OnePoint Health Care Reform Seminar 11-20-2013

advertisement

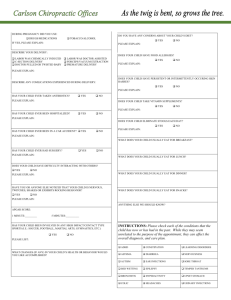

An Employer’s Guide to HEALTH CARE REFORM WHAT YOU NEED TO KNOW BRAIDEN DARLEY, RHU Employers Across America Want to Know… What are the effects on me as an employer? What are the effects on my employees? How much is this going to cost me? What do I have to do? On The Horizon Guarantee issue with no pre-existing limitations Individual coverage mandate Insurance exchanges & subsidies Employer “Pay or Play” Required expanded benefits Taxes, fees and penalties New rating rules New employer obligations & reporting requirements Beginning January 1, 2014 New plan designs and rating guidelines All policies will be guarantee issue regardless of medical conditions Pre-Existing condition limitations will no longer apply Obtaining insurance through Exchanges will be available for individuals and small groups <49 Large/Small Groups Waiting Periods: Max 90 Days Full –time employees working at least 30 hours/week Break time and room for nursing mothers Individual Mandate EVERY AMERICAN WILL HAVE THREE CHOICES IN 2014: 1. Qualify for an exemption based on income, religion or status (native American, undocumented immigrant, or incarceration) 2. Obtain coverage through government program/Exchange, employer or individual insurance 3. Go uninsured and pay a penalty Subsidies & Penalties for Individuals Individual Exchange subsidies are available if no other available coverage is affordable or meets minimum value requirement Penalties phase in beginning in 2014 as part of tax return: 2014: Greater of $95 (adult)/$47.50 (child) or 1% of taxable income 2015: Greater of $325 (adult)/$162.50 (child) or 2% of taxable income 2016: Greater of $695 (adult)/$347.50 (child) or 2.5% of taxable income 2017 and beyond: Annual adjustments Large Employer Responsibilities Offering Minimum Essential Coverage to at least 95% of all full-time employees and their dependent children 1. Coverage must be affordable. 2. Minimum Essential Coverage is defined as providing value of at least 60%of the total allowed costs of benefits expected to be incurred under the plan. Employee’s share of the premium costs (for employee only coverage) is no more than 9.5% of that employee’s annual household income. SAFE HARBOR – Affordability in 2014 (longer?) can be measured by the wages the employer pays the employee for that year, as reported in Box 1 of Form W-2. If an employer offers multiple coverage options, the lowest-cost MEC option available to the employee will apply. Penalties for Large Employers Minimum Essential Coverage (MEC) Not Affordable Coverage Employer doesn’t provide MEC offered to at least 95% MEC OR MEC is offered to less than 95% of the fulltime employees and their dependent children of full-time employees and their dependent children. BUT one or more full-time employees receives a premium tax credit. Penalty =Total number of FTEs employed for the year (minus 30) x $2,000 as long as at least one full-time employee receives the premium tax credit Penalty is $3,000 per employee receiving a subsidy in Exchange. (Monthly Calculation) Plan Design Requirements In/Out of Exchange New Plan Designs sold/renewed Limited to “Metallic” coverage levels Essential Health Benefits 10 required coverage categories-pediatric dental/vision Out of Pocket Maximum (all) $6,350 single/$12,700 family Rx may have a separate out of pocket max for 2014 if separate contract Subsidies for Individuals For INDIVIDUAL exchange plans only To be eligible, individuals must: Have incomes between133% and 400% of federal poverty level (FPL) Not have access to minimum essential coverage through their employer or have access to coverage, but it is not affordable Premium credits – for any level plan Cost-sharing subsidies – silver plan only • Income ranges for 133% to 400% FPL Individual: $14,856 to $44,680 Family of four: $30,656 to $92,200 Keep In Mind… •Exchanges will not replace the private health insurance market. They’re simply another channel for qualified individuals and groups to obtain coverage Taxes & Fees (FOR ALL) Tax/Fee Effective Date Plan fees for comparative effectiveness research (PCORI) Plan/policy years that end after 9/30/2012 and begin before 10/1/2019 Tax on high earners and unearned income Insurer fees Responsible Party Annual Tax/Fee Amount Issuers of fully insured plans Sponsors/administrators of self-insured plans $1 or $2 a year per person (adjusted annually for inflation), based on average number of covered lives 0.9% Medicare surtax on wages in excess of $200,000 single / $250,000 married couples Tax years beginning 1/1/2013 and later Tax years beginning 1/1/2014 and later Reinsurance assessments Plan/policy years beginning in the 3-year period starting 1/1/2014 High-cost insurance tax Tax years beginning 1/1/2018 and later Individual taxpayers Issuers of fully insured plans Issuers of fully insured plans Sponsors/administrators of self-insured plans 3.8% tax on unearned income for taxpayers with modified adjusted gross income in excess of $200,000 single / $250,000 married couples Based on net health insurance premiums written in the preceding calendar year as a percentage of all health insurance premiums written in the preceding calendar year TBD – may be based on percentage of revenue of each issuer and total costs of providing benefits to enrollees in self-insured plans or on a specified amount per enrollee Issuers of fully insured plans Sponsors/administrators of self-insured plans Annual excise tax of 40% on health plan costs that exceed “Cadillac” plan thresholds Important reasons to offer benefits Critical Piece of employee compensation Attract & retain quality employees Employee Loyalty Employee attitude Employee performance Employee health & higher absenteeism THANK YOU.