Closing Costs - Ottawa Mortgage Services

advertisement

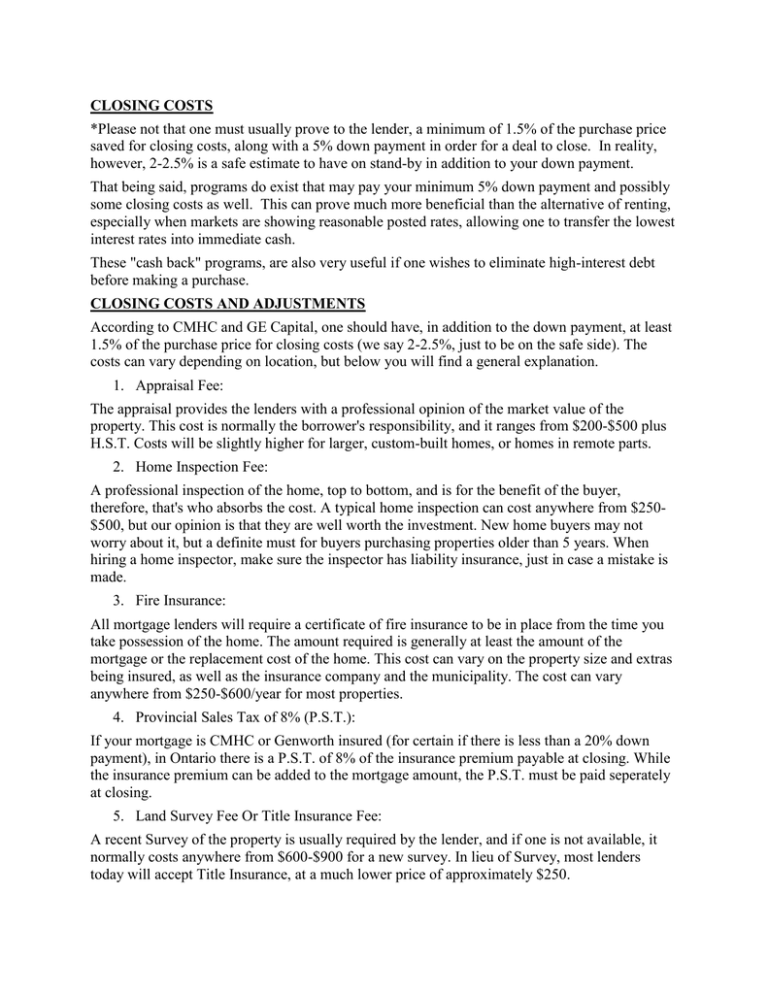

CLOSING COSTS *Please not that one must usually prove to the lender, a minimum of 1.5% of the purchase price saved for closing costs, along with a 5% down payment in order for a deal to close. In reality, however, 2-2.5% is a safe estimate to have on stand-by in addition to your down payment. That being said, programs do exist that may pay your minimum 5% down payment and possibly some closing costs as well. This can prove much more beneficial than the alternative of renting, especially when markets are showing reasonable posted rates, allowing one to transfer the lowest interest rates into immediate cash. These "cash back" programs, are also very useful if one wishes to eliminate high-interest debt before making a purchase. CLOSING COSTS AND ADJUSTMENTS According to CMHC and GE Capital, one should have, in addition to the down payment, at least 1.5% of the purchase price for closing costs (we say 2-2.5%, just to be on the safe side). The costs can vary depending on location, but below you will find a general explanation. 1. Appraisal Fee: The appraisal provides the lenders with a professional opinion of the market value of the property. This cost is normally the borrower's responsibility, and it ranges from $200-$500 plus H.S.T. Costs will be slightly higher for larger, custom-built homes, or homes in remote parts. 2. Home Inspection Fee: A professional inspection of the home, top to bottom, and is for the benefit of the buyer, therefore, that's who absorbs the cost. A typical home inspection can cost anywhere from $250$500, but our opinion is that they are well worth the investment. New home buyers may not worry about it, but a definite must for buyers purchasing properties older than 5 years. When hiring a home inspector, make sure the inspector has liability insurance, just in case a mistake is made. 3. Fire Insurance: All mortgage lenders will require a certificate of fire insurance to be in place from the time you take possession of the home. The amount required is generally at least the amount of the mortgage or the replacement cost of the home. This cost can vary on the property size and extras being insured, as well as the insurance company and the municipality. The cost can vary anywhere from $250-$600/year for most properties. 4. Provincial Sales Tax of 8% (P.S.T.): If your mortgage is CMHC or Genworth insured (for certain if there is less than a 20% down payment), in Ontario there is a P.S.T. of 8% of the insurance premium payable at closing. While the insurance premium can be added to the mortgage amount, the P.S.T. must be paid seperately at closing. 5. Land Survey Fee Or Title Insurance Fee: A recent Survey of the property is usually required by the lender, and if one is not available, it normally costs anywhere from $600-$900 for a new survey. In lieu of Survey, most lenders today will accept Title Insurance, at a much lower price of approximately $250. 