approximately five years after the beginning dates for our data sets reported above, e.g., 7/5/67 for the S&P 500 index and the five equities. They end 120 trading days before the end of the data sets, i.e., 7/11/02 for the S&P 500 index and the equities and 7/16/03 for the interest and exchange rate series. To limit the computational burden, the GARCH model is re-estimated every 40 days. Descriptive statistics for daily log returns are reported in Table 1 where the mean and standard deviation are standardized for ease in interpretation. Skewness varies and is slight for all except return on the S&P500 index. All except Merck exhibit excess kurtosis which is most extreme for the S&P 500 index. Since the AMAD measure only provides a consistent estimate 9 of the population standard deviation if the underlying distribution is normal, the KolmogorovSmirnov D statistic test for normality shown in the last column is of particular interest. In all nine markets, the normality null is rejected at the .01 level. However, the K-S D is considerably higher for Eurodollar returns than any of the other log return series indicating a more serious deviation from normality in that market. This is somewhat surprising since both skewness and kurtosis are more serious for the S&P 500 index emphasizing that skewness and kurtosis do not completely account for deviations from normality. 3. Results Root mean squared forecast error (RMSFE) (equation 5) and mean absolute forecast error (MAFE) (equation 6), measures of how accurately the three models forecast actual future volatility (RLZ), are reported in Tables 2, 3, 4, and 5 for forecast horizons, s, of 10, 20, 40, and 80 trading days respectively. RMSFE statistics are reported in panel A and MAFE in panel B. STD(n) and AMAD(n) are calculated using sample period lengths n of 10, 20, 40, and 80 trading days. For each n, the measure, STD(n) or AMAD(n), with the lowest RMSFE and MAFE is shown in bold. Also, in each market, the cell of the model with the lowest RMSFE or MAFE is shaded. When this is the GARCH model, the STD(n) or AMAD(n) model with the lowest RMSFE or MAFE is more lightly shaded. Consider first the results in Table 2 when the models are used to forecast volatility over a relatively short horizon of 10 trading days or two weeks. As shown by the cells in bold, in all nine markets for all four n (a total of 36 pairwise comparisons) , the historical adjusted mean absolute deviation anticipates actual future volatility better than the historical standard deviation. This results holds whether forecast accuracy is measured in terms of the RMSFE in panel A or the MAFE in panel B. In 31of the 36 pairwise comparisons, AMAD’s volatility forecasting ability is significantly greater than STD’s at the 10% level according to Diebold and Mariano’s (1995) S1 10 statistic. In 16 of 36 it is significantly better at the 5% level. Clearly AMAD dominates STD at this forecast horizon. As shown by the darkly and lightly shaded cells, among the AMAD models, forecast accuracy is best when the mean absolute deviation is measured over 40 (4 markets) or 80 (5 markets) trading days. This parallels Figlewski’s (1997) finding that the historical standard deviation is best measured over a period longer than the forecast horizon. As shown by the darkly shaded cells, the AMAD model beats the GARCH model in all nine markets according to the MAFE criterion. According to the RMSFE criterion however, the evidence is mixed with AMAD