ACCOUNTING AND FINANCIAL STATEMENTS

advertisement

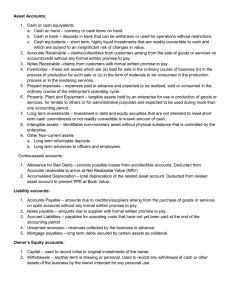

ACCOUNTING AND FINANCIAL STATEMENTS Accountancy and related professions accountants Accounts Department, Accounting Department bookkeeping accounting auditing MK, p.95 bookkeeper accountant auditor Accountants may have a specific focus • Management/managerial accounting • Tax accounting • Cost accounting • Historical cost accounting • Replacement cost accounting MK:pp.95, 96, 98 Vital questions for any business How much do we make? Do we have losses? How much do we own? How much do we owe to others? Where do we find cash if necessary? What do we use cash for? Which financial statements answer the previous questions? The Balance Sheet The Profit and Loss Account -P&L (The Income Statement) The Cashflow Statement net profit, loss, revenues, sales, cash flow, gross profit 1. ………………… profit which remains after all costs, expenses and taxes have been taken away 2. …………………amount of money coming into and going out of a company 3. …………………spending more money than it is received 4. …………………total number of products that a company sells over a period of time 5. …………………money re ceived from selling goods and services 6. …………………profit before taking away expenses and taxes Opposites? 1. 2. 3. 4. 5. 6. 7. 8. 9. Debit Appreciation Debtor Profit Fixed assets/liabilities Long-term Tangible Accounts payable Revenue Opposites? Credit Depreciation Creditor Loss Current assets/liab. Short-term Intangible Accounts receivable Expenditure Opposites Debit Appreciation Debtor Profit Fixed assets/liabilities Long-term Tangible Accounts payable Revenue Credit Depreciation Creditor Loss Current assets/liab. Short-term Intangible Accounts receivable Expenditure Financial statements -revision 1 Where can the following information be found? 1. How much does a company owe? What does it own? 2. What are its sales and related costs and expenditure? 3. Where does cash come from? What is it spent on? 4. What does equity include? Financial statements (RB p.70-75) Balance Sheet: 3 parts? Adjectives used to describe them? What does each part include? Synonyms? Profit & Loss Account(Income Statement:What does it show? What do revenues include? What do expenditures include? What happens with profits? Totals vs. expenses/deductions? Synonyms? Cashflow Statement: What does it consist of? Where does cash come from and go to? Cashflow Statement : Inflows or Outflows? Operations -Investments- Financing? Dividends paid Sales of property, plant and equipment Income taxes paid Proceeds from issuing shares Purchases of property, plant and equipment Receipts from the sale of goods and services Repayment of debt A few more terms used in accounting (MK, p.97): goodwill, share premium, common stock, pre-paid expenses, proceeds Source: Investopedia 1. costs such as rent, interest or insurance premium that are paid in advance 2. an intangible asset such as a strong brand name, good customer relations, good employee relations and any patents or proprietary technology 3. cash realized from a sale or received as a loan, after all commissions, expenses, fees, and taxes are deducted 4. the account to which the amount of money paid (or promised to be paid) by a shareholder for a share is credited to, only if the shareholder paid more than the cost of the share 5. a security that represents ownership in a corporation and gives rights to a company's assets only after creditors and preferred shareholders have been paid in full Find the accounting terms that have the same meaning (AE & BE) AGM Balance Sheet Accounts Receivable P&L Account Common Stock Creditors Statement of Financial Position Additional Paid-In Capital Income Statement Net Income Profit AMS (ASM) Ordinary Shares Debtors Share Premium Accounts Payable Listening, p.98 (MK) What intangible assets are mentioned? Problems in valuation? Profit? Example? What is taken into consideration? What is depreciation charged against? Assignment: Google’s annual report http://www.sec.gov/Archives/edgar/data/1288776/0001193 12513028362/d452134d10k.htm#toc1452134_12 SEC? What accounting firm audited Google’s annual report for 2012? Which financial statements are included? Major risk factors? (key words only) Report writing • Write a report on the trends in Google’s total assets in the period between 2008 and 2012. Use the information published on https://investor.google.com/pdf/2012 1231_google_10K.pdf Report writing – Checklist Layout: title, headings, spacing, clear text organization (e.g. numbering), signature, name, position Content: Task fulfilled? Makes sense? Language: a) phrases typically used in a report, b) terminology, c)spell/gramm General features: accuracy, concision, clarity, objectivity Phrases: We strongly … that ... should … The key … are outlined below. The … of this report is to … the possibilities … Information for this report was … from the following sources: This report … to identify ..., The report was … by Kim Jam last week. It was to be … by 15 March, 2014. No conclusions were … regarding … It is … that the following should be done: It would be … if … This … a number of issues. Firstly, … Contrary to our expectations, it was … that … The data for this report were … from the following sources. Mark Smith, HR Manager, … this report on incentive policies. How many accounting terms can you identify in the next slide? Source: MacKenzie, I. (1995) Financial English. LTP Translate the following: 1. Dobit nakon oporezivanja 2. Zalihe 3. Dugotrajna imovina 4. Dobit od redovitog poslovanja 5. Ukupne kratkoročne obveze 6. Zadržana dobit 7. Materijalna imovina 8. Prekoračenje računa 9. Sumnjiva i sporna potraživanja 10. Troškovi redovnog poslovanja 11. Nematerijalna imovina 12. Potraživanja 13. Amortizacija 14. Obračunato, a neplaćeno/nefakturirano (adj.)