Materials - The University of Texas at Arlington

advertisement

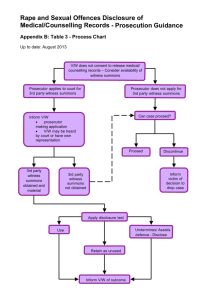

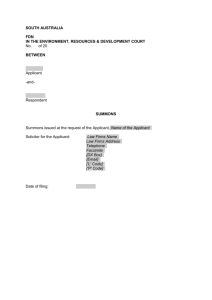

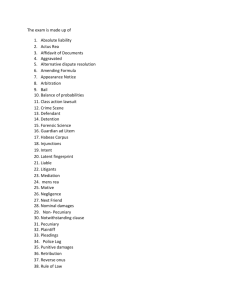

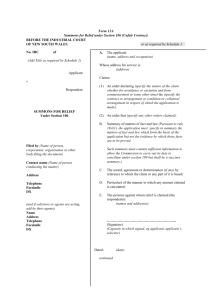

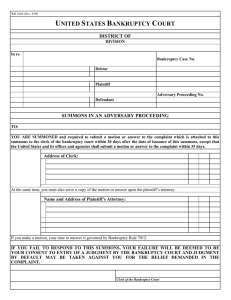

Discovery of taxpayer information: IRS use of its summons power Michael Prindible, Senior Counsel SB/SE IRS Office of Chief Counsel, Dallas, Texas August 14, 2013 3rd Annual CPE Event for Alumni and Friends at University of Texas Arlington, College of Business, Department of Accounting Any views expressed herein are Mr. Prindible's 1 Learning Objectives for IRS use of its summons power Identify statutory and administrative framework for an IRS summons Explain the elements of a valid Summons, Form 2039 (Rev. 10-2010) Discuss how to judicially quash and enforce an IRS summons Explain taxpayer and third-party defenses to an IRS summons Identify special situations for IRS summonses Any views expressed herein are Mr. Prindible's 2 Statutory & administrative framework I.R.C. § 7601(a) directs the Secretary of the Treasury Department to cause officers and employees of the Treasury Department to canvas “each internal revenue district” - to inquire after and determine federal tax liabilities. Any views expressed herein are Mr. Prindible's 3 Statutory and administrative framework I.R.C. § 7602(a) and (b) authorizes the Secretary of the Treasury Department to examine any books, papers, records, or other data, issue a summons, and to take testimony which may be relevant or material to: “ascertaining the correctness of any return … making a return where none has been made … determining the liability of any person for any internal revenue tax … collecting any [internal revenue tax] liability … [or] inquiring into any offense connected with the administration or enforcement of the internal revenue laws.” Any views expressed herein are Mr. Prindible's 4 Internal Revenue Manual (IRM) – Part 25.5 Summons Handbook 25.5.1: Introduction 25.5.2: Preparation 25.5.3: Procedures 25.5.4: Examination of Books and Witnesses 25.5.5: Summons for Taxpayer Records and Testimony 25.5.6: Summonses on Third-Party Witnesses 25.5.7: Special Procedures for John Doe Summons 25.5.8: Use of Summons Special Applications 25.5.9: Fees & Costs for Summoned Witnesses 25.5.10: Enforcement of Summons 25.5.11: Title 31 Bank Secrecy Act Investigations Any views expressed herein are Mr. Prindible's 5 IRS administrative summons authority Authority to issue summonses is delegated to Agents of the IRS Examination, Collection, and Criminal Investigation Divisions Authority carefully described and restricted by Delegation Order 25-1 (formerly DO-4, Rev. 23) IRM ¶ 1.2.52.2. IRS employees are expressly instructed to review the delegation order before taking any action relating to a summons. IRM ¶ 25.5.1.3. Any views expressed herein are Mr. Prindible's 6 IRS administrative summons authority The IRS administrative policy and practice is to obtain information and documents by means other than a summons whenever possible. “Attempt to obtain information voluntarily from taxpayers and witnesses prior to issuing a summons. Consent may be obtained voluntarily by acquainting the taxpayer or witness with the provisions of the Internal Revenue Code.” IRM ¶ 25.5.1.4(1) Any views expressed herein are Mr. Prindible's 7 IRS administrative summons authority IRS employees are expressly directed to take into account the following factors in considering the issuance of a summons: The tax liability involved; The time and expense of obtaining the records; The probability of having to resort to court action; The potential adverse effect on voluntary compliance by other parties if the enforcement efforts are not successful; and Whether a criminal case is pending . IRM ¶ 25.5.1.4(2) Any views expressed herein are Mr. Prindible's 8 IRS administrative summons authority IRS employees are expressly instructed to consider serving a summons in the following situations: No records are made available to permit an adequate examination within a reasonable period of time; Submitted records are known or suspected to be incomplete, and additional records are presumed to be in the possession of the taxpayer or a third party; It appears serious efforts to provide documentation for substantiation will not be made because records and explanations will be offered at another level or after notice of deficiency has been issued; and The existence and location of records are in doubt. IRM ¶ 