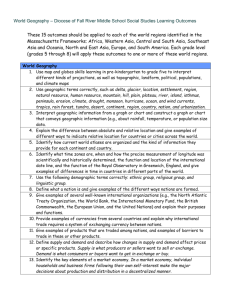

2014 Pricing Bands by Diocese

advertisement

Church Pension Group Info Session Frank Armstrong, Chief Actuary September 21, 2013 House of Bishops Fall Meeting Contents Denominational Health Plan Status Update Affordable Care Act (ACA): Healthcare Reform and the Emerging Marketplace Appendices • Appendix A: 2014 Pricing Bands by Diocese • Appendix B: Emerging Healthcare Marketplace • Appendix C: ACA Provisions – 2010 through 2013 • Appendix D: ACA Provisions – 2014 and Beyond 2 Denominational Health Plan Status Update 3 DHP participation is well underway 100% of domestic Dioceses participating by January 1, 2014 45 additional groups currently participating Individual participation estimated at 95% • DHP currently serving 25,700 members 1 1 Includes active clergy, lay employees and their covered dependents 4 DHP is delivering expected cost containment DHP feasibility study estimated 10% cost containment savings at full implementation of the DHP To date, the DHP has delivered approximately 11% cost containment savings to the church – $60 million since 2009 DHP Feasibility Study Projected Savings (%) Actual DHP Savings (%) 2011 10.0% 8.3% 2012 10.0% 10.4% 2013 10.0% 13.3% Three-Year Cumulative 10.0% 10.8% Plan Year 5 DHP is helping to moderate cost increases Since 2009, Medical Trust average rate increases have been 2% - 4% below national trend levels Note: National trend figures based on Aon Hewitt trend study and represent increases prior to plan design changes 6 DHP is addressing cost disparities1 Eliminated pricing bands 7 through 13 over the past three years 82 dioceses at or within one band of national rate for 2014 • 1 51 dioceses positioned at band 5 (up from 13 at 2012) See Appendix A for list of dioceses and pricing band position effective January 1, 2014 7 89% of each Medical Trust dollar goes to benefits and an additional percent to member surplus1 1 Materially above ACA regulated minimum requirement of 85% for large groups and 80% for small groups 8 Making strides on health and wellness VT WA ME ND MT NH MN OR MI WY UT CA AZ CO NM PA IA NE NV NY WI SD ID WV KS OK MO KY TX VA DC NC TN SC AR MS AK OH IN IL CT NJ DE MD MA RI AL GA LA FL HI Wellness Summit Conducted Robust participation in Wellness Summits • 14 Summits over past 2 years impacting over 1,200 participants New resources and programs under development for 2014 9 Non-Domestic Dioceses - Fund for Medical Assistance The Fund for Medical Assistance is sponsored and administered by The Church Pension Fund for non-domestic dioceses Provides reimbursement for certain health care expenses not otherwise covered by public or private insurance programs • Full-time clergy and lay employees are eligible • Amounts available for benefits vary by diocese • Minimal requests for reimbursement have been made to date 5 year pilot program to be reconsidered by CPF Board before December 31, 2014 For more information, contact Nelida Rivera (nrivera@cpg.org ) 10 Affordable Care Act (ACA): Healthcare Reform and the Emerging Marketplace 11 DHP is compliant with all current applicable ACA provisions, for instance… Preventive services covered at 100% No pre-existing condition limitations or individual health rating Coverage of adult children to age 30 (age 26 required by ACA) No annual or lifetime plan maximums Women’s preventive health expansion 12 The healthcare market is in a state of change Introduction of health exchanges (i.e., Marketplace) in 2014 • Varying widely in structure, plan design, choice of providers and premium rate levels DHP plans are generally competitive • Prevailing TEC plan designs provide for most protective levels of coverage • Early indications showing competitive DHP rates 13 Marketplace Structure Three Types of Exchanges under ACA State-Based Exchange Federal Exchange Partnership Exchange 16 states and D.C. 27 states 7 states 14 Prevailing TEC plans have 15% – 20% higher coverage levels than emerging Marketplace norm Typical Marketplace Design Versus Prevailing TEC Plans Out-ofPocket Maximum Plan Option Total Plan Value Prevailing TEC Plans 85% 90% $0 - $250 $1,500 $2,000 90% - 100% Silver Plan 70% $1,000 $5,000 60% Deductible Plan’s Coinsurance