SEIE TRANSCRIPT - University of North Texas

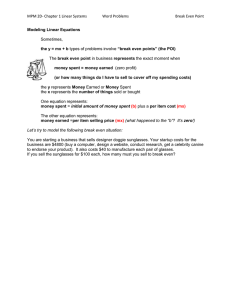

advertisement

/w EPDw UKMTg4 E146420D /w EdAAOrrjQh4IZ Event ID: 2596350 Event Started: 5/20/2015 2:58:03 PM ET [ Please stand by for realtime captions ] good afternoon this is nor enough with University of North Texas pick on here with Sandy and Stacy. They will presenting this afternoon on the student earned income exclusion. I like to welcome everyone in our audience. Hopefully are able to hear us okay. If feel scroll down to your mission box, you can find it down below just give me a message that says you're here and let me know if you can hear us okay. Hello and good afternoon. This is Sandy and Stacy. As you know as you complete this webinar today we will send out a questionnaire you'll be able to upload this to your portable. So without further ado. Thank you I'm happy to have Stacy with me today we have worked together for at least 15 years if not longer. So we make a pretty good team. We've been doing this for quite some time. Stacy has a large caseload and does a lot of the direct care. So shall jump in on some of the specifics of using the student earned income exclusion. But that said let's jump right on in. First of all, Stacy and I have to make some assumptions. Because this isn't a one-to-one training course. We have to assume that you have had at least some type of training on SSI supplemental income that you've been in one of our trading for at least a training. I know many of us know people who are on SSI. I'm also going to make an assumption that you've seen a calculation sheet before. If you have not, don't hang up. I promise we will walk you through when I just don't have a whole lot of time to explain it. Because we only have one hour today. I'm also using terms such as earned and unearned income. Those are just some assumptions I hope you know, but if you don't don't worry. As I said. SSI is one of the best known cash benefits for people with disabilities. It is like the brass ring of cash benefits for disability. Because you get so much money but because you have Medicaid. It is a needs-based program and you need to have limited income and resources. A lot of people are on it and they may be the most familiar with this cash benefit. Student earn income exclusion is a . benefit only. So that's why I am only addressing SSI today. Let's figure out the student in Kern exclusion. I think historically we know people who are on SSI and often times grandmother or mom has been on it. I am on it or my children are on it. There just seems to be a generational use of SSI. We've all heard in the news that SSI is in trouble and that they're going to go bankrupt with scare tactics many people when they get on disability benefits do not choose to go to work. They don't even think about work. Because sometimes the process of getting on benefits is difficult. Not a lot of people really got to work or work at a level with some impact. That gives them some sort of odd safety net. But to me it's teaching people to live in poverty. Social Security is very aware that if you don't get some insight to jobs or experience in working, to figure out what you're good at or interested in, probably by the time you graduate, you're really not going to be that successful in later years. You become a Masters of the remote control watching Netflix. Sosa security has had a laser focus on transition age use. What they're trying to Dale is to figure out how to let students have that work experience while finishing their education. So they came up with an amazing work incentive called the student income earned exclusion, I'm hoping you get excited about this because it's a very easy work incentive to use. Unlike path, where there are several pages to fill out. This is actually pretty painless. You'll be able to find exclusion, finances eligible, explain it to people on your caseload and have some strategies on the best way to set it up for each beneficiary. You'll know how to request the student earned income exclusion. Track it and reported.'s is going to be important as you'll see. We also need to be aware as were becoming knowledgeable with student income earned exclusion, what the impact can be on resource limits. It's a needs-based program and SSI has a $2000 resource limit. So we need to be aware of how the student earned income exclusion can negatively hit the resource limit. How it can delay using the path. You should already have a list of the WHIPA in region 6. Will also to make sure you have access to commute is for. Eligibility for student earned income is pretty simple. It is SSI only. Don't get so excited that you tell everyone about it. Because if they have a title to benefit they do not get this. This is SSI only. So what it says is these beneficiaries are under the age of 22, on the 22nd birthday they are not eligible so they regularly attend school. They can exclude up to $1780 per month in gross earned income. That's a lot of money for a student. If you are aware of the SSI population sheet, that is before that -20-65 and divide by two. This is a very generous inclusion. I remember when this first came out, or really was revamped. Sosa security was focusing on transitioning. I was going around the nation during this training and I saw the threshold amount for that year I figured it was a type out there was no way they can have a program this generous. But they do. So Social Security is brilliant in giving them such a generous threshold on a monthly gross income earned exclusion. However, and I rarely say how brilliant Social Security is, that here they are beyond brilliant. They want to make sure that the student remains in school. Not that the student is just getting by. It's more about work that it is education. Cousin so