forecasting better in four markets and GARCH in five. Considering that the adjusted mean absolute deviation is easily calculated with standard spreadsheet software while the GARCH model requires time, study, and sophisticated software, the AMAD model seems the most time and cost effective for all but professional traders and finance researchers. Of course, since it is dominated by AMAD, STD fares worse against GARCH. In a majority of markets, GARCH forecasts better than the historical standard deviation by both measures. Turning to Table 3 in which the models are used to forecast volatility over a 20 trading day horizon, the same results generally hold. However at this horizon, STD(10) has a lower MAFE than AMAD(10) for GM and STD(80) has a lower RMSFE than AMAD(80) for Eurodollars. The former is of little consequence since our results indicate that in all markets one should never use a sample period as short as 10 trading days to forecast future volatility regardless of the horizon. The latter reversal is more serious since in the Eurodollar market, STD(80) turns out to have the lowest RMSFE of all the models. Recalling from above and Table 1 that the deviation from log normality is most serious in this market, it is not surprising that AMAD should perform least well in this market. Nonetheless, AMAD(80)’s MAFE is considerably lower than STD(80)’s and AMAD beats STD for all n in all other markets by both criteria. Moreover in 12 of the 36 11 pairwise comparisons, AMAD’s forecasting ability is significantly better than STD’s at the .05 level. As we move to horizons of 40 and 80 days in Tables 4 and 5 respectively, STD beats AMAD by one or both criteria in the Eurodollar market for several n and STD(80) beats AMAD(80) by both criteria in the Yen/dollar exchange rate market. However, in all of these cases, the null that the forecasting ability of AMAD and STD is equal cannot be rejected at the .10 level. In all the other markets for all measures based on 20 on more trading days, AMAD beats STD by both criteria. Moreover, in nine comparisons at the 40 day horizon and six at the 80 day horizon, AMAD’s forecasting ability is significantly better at the .05 level. As we move to progressively longer forecast horizons, another trend emerges in that estimates of historical volatility based on longer sample periods tend to forecast volatility better than estimates based on shorter periods. Specifically, as the forecast horizon is lengthened the instances in which AMAD(40) has a lower RMSFE or MAFE than AMAD(80) declines. As shown in Table 5, at a forecast horizon of 80 trading days (about 4 months), AMAD(80) beats AMAD(40) in all markets. At all forecast horizons, AMAD (or STD) forecasts future volatility better than the GARCH(1,1) model in all markets except Merck according to the MAFE criterion while results are mixed according to the RMSFE criterion. 4. Conclusions We have sought to determine whether there is a simple alternative estimator, that is one simple enough to calculate using standard spreadsheet software and easily explained to the average undergraduate student, which provides a better volatility estimate to use in option pricing models than the historical standard deviation. We have found that when log-returns are approximately normally distributed there is - specifically, the adjusted mean absolute return deviation, which is 12 the absolute mean return deviation multiplied by the square root of B/2. In all except the