Marketplace plans categorized into four levels of coverage, ranging from least to most protective • Bronze < Silver < Gold < Platinum • Silver Plan being positioned as the emerging Marketplace norm 15 Prevailing TEC plans are Platinum and Gold Level Platinum Plans Silver Plans Cigna HDHP/HSA Empire BCBS HSA Gold Plans Cigna POS (OAP) Empire PPO 75/50 Empire PPO 80/60 Empire EPO 80 Kaiser Low Option EPO UHC Choice 80 UHC Choice Plus 80/60 Aetna Choice POS II Aetna National HMO Aetna Select EPO Cigna EPO (OAPIN) Empire EPO 100 Empire EPO 90 Empire High Option PPO Empire PPO 90/70 Kaiser High Option EPO Kaiser Mid Option EPO UHC Choice UHC Choice Plus 16 Platinum plans are popular across majority of Dioceses (as percent of total enrollment) VT WA ME ND MT NH MN OR MI WY UT CA AZ CO NM PA IA NE NV NY WI SD ID WV KS OK MO KY TX VA DC NC TN SC AR MS AK OH IN IL CT NJ DE MD MA RI AL GA LA FL HI Plan Type Platinum (30 states and DC) Gold (12 states) Silver (8 states) 17 Early indications showing competitive DHP rates 17 states plus D.C. have recently filed 2014 Marketplace rates • Early look showing wide variation in rate levels within and across rating areas DHP plan rates are generally competitive • DHP rates are at similar, and in some cases lower, levels for similar plans, rating areas and age • Medical Trust will continue to benchmark against the Marketplace as more data emerges 18 DHP at competitive disadvantage - Premium Tax Credits Premium tax credits (PTCs) are tax subsidies that will lower the cost of premiums for certain individuals that buy their own coverage from the Marketplace Two key criteria needed to qualify: Household Income 100% - 400% of FPL1 Qualify For Premium Tax Credits No Access to Affordable Healthcare 1 FPL = Federal Poverty Level 19 However, less than 5% of Medical Trust participants estimated to qualify for PTCs* Total DHP Age 65 and Over 13,000 800 6.2% Household Household Income Income > 300% 400% FPL 400% FPL 2,300 17.7% Household Income 100% - 300% Access to Eligible for Affordable Meaningful Coverage PTC 800 6.2% 600 4.6% 8,500 65.3% *Based on 2013 CPG and Medical Trust clergy and lay employee census data, available employee contribution levels and ESI Tapestry household income database; analysis and results validated by external source 20 Church Health Plan Act requesting equal treatment for church plans in the Marketplace Would allow the 600 eligible clergy and lay employees to: 1. Gain access to premium tax credits 2. Continue to receive benefits of Medical Trust plan offerings Status: • Introduced in Senate (S. 1164) on June 13th by Senator Pryor (D-AR) and Senator Coons (D-DE) • Outreach to Senators to support bill 21 Ongoing communication outreach to the Church Regular Diocesan Administrator Teleconferences Monthly Administrator Emails EBAC Benefits Partnership Conference House of Bishops & Provincial Bishop Meetings Provincial Synod Meetings Executive Council CEEP, CODE, NACBA, etc. FAQ document, instructions and other resources on cpg.org https://www.cpg.org/administrators/insurance/health-andwellness/health-care-reform/ 22 Summary DHP is driving positive results • Participation is well underway • Delivering expected cost containment • Keeping annual rate actions down • Addressing cost disparities • Continued focus on wellness Proactively addressing healthcare reform • Compliant with all current applicable provisions • DHP generally competitive with developing marketplace • Medical Trust exploring opportunities for enhanced value 23 Appendix A 2014 Pricing Bands 24 2014 Pricing Bands by Diocese DHP Enroll 2014 Band Diocese of East Carolina 67 5 5 Diocese of East Tennessee 108 5 34 4 Diocese of Eastern Michigan 29 3 Diocese of Arizona 116 4 Diocese of Eastern Oregon 6 6 Diocese of Arkansas 72 4 Diocese of Easton 26 6 Diocese of Atlanta 272 6 Diocese of Eau Claire 5 6 Diocese of Bethlehem 36 5 Diocese of El Camino Real 69 6 Diocese of California 351 3 Diocese of Florida 118 5 Diocese of Central Florida 126 5 Diocese of Fond Du Lac 23 6 Diocese of Central Gulf Coast 107 3 Diocese of Fort Worth 19 6 Diocese of Central New York 61 3 Diocese of Georgia 71 5 Diocese of Central Pennsylvania 63 5 Diocese of Idaho 12 5 Diocese