TTIPS-article-re-PPACA-judicial

advertisement

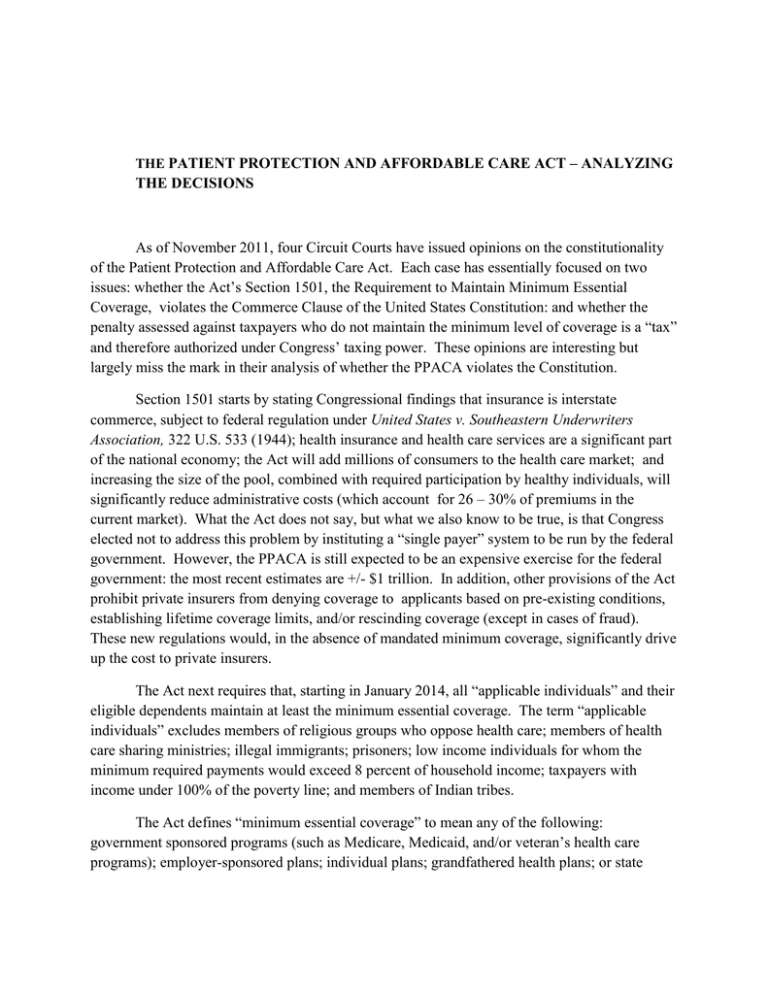

THE PATIENT PROTECTION AND AFFORDABLE CARE ACT – ANALYZING THE DECISIONS As of November 2011, four Circuit Courts have issued opinions on the constitutionality of the Patient Protection and Affordable Care Act. Each case has essentially focused on two issues: whether the Act’s Section 1501, the Requirement to Maintain Minimum Essential Coverage, violates the Commerce Clause of the United States Constitution: and whether the penalty assessed against taxpayers who do not maintain the minimum level of coverage is a “tax” and therefore authorized under Congress’ taxing power. These opinions are interesting but largely miss the mark in their analysis of whether the PPACA violates the Constitution. Section 1501 starts by stating Congressional findings that insurance is interstate commerce, subject to federal regulation under United States v. Southeastern Underwriters Association, 322 U.S. 533 (1944); health insurance and health care services are a significant part of the national economy; the Act will add millions of consumers to the health care market; and increasing the size of the pool, combined with required participation by healthy individuals, will significantly reduce administrative costs (which account for 26 – 30% of premiums in the current market). What the Act does not say, but what we also know to be true, is that Congress elected not to address this problem by instituting a “single payer” system to be run by the federal government. However, the PPACA is still expected to be an expensive exercise for the federal government: the most recent estimates are +/- $1 trillion. In addition, other provisions of the Act prohibit private insurers from denying coverage to applicants based on pre-existing conditions, establishing lifetime coverage limits, and/or rescinding coverage (except in cases of fraud). These new regulations would, in the absence of mandated minimum coverage, significantly drive up the cost to private insurers. The Act next requires that, starting in January 2014, all “applicable individuals” and their eligible dependents maintain at least the minimum essential coverage. The term “applicable individuals” excludes members of religious groups who oppose health care; members of health care sharing ministries; illegal immigrants; prisoners; low income individuals for whom the minimum required payments would exceed 8 percent of household income; taxpayers with income under 100% of the poverty line; and members of Indian tribes. The Act defines “minimum essential coverage” to mean any of the following: government sponsored programs (such as Medicare, Medicaid, and/or veteran’s health care programs); employer-sponsored plans; individual plans; grandfathered health plans; or state benefit risk pools. The Act does not describe any minimum premium payments that an individual must make in order to meet the “minimum essential coverage” standard. Individuals who do not maintain the minimum essential coverage (either for themselves and/or for applicable dependents) will be assessed a penalty, which is added to the individual’s federal tax bill. The maximum amount of the penalty will be $95 per person ($285 per family) in 2014, $350 ($1,050) in 2015, and $750 ($2,250) in 2016 and thereafter (subject to cost of living increases). In each of the cases, the various governmental entity defendants have argued that the penalty is a “tax.” This is because the Anti-Injunction Act, 26 U.S.C. § 7421, provides that “no suit for the purpose of restraining the assessment or collection of any tax shall be maintained in any court by any person, whether or not the person is the person against whom such tax was assessed.” However, three of four circuit courts have held that the penalty is not a “tax” because it is intended to coerce compliance with the mandatory coverage provision, not to raise revenue. The Fourth Circuit, on the other hand, held that the assessment is a “tax” and therefore the AIA applies. With respect to Congress’ ability to enact the mandatory coverage provision under the Commerce Clause, the courts are divided: (a) Thomas More Law Center v. Obama: The plaintiffs argued that refraining from purchasing health insurance constitutes “inactivity”, and