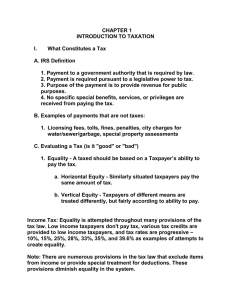

tax - McGraw Hill Higher Education - McGraw

advertisement

Chapter 3 Tax Planning Strategies and Related Limitations © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Learning Objectives 1. 2. 3. 4. Identify the objectives of basic tax planning strategies. Apply the timing strategy and describe its applications and limitations. Apply the concept of present value to tax planning. Apply the strategy of income shifting, provide examples, and describe its limitations. 3-2 Learning Objectives (Cont.) 5. 6. 7. Apply the conversion strategy, provide examples, and describe its limitations. Describe basic judicial doctrines that limit tax planning strategies. Contrast tax avoidance and tax evasion 3-3 Basic Tax Planning Overview Effective planning requires consideration for both tax and non-tax factors In general terms, effective tax planning maximizes the taxpayer’s after-tax wealth while achieving the taxpayer’s non-tax goals 3 parties to every transaction: taxpayer, other party, and the government 3 basic planning strategies: timing, income shifting, and conversion 3-4 Timing Strategies When income is taxed or an expense is deducted affects the associated “real” tax costs or savings for 2 reasons (1) the time that income is taxed or an expense is deducted affects the present value of the taxes paid on income or the tax savings on deductions. (2) the tax costs of income and tax savings income vary as tax rates change 3-5 Timing Strategies The concept of Present Value. $1 today is worth more than $1 in the future. The implication of the time value of money for tax planning is that the timing of a cash inflow or a cash outflow affects the present value of the income or expense When considering cash inflows, higher present values are preferred; when considering cash outflows, lower present values are preferred 3-6 Timing Strategies Present Value = Future Value / (1 + r)n Exhibit 3-1 provides the discount rates for a lump sum (single payment) received in n periods using various rates of return 3-7 Timing Strategies Two basic tax-related timing strategies: Accelerating deductions Essentially accelerating a current cash inflow Deferring income Essentially deferring a current cash outflow 3-8 Timing Strategies When Tax Rates Change When tax rates are increasing, the taxpayer must calculate the optimal tax strategies for deductions and income. Why? When tax rates are decreasing, taxpayers should accelerate tax deductions into earlier years and defer taxable income to later years. Why? 3-9 Limitations of Timing Strategies The tax deduction often cannot be accelerated without the actual cash outflow that generates the deduction Tax law generally requires taxpayers to continue their investment to defer income Deferral strategy may not be optimal if taxpayer has cash flow needs, or if continuing investment generates low returns or subjects taxpayer to unnecessary risk Constructive receipt doctrine: taxpayer must recognize income when it is actually or constructively received 3-10 Income Shifting Strategies Income shifting exploits the differences in tax rates across taxpayers by shifting income from high-tax rate taxpayers (jurisdictions) to low-tax rate taxpayers (jurisdictions) or shifting deductions from low-tax rate taxpayers (jurisdictions) to high-tax rate taxpayers (jurisdictions) Transactions between family members Transactions between owners and their businesses Transactions across jurisdictions Several factors limit this strategy 3-11 Conversion Strategies The conversion strategy is based on the understanding that the tax law does not treat all types of income or deductions the same To implement the conversion strategy, you must: Understand the differences in tax treatment across various types of income, expenses, and activities and Have some ability to alter the nature of the income or expense to receive the more advantageous tax treatment 3-12 Limitations of Conversion Strategies The Code itself also contains provisions to prevent a taxpayer from changing the nature of expenses and income Implicit taxes Judicial doctrines 3-13 Additional Limitations to Tax Planning Strategies: Judicial Doctrines Constructive Receipt Assignment of income Related-party transactions Business purpose doctrine Step-transaction doctrine Substance-over-form doctrine Economic substance doctrine 3-14 Tax Avoidance vs. Tax Evasion The previous strategies fall into legal tax avoidance. Tax evasion: the willful attempt to defraud the government 3-15