of Chicago 211 5 Diocese of Indianapolis 167 4 Diocese of Colorado 117 5 Diocese of Iowa 28 6 Diocese of Connecticut 220 6 Diocese of Kansas 39 5 Diocese of Dallas 156 5 Diocese of Kentucky 22 5 Diocese of Delaware 59 6 Diocese of Lexington 58 5 DHP Enroll 2014 Band 155 1 Diocese of Alaska 7 Diocese of Albany Diocese Diocese of Alabama Diocese 25 2014 Pricing Bands by Diocese DHP Enroll 2014 Band Diocese of Newark 123 6 2 Diocese of North Carolina 281 3 93 5 Diocese of North Dakota 9 2 Diocese of Maine 52 5 Diocese of Northern California 67 5 Diocese of Maryland 213 5 Diocese of Northern Indiana 15 5 Diocese of Massachusetts 280 5 Diocese of Northern Michigan 6 5 Diocese of Michigan 89 4 51 5 Diocese of Milwaukee 39 6 Diocese of Northwest Texas Diocese of Northwestern Pennsylvania 18 4 Diocese of Minnesota 77 5 Diocese of Ohio 96 5 Diocese of Mississippi 74 5 Diocese of Oklahoma 79 5 Diocese of Missouri 64 5 Diocese of Olympia 169 1 Diocese of Montana 23 4 Diocese of Oregon 89 5 Diocese of Nebraska 25 5 Diocese of Pennsylvania 233 5 Diocese of Nevada 7 5 Diocese of Pittsburgh 45 2 Diocese of New Hampshire 45 5 Diocese of Quincy 5 5 Diocese of New Jersey 143 5 Diocese of Rhode Island 58 5 Diocese of New York 788 5 Diocese of Rio Grande 40 6 DHP Enroll 2014 Band Diocese of Long Island 192 5 Diocese of Los Angeles 321 Diocese of Louisiana Diocese Diocese 26 2014 Pricing Bands by Diocese DHP Enroll 2014 Band Diocese of Virgin Islands 11 2 5 Diocese of Virginia 382 2 11 5 Diocese of Washington 196 5 Diocese of South Dakota 19 6 Diocese of West Missouri 50 6 Diocese of Southeast Florida 117 6 Diocese of West Tennessee 83 5 Diocese of Southern Ohio 102 5 Diocese of West Texas 107 4 Diocese of Southern Virginia 116 5 Diocese of West Virginia 37 6 Diocese of Southwest Florida 134 5 Diocese of Western Kansas 5 5 Diocese of Southwestern Virginia 66 2 37 6 Diocese of Spokane 30 4 Diocese of Western Louisiana Diocese of Western Massachusetts 50 6 Diocese of Springfield 18 6 Diocese of Western Michigan 44 5 Diocese of Tennessee 83 3 50 1 Diocese of Texas 590 6 Diocese of Western New York Diocese of Western North Carolina 70 5 Diocese of Upper South Carolina 196 5 Diocese of Wyoming 31 5 Diocese of Utah 38 6 5 30 1 Episcopal Church in Navajoland The Episcopal Church in South Carolina 5 Diocese of Vermont 50 3 DHP Enroll 2014 Band Diocese of Rochester 58 2 Diocese of San Diego 110 Diocese of San Joaquin Diocese Diocese 27 Appendix B Healthcare Marketplace 28 The healthcare market is in a state of change Marketplaces (i.e., health exchanges) expected to vary widely in structure, plan design, choice of providers and premium rate levels Silver Plan positioned as the normative benefit coverage level Premium tax credits (PTCs) are only available through coverage purchased on an Individual Marketplace 29 Three key factors driving change… Uninsured Population Marketplace Structure Carrier Pricing Strategies …and degree of choice, price, network, vendor and quality of available options in the Marketplace 30 Marketplace Structure Three Types of Exchanges under ACA State-Based Exchange Federal Exchange Partnership Exchange 16 states and D.C. 27 states 7 states Two main health plan contracting models 1. Clearinghouse => contract with all Qualified Health Plans 2. Active Purchaser => direct negotiations and selective contracting with health plans on value, choice, quality, service, and price 31 Plan contracting models vary by State with most taking a more passive approach VT WA ME ND MT NH MN OR MI WY UT CA AZ CO NM PA IA NE NV IL OH IN WV KS OK MO KY TX VA CT NJ DE MD MA RI DC NC TN SC AR MS AK NY WI SD ID AL GA LA FL HI Clearinghouse (44 states and DC) Active Purchaser (6 states) 32 25 Million estimated to be covered through the Marketplace by 2017 Uninsured Medicaid/CHIP Private / Other Employersponsored Insurance NOTE: This assumes that all states choose to expand Medicaid eligibility up to 138% FPL January 2014. SOURCE: Congressional Budget Office, February 2013. Total may not equal 100% due to rounding Uninsured Medicaid/CHIP Exchange Private / Other Employersponsored Insurance 33 The Big Bet….what will make up that 9%? Source of PreExchange Coverage Number of Individuals (in