that Congress has never attempted to regulate “inactivity.” They argued by analogy to United States v. Lopez, 514 U.S. 549 (1995), and United States v. Morrison, 529 U.S. 598 (2000). In Lopez, the Supreme Court held that Congress could not criminalize possession of a firearm in a school zone, because possessing a gun in a school zone did not constitute economic activity. In Morrison, the Court invalidated the Violence Against Women Act because of the lack of connection to interstate commerce. Plaintiffs argued that the mandated coverage provision similarly lacked any nexus with interstate commerce because refusing to purchase health insurance is not an economic activity. The Government argued that the controlling cases were Wickard v. Filburn, 317 U.S. 111 (1942), and Gonzales v. Raich, 545 U.S. 1 (2005). In Wickard, the Court held that a farmer’s decision to grow wheat on his farm for his personal consumption affected interstate commerce because in the aggregate such decisions affected the price of wheat on the open market. [The case involved a statute that imposed a penalty on exceeding wheat growing quotas: the Court rejected the argument that the penalty “forced” farmers to purchase wheat on the open market.] In Raich, the Court upheld Congress’s authority to prohibit the growing of marijuana for personal consumption, based on the finding that the statute bore a rational relationship to Congress’ regulation of the “established and lucrative” (albeit illegal) marijuana market. Based on these cases, the Government argued that Congress had the right to mandate the purchase of insurance as part of its overall regulation of the insurance market. The Court held that the decision not to purchase health insurance until an individual becomes ill is an economic decision in that it shifts the burden of satisfying health care costs onto other participants, and that human beings cannot effectively opt out of the health insurance market. The Court also held that the mandatory coverage provision was an essential component of the overall regulatory scheme, and was a reasonable means of effecting Congress’ goal of universal health coverage. On June 29, 2011 the Sixth Circuit affirmed Judge Steeh in an opinion written by Justice Boyce F. Martin Jr., civil action no. 10-2388. Justice Jeffrey S. Sutton concurred in the judgment, but wrote a separate concurrence; Judge James L. Graham, senior district court judge sitting by designation, dissented. Justice Martin wrote that the minimum coverage provision was valid as a regulation of the activity of participating in the national market for health care delivery; deciding to self-insure (or risk retention) was one form of participation in the national market which had a substantial effect on interstate commerce. Judge Martin also upheld the minimum coverage provision as an essential part of a broader economic regulatory scheme, i.e., the interstate markets in health care delivery and health insurance, which Congress has the power to regulate. Justice Martin dismissed the “activity/inactivity” argument, noting that nothing in the Constitution prevents the regulation of “inactivity” and that the overwhelming majority of Americans will be “active” in the health care market because virtually everyone will require health services at some point in time. The Sixth Circuit did not address the question of whether the provision was a valid exercise of Congress’ taxing power (although Judge Sutton stated in his concurrence that the provision was clearly not a “tax”). (b) State of Florida v. Dept. of Health and Human Services: This case was brought by the Attorneys General of 26 states1. The 11th Circuit issued its opinion on August 12, 2011. The two claims before the Court alleged that (1) the individual mandate set forth in Section 1501 violated the Commerce Clause, and (2) the expansion of Medicaid to include individuals under age 65 with incomes equal to or less than 133% of the poverty level, and the aspect of the Act requiring that states to provide Medicaid services, violated the Spending Clause2. The Court initially dismissed the 1 AL, AK, AZ, CO, FL, GA, ID, IN, IA, KS, LA. ME, MI, MS, NE, NV, ND, OH, PA, SC, SD, TX, UT, WA, WI, WY. 2 The plaintiffs also alleged that the Medicaid provisions of the