Camerer-Rangel - Computing + Mathematical Sciences

advertisement

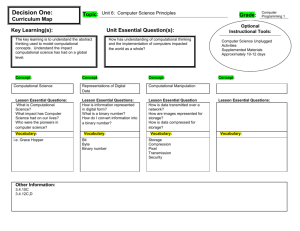

Computational Approaches to Economic Valuation & Strategy Choice Colin Camerer Antonio Rangel Caltech Outline • • • • Brief history of the role of computation in Economics Models of valuation and simple choice (Rangel) Models of strategic choice and learning in games (Camerer) Computational issues at different levels: individuals, firms, markets (Camerer) • Future directions of research I Brief history of the role of computation in Economics Computation is at the heart of economic problems Consider some typical problems: •Individual: What snack should I pick out of the buffet table? •Individual: Optimal investment portfolio? •Firm: Price setting and production selection problem •Market system: price formation Thus, one would expect computational based models of decisionmaking to be common in Economics This is not the case: Traditional deliberate ignorance of computational detail • The triumph of “as if” modelling (economic behaviorism) -- Pareto (1987): “Pure political economy has therefore a great interest in relying as little as possible on the domain of psychology” -- Friedman (1953) Test predictions of theory rather than realism of assumptionsà can ignore computational detail • Fictional stand-ins for computation - Walrasian auctioneer - equilibrium in games • Underlying computational processes are modeled in REDUCED FORM Traditional view (cte.) • Axioms are considered primitives (logic vs biology as constraint on choices) • A developed preference for general mathematical proof over simulation – Study of “procedural rationality” algorithms (Simon) did not gain traction – Distrust of complicated many-equation macroeconomic models & simulations – Little post-1990 taste for SFI agent-based modeling Neuroeconomics: neurobiologically based computational models of decision-making Goals of Neuroeconomics: 1. What computations are carried out by the brain to make different types of economics decisions? 2. How are these computations implemented by the brain? 3. What are the implications of this knowledge for economics, finance, education, AI, marketing, … ? Computation is at the core of Neuroeconomics BUSINESS APPLICATIONS JUGDMENT & DM THERAPEUTIC APPLICATIONS ECONOMIC APPLICATIONS COMPUTAT. MODELS NEUROSCIENCE A.I. PSYCHOLOGY II Neuroeconomic Models of Valuation and Simple Choice Example I: Reward Prediction Learning 5 8 9 10 11 Reward wait 7 … Cue 6 Reward wait Reward 3 4 trial 3 Cue Time: 1 2 trial 2 wait Cue Event: trial 1 12 …. • Brain’s problem: learn to predict size & timing of rewards that follow each type of cue • Temporal-difference learning algorithms have been designed in CS to solve this problem (Sutton & Barto (1998)) How can the brain learn the reward function? Notation: - True value of state s: mean r(s) - pt(s) = computed predicted value at beginning of triat t (= brain’s best guess about the state’s true value) - t(s) = r(s) - pt(s) = error signal in trial t This error term is extremely important: it serves as THE teaching signal! Learning Algorithm Step 1. Arbitrarily initialize the decision values p1(s) for all s Step 2. Every trial t: -- begin with pt(s) -- measure actual reward -- Compute error (t) -- Update the DV for a and c active in trial as follows: pt+1(s) = pt(s) + (t) where -> (0,1) is a learning rate • Under very general conditions, E(pt(a|c)) -> E(r(s)) for all s How well do TD algorithms describe brain’s reward learning? Cue TD-Errors Before Learning TD-Errors During Learning TD-Errors After Learning if Unexpected Omission of reward Reward Can we find evidence of TD-error signals in monkeys’ brains? Single unit recordings from VTA dopamine neurons revealed that these neurons produce responses consistent with TD - learning: Schultz [1998] What brain areas show activation that correlates w/ TD-error signals in humans? p<<0.001 +3 R -3 -6 -30 +54 From O’Doherty et.al. [2003] at time of CS +6 CS+ trials Example II: Role of Visual Attention in Simple Choice ? Model: Three Parallel Processes • e=time elapsed since beginning of choice trial Visual attention DVs computation Comparator g(e)= L,R dL(e), dR(e) Choose L,R,or wait Visual