25.5.1.4(3) Any views expressed herein are Mr. Prindible's 9 IRS keeps original Any views expressed herein are Mr. Prindible's 10 Technical elements of a valid summons: 1. Identifies the taxpayer 2. Identifies the summoned person 3. Identifies the IRS employee designated to take testimony and receive summoned information and documents 4. Sets an appropriate place and time for appearance 5. Insure that authorized IRS employees issue and approve the summons 6. Satisfies the attestation requirement 7. Gives proper notice of third-party summonses 8. Proper service of the summons Any views expressed herein are Mr. Prindible's 11 Service of summons Any views expressed herein are Mr. Prindible's 12 Part A given to person summoned Any views expressed herein are Mr. Prindible's 13 IRS administrative summons authority Service of summons: A summons must be served by hand to the person to whom it is directed or left at the person’s last known address. I.R.C. § 7603(a); Treas. Reg. § 301.7603-1(a); IRM ¶25.5.3.2(1). A summons issued to a third-party record-keeper, defined in I.R.C. § 7603(b)(2), may also be served by certified or registered mail. See I.R.C. §7603(b)(1); Treas. Reg. §301.7603-1(a)(2); IRM ¶ 25.5.3.2(1). IRS must give timely notice to the taxpayer of a third party summons (Form 2039 part D). IRM ¶25.5.6.6.4(1). Any views expressed herein are Mr. Prindible's 14 Petition to quash a summons If a notice of a third-party summons is required to be given to any person identified in the summons, the person receiving such notice is entitled to bring a proceeding to quash the summons. A taxpayer has the right to file a petition to quash the summons within 20 days after the date the notice of summons is given. An action to enforce a summons must be brought by the United States in federal district court. I.R.C. §§ 7402(b) and 7604(a). In most instances where a taxpayer files a petition to quash a summons, the United States will counterclaim for enforcement of the summons. See I.R.C. § 7609(b)(2)(A). Jurisdiction: petition to quash or enforce a summons must be filed in judicial district where the summoned person “resides or is found.” Any views expressed herein are Mr. Prindible's 15 Petition to quash a summons When a third-party-summons action is pending, the IRS is restricted from examining the records subject to the summons (I.R.C. § 7609(d)), all statutes of limitations with respect to assessment, collection, or criminal prosecution of the taxpayer are suspended (I.R.C. § 7609(e)), and the summonsed third-party is required to assemble the records in question. I.R.C. §7609(i)(1). A taxpayer has the right to intervene in a summons enforcement proceeding commenced by the United States. See I.R.C. § 7609(b). Any views expressed herein are Mr. Prindible's 16 Summons-enforcement action A summons-enforcement action is commenced by the United States through filing a petition in federal district court seeking issuance of an order to show cause to the summonsed person. A petition is accompanied by an affidavit of the issuing IRS agent that must state the prima-facie facts sufficient to show compliance with all statutory and judicial requirements for enforcement. IRM Exhibit 25.5.10-3 affidavit example Any views expressed herein are Mr. Prindible's 17 Summons enforcement action United States v. Powell, 379 U.S. 48, 57-58 (1964). Enforcement – the four Powell requirements: To be enforceable, a summons must: 1. Be issued for a legitimate purpose; 2. Seek information that may be relevant to the investigation; 3. Seek information that is not already in the Service’s possession; and 4. All administrative steps required by the Code must be followed. See also IRM ¶ 25.5.4.4(1). Any views expressed herein are Mr. Prindible's 18 4th Amendment protection against unreasonable searches and seizures and U.S. v. Powell, 379 U.S. 48 (1964) The Service need not meet any standard of probable cause or the like to obtain enforcement of its summons, either before or after limitation on ordinary tax liabilities has expired. It need only satisfy the 4 Powell requirements: proper purpose; may be relevant; information not already in its possession of IRS; and the rules have been followed. Result: Tremendous authority for IRS to engage in a fishing expedition in the taxpayer’s records The Service’s authority is not dependent on the existence of a case or controversy to require the production of evidence. The Service can investigate merely on suspicion that the law is being violated, or even just because