millions) Percent of Nonelderly Population Uninsured 14.0 5% Private / Other 5.5 2% Employer Sponsored 5.5 2% Total 25.0 9% What is the size and characteristics of this population? • How many of the 14M uninsured will be low utilizers? • Will the young and healthy purchase healthcare insurance? • Underlying financial model of ACA is based on the premise that they will buy 34 New Pricing Considerations for Health Plans Limits on rating methodology • No gender • No adjustment for health status or experience • Age rating limited to 3:1 ratio Regulatory Fees • ACA requires insurers to pay several new fees • Estimated to add about 7-10% to cost of insurance Access to risk mitigation programs and subsidies • Provide premium stabilization in early years of Marketplace • Mitigate impact of selection 35 What does this all mean for healthcare premium rates? PRICE will be primary competitive driver in the Marketplace Medical Loss Ratio (MLR) requirements limit returns at the global level Health plans will look to remaining levers to lower price: • Market share versus profit strategy • Narrow networks, tiered products, Rx formularies • Treatment of risk adjustment and reinsurance • Benefit design within de minimis range (+/-2%) • Product array on versus off Marketplace 36 Silver Plan positioned as norm in Marketplace Sample Silver Marketplace Design Versus Prevailing TEC Plan Out-ofPocket Maximum Plan Option Total Plan Value Prevailing TEC Plans 85% 90% $0 - $250 $1,500 $2,000 90% - 100% Silver 70% $1,000 $5,000 60% Deductible Plan’s Coinsurance Prevailing TEC plans are 15% – 20% higher in value than emerging Marketplace norm PTCs only sufficient to cover a portion of Silver Plan premium rates offered in the Marketplace 37 Different Shades of Silver Sample Silver Plan Designs PCP/SCP Office Visit Copay Deductible1 Out-ofPocket Maximum1 Plan’s Coinsurance Silver A $25/$40 $1,000 $5,000 60% Silver B2 $45/$65 $2,000 $6,400 various copays Silver C $35/$70 $2,500 $6,350 70% 20% $2,700 $4,200 80% Silver Plan MT HDHP 1 2 Meaningful differences among Silver plan designs • All should result in similar out-of-pocket (OOP) costs for the “average” utilizer (from 68% to 72% Actuarial Value) • Materially different OOP costs for low and high utilizers Represent individual (single) amounts; family amounts are twice individual amounts $250 copay for hospital care and outpatient surgery, imaging; additional $250 deductible for brand drugs 38 Prevailing TEC plans are Platinum and Gold Level Platinum Plans Silver Plans Cigna HDHP/HSA Empire BCBS HSA Gold Plans Cigna POS (OAP) Empire PPO 75/50 Empire PPO 80/60 Empire EPO 80 Kaiser Low Option EPO UHC Choice 80 UHC Choice Plus 80/60 Aetna Choice POS II Aetna National HMO Aetna Select EPO Cigna EPO (OAPIN) Empire EPO 100 Empire EPO 90 Empire High Option PPO Empire PPO 90/70 Kaiser High Option EPO Kaiser Mid Option EPO UHC Choice UHC Choice Plus 39 Platinum plans are popular across majority of Dioceses (as percent of total enrollment) VT WA ME ND MT NH MN OR MI WY UT CA AZ CO NM PA IA NE NV NY WI SD ID WV KS OK MO KY TX VA DC NC TN SC AR MS AK OH IN IL CT NJ DE MD MA RI AL GA LA FL HI Plan Type Platinum (30 states and DC) Gold (12 states) Silver (8 states) 40 Summary of Emerging Marketplace Material variability across and within markets • Number of health plans participating differing widely across markets • Wide spread in rates (range of lowest to highest over 200%) • Variety of network types (e.g., select, tiered networks) Competitiveness with DHP offerings • Early indications showing competitive DHP rates • Prevailing TEC plan designs are on high end of design spectrum (provide for most protective levels of coverage) • Network of providers in Medical Trust plans is generally broader than network types in emerging Marketplace 41 What does the future hold? 1. 2. 3. 4. 5. 6. 