Act violated the principles of federalism defined under the Ninth and Tenth Amendments, but (according to the Court) essentially abandoned that argument. Government’s standing issue, finding it undisputed that at least one plaintiff had standing and therefore the case is justiciable. Next, the Court addressed the Medicaid issue, stating the plaintiffs’ claim as alleging that the Medicaid provisions were “coercive and commanding” in that they essentially required the states to participate in a federal program. The Court noted that the Tenth Amendment places limits on congressional spending, namely that Congress cannot impose burdens so onerous as to compel a state to participate in “optional” programs. However, the Court concluded that the Act’s expansion of Medicaid is not unduly coercive. In so finding, the Court noted that the Federal Government initially bears nearly all of the costs associated with the expansion, and that the States have at least until 2014 to decide whether to continue to participate in Medicaid or to develop replacement programs. With respect to the individual mandate, the Court initially analyzed the case law interpreting the Commerce Clause and the Necessary and Proper Clause. The Court noted that Congress’ power under the Commerce Clause is “necessarily broad yet potentially dangerous to the fundamental structure of our government.” The Court found that the Supreme Court has placed two limits on Congress’ power under the Commerce Clause: regulations must “preserve a distinction between that which is truly national and the truly local”, and courts may not interpret the Clause in a manner that would give Congress “general police power.” The court rejected what it called “the formalistic dichotomy of activity and inactivity” but (after noting the unprecedented nature of the individual mandate) defined the individual mandate as an attempt to regulate individuals who are “outside” the stream of commerce, or to regulate the “absence” of commerce. The Court also interpreted the Government’s position that most individuals will obtain health care services at some point in the future to mean that Congress is attempting to regulate “the mere possibility of future activity” which might involve interstate commerce. The Court further found a lack of support for the proposition that the Government may force a citizen to purchase insurance from a private company. On these grounds, the Court held that the individual mandate exceeds Congress’ power. The Court also held that the mandate involved a “penalty” rather than a “tax” and therefore could not be upheld under Congress’ taxing power. However, the Court held that the individual mandate was severable, noting the presumption of severability, the lack of a non-severability clause, and the fact that the mandate includes several enumerated exceptions. (c) Liberty University v. Geithner, 4th Circuit Court of Appeals, opinion issued September 8, 2011: this is the lone Court (to date) holding that the Anti-Injunction Act deprives the Court of jurisdiction to address the constitutional challenge. The Court initially noted that the plaintiffs challenged the “penalty” assessed against an individual taxpayer who fails to maintain adequate health coverage, and the “assessable payment” imposed on employers whose employees receive a tax credit or a government subsidy to offset payments for certain health related expenses. The Court noted that the Supreme Court has held that the term “tax” has a broad meaning under the interpretation of the Anti-Injunction Act, citing a 1936 case defining the word “tax” to mean simply “an exaction for the support of the government.” The Court did not find in law a distinction between a “tax” and a “penalty” for the purpose of the Anti-Injunction Act. To the contrary, the Court found that the label of an exaction is immaterial to the purposes of the AIA, holding instead that the term “tax” in the AIA “reaches any exaction imposed by the (Internal Revenue) Code and assessed by the tax collector pursuant to his general revenue authority.” The Court also noted that Congress could have exempted the Act from the AIA, but neglected to do so. [The Court was unpersuaded by the argument that penalty is not intended to raise revenue.] (d) Commonwealth of Virginia