shortterm interest rate market where the deviation from log-normality is most serious, the adjusted mean absolute deviation forecasts actual volatility consistently better than the historical standard deviation. We also find that this simple estimator compares very favorably with GARCH model estimates. By one measure of forecast accuracy, the adjusted mean absolute return deviation beats GARCH consistently, while by the other measure, they approximately break even. 13 REFERENCES Andersen, Torben, and Tim Bollerslev, 1998, Answering the skeptics: Yes standard volatility models do provide accurate forecasts, International Economic Review 39 (#4), 885-905. Andersen, T.G., T. Bollerslev, F.X. Diebold, and P. Labys, 2003, Modeling and forecasting realized volatility, Econometrica 7 (#2), 579-625. Andersen, T.G., T. Bollerslev, and S. Lange, 1999, Forecasting financial market volatility: sample frequency vis-a-vis forecast horizon, Journal of Empirical Finance 6, 457-477. Diebold, Francis X., and Roberto S. Mariano, 1995, Comparing predictive accuracy, Journal of Business and Economic Statistics 13, 253-263. Ederington, Louis H. and Jae Ha Lee, 1993, How Markets Process Information: News Releases and Volatility, Journal of Finance 48 (September), 1161-1191. Ederington, Louis H. and Jae Ha Lee, 2001, Intraday Volatility in Interest Rate and Foreign Exchange Markets: ARCH, Announcement and Seasonality Effects, Journal of Futures Markets 21 (#6), 517-52. Ederington, Louis H. and Guan, Wei, 2005, Forecasting Volatility, forthcoming Journal of Futures Markets, and currently available on SSRN.com. Engle, Robert, 2004, Risk and volatility: econometric models and financial practice, American Economic Review 94(3), 405-420. Figlewski, Stephen, 1997, Forecasting volatility, Financial Markets, Institutions, and Instruments vol. 6 #1, Stern School of Business, (Blackwell Publishers: Boston). Huber, Peter, 1996, Robust Statistical Procedures, 2nd ed., (Society for Industrial and Applied Mathematics: Philadelphia). Hull, John C., 2003, Options, Futures, and Other Derivatives, 5th edition, Englewood Cliffs: Prentice Hall. 14 Poon, Ser-Huang and Clive Granger, 2003, Forecasting Volatility in Financial Markets: A Review, Journal of Economic Literature 41 (#2), 478-539. Staudte, Robert, and Simon Sheather, 1990, Robust Estimation and Testing, (John Wiley & Sons: New York). Stuart, Alan and Keith Ord, 1998, Kendall’s Advanced Theory of Statistics: Volume 1 Distribution Theory, 6th edition, New York: Oxford University Press. 15 Table 1 - Descriptive Statistics Statistics are reported for annualized daily log returns for the following periods: S&P 500 and the five individual equities: 7/5/67-7/11/02, T-Bonds: 11/02/66-7/16/03, Eurodollars and the Yen/Dollar exchange rate: 11/04/75-7/16/03. Standard Mean Kolmogorov- Deviation Skewness Kurtosis Smirnov D S&P 500 0.066402 0.1537 -1.6081 39.893 .0583 T-Bonds -0.00602 0.1392 .0922 4.986 .0786 Eurodollars -0.06424 0.2430 -.3859 8.311 .2395 Yen/Dollar -0.03267 0.1043 -.5116 4.617 .0755 Boeing 0.098581 0.3369 .0212 5.242 .0556 GM 0.06834 0.2680 -.1853 7.351 .0470 Int. Paper 0.085882 0.2874 -.4092 13.128 .0459 McDonalds 0.12594 0.2898 -.3210 7.948 .0501 Merck 0.12818 0.2482 -.0516 3.375 .0444 16 Table 2 - Volatility Forecast Accuracy – 10 Trading Day Horizon Root mean squared forecast errors (RMSFE) and mean absolute forecast errors (MAFE) are reported when the procedures listed in column 1 are used to forecast the