Competition May Be Fierce, But Still More Room for Cooperation Stella Xu

advertisement

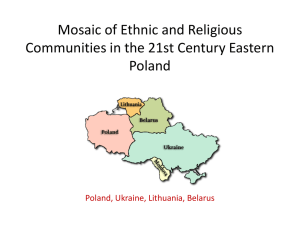

Student Research Projects/Outputs No.029 Competition May Be Fierce, But Still More Room for Cooperation Stella Xu MBA 2009 China Europe International Business School 699, hong feng Road Pudong, Shanghai People’s Republic of China Proposal of research project for EU-BMT Exchange Scholarship By Stella Xu 20091165 Research title: Analysis of comparative and competitive advantages in international trade between China and Eastern European economies. Objective: The paper aims to use statistics data to develop a comprehensive overview of the comparative and competitive advantages for trades between China and Eastern European countries; to analyze the degree of overlap of these advantages; and further on to identify trade directions and areas where the two economies can collaborate with each other to a win-win situation. Proposal: The Eastern European economy (the ex-Socialist Bloc) used to be a heavy weight trade partner to China in 1950s/1960s. The reason is largely political at a time the western world closed their doors to new China, while the socialist bloc countries stepped forward to support the new born economy. The foreign trade to Eastern Europe was once 20% of total foreign trade volume of China. However, that share has since declined to much lower level and remains so up to today. It is encouraging to note that since 1990s the bilateral trade between China and Eastern Europe has leaped forward when both emerging economies drive on the fast track of economic development. But the ratio remains less than 1% and there is a lot more room for improvement. In the meanwhile, the 2 economies are considered as key low cost countries (LCCs) by developed countries for sourcing/manufacturing of goods and equipments. Competition is evident and it becomes even fiercer when Chinese manufacturers improved their know-how, quality and technological levels to erode the solid ground of their Eastern European counterparts, for example in areas of heavy manufacturing – forging, castings and heavy equipment manufacturing. The paper will tap on the principal theories behind internal trade – comparative advantage (by Classical economist David Ricardo) and competitive advantage (by Michael Porter) to analyze what are the advantages for China and Eastern European economies. The paper hopes to serve as references for businesses in China and Eastern Europe to develop more collaboration in bilateral/international trade. Sectors to focus: Light industries – hardware, appliances, FMCG; Heavy industries – steels, heavy machineries; Telecommunications Case studies: Huawei Source of data: UNSD data on international trade; trade statistics data from China customs. Note: According to UN statistics division, Eastern Europe refer to following 10 countries: Belarus, Bulgaria, Czech Republic, Hungary, Moldova, Poland, Romania, Russia, Slovakia, Ukraine. The paper will focus on Poland and Romania. Competition may be fierce, but still more room for cooperation A review on revealed competitive advantages between China and Central & Eastern European Countries – with focus on Poland and Romania By Stella Xu for EU-BMT Exchange 2010 The huge success of World Expo in Shanghai in year 2010 revealed something which is often overlooked by the general public – a closer tie of China, with most (if not all) parts of the world. China is viewed as a locomotive to world economy in the recent recession, and has been playing a strategic role as largest importer/consumer of global commodities. The inclusion of Eastern European countries (Poland in 2004 and Romania in 2007) into European Union has made EU, as a whole entity, the largest trade partner for China, taking over US, Japan and others. There have been numerous articles debating on the pros and cons of trade between China and Central and Eastern European countries (CEECs). This article aims to look at a more specific factor – the comparative advantage between China and CEECs. Given the limits of time and space allowed, the scope will be focused on 2 countries – Poland and Romania as the most populous countries in the CEEC region, and also traditional trade partners with China. Chapter 1: General Facts (Data from Economy Watch): Poland Following are the products that feature prominently in Poland exports: Machinery and equipment Textiles and footwear Metals and metal products Machinery and equipment Minerals and fuels Agricultural products. In 2008, Poland‟s leading trading partner is its neighbor Germany, followed by Italy, France, Turkey, Hungary and Bulgaria. The main products that are imported are: Machinery and equipment Fuels and minerals Chemicals Textile and products Metals Agricultural products The main import partners for Poland as of 2008 are Germany, Italy, Hungary, Russia, France, Turkey, Austria, Kazakhstan and China Romania Similar to Poland, Romania has always been troubled by trade deficit. While the estimated total exports in Romania amounted to $49.41 billion in 2009, its total imports were $76.17 billion. Leading export categories include: Machinery and equipment Textiles and footwear Metals and metal products Machinery and equipment Minerals and fuels Chemicals