Spring 8 Lesson

advertisement

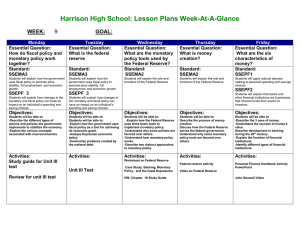

Harrison High School: Lesson Plans Week-At-A-Glance WEEK: 8 Monday Essential Question: What is fiscal policy? Standard: SSEMA3 Students will explain how the government uses fiscal policy to promote price stability, full employment, and economic growth. GOAL: Tuesday Essential Question: What are the monetary policy tools used by the Federal Reserve? Standard: SSEMA2 Wednesday Essential Question: What is money creation? Students will explain the role and functions of the Federal Reserve Students will explain the role and functions of the Federal Reserve Standard: SSEMA2 SSEPF 3 Students will explain how changes in the monetary and fiscal policy can have an impact on an individual’s spending and saving choices. Thursday Essential Question: What are the six characteristics of money? Standard: SSEPF1 Friday Essential Question: What is absolute vs comparative advantage? Students will apply rational decision making to personal spending and savings choices. Students will explain why individuals, businesses, and governments trade goods and services. SSEPF2 SSEIN2 Students will explain that banks and other financial institutions are businesses that channel funds from savers to investors. Student will explain why countries sometimes erect trade barriers and sometimes advocate free trade. Standard: SSEIN1 SSEIN3 Students will explain how changes in exchange rates can have an impact on the purchasing power of the United States. Objectives: Objectives: Objectives: Objectives: Objectives: Students will be able to: Students will be able to: -Explain how the government uses fiscal policy as a tool for achieving its economic goals. -Analyze Keynesian economic policy -Summarize problems created by the national debt. Students will be able to: . -Explain how the Federal Reserve uses three basic tools to implement monetary policy. -Understand why some policies are favored over others. -Understand how monetary policy works. -Describe two distinct approaches to monetary policy. Students will be able to: Describe the process of money creation. Discuss how the Federal Reserve serves the federal government. Understand why some monetary policy tools are favored over others. Students will be able to -Describe the 3 uses of money. -Understand the sources of money’s value. Describe development in banking during the 20th century -Explain the function of financial institutions. -Identify different types of financial institutions. Students will be able to -Explain the concepts of comparative and absolute advantage in trade. -Define Various types of trade barriers -Calculate currency exchange rates Activities: Activities: Activities: Activities: Activities: PowerPoint/discussion Compare/Contrast Economic theories Worksheet on Federal Reserve UNIT I Test Personal Finance Handbook Activity PowerPoint Case Study: Banking, Monetary Policy, and the Great Depression HW- Chapter 15 Study Guide Test International Economics Video on Federal Reserve HW- Chapter 16 Study Guide HW- Study guide Ch 10 Unit I test on WED *Template created by AVID.