security is aware that people on SSI, the more education they get the higher the opportunity they have to get a better paying job. And to actually work themselves out of poverty. We want the focus of the student to remain on their studies graduating going on to higher education. So they put a calendar year On it. January through December. Demotes tended up a little bit each years were just looking at this year. He can exclude up to $1780 per month. But there is a January through December. Again it's brilliant. Because we want to make sure that the student is focusing on their studies and we also have to be careful. Because if the student did earn this much a month, this exclusion is only going to be good for little over four months. Then we have to figure out what to do with the other eight months. Because there's not can be eligibility until the following January. I put on my PowerPoint for a moment and ask Stacy to jump in. She's come up with a calculation sheet that she'd like to introduce you to that helps us track the monthly Versus the annual And what that means. We always count the gross wages when somebody is working. We have students who have made a lot of money because they are enrolled in school. I normally see around 4500 per month. But you could come across a student who is in the program or he is welding or in a trade where he's earning a lot of money. It's good to be aware of this. Usually in January when we do the cost of living increase that's usually increased by a lot of the other amounts. They want to watch every January to see if the amount has changed. This is the sheet that I use to see how much of this didn't earned income is being used each month and how much is remaining. So this person earns $985 in gross wages. You can see that on my 19 it's the amount he's used so far. And online 20 is the remaining balance. That's how much he has left for the year. In February let's say there's $2000 . you can see that he got the 1780. That's the maximum allowed student earned income for the month. So the remaining balance the 220, that is where our calculation sheet comes in. That is where we subtract be $20 from the 200. 65 subtracted and then divided by two. So his SSI is reduced by about $67.57. So instead of getting the full federal benefit rate for this month, he would get $665.50. Because of the 220 that was not eligible to be accounted under the inclusion. His remaining balance is $4415. So the sheet is very helpful. Especially when you have students who are earning random amounts. Sometimes they may be awful lot during football season. So in September and October their wages may be lower. In December or January their wages may be higher. This is just a good tracking form to help me keep track of exactly how much is remaining in this earned income exclusion. This can also be used as a planning tool. If you take a job and earn so much money you can see it if it would last the entire calendar year. One thing that we teach is that it is very important as WIPA that they plan out the calendar amount. If I was on Stacy's caseload she would sit down with me and figure out the best way to utilize this exclusion that would last the entire calendar month. The it football season or maybe just focusing on studies so I'm only going to work summers or weekends. But just to make sure that it lasts. If you're worried about the calculations were going to do an exercise at the end. So don't be intimidated. At this point all stop to see if there's any questions. Regularly attending is going to be the next two slides. Because there are very specific guidelines on what regularly attending means. The question we often get is what about when they are off for the summer. If the intent is you were regularly attending at the end of the school year and you plan to return the next school year, you get to use the summertime when you're not technically a student. As the student income earned exclusion. Because your intent is to return. Casino with SSI. Every year they do an annual redetermination, or as I call it bookkeeping. They want to know where you're working higher living and if you're paying your fair share. They want to know if your eligible and they just reconcile their books. So usually this is when the student earned income exclusion is verified. One thing that you need to know. If you've been on my training or any other trainings the Social Security work incentives, often times we have to submit them and hope they can approved. With student earned income exclusion, that is not the case. The exclusion must be applied once they are found to be eligible. Our job, and this is my set is not that hard is to let Social Security no that they are student who is working. And as your grandmother or mother taught you, you do not assume in life. Don't assume that SSA does the person is a student and that they are working. The best thing to do is, when they go to work, this is when we make sure that we notify Social Security of their student status. Again all shut this down in an Stacy can introduce us to the letter that you created? I got to all of the transition meetings and all the region 14 meetings whenever they're talking about transition I talk to teachers and parents about student income earned exclusion. I had a lady who works for East and education co-op and her job is to help students find jobs whether in school. Like them to have work experience for graduation. She called me and told me about a mother who is first because we let her son go to work and his on SSI. We told her it would not impact her -- his benefits, but his benefits have gone down. It wasn't just him but it was his brother. In this family the boys who are on SSI. That was the income of the family. They were surviving on these boys SSI. So going