Slides to the speech

advertisement

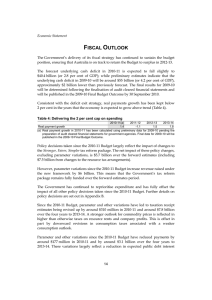

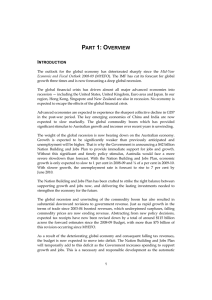

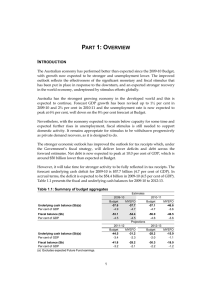

Weak international public finances and Swedish monetary policy Deputy Governor Karolina Ekholm Figure 1. Gross debt in advanced and emerging economies Per cent of GDP 130 130 Advanced economies M ajor advanced economies (G7) Emerging & Developing Economies 120 120 110 110 100 100 90 90 80 80 70 70 60 60 50 50 40 40 30 30 92 94 96 98 00 02 04 Note. Broken lines represent IMF’s forecast October 2010. 06 08 10 12 14 Source: IMF Figure 2. Fiscal policy and the economic cycle in the euro area 1992-2009 Annual change in general government structural balance, per centage points of GDP 3 Pro-cyclical fiscal policy: Counter-cyclical fiscal policy: Tighter fiscal policy, weak economy Tighter fiscal policy, strong economy 2 1 0 2008 -1 2009 -2 Counter-cyclical fiscal policy: Pro-cyclical fiscal policy: Expansionary fiscal policy, weak economy Expansionary fiscal policy, strong economy -3 -4 -3 -2 -1 0 1 2 3 4 Output gap, per cent of potential GDP Note. Regression refers to the years 1992-2007. Source: IMF Figure 3. Debt increase in G7 countries 2008-2010 Financial sector support (12% ) Discretionary fiscal policy (16% ) Automatic stabilizers and other effects of lower growth (72% ) Source: IMF Figure 4. Austerity according to the IMF Change in cyclically adjusted primary balance, per cent of GDP 10 8 8 6 6 4 4 2 2 0 0 Fin lan d Ge rm an y Sw ed en 10 Ita ly 12 Sp ain Fra nc Ne e the rla nd s Po rtu ga l Ca na da Au str ia Be lgi um De nm ark 12 Un US ite A dK ing do m 14 Ja pa n Ire lan d 14 Note: Austerity refers to the improvement in the cyclically adjusted primary balance needed between 2010 and 2020 to reach a gross debt level of 60% (or stabilize debt at a lower level) until 2030. The scenario targets a net debt level of 80% for highly indebted Japan. Source: IMF Figure 5. Comparison of recovery in Sweden, the euro area and USA GDP level, index 2007 quarter 4 = 100 110 110 USA 108 108 Euro area 106 106 Sweden 104 104 102 102 100 100 98 98 96 96 94 94 92 92 07 08 09 10 Note. The quarter prior to the recession breaking out in the USA = 100. 11 12 13 Sources: Bureau of Economic Analysis, Eurostat, SCB, the Riksbank Figure 6. Swedish exports to different parts of the world Exports of goods 2009 Q3 - 2010 Q2, per cent Rest of the world (1,5% ) Asia (11,8% ) South America (2,4% ) Euro area (37,6% ) North America (8,3% ) Africa (3,3% ) Other European countries (34,7% ) Source: Statistics Sweden Figure 7. Spreading effects Europe Tighter fiscal policy Households and companies Lower demand from companies and households Sweden Households and companies Central bank Changes in asset prices, exchange rates etc More expansionary monetary policy in the troubled country The Riksbank Figure 8. Monetary policy expectations Per cent 4 4 Forward rates Euro area Forward rates USA Forward rates UK The Riksbank's TCW-weighted policy forecast TCW-weighted forward rates based on market rates abroad 3 3 2 2 1 1 0 0 09 10 11 12 Note: Forward rates have been adjusted for risk premiums and describe the expected overnight rate. 13 Sources: Reuters EcoWin and the Riksbank Figure 9. Alternative repo rate paths, CPIF, CPI and unemployment in different alternatives Foreign interest rates according to market listings a. Repo rate Per cent 4 4 3 c. CPIF Annual percentage change 3 3 2 2 1 1 3 2 2 1 1 0 0 10 11 12 0 13 0 10 b. CPI 11 12 13 d. Unemployment Annual percentage change Per cent 3 9 2 2 8 8 1 1 7 7 0 6 3 0 10 Outcome Main scenario 11 12 13 Market rates abroad Lower policy rate with no initial increase 9 6 10 11 12 13 Sources: Statistics Sweden and the Riksbank