standard deviation of returns over the next 10 trading days. STD(n) denotes the standard deviation calculated over the last n trading days. AMAD(n) denotes the adjusted mean absolute deviation over the last n days. Data periods are reported in Table 1. For each n, the STD(n) or AMAD(n), with the lowest RMSFE and MAFE is shown in bold. In each market, the cell of the model with the lowest RMSFE or MAFE is shaded. When this is the GARCH model, the STD(n) or AMAD(n) with the lowest RMSFE or MAFE is lightly shaded. Markets Forecasting Model 10-year 90-day T-Bond Eurodollar S&P 500 Yen/Dollar Boeing GM Int’l Paper McDonalds Merck Panel A - Root Mean Squared Forecast Errors (RMSFE) STD(10) 0.07312 0.05717 0.12313 0.04790 0.15634 0.11596 0.12563 0.12338 0.10326 AMAD(10) 0.07023 0.05665 0.11976 0.04662 0.15101 0.11481 0.12003 0.12208 0.10197 STD(20) 0.07076 0.05325 0.11697 0.04327 0.14163 0.10928 0.11856 0.11314 0.09399 AMAD(20) 0.06616 0.05199 0.11317 0.04185 0.13465 0.10566 0.11244 0.11024 0.09162 STD(40) 0.06964 0.05216 0.11163 0.04215 0.13270 0.10321 0.11309 0.10750 0.08948 AMAD(40) 0.06477 0.05095 0.10834 0.04097 0.12638 0.09948 0.10798 0.10485 0.08729 STD(80) 0.07073 0.05296 0.11059 0.04148 0.12970 0.10113 0.10979 0.10957 0.08884 AMAD(80) 0.06661 0.05187 0.10885 0.04068 0.12504 0.09821 0.10473 0.10831 0.08712 GARCH 0.06461 0.05038 0.11192 0.04240 0.12716 0.09738 0.10741 0.10427 0.08586 Panel B - Mean Absolute Forecast Errors (MAFE) STD(10) 0.04060 0.04142 0.08306 0.03469 0.10941 0.07839 0.08724 0.08448 0.07604 AMAD(10) 0.04021 0.04101 0.08253 0.03375 0.10750 0.07905 0.08528 0.08463 0.07576 STD(20) 0.03865 0.03823 0.08002 0.03143 0.09912 0.07336 0.08111 0.07608 0.06951 AMAD(20) 0.03719 0.03724 0.07747 0.02992 0.09570 0.07248 0.07861 0.07460 0.06817 STD(40) 0.03882 0.03789 0.07886 0.03045 0.09403 0.06979 0.07686 0.07211 0.06642 AMAD(40) 0.03679 0.03638 0.07342 0.02884 0.08943 0.06774 0.07440 0.06980 0.06412 STD(80) 0.04059 0.03896 0.07921 0.03027 0.09393 0.06856 0.07372 0.07241 0.06572 AMAD(80) 0.03797 0.03710 0.07378 0.02871 0.08877 0.06572 0.07050 0.07038 0.06366 GARCH 0.03721 0.03688 0.08217 0.03188 0.09482 0.06608 0.07428 0.07134 0.06452 Table 3 - Volatility Forecast Accuracy – 20 Trading Day Horizon Root mean squared forecast errors (RMSFE) and mean absolute forecast errors (MAFE) are reported when the procedures listed in column 1 are used to forecast the standard deviation of returns over the next 20 trading days. STD(n) denotes the standard deviation calculated over the last n trading days. AMAD(n) denotes the adjusted mean absolute deviation over the last n days. Data periods are reported in Table 1. For each n, the STD(n) or AMAD(n), with the lowest RMSFE and MAFE is shown in bold. In each market, the cell of the model with the lowest RMSFE or MAFE is shaded. When this is the GARCH model, the STD(n) or AMAD(n) with the lowest RMSFE or MAFE is lightly shaded. Markets Forecasting Model 10-year 90-day T-Bond Eurodollar S&P 500 Yen/Dollar Boeing GM Int’l Paper McDonalds Merck Panel A - Root Mean Squared Forecast Errors (RMSFE) STD(10) 0.07178 0.05346 0.11811 0.04358 0.14199 0.11011 0.11926 0.11448 0.09447 AMAD(10) 0.06830 0.05264 0.11521 0.04213 0.13579 0.10862 0.11292 0.11227 0.09296 STD(20) 0.06824 0.04855 0.10860 0.03910 0.12424 0.10092 0.10872 0.10127 0.08315 AMAD(20) 0.06291 0.04720 0.10520 0.03756 0.11644 0.09699 0.10217 0.09750 0.08097 STD(40) 0.06643 0.04694 0.10047 0.03714 0.11371 0.09306 0.10027 0.09631 0.07803 AMAD(40) 