6. Legal Costs and Disbursements: A lawyer or notary will charge a fee for their professional services involved in drafting the title deed, preparing the mortgage and conducting the various searches. Additional disbursements (such as debt payouts), are in addition to these fees, and range from $50-$100 each plus H.S.T. Purchase of a Residential Property with One Mortgage Purchase Price Fees On the first 100K $850 On excess between 100K 300K 0.5% On the excess over 300 K 0.25% Purchase/Sale of a Residential Property with No Mortgage Sale Price Fees On the first 100K $560 On excess between 100K 300K 0.33% On the excess over 300 K 0.165% 7. Land Transfer Tax: Most provinces charge a land transfer tax, payable by the purchaser, and the amount varies from province to province. This tax is based on the purchase price. In Ontario, first time home buyers who purchase a home, whether it's new or re-sale (as of December 13, 2007) get a refund of up to $2000. In addition, if you are purchasing a home in Toronto, Toronto City Council approved a new Municipal Land Transfer Tax (MLTT) effective February 1, 2008. If you are a first-time buyer of a new home or re-sale home, you are exempt from this tax if the purchase price is under $400,000. Land Transfer Tax - Ontario Value of Consideration LTT Rate Up to and including $55,000.00 0.5% $55,000.01 to $250,000.00 1.0% $250,000.01 to $400,000.00 1.5% Over $400,000.00 2.0% Municipal Land Transfer Tax (Toronto Only) Value of Consideration MLTT Rate Up to and including $55,000.00 0.5% $55,000.01 to $400,000.00 1.0% Over $400,000.00 2.0% 8. New Home Warranty: In many provinces, new homes are covered by a new home warranty program. The cost to the purchaser for this warranty is approximately $600, and should the builder default or fail to build to an agreed upon standard, the fund will finish or repair the deficiencies. 9. Closing Adjustments: An estimate should be made for closing adjustments, or bills that the seller has prepaid such as property taxes, utility bills, and other charges. Any bills after the closing date are the purchaser's responsibility. Your lawyer/notary will let you know what they are exactly once the various searches have been completed. 10. H.S.T.: On the purchase of a newly constructed home, HST is payable, but make sure you know who pays this, you or the builder. On the offer, the purchase price will say "Plus HST" or "HST Included", and who gets the HST new home rebate. A lot of builders have included this cost into the purchase price so that the buyer does not have to come up with that at closing. (As well, this tax is also charged on all professional fees). 11. Moving Expense: You can rent a truck for $75-100 per day and do-it-yourself, or you can hire professional movers (who carry insurance for damaged goods), costing several hundred dollars. This will depend on personal preference, how much stuff is being moved and how far. 12. Additional Costs: These include utility hook-ups, any repairs, painting etc.