down, that amount made her angry because there was the student income earned exclusion. I met with her and found out that her boys checks were being reduced but there were several students who are on SSI with reduced checks. She wasn't aware of that exclusion because she was kind of new, kind of new to SSI. She wasn't familiar with the rules. We decided that we would come up with a letter to send each time one of the students goes to work. So that the SSI rep is aware they are in school. So they have contact numbers of people at schools that they can get in touch with. What ended up happening was all of these students checks had been adjusted mistakenly and they all got money back. But because of this error and no paperwork in place. They hadn't contacted me prior to this, she knew or did not know that she needed to do something. This is something we just came up with. So each time I work with a student I always send this form. And then I send the parents copy as well. So when they get a letter from Social Security that they owe an overpayment, they have this to refer back to. And also asked Sandy said. You have to let Social Security no if the student is going to be in school beyond the age of 18. Because a lot of times they just assume that it 18 years of age you graduate and are no longer in school. If you have a student in school told the age of 22, you need to let Social Security know that. They won't come and ask you. So it's important to children or students that are staying in school be on the age of 18. I had a woman at Cooper high school who refers every student on benefits to me. To talk about the determination employment and earned income exclusion. So I think that's a really good idea. Anybody on SSI should speak with the benefit planner to talk about the age 18 redetermination and to learn about the student earned income exclusion to make sure you're receiving the work incentives that are available. Do we have any questions? Is this letter available? My understanding is that after the session is over. We will have this presentation on and all of the material available at the on-demand page on the website. So any listeners today should know, if there's something you didn't get them we sent out the return notice that you'll be able to get it to the website and receive that information. I think the other question you may have answered in regards to the 18 to 22-year-old who is still in school. On the slide and what really read it because he won't remember what I said. This is more of a resource slide. This is Social Security's definition of what they mean when they say regularly attending school. It is not just through 12th grade homebound is fairly new this just came out in 2006. I'm not going to say this consent never remember these numbers. But please use the slides as a resource to see if they meet the definition of regularly attending. As long as the intent was to return to school, what happens when this intent changes. Here's an example of somebody who completed a vocational course that ended in June. She planned to return to the second half in August but she didn't. The field office found out about it in October so they went back to August 1. The last date she could have enrolled she said that's when you're intent changed. So as of August 1 she was no longer allowed to use the earned income exclusion. Fishing on longer met the definition of student. So this is just a very simple summary example of what they're talking about when they mean intent to changes. Were assuming that Janus works. Because you can't have a student income earned exclusion down the earned income. It's part of the rules. So just to repeat what Stacy said. Please don't assume that Social Security knows that the student meets the requirements. Provide the verification. Will it number three gives details. I think you can confirm that this is enough information to verify the benefits. I think a lot of times after we send that letter, that's why we give the contact name of the person that she can get in contact with if she needs further information. But for the most part you found this is pretty cut and dry? Yes. I do want to point to this fourth bullet that says make sure there's training to prepare the beneficiary for the paid job. Some students who thought they met the definition, did not because they were in more of it day have type setting. So we just need to make sure our documentation is good and it's good for people on our caseload. We want to make sure the training prepares the beneficiary for a paying job because that meets the definition of a student income earned exclusion. In the beginning, I talked about precautions when using the student earned income exclusion. Or you might want to pass. Cannot talk about student income earned exclusions and how this passes by them. As you know or about see, on the SSI calculation sheet. The exclusion is taken prior to anything else. Before the -20 and before the -65. It's taken right off the top of the gross income. Is not taken off the top of entered income because this is a student earned income exclusion. It's always taken off step 2 student earned income has no impact because you can't have that if you only have earned income. You need to have SSI and you need to have earnings. One thing going to see in our examples that were talking about as we wrap up. Going to see that the students, after the exclusion, still have a lot of usable money at the end of each month. That is so exciting to a teenager. But we have to be very careful that they don't go over the SSI resource limit of $2000. If we could have the student who want to save their money to putting it aside and it PATH. You could have that but it's not for their earnings. It's not access resources it's money that goes