attention switch g(e) g(e) DV Computation Comparator dL(e), dR(e) choose g(e) or switch Visual attention process First fixation: Stochastic bottom-up process •P0 = Prob first fixation to L •Exponential latency: Pr(First fixation begins at t)= 1- B.e- t Subsequent fixations: top-down process •Follow the commands of the comparator process Value construction process v+ 0 vt Comparator process: • During each fixation, the comparator either chooses g(e) or sends a signal to the visual system to switch gaze • Length of each fixation stochastic: -- d = duration of current fixation -- Pr(comparator evaluates at d)= 1- A.e- d • Decision made as follows: -- rx(e) = d(tx(e)) - d(ty(e)) • -- Choose g(e) with probability -- Wait (and switch fixation) with prob • Always switch after first fixation Model predictions • Behavioral: S-shaped choice probabilities • Process: RTs and #saccades increase with choice difficulty • Performance: - Importance of first fixation: P(choice=best|fist-fixation=best)> P(choice=best|fistfixation=worse) - First look bias: for items with similar value P(choice=L|fist-fixation=L)> P(choice=L|fist-fixation=R) -… Test Enforce 2000 ms fixation + Present until a choice is made 1000 ms + + Collect eye-fixations @ 50 Hz Results QuickTime™ and a TIFF (PackBits) decompressor are needed to see this picture. QuickTime™ and a TIFF (LZW) decompressor are needed to see this picture. QuickTime™ and a TIFF (LZW) decompressor are needed to see this picture. QuickTime™ and a TIFF (LZW) decompressor are needed to see this picture. Summary • Computation is at the core of the nascent field of Neuroeconomics • Goal is to (1) describe the computation and processes that the brain uses to make decisions and (2) establish their neural basis • Test the computational processes directly using modern neuroscience and psychology tools -- from fMRI to eye tracking • Feasibility of the research agenda has already been proven • Novel insights into DM are already being generated by this class of models. III Models of Strategic Choice & Learning in Games Some theoretical interest in computational models • Finite-state automata (Rubinstein, Neyman, et. al.) • Computational complexity (Gilboa-Zemel on NP-hard games) • Not linked to data or practical problems Cognitive hierarchy models of limited strategic thinking • Selten (1998): – “The natural way of looking at game situations…is not based on circular concepts, but rather on a step-by-step reasoning procedure” • Cognitive hierarchy – “Level 0” use a heuristic (e.g. randomize) – “Level k” best-respond to choices of level 0-(k-1) – Axiom f(k)/f(k-1) 1/k (k-th step increasingly difficult) f(k)=e-ttk/k! (Poisson) – Limit as t often converges to equilibrium – Simpler than equilibrium in some ways easier to compute predictions no problem of multiple equilibria Limited planning ahead in bargaining (Science, 03) 3-stage bargaining 1: $5 p1 offers 2: $2.50 p2 offers 3: $1.25 p1 offers (0,0) if rejected E.g. “P-beauty contest” (Ho et al AER 98) pick x in [0,100], x closest to (2/3) of average wins 1 0.8 equilibrium=0 0.7 data 0.6 CH prediction (τ=1.5) 0.5 0.4 0.3 0.2 0.1 number choice 95 85 75 65 55 45 35 25 15 0 5 relative frequency 0.9 “Choosing” computations are different than “belief formation” computations Bhatt-Camerer GEB 2005 Field application: “Cold opening” of movies (unavailable to critics for Friday review) Studios do not let worst movies get reviewed… ”cold” opening increases box office EWA learning in games: Generalized reinforcement • Reinforcement, fictitious play linked (Econometrica 99) • Update attractions to strategy j from payoff A ij (t) - A ij (t-1) = [*π(s ij,s-i (t)) -A ij (t-1)]/(ϕN(t-1)+1) = prediction error/increasing weight is “imagination” of counterfactual payoffs ϕ is recency weight Typical values: N(0)=1, ϕ=.8, weights go from .56 .20 • Can replace , ϕ with “self-tuning” functions (JET ’07) • Can add “sophistication”– players know others are learning (JET 02, GEB 06) Example: Price matching with loyalty rewards (Capra, Goeree, Gomez, Holt AER ‘99) • Players 1, 2 pick prices [80,200] ¢ Price is P=min(P1,,P2) Low price firm earns P+50 High price firm earns P-50 • What happens? – Theory: competition drives prices to 80 