Leading import categories include: Machinery and equipment Fuels and minerals Chemicals Textile and products Metals Agricultural products The leading countries with which Romania trades with are: For export (2008), Germany 16.3%, Italy 15.4%, France 7.3%, Turkey 6.5%, Hungary 5%, Bulgaria 4.1%; For import (2008), Germany - 16.1%, Italy 11.2%, Hungary 7.3%, Russia 5.9%, France 5.6%, Turkey 4.9%, Austria 4.8%, Kazakhstan 4.5%, China 4.2% Chapter 2: Trade with China Before 1990s, the trade between China and Poland/Romania was conducted on „book keeping‟ style where there was no physical foreign exchange involved. While the switch to FOREX physical trade impacted the trade volumes at the beginning of 1990s, the trade volume increased significantly in the following years, especially in the years of 2000s, the period in which Poland and Romania were accepted into EU, and in which China enjoyed tremendous economic boom. All 3 countries have exhibited similar growth patterns in export/import – a continuous growth (with exception of year 2009 due to global economic recession). Poland was the only country in EU which exhibited positive GDP growth in 2009 when crisis hit. Besides an order of magnitude difference in trade volumes between China and Poland/Romania, another sharp contrast that can be seen from the graph is that China has been enjoying a huge trade surplus (export in excess of import) while both Poland and Romania have been seeing a quite huge (percentage wise) trade deficit. And China has contributed to this trade deficit in very heavy weight percentage. Figure 1. Data Source from UNSD Annual Table 2009, Figures in USD Bilateral Trade History between China and Poland: Figure 2. Figure in 100 M USD unit, Source: Polish Embassy in China, China Customs For Romania, in 2009, the total bilateral trade (import plus export) with China is 3.041 Billion USD, while China export to Romania stands at 2.662 Billion USD, and import from Romania is 0.379 Billion USD. (Source: Li,Lu, 2010, Interview with Sorin Toader). The large trade deficit certainly worries both Polish and Romanian officials. They have been promoting measures to ease the deficit situation, and to reach a dynamic balance in bilateral trades with China. China, as the counterpart, also takes serious measures to turn around the situation. Chapter 3: Balassa Index Analysis of Comparative Advantages The Balassa Index is used to determine a country‟s comparative advantages (literally its strong sectors) by analyzing the export data from the country, relative to other countries. It was invented by Liesner, and popularized by Bela Balassa. It is known as Balassa Index, also referred to as “Revealed Comparative Advantage‟. The Balassa index is defined as: BI jA share of industry j in country A exports share of industry j in reference country exports If BIAj >1, the country (A) is said to have a revealed comparative advantage in this specific industry(j). The Balassa data (for 36 countries, including Poland and China) that is available at website of Utrecht University (by Prof. C. van Marrewijk) is based on the reference countries of the basket of 15 most populous countries. The focus of this paper will be China and Poland. China’s strong sectors (in HS codes, Harmonized System 2007 classification): Articles of leather (HS 42), Manufacturing of plaiting materials, basket work (HS 46), Silk (HS 50) and from HS 50 to HS 70 which covers apparels, footwear, ceramic products, glass and etc; Railway, rolling stock equipments (HS 86); Musical instruments (HS 92), Furniture (HS 94) and Toys (HS 95). Poland’s export strengths lie on: HS 01 to 10 and HS 15 to 20 covering meat, fishery, dairy products, vegetables; Rubber and articles (HS 40); Wood and articles (HS 44), Paper (HS 48); Various from HS 60 to HS 70; Iron & Steel (HS 73); Copper (HS 74), HS 82 to 89; Furniture (HS 94). It is notable that the similarity between the economic structure of Poland and China is high. However there are certain areas that the two countries showed distinctive revealed comparative advantages. The example is in copper related (HS 74) where Poland is endowed with good reserve of copper and the Polish Copper group company KGHM (Kombinat Górnictwa i Hutnictwa Miedziowego), which has exported copper related products to China Minmetals Group for the past 10+ years. 2009 was a good one for KGHM in China, as the company‟s sales revenue in China contributed nearly 14 percent of the company's global sales. KGHM has just signed a copper cathode delivery agreement with China Mine Metal Group, with deal valued between USD 0.4-0.8 billion Another study by Li, Xie, 2001 (of all HS categories where the export data from China and CEECs to original EU countries (Western and Northern Europe) with value larger than 1 B EUR) revealed that on certain categories such as HS 39 (Plastics and articles), HS 84 (Nuclear components) and HS 85 (Motors), the overlap of China and CEECs are not very limited/little. To validate the viability of the Balassa Index, let‟s have a look at HS 89 - ship, boats. Due to tight requirements by the European Commission to cut off government subsidiaries to shipbuilding sectors (in order to fulfill the obligations as conditions to join EU), the Polish shipbuilding sector suffered a painful