07 locuming -b-the powerpoint

advertisement

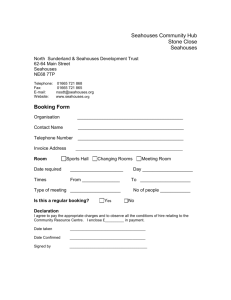

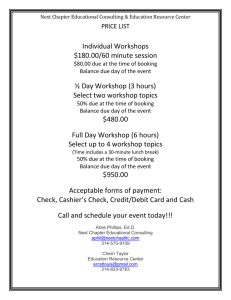

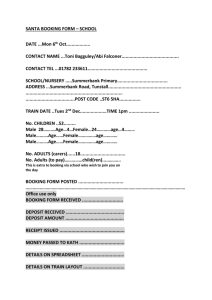

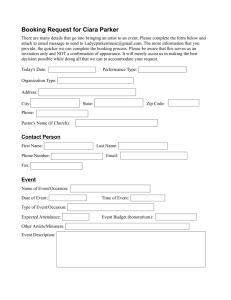

LOCUMING MADE SIMPLE BY DRs. CHARLOTTE BATCHELOR , ALISHA SYMONS & RAMESH MEHAY image-check done WHY LOCUMING? WHY NOT? Feeling like this? Wanna feel like this? Aims • Gain insight into: • preparation needed to become a successful locum • financial issues and record- keeping • how it can be enjoyed Objectives • Get a better idea of: • steps required to set up as a locum • what administration work is involved and how to keep on top of it • how to keep records for the tax man and whether to self assess / recruit an accountant • financial issues e.g. income protection, superannuation • pitfalls common to locums • benefits of locuming Summary of locuming PREPARATION MAKING CONTACT BOOKING ON THE DAY INVOICING OTHER THINGS Record keeping Fees Tax Preparation 1 – Change your mindset • Don’t think for a second that all practices that you locum in will be like the training practices you have been in as a GP trainee. • Practices differ in so many ways. • Infrastructure and design • Design of building • Computer systems • Appointment systems (5min, 7min, 10 min etc) • On Call, Home Visit Procedures • Patient population • Ethnic makeup • Age range • How well trained patients are (in terms of self-care) • Whether teaching practice or not • Relationships • Between doctors • Between different teams Preparation 1 – Change your mindset Because practices differ in so many ways… • It’s illogical to have ‘one rule for all’ • Don’t be so rigid about things - yes, there is a business relationship but that doesn’t mean you can’t bend the rules and be flexible. • Although you need to be business like, there is no need to be autocratic – like an Alan Sugar like person. • Practices are likely to use you again if they like you – so be personable. Preparation 2 – Work out your work Start early! • Where do you want to work? Which regions? • When do you want to work? Everyday? • How much do you want to work? 2h surgeries, 3h surgeries? • What type of work do you want to do? Just surgeries, on- call, home visits? OOH? Preparation 3 – Certificates & Registers Start early! REGISTERS TO GET ON • Performer’s List (WYCSA) • Information Commissioner (for handling personal data & information): https://ico.org.uk/for-organisations/register/ • HMRC as ‘self-employed’ - HMRC business taxes, Self assessment, Class 2 NIC CERTIFICATES TO GET TOGETHER • CCT certificate • GMC certificate • BLS certificate • Safeguarding certificate (Child & Adult) • Indemnity cover certificate • DBS certificate – do it online: https://www.gov.uk/dbs-update-service Preparation 4 – The Doctor’s Bag Start early! • Stethoscope, Auroscope, Ophthalmoscope, Thermometer, BP & BM machine • Headed note paper (of the practice you are working for) • Prescription pad for the practice you are working for (or print off ‘blank prescription’ through the surgery’s computer system. • What emergency drugs do you need to carry? • Do you need to carry any? • Get them from a pharmacist (write a private prescription out) • Aspirin, GTN spray, Salbutamol inhaler, Benzylpenicillin, Water for injections and syringes. Preparation 5 – Your things Start early! VACCINATIONS • Are you up to date? If not, get boosters etc. CAR INSURANCE • Need to update to ‘Home & Business’ use. GET YOUR CV READY • Needs to be short and concise – max 2 sides of A4 for locums. GET A COMPUTER AND FILING CABINET • To start doing your invoices and things. Try and use an electronic diary like the one that comes with Outlook for booking sessions in. Develop a website to advertise your services and perhaps even an online booking system? OPEN A NEW BANK ACCOUNT • For locuming work GET SUPPORTED AND INFORMED • Sign up to an accountant and seek advice. • NASGP – National Association of Sessional GPs – sign up https://www.nasgp.org.uk/ • Join a local locum group – if not one available, start one up. Summary of locuming PREPARATION MAKING CONTACT BOOKING ON THE DAY INVOICING OTHER THINGS Record keeping Fees Tax The Curriculum Vitae • Be concise • Be precise • No more than 2 sides of A4 with a personal statement • Referees • Clear contact details • Sent to Practice