beyond the months that they get it. We would set aside will be consider resource and Social Security which is totally allowable. The dance of that is not easy. So don't hear me say I figured out how to have student income earned exclusions. Is not that easy. Because someone you have that student income earned exclusion that can be automatic. You need the nuances of somebody who has done it for a while. You can figure out if it PATH could fit into it. If somebody has earned income in excess resources it's a little bit smoother because then there's always something to set aside. But just know that it usually delays having a PATH. Because this takes away all of the accountable earned income. So before we go on to our examples other any questions? All trying to decipher that and if I'm wrong please do not be offended just send me a clarifying email. Were talking about credit when someone goes to work and should be acquire a disability. This determines how much of our disability check we are eligible for. If you are under the age of 24 you need fewer credits to become entitled to SSDI. You'll see this in this example. Usually because you are not earning a high living wage as maybe the head of household. That your title to check makes the concurrent beneficiary. It doesn't jeopardize your Medicaid or SSI. I hope that answered your question. Lets talk about some cases but answer some questions. Let's look at a calculation sheet and hopefully this will all click. We have savanna. She is on SSI to the full time student who regularly attends. At 16 will me get a driver's license we all want a car. She decides to go to work. She has a really good support person because they encourage her to work evening and weekends. Shoes going to gross about $995 per month. She doesn't have any other source of income title II or anything else. These are the questions were going to answer. Let's first explore if savanna meet eligibility and if eligible. At $985 per month, how long will that student income earned exclusion last. Happens to those additional months went she is ineligible. The next question we will pursue is will she be eligible again next year. And if so when will it start. We always say well if she didn't start in January but then started in October, what would that look like. Will finally look at her calculation sheet so we can put it all together. Let's look at some answers. She eligible? Yes she is. The criteria is a student attending on SSI under the age of 22. So yes she is eligible. At $985 per month. Her student earned income exclusion will last a little over seven months. In these months she should have about $285 left for her August check. Because it's ending in August, we know she's not going to make it the full 12 months. And she's not eligible for the remainder of the calendar year. However, if she goes back to school next year she will be eligible as long as she plans to return so she won't get it from September through December. But in January, as long as she returns to school, should get it again in January of next year. We half to look at what Stacy said about the threshold. Had she started in October, instead of January she would've only had 3 calendar months of the student income earned exclusion. She doesn't get to carry the remainder over. Remember this is calendar year. And before we look at the calculation sheet you have any questions? This is an SSI calculation step. There are actually five steps. Social Security only uses 4. We know unearned income is like veterans benefit as long as you don't tell them it's unearned. Because if it may have earned it. If you're the child receiving it there are certain types of unearned income. In this case, savanna has none. So we leave step 1 alone. We know she's started her job grossing 985 grossing $985 and remember, the monthly Is 1000 1780. We don't put that their because she's not earning that. That is just a highest we can adopt. If it's less than we deduct the actual amount. There is no unearned income. There is no countable income. So savanna is eligible for the entire check of $773. That's pretty amazing. Because in step 5. If you look at this she's getting $985 a month in gross wages. So that's a lot of money each month for a teenager remember we have eight $2000. So the night not the danger in January. But say she doesn't spend it all we get into February and March and then she's over access resources. I always put that we have danger. Because when somebody uses this inclusion we always have to remember to look at how the resource limits are doing. Are they staying under resources? I also say were not done yet. Because remember Stacy's calculation sheet. We need to subtract this first from the calendar year balance. So as I said this is going to last about seven months. In August we would only use the $285 that we had remaining right here. Under the student earned income exclusion line. Then we would have something to minus. To be have any questions? So two years later savanna is still on SSI shoes 18 and attending school full-time. She's about to graduate high school. She's enrolled in college so she could become a lawyer. She is excited about graduating and starting college. She's secured a job as a legal assistant just to get her feet wet. She's going to start January 2 and grows about $2000 per month. The other change is, because she has been working for 2 years. She's probably now eligible for title 2. So now she's concurrent. She's receiving eight $200 SSDI check in this to her SSI. So will answer the same question. She still eligible at $2000 per month. Will she be eligible next year. What happens when her SSI runs out. She still eligible because she's under the age of 22. She still regularly attending school and although she's plan to graduate, she