Chapter 3 - New River Community College

advertisement

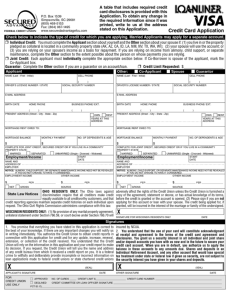

Chapter 3 Credit Cards Ken Long New River Community College Dublin, VA 24084 http://www.nr.cc.va/fin107 1 Should I switch to a lower rate credit card? Maybe No Not if the new card uses the two-cycle method of interest calculation 2 What are the two interest calculation methods? Average daily balance Two-cycle 3 What is the Average Daily Balance method? Interest at time of billing is calculated by adding up the interest charges for each day of a 25 day cycle 4 With an interest of 18% and a balance of $1,500 the interest the first day is? $1,500 x .18 = $270 $270/360 = .75 5 What is the interest the second day of the cycle? $1,500 + .75 = $1,500.75 $1,500.75 x .18 = $270.14 $270.14 / 360 = .75 6 What is the interest the third day of the cycle? $1,500.75 + .75 = $1,501.50 $1,501.50 x .18 = $270.27 $270.27 / 360 = .75 7 How much interest will I owe at the end of the cycle? $22.50 8 How does the twocycle method work? Each billing cycle is two months instead of one month despite monthly billing 9 Suppose I owe $1,500 and pay $500, what is my balance the second month? With the average daily balance method $1,000 10 Suppose I owe $1,500 and pay $500, what is my balance the second month? With the two-cycle method $1,500 11 All else being equal, what is the difference? You will pay about twice as much with the two-cycle method on any balance carried over 12 Which credit card company uses the two-cycle method? The Discover Card Some MasterCards and VISA as well 13 What is a time tiered interest calculation? The interest rate is different for old purchases and new purchases 14 What are new purchases? Purchases made in the current billing cycle and previous are considered new 15 What are old purchases? Purchases made more than two billing cycles ago and carried forward are old 16 What is the difference in interest rates? Typically new purchases 9.9% and for old prime + 9.9% 17 What is the name of this credit card? Prime Option MasterCard 18 Does it make any difference when I pay my bill as long as it is paid on time? Yes Every day the bill is not paid you owe another day of interest 19 What is a grace period? That time which you are not charged interest on a purchase 20 Do I have a grace period if I carry over a balance from month to month? NO! A grace period applies only if you start the month with a zero balance 21 Is there a credit card that always gives me a grace period? American Express Optima True Grace Card 22 Why should I pay off my balance each month? To take advantage of the grace period and to avoid interest and possibly other charges 23 Is a low minimum payment a good thing? NO! The lower the monthly payments you make the longer and the more interest you will pay 24 Sometimes I can skip payments without penalty, is this a good thing? NO! Interest charges continue to be accrued each day 25 How do credit cards make money? 26 Charging retail store owners a percentage of every purchase made with their card Penalty fees Annual fee Interest 27 How do I compare different credit cards? 28 Cash advance fees Penalty fees Fixed or variable interest rate Billing method Annual fee 29 What are some perks that go along with credit cards? 30 Insurance Flight and hotel arrangements Guarantees Record keeping Convenience 31 How do I qualify for a low interest rate credit card? 32 Close any accounts not needed Pay down high balances Be careful not to have a high debt to income ratio Do not mention consolidation Apply to no more than 2 card companies in any 6 month period 33 What are some tips in using credit cards? 34 Beware insurance's Switch to a lower interest rate Avoid impulse buying Mail payments as soon as you can Keep track of purchases in checkbook - avoid double spending Pay off balance in full each month Use short term savings account 35 Why should I mail my payments in promptly? If you carry over a balance, the sooner you make a payment the more money you save 36 What is double spending? When you charge something but feel like you still have the money - you spend the money again 37 How do I avoid double spending? Subtract from your checkbook any money spent when using your credit card if you plan to pay it off with the next bill 38 How can I use my short term savings account? For any unusual or large outlays that you plan to pay off, take the money from your short term savings 39 What is impulse buying? The feeling that you are using play money 40 Should I feel a loyalty to my credit card company? NO! Never hesitate to cancel a card if another card can give you a better deal 41 Are the insurance's that come with a card a good thing? That all depends! Usually they are much more expensive than the same insurance coverage elsewhere 42 Can I challenge a rate increase? Yes! Some card companies will offer you a lower rate if you ask 43 I have a credit card with my ex-spouse, am I liable for all charges made? Yes! If your ex-spouse does not pay - you must pay or be sued and suffer a bad credit report 44 END 45