GRIEVANCE REDRESSAL MECHANISM. Credila Financial

advertisement

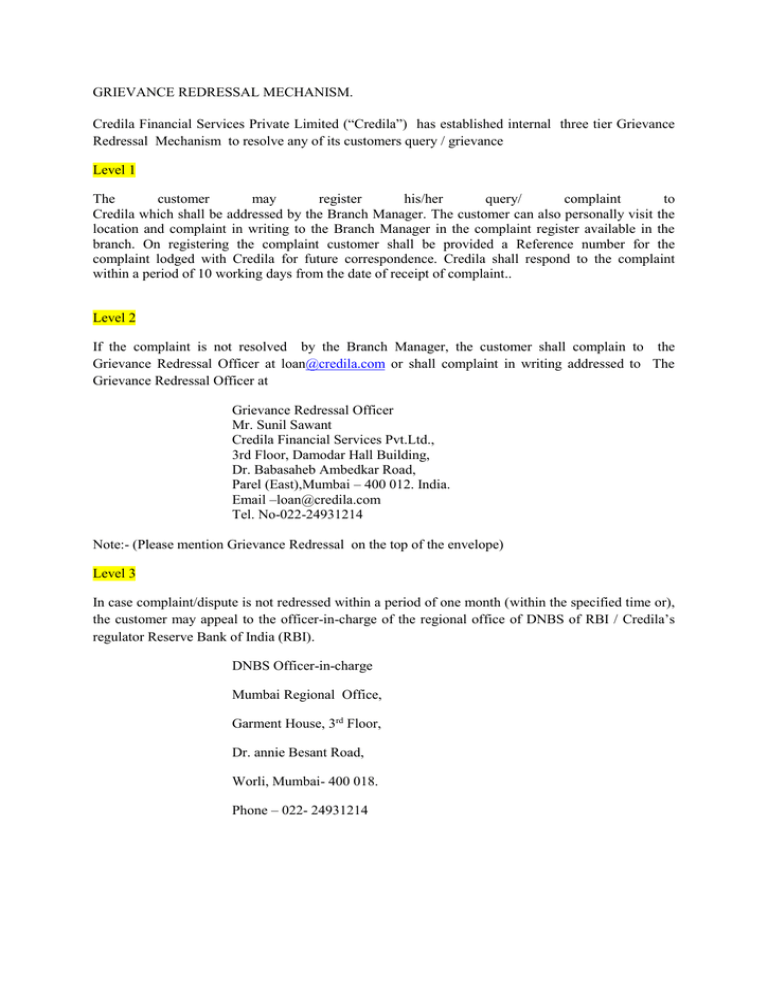

GRIEVANCE REDRESSAL MECHANISM. Credila Financial Services Private Limited (“Credila”) has established internal three tier Grievance Redressal Mechanism to resolve any of its customers query / grievance Level 1 The customer may register his/her query/ complaint to Credila which shall be addressed by the Branch Manager. The customer can also personally visit the location and complaint in writing to the Branch Manager in the complaint register available in the branch. On registering the complaint customer shall be provided a Reference number for the complaint lodged with Credila for future correspondence. Credila shall respond to the complaint within a period of 10 working days from the date of receipt of complaint.. Level 2 If the complaint is not resolved by the Branch Manager, the customer shall complain to the Grievance Redressal Officer at loan@credila.com or shall complaint in writing addressed to The Grievance Redressal Officer at Grievance Redressal Officer Mr. Sunil Sawant Credila Financial Services Pvt.Ltd., 3rd Floor, Damodar Hall Building, Dr. Babasaheb Ambedkar Road, Parel (East),Mumbai – 400 012. India. Email –loan@credila.com Tel. No-022-24931214 Note:- (Please mention Grievance Redressal on the top of the envelope) Level 3 In case complaint/dispute is not redressed within a period of one month (within the specified time or), the customer may appeal to the officer-in-charge of the regional office of DNBS of RBI / Credila’s regulator Reserve Bank of India (RBI). DNBS Officer-in-charge Mumbai Regional Office, Garment House, 3rd Floor, Dr. annie Besant Road, Worli, Mumbai- 400 018. Phone – 022- 24931214 GRIEVANCE REDRESSAL GUIDELINES If in case, your query remains unanswered, you may to lodge/ file complaint, you could follow our grievance redressal Guidelines. Credila have its own Grievance redressal Mechanism for customer convenience and mechanism to ensure effective and timely resolution to our valued customers. This is in line with the guidelines issued by RBI from time to time. Objective To define the user friendly process for complaints received from various channels Procedure to register a complaint To provide timely resolution to our customers cause analysis customer satisfaction. The Grievance Redressal Guidelines are applicable for any grievance or complaints. These complaints may be received either at the branch, Registered Office or Head Office / web site through any of the following ways : Online Complaint Customer may file write to us at our web site at customer service section. using the form available therein. Our representative will reach out to you and understand your concern. We will evaluate your complaint and endeavour to address your concerns suitably. Letter Customer shall write *letter to us which should duly signed by the Customer at any of our Branch. (The branch address is available on our website www.credila.com ). Note:- (Please mention Grievance Redressal on the top of the envelope) Personal Visit Customer