is signing up for college. How long will her student earned income exclusion last at $2000 per month? It will only last 4 months. Because after that she will have spent $7120. Shall only have $60 left in May. So it's going to run out very soon. That's one reason we encourage people to look at what their earning to make sure we can get it is close to 12 months as we can. The student earned income exclusion will not be available from June through December. However she still is eligible because she plans to go back next year. But she can't start taking the exclusion again until January. Because she is used up that calendar year. So even though she still eligible she can't use it because she has used it up already over four months. But come January 1 as long she still planning to attend school. Shall be eligible again. Make sure we know what the new threshold is and during that time June through December at $2000, we will look at a calculation sheet is going to think she loses her Medicaid because as long as she went zero for SSI, she's allowed to keep her Medicaid under the loss. It allows you to keep the state threshold and that is 34,000 $34,289. Even though she's going to a cash benefit look at the sheet that says okay while she's in college she's probably going to age out this would be a good time to look at it PATH to finish paying for her college. Savanna has a lot of things working for her here . My reluctance is I would say to you really want to earn that much money is your finishing up your high school year and getting ready to go to college? It's ultimately savannas decision. Were just here to help guide her. Let's look at the calculation sheets to see where her journey leads her. You'll see we did add the $20. To get in SSDI check and from that we subtract $20. So of the $200 be only count 180. Savanna has grossed earnings of $2000. But that is over the monthly Four 2015. So were only allowed to take $1780 which leaves us the remainder of 20 $20. We've already used it up here and we can't use it twice. So we go to the minus So we go to the -65 and divided I too. Of the $2000, Social Security only count $77 and $77.50 of her earnings. That's pretty incredible. Let's look at step 3. Bring the $180 over here. Bring the 7750 over here add them together and subtract that amount from the highest the check can be which is $733. So her SSI payment is still $475.50 even though she had $2000 in earnings. In step 5 we would say savanna. You have $200 in SSDI and $2000 in earnings. $475.50 in SSI for a total of $2675.50. Can you say danger? I probably should of put that in red letters. They are way over resources. This is a problem instantly. So you have to be prepared for savanna to spend spend spend. This is where we need to see, for these four months. What savanna plans to do with this money and stay under resources. When a student chooses to max out their exclusion, they really put their eligibility for SSI at risk for going over resources. There is no special bullet for resources. You either over or you're not. In this case she is significantly over. And we must remember to subtract it from our handle -- annual calorie -- annual salary. In May she had $60 left. I won't want you to the whole calculation sheet. Cause were already familiar with it. But I will say her unearned income is $1117.17. That is well over the highest in SSI check can be. So she's not getting an SSI check. So in her step she still has this check. She still has her earned income. She still over resources. This is a mess coming and going. It's very good. Because savannas getting the work experience. That when you're a support person and you've educated her, you have to stay on your feet about resources. I can't say this enough. Because as excited as I am, you have to be aware of the dangers that it puts you in for access resources. This is where you need somebody who can finesse the PATH plan. [ Indiscernible ] can a person put money they earned into a trust fund or does it become unearned income. There are restrictions there is a special needs trust and attorneys who specialize in it. Just having trust fund it's all about who has access and what it pays for. If the going to count it or not. Just because you have a trust fund doesn't mean it's not going to be counted. So that is a way to keep that under the. To have that available like a special needs trust? Maybe she could finish paying off her car as long as she spends it. It's just a matter of working with them so they are spending it or not just blowing it to spend but spending it wisely. Person uses money from the special needs trust, is that considered unearned income? One reason Social Security uses it is because the special needs trust is set up in a way that does not pay for food and shelter. It's not a special needs trust if it pays for food and shelter. That money will not come unearned income. If you're going on vacation or you've got a credit card.'s got a big screen TV or you going out on activities. It just cannot pay for food and shelter. Anything else but that. Is not considered unearned income. It's like I tell parents. A for your child gas for their car. Make a car payment and make their insurance payment. Do not pay their rent in their food. Because of security does not care about those other things. They just want to make sure that you're paying for your food and shelter. Will the title to check make the person eligible for Medicare insurance? Does that change the person's eligibility for Medicaid waiver? The income limit for Medicaid is 2160. But it my understanding that they get to use the same work incentive. If they were using it that would reduce the countable income. So in this case she's keeping her Medicaid and that it's only $1117. So I would say yes she is eligible. One