7. Exchanges shelf-life Role of Accountable Care Organizations Employer strategies Information technology wave Telemedicine and self-care New drug therapies Patient demand for integrated experience Fight for cheese among government, providers and health plans 42 Appendix C ACA Provisions: 2010 through 2013 43 2010: Key provisions Small Business Tax Credit • 2010-2013: Available to small church employers (fewer than 25 fulltime equivalent employees with average wages of less than $50,000) • 2014-2016: Only available to small employers purchasing insurance through Marketplace • Note that sequestration will reduce credit for 2013 • For further information and detailed instructions on how to apply for the credit, see memo available on www.cpg.org Nursing Mother Provisions • Mandatory for large employers (those with more than 50 employees) • Must provide private space and reasonable break Early Retiree Reinsurance Program (ended in 2012) 44 2011: Key Provisions Form W-2 reporting of value of health insurance • Delayed for employer participating in church health plans (earliest effective date is 2014 Forms W-2) Coverage of adult children through age 26 • Note: The Medical Trust provides coverage through age 30 Health FSAs, HRAs and HSAs - over-the-counter drugs are not eligible for reimbursement unless prescribed or insulin Restrictions on lifetime and annual limits Zero cost preventive care services No pre-existing exclusions for dependents under age 19 Restrictions on retroactive rescission of coverage Revised claims procedures with access to external review Increase in excise tax on ineligible distributions from health savings accounts (HSAs) from 10% to 20%. 45 Tax Implications of Health Coverage For Adult Children Under the ACA, healthcare benefits are tax-free through the calendar year the child turns age 26 The Medical Trust provides coverage through age 30 • • The value of benefits provided to adult children in year child turns age 27 through age 30 may be taxable if child is not a tax dependent who is a qualifying child or qualifying relative under the Internal Revenue Code Report “value” of benefit as imputed income on employee’s Form W-2 Note: Similar imputed income requirement applies to domestic partners and partners in civil union. Due to recent DOMA ruling, no imputed income on Form W-2 for coverage provided to same gender spouse. Required, however, for civil unions and domestic partners. 2012: Key Provisions • • • Summary of Benefits and Coverage Report and pay Patient-Centered Outcomes Research Institute Fee (2012 through 2019) $1 per member (for 2012)/ $2 per member (2013-2019) The Medical Trust files the Form 720 and pays this fee for the health plans it sponsors Note that if you sponsor separate medical plans or HRAs, you may be required to file a Form 720 and pay this fee 47 2013: Key Provisions $2,500 limit on Employee Pre-Tax Health FSA Contributions Additional Medicare Payroll Tax on High Earners • New additional .9% Medicare tax on high income earners • Employers must begin withholding in payroll period in which wages exceed $200,000 • Note: Employers are not required to match the additional .9% Health Insurance Marketplace Notifications 48 Health Insurance Marketplace Notifications Employers must provide notice of the availability of coverage through the Marketplace by October 1, 2013 • Employers subject to the Fair Labor Standards Act • All employees – full-time, part-time, with or without coverage • Must provide notice to new employees within 14 days of hire • DOL announced that there will be no penalty for noncompliance The Department of Labor created Model Notices • CPG created resources to assist in completing the Notices • Includes instructions, model cover letters, FAQs for employees • Go to administrator’s page on www.cpg.org 49 Appendix D ACA Provisions: 2014 and Beyond 50 Miscellaneous 2014 Provisions Limits on Out-of-Pocket Costs • Annual out-of-pocket costs limited to $6,350 for individuals and $12,700 for families • In 2014, ancillary benefits that are separately administered (such as pharmacy) may provide a separate out-of-pocket maximum Maximum waiting period of 90 days • Employers participating in Medical Trust plans are not permitted to have waiting periods Must cover certain clinical trials No pre-existing conditions regardless of age Increase permitted for wellness incentives • Employers may offer up to a 30% premium reduction (up to 50% for tobacco cessation programs) • Programs may not discriminate based on health factors 51 Elimination of annual limits - Impact on HRAs Effective January 1, 2014, employers cannot offer “standalone” Health Reimbursement Accounts (HRAs) The HRA must be integrated with a high deductible plan or other health plan in order to impose a limit Note: Can offer stand-alone HRAs that cover retirees only due to special exception for retiree-only plans. 