Managers with a covering mail shot email. • Via NHS Outlook – select PM group for your desired region • Do NOT send to GPs re: e-overload Summary of locuming PREPARATION MAKING CONTACT BOOKING ON THE DAY INVOICING OTHER THINGS Record keeping Fees Tax Booking Work • When & how long for? • How many patients/visits? • Any admin. work/other clinics? • Any on-call? • Details of surgeries, e.g. start times, breaks • Fees • What computer system? • Do they have a Locum pack? • Get confirmation in writing Remember, you can choose what you want to do (even if a PM would prefer someone for visits and tasks but you would prefer not to). You can cherry pick the nourishing bits of the job. Summary of locuming PREPARATION MAKING CONTACT BOOKING ON THE DAY INVOICING OTHER THINGS Equipment Tax & finances Leave On the day • Self care – toilet, tea and coffee, panic button • Computer system • Phone system and numbers • Equipment, emergency meds and BNF • FP10’s/MED3’s • Investigations • Referrals • Appointments • Delegation Say ‘no’ if not appropriate Summary of locuming PREPARATION MAKING CONTACT BOOKING ON THE DAY INVOICING OTHER THINGS Record keeping Fees Tax Invoices • Use a computer • Keep layout simple • Clear heading • Legible figures • Precise • Superannuation • www.pennyperfect.co.uk (fab for finances) messy or complicated - your payment may be delayed Summary of locuming PREPARATION MAKING CONTACT BOOKING ON THE DAY INVOICING OTHER THINGS Record keeping Fees Tax Record Keeping • Set time aside for this each week/month • work done • mileage • expense receipts • KEEP ON TOP OF IT • makes invoicing, superann. and self assessment a lot easier Fees • ‘BMA-suggested’ locum rates ruled anti-competitive in 1999 • Locums and Practices must negotiate rates • You must have a base to start from: • Sign up to NASGP.ORG.UK – they provide an audit of rates in various regions (helps you decide what you might like to charge) • Speak to other locums • Ask the practice manager what they normally pay • Vary rates • surgery only • on-call Learn the art of negotiation • hourly/sessional • You can even charge different practices different rates • As doctors we are not trained up to financially negotiate. But it becomes easier the more your practise. patients! We negotiate management plans with Tax • Self Assessment +/- accountant • High interest savings account • Save about 1/3 of your monthly earnings • Make payments twice a year (Jan & July) • Don’t touch it until after you receive your tax bill! • Don’t be fooled if low tax return in first year PAY TAX ON TIME (31st Jan deadline) - otherwise you will be fined and charged interest! Other Finances • National Insurance • Class 2 contributions • Monthly direct debit • NHS Superannuation scheme • Locum form A (give to practice with invoice) and form B • Personal pension contribution by cheque • Income protection Extras • Long-term locums • Locum agencies/chambers • Cancellation policy • Details of other locums • Continuing Professional Development • Appraisal/Revalidation Potential pitfalls of locuming • Being poorly organised • Abuse by practices • Income • unpaid leave/no sick benefits • hidden costs • appraisals • CPD • Isolation (so join or form a local locum group) • Not being able to say ‘NO’ Enjoying it! • Own boss • Flexible & varied • Cherry pick the things you like doing (e.g. can say no to home visits) • Income can be good • Gain insight into workings of different practices • Good way of finding the right practice for you in the future - networking Useful websites & contacts • Institute of Chartered Accountants of England & Wales: www.icaew.co.uk • HM Revenue & Customs: www.hmrc.gov.uk (registering as self-employed) • www.hmrc.gov.uk/selfemployed/register-selfemp.htm • Register with the Information Commissioner (because you are handling personal data & information): https://ico.org.uk/for-organisations/register/ • NHS Pensions: www.nhsbsa.nhs.uk/pensions • National Association of Sessional GPs: www.nasgp.org.uk • Financial management software: www.pennyperfect.co.uk • Example of a locum website: www.drilyons.com • BNF: 01268 495600 bnf@binleys.com • Newly Self-Employed Helpline (Inland Revenue): 0300 200 3504 Locuming Made Simple • Preparation is key • Keep on top of finances & record-keeping • Avoid pitfalls and enjoy the benefits!