0.06109 0.04576 0.09876 0.03609 0.10730 0.08893 0.09456 0.09326 0.07611 STD(80) 0.06768 0.04722 0.09820 0.03572 0.10976 0.09008 0.09631 0.09805 0.07696 AMAD(80) 0.06302 0.04642 0.09864 0.03538 0.10580 0.08702 0.09059 0.09691 0.07547 GARCH 0.06141 0.04492 0.10012 0.03713 0.10638 0.08616 0.09506 0.09137 0.07286 Panel B - Mean Absolute Forecast Errors (MAFE) STD(10) 0.03883 0.03888 0.08025 0.03161 0.09955 0.07424 0.08129 0.07676 0.07043 AMAD(10) 0.03835 0.03866 0.08198 0.03077 0.09787 0.07486 0.08012 0.07662 0.07027 STD(20) 0.03612 0.03522 0.07507 0.02832 0.08764 0.06676 0.07278 0.06555 0.06220 AMAD(20) 0.03456 0.03435 0.07455 0.02697 0.08422 0.06579 0.07027 0.06392 0.06105 STD(40) 0.03635 0.03425 0.07161 0.02655 0.08101 0.06135 0.06609 0.06210 0.05802 AMAD(40) 0.03434 0.03290 0.06830 0.02515 0.07701 0.05941 0.06332 0.06000 0.05641 STD(80) 0.03817 0.03495 0.07106 0.02617 0.07963 0.05903 0.06197 0.06241 0.05587 AMAD(80) 0.03545 0.03339 0.06798 0.02497 0.07583 0.05636 0.05852 0.06049 0.05442 GARCH 0.03468 0.03329 0.07588 0.02806 0.08102 0.05734 0.06346 0.06079 0.05442 Table 4 - Volatility Forecast Accuracy – 40 Trading Day Horizon Root mean squared forecast errors (RMSFE) and mean absolute forecast errors (MAFE) are reported when the procedures listed in column 1 are used to forecast the standard deviation of returns over the next 40 trading days. STD(n) denotes the standard deviation calculated over the last n trading days. AMAD(n) denotes the adjusted mean absolute deviation over the last n days. Data periods are reported in Table 1. For each n, the STD(n) or AMAD(n), with the lowest RMSFE and MAFE is shown in bold. In each market, the cell of the model with the lowest RMSFE or MAFE is shaded. When this is the GARCH model, the STD(n) or AMAD(n) with the lowest RMSFE or MAFE is lightly shaded. Markets Forecasting Model 10-year 90-day T-Bond Eurodollar S&P 500 Yen/Dollar Boeing GM Int’l Paper McDonalds Merck Panel A - Root Mean Squared Forecast Errors (RMSFE) STD(10) 0.07199 0.05278 0.11404 0.04291 0.13364 0.10540 0.11535 0.11053 0.09035 AMAD(10) 0.06808 0.05180 0.11119 0.04138 0.12666 0.10388 0.10864 0.10770 0.08904 STD(20) 0.06774 0.04739 0.10192 0.03758 0.11437 0.09430 0.10180 0.09792 0.07841 AMAD(20) 0.06210 0.04593 0.09948 0.03602 0.10606 0.09010 0.09462 0.09368 0.07629 STD(40) 0.06540 0.04480 0.09249 0.03440 0.10085 0.08574 0.09063 0.09223 0.07163 AMAD(40) 0.05993 0.04360 0.09266 0.03357 0.09525 0.08113 0.08407 0.08945 0.06996 STD(80) 0.06620 0.04422 0.08819 0.03206 0.09692 0.08228 0.08652 0.09377 0.07029 AMAD(80) 0.06095 0.04362 0.09085 0.03220 0.09360 0.07898 0.07990 0.09224 0.06870 GARCH 0.06009 0.04211 0.09092 0.03518 0.09216 0.07734 0.08623 0.08529 0.06436 Panel B - Mean Absolute Forecast Errors (MAFE) STD(10) 0.04011 0.03855 0.07920 0.03112 0.09550 0.07098 0.07816 0.07492 0.06775 AMAD(10) 0.03954 0.03828 0.08204 0.03040 0.09322 0.07193 0.07691 0.07422 0.06792 STD(20) 0.03714 0.03464 0.07230 0.02691 0.08106 0.06228 0.06732 0.06422 0.05879 AMAD(20) 0.03589 0.03387 0.07335 0.02589 0.07741 0.06168 0.06498 0.06215 0.05804 STD(40) 0.03701 0.03285 0.06781 0.02469 0.07208 0.05664 0.05849 0.05926 0.05291 AMAD(40) 0.03509 0.03146 0.06770 0.02401 0.06919 0.05486 0.05560 0.05754 0.05176 STD(80) 0.03794 0.03326 0.06579 0.02368 0.07112 0.05392 0.05490 0.05997 0.05063 AMAD(80) 0.03517 0.03172 0.06488 0.02331 0.06831 0.05142 0.05092 0.05819 0.04905 GARCH 0.03531 0.03181 0.07232 0.02650 0.07231 0.05160 0.05736 0.05835 0.04788 Table 5 - Volatility Forecast Accuracy – 80 Trading Day Horizon Root mean squared forecast errors (RMSFE) and mean absolute forecast errors (MAFE) are reported when the procedures listed in column 1 are used to forecast the standard deviation of returns over the next 80 trading days. STD(n) denotes the standard deviation calculated over the last n trading days. AMAD(n) denotes the adjusted mean absolute deviation over the last n days. Data periods are reported in Table 1. For each n, the STD(n) or AMAD(n), with the lowest RMSFE and MAFE is shown in bold. In each market, the cell of the model with the lowest RMSFE or MAFE is shaded. When this is the GARCH model, the STD(n) or AMAD(n) with the lowest RMSFE or MAFE is lightly shaded. Markets Forecasting Model 10-year 90-day T-Bond Eurodollar S&P 500 Yen/Dollar Boeing GM Int’l Paper McDonalds Merck Panel A - Root Mean Squared Forecast Errors (RMSFE) STD(10) 0.07456 0.05419 0.11356 0.04231 0.13081 0.10505 0.11202 0.11459 0.09034 AMAD(10) 0.07063 0.05307 0.11158 0.04081 0.12424 0.10305 0.10467 0.11217 0.08913 STD(20) 0.07050 0.04827 0.10026 0.03638 0.11064 0.09348 0.09835 0.10184 0.07792 AMAD(20) 0.06468 0.04688 0.09923 0.03508 0.10325 0.08880 0.09000 0.09818 0.07574 STD(40) 0.06760 0.04482 0.08899 0.03232 0.09727 0.08470 0.08754 0.09601 0.07075 AMAD(40) 0.06141 0.04378 0.09073 0.03199 0.09207 0.07986 0.07931 0.09282 0.06873 STD(80) 0.06535 0.04307 0.08238 0.02940 0.08993 0.07881 0.08169 0.09272 0.06800 AMAD(80) 0.05926 0.04275 0.08678 0.03013 0.08680 0.07515 0.07367 0.09048 0.06607 GARCH 0.05994 0.04123 0.08351 0.03373 0.08315 0.07204 0.08343 0.08503 0.05890 Panel B - Mean Absolute Forecast Errors (MAFE) STD(10) 0.04351 0.04004 0.08066 0.03119 0.09389 0.07250 0.07661 0.07836 0.06771 AMAD(10) 0.04288 0.03990 0.08443 0.03060 0.09199 0.07307 0.07488 0.07793 0.06752 STD(20) 0.04063 0.03569 0.07259 0.02683 0.07895 0.06348 0.06506 0.06724 0.05775 AMAD(20) 0.03934 0.03543 0.07576 0.02639 0.07604 0.06266 0.06253 0.06540 0.05725 STD(40) 0.03918 0.03346 0.06634 0.02413 0.07028 0.05695 0.05645 0.06175 0.05148 AMAD(40) 0.03727 0.03273 0.06946 0.02395 0.06828 0.05503 0.05307 0.06045 0.05045 STD(80) 0.03846 0.03314 0.06254 0.02215 0.06873 0.05270 0.05300 0.06047 0.04889 AMAD(80) 0.03567 0.03220 0.06516 0.02247 0.06586 0.05013 0.04884 0.05868 0.04767 GARCH 0.03638 0.03231 0.06763 0.02573 0.06653 0.05030 0.05684 0.06028 0.04366 ENDNOTES 1. Several textbooks do mention GARCH as a method for estimating volatility and reference sources but do not attempt to explain or describe it. The only text that seeks to teach students how to estimate volatility using GARCH that we have seen is Hull (2003). 2. See for instance Ederington and Lee (1993, and 2001). For an excellent review of the issues in volatility forecasting see Poon and Granger (2003). 3. For a nice review of the highlights of this literature see Robert Engle’s Nobel prize acceptance speech (Engle, 2004). 4. In the case of dividend paying stocks, the numerator is changed to Pt+Dt where Dt denotes any dividends paid over the period from t-1 to t. 5. While the sample variance is an unbiased estimator of F2, the sample standard deviation is a biased estimator of F in small samples. However, it is asymptotically unbiased and consistent. 6. The model in equation 7 yields a forecast variance for the next day, t+1. The forecast variance over the next s days is obtained by successive forward substitution following the procedure outlined in Ederington and Guan (2005).