restructure and lost its competitive edge against rising stars such as Korea, China and Vietnam. Figure 3. Development of Balassa Index for shipbuilding sector of Poland Chapter 4: Room for cooperation? A lot Looking forward, the room to increase bilateral trade and cooperation between China and Poland, China and Romania is enormous. We have to take into consideration that the trade pattern changes as economic structure (industrial base structure) of the subject countries change. Quoted from Mr. Tomasz Ostaszewicz, the chief of Bilateral Trade Cooperation Bureau, Polish Ministry of Commerce “In the past, China mainly exported textile products, footwear and teas to Poland, now China is the largest electronics products supplier to Poland”. China is also putting investment into Poland. In 2007, the FDI volume by China in Poland reached 70B EUR. The Polish government and officials have been promoting Chinese companies to invest in Poland to achieve a more balanced trade. The recent visit of Chinese leader Mr. Jia Qinglin to Poland drew closer bilateral ties. During his visit, Jia suggested the two countries enhancing political mutual trust, expanding economic and technology cooperation, encouraging two-way investment and focusing on such sectors as infrastructure construction, machinery equipment, energy and environmental protection, including coordination on international affairs such as climate change and global governance. Jia also suggested the two states should increase trade of high-tech products to re-balance trade, stimulate cooperation between small and middle-sized enterprises. China's ambassador to Poland, Sun Yuxi, has confirmed China‟s intention to invest in all fields accessible to foreign investment in Poland. Meanwhile, Polish Deputy Prime Minister Waldemar Pawlak has declared that this year's bilateral trade between the two countries would exceed €13 billion. An excellent example is Huawei, the much applauded Chinese technology firm who provides top-notch telecommunication products and solutions to customers globally. Huawei has been very successful in winning a few major contracts from telecom operators in Romania (Vodafone) and other parts of CEEC region. In addition to selling in the CEEC market, Huawei has been promoting local procurement from the CEECs. Huawei has held numerous supplier conferences, engineering partner conventions in the past few years in Poland and Romania to promote bilateral trust and for enhancing long term cooperation with partners in the region. The speech delivered by Mr. Jia, Qinglin on his visit to Poland exactly covers the 2 main routes for development of bilateral trade relations between China and Poland (as well as other CEECs): 1. Upgrade the portfolio of goods traded to balance the trade deficit situation of today; Even the traded portfolio of goods has been changing between China and CEECs, the large percentage of traded goods remains primary products (textiles, footwear) with low added values. The opportunities for trading of High-tech products, environmental technologies and renewable energies remain large. 2. To boost FDI investment of Chinese companies in the area, and Polish and CEECs companies in China. Below table gives an example of FDI volume into Poland. Even though the Chinese FDI investment in Poland has been leaping in magnitude, but still it is mere 0.4% of its total FDI volume. And the room to grow is huge. Inflow of FDI into Poland 2004–2007 Region/countr y World EU Japan China 2004 2005 2006 2007 10,304.8 9,052.1 150 2.1 8,259.9 6,783.2 239.3 36.6 15,575.9 13,362.3 253.7 20.0 16,582.1 12,303.9 191.6 62.0 Table 1. Inflow of FDI into Poland, 2004 to 2007 References: AgroTrade, Ministry of Commerce China, 2009, Guide to export market for Chinese agricultural goods: Poland. Balassa, B., 1965, „Trade liberalization and “revealed” comparative advantage‟, The Manchester School of Economic and Social Studies No.33: Page 92–123. Che, Huichun, 2007, the influence of the east expansion of EU on Sino-EU trade relations and China‟s countermeasures. China Academic Journal Electronic Publishing House. China customs, 2010, Statistics of bilateral trade between China and Poland Jia, Ruixia, 2010, Trade relationship between China and Central Eastern European countries. Institute of European Studies, CASS, China. Jin,Xin, 2009, Polish Food: From Europe to China, Food and Beverage Industry, Issue No.8 2009 Li, Lu, 2010, Interview with Sorin Toader, Imp-Exp Executive, Issue No.4 2010 Li, Xie, 2001, the competitiveness of Chinese and Central Eastern European exports to Europe, Intertrade, Issue No.12 Luo, Zhaohui, 2008, Research on marketing strategy of HME (Hunan Machinery Import and Export Co.,Ltd.) in Romania, Master‟s Thesis, Hunan University Palonka, Krystyna, 2010, Economic and trade relations between Poland and China since 2004, Asia Eur J (2010) 8:369-378 Santiso, Javier, 2005, “Angel or Devil? Chinese impact on Latin America”, Annual Bank Conference on Development Economics, Amsterdam Serin, Vildan and Civan, Abdulkadir, 2008, Revealed Comparative Advantage and Competitiveness: A case study for Turkey towards the EU, Journal of Economics and Social Research, 10(2) 2008, 25-41 Shen, Diancheng, 2002, Interview with Yin Xiaoping, Overseas Chinese, Issue No.3, 2002