52 Individual Responsibility Provision Effective January 1, 2014, each individual must: • Have basic health insurance, referred to as minimum essential coverage (all Medical Trust plans provide this coverage), • Qualify for an exemption, or • Make shared responsibility payment when filing tax return Shared responsibility payment is equal to the greater of: Year Individual $ Penalty Individual % Penalty 2014 $95 1% 2015 $325 2% 2016 (and thereafter) $695 2.5% Penalty will be assessed for your dependents, but reduced by 50% for individuals under age 18. Minimum Essential Coverage reporting (to IRS and individuals) effective for 2015 calendar year. 53 Individual Responsibility Provision Exemptions include the following: • Individuals whose contribution for the lowest cost plan would be in excess of 8% of household income • Taxpayers with income below filing threshold • Members of Indian tribes • Hardships • Individuals who experience short coverage gaps (three months) • Religious conscience • Members of health sharing ministry • Incarcerated individuals and • Individuals who are not lawfully present 54 Employer Shared Responsibility Provision- 2015 Postponed until 2015! Applies to large employers – 50+ full-time or full-time equivalent employees Must provide all full-time employees and their dependents (not spouses) affordable and adequate healthcare coverage or pay a penalty Two types of penalties: • No Offer Penalty: $2,000 (annual, calculated monthly) per fulltime employee (excepting the first 30 employees), if at least one employee obtains federally-subsidized coverage on the Marketplace • Unaffordable or Inadequate Penalty: lesser of $3,000 per subsidized employee or the “No Offer” penalty Subject to IRS reporting The Medical Trust will be offering webinar with detailed guidance 55 Transitional Reinsurance Fee (2014-2016) $20 Billion to fund reinsurance pool plus $5 Billion to reimburse government for the Early Retiree Reinsurance Program (EERP) payments Estimated annual costs to the Medical Trust: • 2014: $1,300,000 • 2015: $900,000 • 2016: $600,000 56 The “Cadillac Tax” – 2018+ 40% excise tax paid on the “Excess Amount” of coverage Excess Amount defined as the annual cost for coverage in excess of established thresholds, 2018 amounts: • $10,200 for single coverage • $27,500 for family coverage Threshold amounts will be adjusted for certain factors • Indexed at CPI+1% for 2019 & 2020; at CPI for 2021+ • High risk profession (unlikely to include church employees) • Age and gender (likely to result in higher thresholds for Medical Trust plans) 57 How might the Cadillac tax impact the DHP rates? 1 Band 5, 3-tier rates. Annual healthcare cost trend assumption of 7%, CPI of 3%, 10% adjustment for high average age 58 How might the Cadillac tax impact the DHP rates? The Medical Trust could be subject to significant excise taxes with potential impact on DHP healthcare costs: • $2.7 million in 2018 (1.2% of total annual contributions) • $14.8 million in 2023 (4.8% of total annual contributions) • Note: Assumes threshold amounts are increased by 10% due to higher average age 59 Two key criteria to qualify for PTCs Household Income 100% - 400% of FPL No Access to Affordable Healthcare Qualify for PTCs Affordable minimum essential coverage through employer defined as: • Affordable: • when the required contribution for self-only coverage does not exceed 9.5% of household income (excluding housing); and Minimum Value (MV): when benefit provisions cover at least 60% of the plan costs (all MT plans meet MV requirement) Must enroll in a plan offered through an Individual Marketplace to gain access to PTCs 60 Annual Federal Poverty Level Federal Poverty Guidelines for the 48 Contiguous States and the District of Columbia – 2014 Projected1 Family Size Poverty Guideline 133% of FPL 200% of FPL 300% of FPL 400% of FPL 1 $11,820 $15,720 $23,640 $35,460 $47,280 2 $15,900 $21,150 $31,800 $47,700 $63,600 3 $19,980 $26,570 $39,960 $59,940 $79,920 4 $24,060 $32,000 $48,120 $72,180 $96,240 5 $28,140 $37,430 $56,280 $84,420 $112,560 6 $32,220 $42,850 $64,440 $96,660 $128,880 7 $36,300 $48,280 $72,600 $108,900 $145,200 8 $40,380 $53,710 $80,760 $121,140 $161,520 Note: clergy housing allowance excluded for purposes of determining eligibility for PTCs 1 2014 figures based on applying 2013 percentage increases (over 2012) to the 2013 Federal Poverty Guidelines 61 Less than 5% of Medical Trust participants estimated to qualify for PTCs* Total DHP Age 65 and Over 13,000 800 6.2% Household Household Income Income > 300% 400% FPL 400% FPL 2,300 17.7% Household Income 100% - 300% Access to Eligible for Affordable Meaningful Coverage PTC 800 6.2% 600 4.6% 8,500 65.3% *Based on 2013 CPG and Medical Trust clergy and lay employee census data, available employee contribution levels and ESI Tapestry household income database; analysis and results validated by external source 62 Premium Tax Credits (PTCs) – Levels of Subsidies Income Level (in terms of FPL) Up to 132% 133 - 149% 150 - 199% 200 - 249% 250 - 299% 300 - 399% Maximum Percentage of Household Income to Pay Premiums for Healthcare Coverage 2% 3 - 4% 4 - 6.3% 6.3% - 8.05% 8.05% - 9.5% 9.5% Three types of subsidies available to those that qualify • Premium credits (2.0% to 9.5% of income) • Increase in benefit plan value (from 70% up to 94%) • Limits on out-of-pocket expenses (ranging from $1,983 to $7,973) 63 Additional complexities come with PTCs Loss of employer contributions towards healthcare coverage Loss of pre-tax treatment on employee contributions Additional cost to purchase Gold/Platinum coverage or any Silver coverage costing more than 2nd lowest priced Silver Plan in the market Available plan designs, provider networks, level of premium rates and PTCs in each market Nondiscrimination rules Changes in household income during the year 64 Church Health Plan Act requesting equal treatment for church plans in the Marketplace Would allow eligible clergy and lay employees to: 1. Continue to receive benefits of the DHP – Cost containment – Higher levels of benefits and services 2. Gain access to premium tax credits Status: • Introduced in Senate (S. 1164) on June 13th by Senator Pryor (D-AR) and Senator Coons (D-DE) • Outreach to Senators to support bill 65 Church Health Plan Act of 2013 Why ask for relief? • For parity between for-profit health insurers and church plans • Unlike for-profit health insurers, church plans cannot offer plans on the Marketplace • Members cannot access the premium tax credit unless they purchase insurance through a Marketplace plan Will church employees receive special tax benefits? • No. Similar to employees who purchase insurance on the Marketplace, an employee who receives a premium tax credit, will be taxed on all contributions made to the Medical Trust Plan. 66 Estimated impact of PTCs Under Current Guidance If Church Bill Passes % Qualify Total Annual PTCs (in millions) % Qualify Total Annual PTCs (in millions) Clergy 0.2% $0.1 5.1% $2.2 Lay 7.0% $4.9 13.1% $9.1 Total 4.8% $5.0 10.5% $11.3 Under current guidance, most clergy and lay employees will not qualify for PTCs as they currently have access to affordable healthcare coverage • Material employer behavior change not expected If Church Bill passes, church plans will be treated the same as for-profit health plans allowing clergy and lay employees to remain in Medical Trust plans and gain access to PTCs 67 Premium Tax Credit Recap Limited percentage of Medical Trust participants expected to qualify for meaningful level of PTC • • Under current guidance: Less than 5% of MT participants with annual PTCs of about $5 million Church Health Plan Act could increase percentage to 11% and annual PTCs to about $11 million Will employer behavior change? • • …stop offering healthcare coverage? …materially decrease current cost sharing levels? Additional points of consideration • • • • • Loss of pre-tax treatment on contributions Loss of employer contributions Available plan designs, provider networks, level of premium rates and PTCs in each market Nondiscrimination rules Changes in household income during the year 68