IFTA IQ Test – ANSWERS

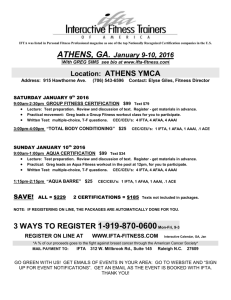

advertisement

IFTA IQ Test – ANSWERS True or False #1 Jurisdictions are required to finalize their tax rates and determine tax exemptions. True: Procedures Manual, P1120.100 and P1130 #2 An annual IFTA tax return is for one calendar year. True: Articles of Agreement, R930.200 #3 A recreational vehicle is not a qualified motor vehicle but a bus transporting children to a church recreation camp is a qualified motor vehicle. TRUE: R248 #4 Temporary IFTA permits can be issued for 60 days False: Articles of Agreement, R263 and R650 #5 When a carrier fails to pay your jurisdiction, you can require them to post a bond. True: Articles of Agreement, R340 and Procedures Manual, P400 #6 To stream line the renewal process your jurisdiction can automatically renew active licenses. True: Articles of Agreement, R345.200 #7 Jurisdictions are required to send an initial billing and a second billing for IFTA tax returns that do not have complete payments. False. #8 Jurisdictions cannot write off credit or debit amounts. False: Articles of Agreement, R1120 #9 Jurisdictions must have an appeal procedure in place for licensees whose license has been revoked True: Articles of Agreement, R370, R1400 #10 Trip permits are not allowed in lieu of IFTA licensing. False: Articles of Agreement, R310 #11 Jurisdictions must charge a fee for decals and licenses False: Articles of Agreement, R355 and Procedures Manual, P145 and P320.300 #12 Licensees must provide a lease when they renew. False: Articles of Agreement, R540, P520 #13 Jurisdictions cannot have their state logo on the IFTA decal False: Procedures Manual, P320.100 #14 If you can verify that a company has a valid IFTA license then they do not need to have a copy in the vehicle they are operating. False: Articles of Agreement, R620 #15 Licensees can transfer decals between vehicles False: Articles of Agreement, R640 #16 Licensees must renew their IFTA license and decals by December 31st of each year because there is no grace period. True: Articles of Agreement, R610 (Grace period is for display see R655) #17 Licensees are exempt from reporting fuel information for cement trucks because they manufacture a product while on the road. True/False: R830.100 #18 Licensees can request a refund when credit exists from their IFTA tax return. However, jurisdictions can issue the refund whenever they want. Part 1: True: Articles of Agreement, R1110. Part 2: False: Articles of Agreement R1150 #19 IFTA tax returns are considered “Timely” when the return is received along with the complete payment by the return due date. True: Articles of Agreement, R920, R960 and R970 #20 Annual IFTA tax reporting is allowed when a licensee operation has less than 5,000 miles or 8,000 kilometers in all jurisdictions. False: R930.200 “in all member jurisdictions other than the base jurisdiction. #21 Each tax return must contain a complete tax rate matrix as part of the form. False: Articles of Agreement, R940.100, Procedures Manual, P730 and P720.500 and P720.500.010 #22 The letters “IFTA” on the IFTA decal must be a minimum of ½”. False: Procedures Manual, P320.100 #23 The jurisdiction must notify all member jurisdictions within 15 days of all revocations/suspensions or reinstatements. False: Articles of Agreement, R420 #24 The jurisdiction must allow a licensee to submit a computer-generated tax return in lieu of the standard tax return. False: R940.300 #25 Payments of billing transmittals received from other jurisdictions are made by the last day of the month following the month in which the billing transmittal was received. True: P1040