GAAP 2001

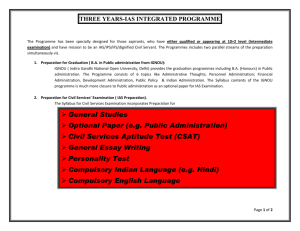

advertisement