Powerpoint Slides

advertisement

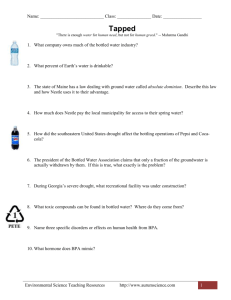

The Water Bottle Market in the United States Greta Fails and Ludovic Rajibe Experimental Economics 488 Fall 06 Overview of the Bottled Water Industry The cost of bottled water compared to other products: Cost of a gallon of gasoline : $3.19 Cost of a gallon of milk : $2.99 Cost of a gallon of Fiji water : $ 9.46 Cost of a gallon of tap water: $0.01 3.7854118 liters/gallon, Fiji is $2.50/liter Revenues from Bottled Water • The market has been expanding exponentially • 154 billions liters sold worldwide in 2004 • Revenue of $26 billion in the US • Sales increase 7% annually sales/millions of gallons Un i te d 30 25 sales/millions of gallons 20 15 gallons pre capita Sp ai n Fr an ce ly Ita na 10 Ch i St at es 8,000.00 7,000.00 6,000.00 5,000.00 4,000.00 3,000.00 2,000.00 1,000.00 0.00 gallons per capita 5 0 2001 2002 2003 2004 2005 Types of Bottled Water There are three main types of bottled water: • Natural mineral water - which is found underground and which is characterized by a constant level of minerals • Spring water - is obtained from underground water that flows naturally to the surface • Purified water - can come from any source, including spring water, well water, seawater, or municipal water. This source water is then processed and purified. Purified water contains no dissolved solids. Water quality in the US is regulated by the Food and Drug Administration. Major Categories of Bottled Water Distributors • • Firms that sell a particular brand like Evian and Fiji Soft drink companies like Pepsi and Coca Cola that have entered the market – Coca Cola sells bottled water under the Dasani brand name and Pepsi under the AquaFina brand Market for Bottled Water • • 54 % of Americans drink bottled water More than half of the bottled water consumed is purified water (basically filtered tap water) gender classification of buyers age classification 9% 19% 18-24 Years Old 14% 42% 58% 25-34 Male 35-44 Female 45-54 19% 19% 55-64 65 and older 20% What drives the sales of bottled water in the US market? • • • • Taste Perceived quality differential between tap and bottled water Health reasons – less calories than soda Convenience and availability – sold in every store Hypothesis • Taste is the main driving factor behind the sales of bottled water. • People buy bottled water that tastes the best. • Within their budget limit, people are going to buy the bottle of water that tastes the best. Predictions • The majority of customers will claim that the most expensive bottled water tastes the best. • Tap water, which is free, will be perceived as the worst. Experiment • The experiment was divided into two parts: • A branded taste test and a blind taste test • In the branded test, students were given 5 types of water and asked to taste and compare them. They knew the brand of the water they were tasting as they completed questionnaires. • In the blind test, students repeated the same experiment, but this time were not told the identity of the water they tasted. Their answers to the questionnaire in this round were based on taste alone. Results – Question 1: Tasting a Difference BRANDED ID# NO BLIND YES NO ID# YES 14 2 8 3 7 15 1 9 3 7 17 4 6 4 6 19 0 10 3 7 21 5 5 4 6 23 2 8 1 9 