shall visit the branch office personally and register his/her query/ grievance in the complaint register available in the branch. Email Customer shall complain through its registered email-ID@ service@credila.com. Call Customer shall also call Credila on the help line number 1800 209 3636. *(In case of Request and Query Complaint) Customer dissatisfaction for the following reasons mentioned below will be treated by us as a complaint Fail to fulfilment of a promise Misrepresentation of fact or suppression of facts to the customer request. Any communication from a customer soliciting a service such as a change or modification in the policy. Any communication from a customer for the primary purpose of requesting information about a company and/or its services. Contact issue / behaviour of our officers Disbursement issues. Charges related to origination fee. Change/ modification in Loan structure / repayment Credila will ensure that the following processes are followed: 1 The Company has established internal three tier Grievance Redressal Mechanism to resolve any of their customers query / grievance Level 1 The customer may register his/her query/ complaint to Credila which shall be addressed by the Branch Manager. The customer can also personally visit the location and complaint in writing to the Branch Manager in the complaint register available in the branch. On registering the complaint customer shall be provided a Reference number for the complaint lodged with Credila for future correspondence. Credila shall respond to the complaint within a period of 10 working days from the date of receipt of complaint.. Level 2 If the complaint is not resolved by the Branch Manager, the customer shall complain to the Grievance Redressal Officer at loan@credila.com or shall complaint in writing addressed to The Grievance Redressal Officer at Grievance Redressal Officer Mr. Sunil Sawant Credila Financial Services Pvt.Ltd., 3rd Floor, Damodar Hall Building, Dr. Babasaheb Ambedkar Road, Parel (East),Mumbai – 400 012. India. Email –loan@credila.com Tel. No-022-2472448. Note:- (Please mention Grievance Redressal on the top of the envelope) Level 3 In case complaint/dispute is not redressed within a period of one month (within the specified time or), the customer may appeal to the officer-in-charge of the regional office of DNBS of RBI / Credila’s regulator Reserve Bank of India (RBI). To, DNBS Officer-in-charge Mumbai Regional Office, Garment House, 3rd Floor, Dr. annie Besant Road, Worli, Mumbai- 400 018. Phone – 022- 24931214 2 All complaints received by Credila will be responded within the prescribed) as per the level mentioned above. 3 Written complaint or email from the registered email id is mandatory. 4 For the existing customers application ID will be mandatory. 5 Reference number shall be provided to the Customer on receipt of the complaint in writing/ or on website.. 7 The policy will be reviewed and placed before the board for approval whenever there is change in regulatory guidelines from time to time. The endeavour of Credila is to provide good customer service.