it wants assurance that it is not. Again: Tremendous authority to fish. Whatever may “throw light” on the correctness of the return can be summoned. Within this broad boundary, the Service usually won’t run afoul of the 4th Amendment by pursuing an “unreasonable search.” Any views expressed herein are Mr. Prindible's 19 Summons-enforcement action The government’s burden is a “slight” one. The burden is almost always met by the affidavit of the examining agent attesting to each of the four Powell elements. The test - the government must demonstrate a sufficient nexus between the taxpayer and the records of a third person’s affairs to make the investigation reasonable. Any views expressed herein are Mr. Prindible's 20 Summons-enforcement action Once the government establishes prima facie case, the burden shifts to the party contesting the summons. The taxpayer’s burden to overcome the IRS’s prima facie showing is heavy, and requires the allegation of specific facts and the introduction of affirmative evidence. Any views expressed herein are Mr. Prindible's 21 Summons-enforcement action Summons-enforcement actions are conducted as summary proceedings under Fed. R. Civ. P. 81(a)(5). Courts rarely allow an evidentiary hearing or discovery – usually decided “on the papers” – based on the pleadings, affidavits, and a non-evidentiary hearing Compliance with summons is enforced by contempt. Any views expressed herein are Mr. Prindible's 22 Summons enforcement action Sanctions: A taxpayer who fails to comply with an enforcement order may be held in contempt. Any views expressed herein are Mr. Prindible's 23 Defenses to an IRS summons Failure to satisfy 4 Powell requirements Relevancy standard – whether the summoned information “might . . . throw . . . light upon the correctness of the return”? See United States v. Arthur Young & Co., 465 U.S. 805, 813-814 (1984). “Possession, custody, or control” issues 5th Amendment privilege against self-incrimination – this “natural individuals” (not corporations) defense applies to both documentary requests and oral testimony. Other privileges – attorney-client privilege; section 7525 tax practitionerclient privilege (protects legal advice, not accounting advice, in noncriminal matters; but does not protect communications regarding tax shelters); and attorney-work-product doctrine. Any views expressed herein are Mr. Prindible's 24 Defenses to an IRS summons Powell requirements: Legitimate investigatory purpose Dual Purpose: IRS employees are instructed to consult with IRS Office of Chief Counsel before issuing a dual purpose summons – e.g., to obtain information relating to a specific, identified taxpayer as well as an unidentified taxpayer(s). See IRM ¶ 25.5.4.4.1(3)(B). Relevancy Overbroad/burdensome The examining agent must describe why documents are relevant. IRM ¶ 25.5.10.4.5. Any views expressed herein are Mr. Prindible's 25 Defenses to an IRS summons Powell requirements: Information not possessed by IRS Statutory requirements Courts will “evaluate the seriousness of the violation under all circumstances …” Failure to comply with IRM not sufficient IRS’s failure to comply with third-party contact rule is sufficient basis for denial of enforcement of summons. Any views expressed herein are Mr. Prindible's 26 Defenses to an IRS summons “Possession, custody, or control” issues Lack of possession or control is a valid defense. Taxpayer must rebut presumption of control with “clear proof.” “Control” includes the legal right of the producing party to obtain documents from another source on demand. A court order enforcing a summons is a finding that the summonsed party has the requisite control over the summonsed document. Any views expressed herein are Mr. Prindible's 27 Defenses to an IRS summons Privilege against self-incrimination Limited in application to a summons on for the production of documents The mere act of production is testimonial in some instances, but “Foregone conclusion” exception to the privilege – where the government independently knows of the existence and authenticity of the documents, production is not testimonial - e.g., known and unknown multiple foreign bank accounts & information known by return preparer “Required records” exception to the privilege – e.g., records required to be maintained under the 1970 Bank Secrecy Act Other Privileges Attorney-client communications are protected – but see Federal Rule of Evidence 502(a) about subject-matter waivers of attorney-client privilege and attorney-work-product