v. Sibelius, 4th Circuit Court of Appeals, opinion issued September 8, 2011: The plaintiff State of Virginia challenged the individual mandate, alleging that it had standing on the grounds that the mandate conflicted with Virginia’s Health Care Freedom Act. The Court held that Virginia lacked standing because it had suffered no “injury in fact.” In so holding, the Court determined that the Health Care Freedom Act “regulates nothing and provides for the administration of no state program.” Rather, its sole purpose was to “immunize Virginia citizens from federal law.” As such, according to the Court, it is the Constitution, not the Act, that precludes enforcement of the state law. The Court held that the Health Care Freedom Act was “not even hypothetically enforceable against the federal government.” (e) Susan Seven Sky, et al., v. Eric H. Holder, Jr. et al., D.C. Circuit Court, opinion dated November 8, 2011: Plaintiffs in this matter challenged Section 1501 on two grounds: violation of the Commerce Clause, and violation of the Religious Freedom Restoration Action of 1993, 42 U.S.C. § 2000bb et seq. In addition, Defendants asserted as an affirmative defense that Section 1501 was a valid exercise of Congress’ taxing power under the General Welfare Clause (aka the Taxing and Spending Clause), 26 U.S.C. § 5000A(b). Initially, the Court held that the Anti-Injunction Act (which bars pre-enforcement challenges to the assessment and collection of taxes) does not cover penalties that are unrelated to tax law and/or enforcement. The Court held that the Act involves “penalties,” not “taxes.” With respect to the Commerce Clause, the Court found that the individual mandate did not exceed Congress’ authority to regulate interstate commerce. Initially, the Court noted that no Supreme Court case has ever limited congress’ Commerce Clause authority to individuals engaging in “existing activities” involving interstate commerce. [To the contrary, the Court noted that Congress has passed laws criminalizing the mere possession of things such as controlled substances and child pornography.] The Court held that if Congress can regulate “even instances of purely local conduct that were never intended for, or entered, an interstate market,” then Congress “can also regulate instances of ostensible inactivity inside a state.” [Emphasis in original.] The Court noted that the argument that the Act compels an individual to enter into the stream of commerce “seems more redolent of Due Process arguments” but was not supported by the Commerce Clause. The Court concluded that “the right to be free from federal regulation is not absolute, and yields to the imperative that Congress be free to forge national solutions to national problems, no matter how local – or seemingly passive – their individual origins.” In many of the cases, the courts parsed the issues unnecessarily. Commentators have suggested that the decisions are all politically motivated (for the most part, the judges upholding the statute were Democratic appointees, while the judges striking the statute down were Republican appointees). Whatever the reason, the majority of the opinions either ignore or fail to appreciate the following points: 1. It is undisputed that, under United States v. Southeastern Underwriters Association, 322 U.S. 533 (1944), the business of insurance is a form of “commerce” which Congress may therefore regulate under the Commerce Clause. [The McCarran-Ferguson Act, 15 U.S.C. § 1012(b), provides that federal law will not pre-empt state laws regulating insurance unless the federal law “specifically relates to the business of insurance.” Barnett Bank, N.A. v. Nelson, 517 U.S. 25, 38 (1996).] The PPACA, clearly and unequivocally, relates to the business of insurance, because it is specifically designed to regulate the creation, marketing, and sale of health insurance. This fact alone distinguishes the PPACA from the statutes at issue in Lopez and Morrison. In Lopez, the subject of the statute was the possession of a firearm in a school zone. If the statute had addressed the manufacture, marketing, or sale of firearms, it would most certainly have been within Congress’ regulatory powers as provided by the Commerce Clause. Similarly, the PPACA cannot reasonably be characterized as