Computer Literacy

advertisement

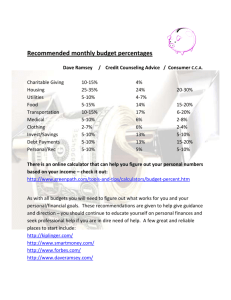

Jacob Triplett The Total Money Makeover The book I chose to read this semester is The Total Money Makeover by Dave Ramsey. When I received the list of books we could choose, I didn’t really know which to read, but then I saw that Dave Ramsey was the author of the book. The reason that mattered is because I have been in the car with my parents as they listen to his radio show and have always found his ideas to be interesting. I always wanted to do more research on him and his ideas, but never did. Reading this book has allowed me to learn many of his ideas regarding money management. When I opened the book and started reading the introduction I came across a part saying “Read the stories of the lives changed by this book! As a matter of fact, I recommend you skip through the book reading all the stories first. They will inspire you to read all the way through…” After reading this, I skipped through the book finding all the stories and he was right. The stories sparked my interest to read thru the book quicker than I have ever read thru a book. The story that caught my eye was the story of a couple who was doing well and had plenty of left over money, as a result of having well-paying jobs and they weren’t spending a lot of money. So they decided to buy a bigger house and nicer cars and they found themselves in a decent amount of debt, $16,000 to be exact. The wife went to the bookstore and picked up The Total Money Makeover. The couple started implementing the strategies that Dave Ramsey suggested and got their debt snowball rolling. In 10 months they were able to pay off their debt and start investing in their future. I did not pick this story because it was the most impressive or that they overcame massive odds. Rather, I picked this story because it’s something I feel is very common and that I could see possibly happening to me, if I didn’t read the many stories similar to this one. Also this story happened to a couple where both were in well-paying jobs. This goes to show that even people who are making a good amount of money can make mistakes and they can recover from them just like anyone. My overall impression of this book is “Wow!” I am not a recreational book reader. I do like reading as long as it’s entertaining to me and most books fail to keep me entertained and interested from cover to cover. However, this book was able to do that and more. When I picked up this book and read the introduction, I was hooked and found it surprisingly hard to put down. I think the reason for this is that I’m always seeking knowledge and I want to be a sponge for knowledge. I believe The Total Money Makeover provides good knowledge and I found myself wanting more. I feel like this book can be used and the ideas expressed by Dave Ramsey can be implemented by college students. Included in the book are chapters on how to save up money fast and also how to pay off debts. The book focuses on saving up for a college fund. I think college students and even high school students can relate to all the chapters in this book. The chapter on how to save up money fast talks about an important concept, that I’ve learned, and that’s to take baby steps and don’t try and do everything at once. I have quickly learned this concept while attending college for almost the past year. While I was a high school student there was times where I could slack off, but wouldn’t feel any repercussions. However now that I’m in college, I have to find the perfect balance between wanting to do everything at once and getting it over with and procrastination. In this chapter Ramsey expresses the importance of a budget. I feel like for a college student like myself, a schedule is like a budget for someone trying to save money or pay off debt. It’s much easier to accomplish things in life with a schedule and/or goals. To enforce my point the book includes these words: ‘This is a book about process that will enable you to win with your money, a process that others have completed successfully, and I assure you that virtually none of the thousands of winners I have seen did so without a written budget.’ I think this book goes hand and hand with personal finance and is written on the concept of personal finance. The book encourages people to fix their financial situations on their own. If you’re personally assessing and fixing your financial situations on your own, isn’t that personal finance? I would argue that you are. If I was a high school teacher, I would require The Total Money Makeover be reading material for the class. From what I’ve seen in high school nothing shows the importance of certain concepts more than visually seeing it work or hearing about success stories. This book implements stories in a way that shows anyone in any situation can improve their financial situation, decrease stress associated with how bad the situation is, and in the end it improves their life. This book applies to society and the economy because everyone in society has a final situation, no matter how rich or poor you are, you can always improve your financial strategies and, therefore, improve your life. The book applies to both the economy and economics in the way that this book revolves around money and that both economics and the economy revolve around money.