24 4 6 4 6 26 6 4 4 6 28 0 10 1 9 31 1 9 1 9 35 3 7 1 9 37 3 7 3 7 39 0 10 3 7 41 4 6 0 10 Tot 35 105 35 105 PS/E PS/D PS/T PS/F E/D E/T E/F D/T D/F T/F 14 Y/Y Y/N N/N Y/Y Y/Y Y/Y N/Y Y/N Y/Y Y/Y 30% 15 Y/Y Y/N Y/Y Y/Y Y/Y Y/Y Y/Y Y/N N/N Y/Y 20% 17 Y/Y Y/N N/Y Y/N N/Y Y/N N/Y Y/Y N/N Y/Y 60% 19 Y/Y Y/N Y/Y Y/N Y/Y Y/Y Y/Y Y/Y Y/N Y/Y 30% 21 N/Y N/N N/Y N/N Y/N Y/Y N/Y Y/Y Y/N Y/Y 50% 23 Y/Y Y/Y Y/Y Y/Y N/Y Y/N Y/Y Y/Y Y/Y Y/N 30% 24 N/Y N/N Y/Y Y/N N/Y Y/N Y/Y Y/Y Y/N N/Y 60% 26 N/Y N/Y Y/N N/N N/Y Y/N N/Y Y/Y N/N Y/Y 60% 28 Y/Y Y/Y Y/Y Y/Y Y/Y Y/Y Y/N Y/Y Y/Y Y/Y 10% 31 Y/Y Y/Y Y/Y Y/Y Y/N Y/Y Y/Y Y/Y N/Y Y/Y 20% 35 N/Y Y/Y Y/Y Y/Y N/Y Y/N Y/Y Y/Y N/Y Y/Y 40% 37 N/Y Y/N Y/N Y/N N/Y Y/Y N/Y Y/Y Y/Y Y/Y 60% 39 Y/Y Y/N Y/N Y/Y Y/Y Y/Y Y/Y Y/Y Y/N Y/Y 30% 41 N/Y Y/Y Y/Y N/Y Y/Y Y/Y N/Y N/Y Y/Y Y/Y 40% Analysis: Question 1 – Tasting a Difference On average… Participants were able to taste a difference 2/3 of the time This statistic was consistent across the tests Yet, on the individual level… 39% of responses switched between rounds No single person’s answers remained consistent Participants switched anywhere from 10%-60% of their responses Significance of the switches (YES to NO, and NO to YES) Results: Question 2 – Ranking Preferences ID# 14 15 17 19 21 23 24 26 28 31 35 37 39 41 POLAND 5 5 5 1 2 1 1 3 4 3 2 4 4 2 EVIAN 4 3 3 4 4 2 1 1 2 1 3 2 2 3 DASANI 1 2 2 2 5 2 1 3 3 4 4 3 3 5 TAP 2 4 4 5 3 5 4 5 5 5 5 5 5 4 FIJI 3 1 1 3 1 4 5 2 1 2 1 1 1 1 POLAND (E) 1 3 3 3 5 2 1 3 3 3 5 1 3 1 EVIAN (D) 2 1 4 4 1 4 5 4 5 1 3 5 5 5 DASANI (B) 3 2 1 1 3 2 1 2 1 4 4 3 1 3 TAP (C ) 5 4 5 5 4 5 4 5 2 5 1 4 1 4 FIJI (A) 4 5 2 2 2 1 1 1 4 2 2 2 4 2 Analysis: Question 2 – Ranking Preferences Branded Test Rankings 1. 2. 3. 4. 5. Fiji Evian Dasani Poland Spring Tap Blind Test Rankings (1.9) (2.5) (2.9) (3.0) (4.4) 1. 2. 3. 4. 5. Dasani Fiji Poland Spring Evian Tap (2.2) (2.4) (2.6) (3.5) (3.9) Preferences differ between tests, providing evidence that taste is not the only factor at work Range of average ranks Only one person maintained the same rankings between tests 36% of participants changed all their rankings 93% changed at least 2 rankings 62% of all rank changes were greater than a 1 rank difference (switch from a 5 to a 3 or better) Results: Question 3 – Identification Number of individuals who correctly identified the brand CORRECT RESPONSE 14 15 17 19 21 23 24 26 28 31 35 37 39 41 POLAND E C A C A D A E E C E B C C A 3 EVIAN D D E E D B B A A A D C A A B 3 DASANI B A B A B E E B D E B A B B D 6 TAP C B C D C C C C C D C E D E C 9 FIJI A E D B E A D D B B A D E - E 2 1 1 0 3 2 1 3 2 0 5 0 1 1 1 Number of correct responses Analysis: Question 3 – Identification Only one person able to correctly identify all the cups Tap and Dasani were easiest to identify (~50% correct responses) Fiji, Evian, and Poland Spring only identified 15%-20% of the time Able to identify the extremes but unable to delineate the middle Conclusions Inconsistencies across students’ responses provide evidence that taste preferences are not solidified and that students’ in fact claim to prefer brands when they actually rank others higher Taste differences are negligible and unidentifiable The influence of the brand name, and all that it connotes, is the driving factor when purchasing