being limited to addressing the possession of health insurance; rather, it is a comprehensive statute created to address health insurance with respect to consumers, physicians, and carriers. Comparison to Morrison underscores the same point. The statute in Morrison had as its sole focus the issue of domestic violence. Unlike Southeastern Underwriters, there was no prior case law interpreting the Commerce Clause to grant Congress the power to regulate domestic violence. While domestic violence is a serious issue worthy of attention, it is not affected by the trade between states; while it has an indirect impact on commerce (by affecting the ability of individuals to engage in commerce), it does not constitute “commerce” in the same way that the purchase of health insurance does. Therefore, these cases do not aid in the intellectual analysis of the PPACA. 2. The “activity v inactivity” analysis is a false distinction which does not add to the analysis. Article I, Section 8, Clause 3 states that Congress has the power “[t]o regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes . . .” There is no mention of “activity” or “inactivity” in the Constitution. Moreover, there is nothing unusual about the notion of Congress requiring individuals or companies to conduct “activities” or to pass laws prohibiting forms of “inactivity.” See, e.g., Interstate Commerce Commission v. Goodrich Transit Co., 224 U.S. 194 (1912) (requiring common carriers to adopt uniform standards of bookkeeping, accounting, and annual reports). In a similar fashion, the current iteration of the Selective Service Act requires selective service registration by all males between the ages of 18-25 years old; willful failure to register is punishable by fine. Finally, the PPACA does in fact address “activity,” i.e., the design, marketing, sale, and purchase of health insurance. The Sixth Circuit’s opinion in Thomas More is the lone opinion to fully grasp this concept. 3. The Necessary and Proper Clause, Article I, Section 8, Clause 18, states that “The Congress shall have Power - To make all Laws which shall be necessary and proper for carrying into Execution the foregoing Powers, and all other Powers vested by this Constitution in the Government of the United States, or in any Department or Officer thereof.” As Justice Vinson correctly noted in his District Court opinion in State of Florida v. Sibelius, the Necessary and Proper Clause “vests Congress with the power and authority to exercise means which may not in and of themselves fall within an enumerated power, to accomplish ends that must be within an enumerated power.” Judge Vinson went on to correctly note that the regulation of health insurance is clearly “legitimate” and “within the scope of the Constitution.” However, Judge Vinson then undercut his own logic by declaring that the means must be “appropriate” and not “inconsistent with the letter and spirit of the Constitution.” In other words, Judge Vinson held that, contrary to the express language of the Constitution, Congress does not have power to make all laws which shall be necessary and proper for regulating health insurance, but only those laws which are “appropriate” and “not inconsistent with the letter and spirit of the Constitution.” In so holding, he essentially re-visited the 18th Century argument between Jefferson and Hamilton regarding the scope of the Clause, which Justice Marshall laid to rest in McCulloch v. Maryland, 17 U.S. 316 (1819) when he stated: The subject is the execution of those great powers on which the welfare of a Nation essentially depends. It must have been the intention of those who gave these powers to insure, so far as human prudence could insure, their beneficial execution. This could not be done by confiding the choice of means to such narrow limits as not to leave it in the power of Congress to adopt any which might be appropriate, and which were conducive to the end. This provision is made in a Constitution intended to endure for ages to come, and consequently to be adapted to the various crises of human affairs. To have prescribed the means by which Government should, in all future time, execute its powers would have been to change entirely the character of the instrument and give it the properties of a legal code. It