thing we didn't do in savannas example is give her a blind work expense. This is an income earned training. She might have other work incentives she might have a different expense. So there's still ways of lowering this countable income. Once we have exhausted the student income earned exclusion. Just in this last example I would remind them that, she lost her cash benefit but she still has Medicaid under 1619 B. That supposed to happen automatically. But one of the biggest things that I see is that this does not happen automatically. So when I see 70 going to a zero cash benefit, I always send it back. We realize it's going to zero benefit but Medicaid should considered under 19 be. This gets missed more than any of the work incentives. I didn't do that in a because I didn't think we would have time. There probably isn't going to be in the other questions. Because the last thing is, make sure you know your resources are. One of our handout are the WIPA projects in region 6. Were highly changed where a free service. You -- and employment network or someone who knows what they're doing and talking about. There is no reason why, if you're on the line and your a counselor that you want to collaborate with the WIPA staff. That's what were all about you don't have to pick one or the other. Were all in this to help the beneficiary work themselves out of poverty and have a better life. If there aren't any questions. I was going to ask Stacy if she wanted to talk about a few actual cases she might've had. Recently I worked with a diagnostician at Cooper high school. She referred a parent to me who said they want my daughter to graduate this year. But she connexus stay in school another two years. She is working and I want her to get the student earned income exclusion. So after she told the diagnostician that she wanted the daughter to continue in school so she could get some work experience they made a decision that she would stay in school so she gets some more experience without impacting her benefits. Schools the call me and tell me they have parents who are against their children going to work. This me to these come talk to them. And telling your. 99% of the time I sit down with the parent and show them the calculation mother in school. Show the matriculation they leave school where they still end up making more money. Because when you're on SSI you always have more money. Author have the potential to earn more credit to become eligible for title 2. Can almost always talk to the parents and calm their fears. Alleviate the fears about the child working. I get a lot of referrals for transition aged youth. If you have a parent fearful about the child going to work I recommend we talked to someone think of this free benefit summary and analysis. You want to make sure that they report their wages every month. Regardless of the amount earned. The minute out of school you want to report that. Report every single change. Because August interest impact the SSI check. They get married leave school. They cut back on ours are listed job. Everything needs to be reported. Just had on. I talked about the annual redetermination. Bookkeeping part where they go in every year to make sure that eligible unless they get new information. Started or stopped working. Increase our her living arrangements change. List to get the information that go until the next redetermination sending that check. And then we look an overpayment the best way to keep the benefits clean is to report. Once claims representative get the report you have to act. We want every part because we need to make sure were not leading them down the path to a huge overpayment customer not know where of their situation. Even when they should be stopping, there's nothing wrong with notifying claims Representative to make sure we are on the same page. Above comments about the information, and thanks very much. A lot of people can connect with the stories. Want to make sure you answer this question. Stacy mentioned people should get in touch with their local WIPA provider. I know that if they Google that they can probably find it for their any sure we. We actually have been in touch with Social Security in Baltimore. Is not easy to Google us. Because WIPA is up for renewal they have no plans to update their expired website. It included in a handout, a list of sites. The contact information. This will be a part of the handout. We were talking about the initiatives that been taken around the Social Security work incentives. Go ahead from a management perspective. WIPA in Texas has an amazing relationship with VR here in the state. We have a fee-for-service contract work counselors are able to get work incentive plans information and referrals. There is different areas of expertise that we offer. What we find is we send these into DARS and those counselors are learning more to. They do some inservice to our team so they can understand the letters we are sending to the folks on their caseload. It's been a wonderful working relationship. I think on the last phone call we had, Sarah and John said the monthly call with our DARS counselor, they're going to have one DARS counselor in each office who will learn about the work incentive. But the training will be quite as expensive. They always know who to contact to get to the right person. A lot of complements coming through with information and stories. People are grateful. We've come to the end of our session. You've covered a lot of amazing information. Our practice up and will receive an email with the evaluation. And when you return that you be able to get your continuing education units up on your site. Thank you for all the information is always great to hear from you. Thank you all for staying with us. [ Event concluded ]