191~200 181~190 171~180 161~170 151~160 141~150 131~140 121~130 111~120 101~110 91~100 81~90 80 1 3 5 Period 7 9 5 9 191~200 181~190 171~180 161~170 151~160 141~150 131~140 121~130 111~120 101~110 91~100 81~90 1 80 3 Period 7 Empirical Frequency 0.9 0.8 0.6 0.7 0.5 0.4 Prob 0.3 0.2 0 0.1 Thinking fEWA Strategy 0.9 0.8 0.7 0.6 0.5 Prob 0.4 0.3 0.2 0.1 0 Strategy IV Computational Issues at different levels: individuals, firms, markets Levels of computational modelling in economics • • Individuals (what you’ve seen) Firms – Firms as hierarchies of imperfectly informed individuals (Radner-Van Zandt) Optimal hierarchies for aggregating formation • Mechanism design – Computability as an individual rationality constraint (Ledyard) • Markets – Markets as computational mechanisms • Computing equilibria (Judd, Kearns et al) – Smart markets: Hybrids of bids and optimal combination (e.g. combinatorial “package auctions” e.g. PCS spectrum) – Information aggregation • Markets ‘compute’ probabilities of events (e.g. prediction markets) Prediction markets • • • • • • • • • • Began with basic research: 20 yrs to wide use Plott and Sunder (1982 Econometrica): Markets for “contingent claims” Pay $1 if an event occurs. Prices reveal probabilities Markets are $-weighted opinion polls of self-selected respondents Iowa Political Markets 1988 (http://www.biz.uiowa.edu/iem/) Markets for political events predict surprisingly accurately Tradesports 2002 (http://www.tradesports.com/) et al Used by some companies, policy markets See Wolfers & Zitzewitz J Econ Perspectives 04 Six hours earlier (9pm EST Oct 26 ‘06): Guess about Karl Rove nonindictment appears in Intrade price drop…36 hrs before Oct 28 Libby indictment ROVE.INDICTED.31DEC ASK BID Price Price 1 25.1 29.9 1 10 25.0 30.0 3 1 24.6 31.9 1 1 24.4 32.0 2 1 24.2 32.7 2 1 23.7 33.0 10 1 23.6 34.9 4 3 23.4 35.0 20 11 23.3 39.0 5 27 23.2 40.0 11 16 23.0 50.0 10 13 22.5 68.8 5 10 22.0 70.0 99 20 21.0 72.0 4 74.9 1 Qty 11 20.0 Qty Google news at 1:46am EST Oct 27: Will Karl Rove be indicted? •Rove critics again turn up the volume New York Daily News - Oct 27 1:18 AM With rampant rumors of a soon-to-drop indictment in Special Counsel Patrick Fitzgerald 's CIA leak investigation, the Karl Rove literary business is booming. •Rove's Last Campaign Washington Post - Oct 26 11:31 AM Will Karl Rove, architect of President Bush's improbable political career, snatch one last victory from the jaws of defeat? (Or at least avoid getting indicted?) Something appears to have provoked special prosecutor Patrick J. Fitzgerald into a last-minute flurry of activity centered............ •Leak Counsel Is Said to Press on Rove's Role New York Times - Oct 25 7:25 PM Three days before the grand jury is set to expire, Patrick Fitzgerald appeared to be trying to determine Karl Rove's role in the outing of a C.I.A.'s officer's identity. •Libby, Rove Await Indictment Decisions By Martin Sieff, UPI Senior News Analyst Washington DC (UPI) Oct 25, 2005 Space War - Oct 26 9:53 PM Washington seethed with rumors and speculation Tuesday night on the eve of the expected announcement of possible indictments in the Valerie Plame CIA leak probe. Current (3/15) “prices” of Scooter Libby pardon Legal - I. Lewis Libby Contract Bid Ask Last Vol Chge I. Lewis (Scooter) Libby Pardon LIBBY.DEC 07.PARDO N I.Lewis Libby to be pardoned by 31 Dec 2007 M 10.0 17.0 9.5 1012 0 LIBBY.EOT .PARDON I.Lewis Libby to be pardoned by the end Mar 16 - 3:18AM GMT of President Bush's term in office M 62.0 63.2 63.2 948 -0.2 V Future of computational models of decision in Economics @ the Individual level • It will look like theoretical neuroscience • Focus on modeling the neural and psychological processes involved in decision-making • Modeling constraints provided by neural, psychological, and behavioral data • Models will be tested with techniques such: - fMRI - electrophysiology - TMS - eyetracing - behavioral predictions @ the firm and market levels • Will build on the properties of the individual level models • Model the interactions of many agents • Goal will be to improve our understanding of: - auctions - price formation in markets - financial markets dynamics - macroeconomic performance and policy