would have been an unwise attempt to provide by immutable rules for exigencies which, if foreseen at all, must have been seen dimly, and which can be best provided for as they occur. To have declared that the best means shall not be used, but those alone without which the power given would be nugatory, would have been to deprive the legislature of the capacity to avail itself of experience, to exercise its reason, and to accommodate its legislation to circumstances. Id. at p. 415 (emphasis added). As such, because the individual mandate is a necessary part of the overall regulatory scheme, the overall regulatory scheme is constitutionally valid; because nothing in the Constitution expressly forbids the imposition of the individual mandate, this provision is a proper exercise of Congressional power under the Necessary and Proper Clause. 4. The final misconception in these cases is that the PPACA “requires” individuals to purchase health insurance. To the contrary, individuals (leaving aside those who are excluded from the mandate by reason of income level) have the choice of either obtaining employment with an employer who provides health insurance; purchasing health insurance; or paying a penalty. [Note that, as part of the PPACA, employers above a certain size are required to provide health insurance for their employees, either by the purchase of group coverage or by payment into an insurance exchange; the penalty for noncompliance is a similar fine.] The failure to purchase health insurance is not considered “criminal” conduct, and does not result in the loss of life, liberty, or property. Rather, as the court noted in Liberty University v. Geithner, the resulting penalty is properly considered a “fee” and is a legitimate means of regulating commerce. Id. There are well founded concerns regarding the PPACA, not the least of which are the potential costs involved; the availability of health care providers to serve the anticipated influx of customers into the system; and the quality of care that will be available. However, a close and correct reading of the Constitution reveals that the Founding Fathers do not stand in the way of Congress’s effort to make affordable health care a fundamental right for all American citizens. Opinions Holding that the Plaintiffs lack standing In addition to the cases cited above, the following opinions have dismissed constitutional challenges to the PPACA on the grounds that the Plaintiffs did not have standing the challenge the Act: 1. Steve Baldwin and Pacific Justice Institute v. Sebelius, 654 F.3d 877 (9th Cir. 2011) 2. Shreeve v. Obama, U.S. Dist. LEXIS 118631 (E.D. Tenn. Nov. 4, 2010) 3. N.J. Physicians, Inc. v. President of the United States, 653 F.3d 234 (3d Cir. 2011) 4. Kurt Joseph Van Tassel v. United States of America, case no. 1:10CV310, U.S.D.C. Middle District of North Carolina, Dec. 16, 2010 5. Bryant v. Holder, 2011 U.S. Dist. LEXIS 96583 (S.D. Miss. Aug. 29, 2011) 6. Peterson v. United States of America, 774 F.Supp.2d 418 (D.N.H. 2011) 7. Purpura v. Sebelius, 2011 U.S. App. LEXIS 19943 (3d Cir. 2011) 8. Kinder v. Geithner, 2011 U.S. Dist. LEXIS 45067 (E.D. Mo. April 26, 2011) Other Challenges to the PPACA In addition to the cases addressing Section 1501 and standing, the following opinions have asserted other challenges to the PPACA: 1. New Jersey Physicians, Inc., et al v. President of the United States, 653 F.3d 234 (3d Cir. 2011)– a physician and a physician’s association alleged that they had standing to challenge the Act on the grounds that it affected their ability to treat patients and seek payment for medical services. The Court affirmed the District Court’s granting of the Defendants’ Motion to Dismiss, holding the physician failed to show that his practice was subject to the Act, and that the association would be directly affected. 2. Physician Hospitals of America, et al., v. Sebelius, 2011 U.S. Dist. LEXIS 35491 (E.D. TX March 31, 2011) – Plaintiffs challenged an amendment to the Medicare Act limiting their ability to bill for services provided to Medicare patients. The Court granted Defendants’ motion for summary judgment, holding that § 6001 of the PPACA did not violate the substantive due process and equal protection clauses. (Plaintiffs have appealed to the 5th Circuit)