privilege Attorney-work-product doctrine – documents prepared in anticipation of litigation and litigation was objectively reasonable Tax-accrual workpapers – very limited privilege, but IRS policy of restraint for requesting them Any views expressed herein are Mr. Prindible's 28 Defenses to an IRS summons Foregone Conclusion: U.S. v. Sideman & Bancroft, LLP, 704 F.3d 1197 (9th Cir. 2013) For the “foregone conclusion exception to apply, the government must establish its independent knowledge of three elements: (1) The documents’ existence; (2) The documents’ authenticity; and (3) [The taxpayer’s] possession or control of the documents.” Any views expressed herein are Mr. Prindible's 29 Defenses to an IRS summons U.S. v. Sideman & Bancroft, LLP: The 9th Circuit panel affirmed the district court’s order enforcing an Internal Revenue Service administrative summons in connection with a criminal investigation of an individual taxpayer. The taxpayer’s documents had made their way from the taxpayer’s residence to appellant, her counsel for the IRS criminal investigation. The panel held that the “foregone conclusion” exception to the Fifth Amendment applied to the documents because, before the IRS issued the summons, it knew with reasonable particularity of the existence and appellant’s possession of the documents and could independently establish their authenticity based on taxpayer’s tax preparer’s familiarity with them. Any views expressed herein are Mr. Prindible's 30 Special Situations Withdrawal – IRS may withdraw summons with procedural defects and then reissue summons later Conditional summons enforcement – courts are divided Restricted access to, and use of, computer software/tax-related computer software source code – see I.R.C. § 7612 & IRM ¶25.5.6.10 Summonses and related pending U.S. Tax Court case & discovery Ash v. Commissioner, 96 T.C. 459, 468-473 (1991) – Tax Court held that a summons served before the taxpayer files a Tax Court petition posed no threat to the integrity of the Tax Court's discovery rules. Final appealable enforcement order and stay pending appeal – absent a stay, summoned party risks being held in contempt I.R.C. § 7609(f) John Doe summons authority Any views expressed herein are Mr. Prindible's 31 John Doe summons “John Doe” summons are used where the identity of the taxpayer or group or class of taxpayers under investigation is not known. Special statutory rules govern the issuance of a John Doe summons - see I.R.C. § 7609(f) and IRM ¶ 25.5.7 (John Doe summons procedures) Ex-parte court proceeding required to determine if the John Doe summons is appropriate Any views expressed herein are Mr. Prindible's 32 John Doe summons For example, the Internal Revenue Service has statutory authority to issue a summons to a bank to ascertain the identity of a person whose transactions with that bank strongly suggest liability for unpaid taxes. “[The IRS must show] evidence that a transaction has occurred, and [it] is of such a nature as to be reasonably suggestive of the possibility that the correct tax liability with respect to that transaction may not have been reported.” Senate Explanation of I.R.C. § 7609(f). The IRS may issue a John Doe summons if the government establishes to a district court: The summons relates to the investigation of a particular person or ascertainable group or class of persons. There is a reasonable basis for believing such person or group or class may fail or may have failed to comply with the internal revenue laws. The name(s) of the unidentified taxpayer(s) is not readily available from other sources. Any views expressed herein are Mr. Prindible's 33 Conclusion 1. 2. 3. 4. A summons request should be clear and as specific as possible, it should not create an undue production burden, and it should request records within the taxpayer’s possession, custody, or control. To avoid potential waiver arguments, a summoned party should timely raise any objections or privileges to a summons (in writing or on a formal record) at or before the time for compliance stated in the summons and comply with summons requests to the extent that there are no objections. In a summons enforcement action, the court’s decision on whether to enforce the summons can turn on the detail and quality of the parties’ supporting affidavits. Special provisions that apply to certain summonses – third-party summonses, requests for computer software, and requests for information relating to tax reserves. Any views expressed herein are Mr. Prindible's 34