Contemporary World History

advertisement

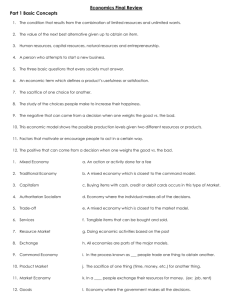

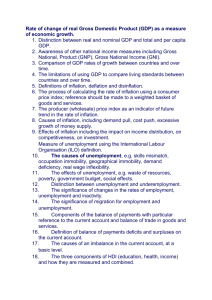

Economics Final Review Part 1 Basic Concepts 1. The condition that results from the combination of limited resources and unlimited wants. 2. The value of the next best alternative given up to obtain an item. 3. Human resources, capital resources, natural resources and entrepreneurship. 4. A person who attempts to start a new business. 5. The three basic questions that every society must answer. 6. An economic term which defines a product’s usefulness or satisfaction. 7. The sacrifice of one choice for another. 8. The study of the choices people make to increase their happiness. 9. The negative that can come from a decision when one weighs the good vs. the bad. 10. This economic model shows the possible production levels given two different resources or products. 11. Factors that motivate or encourage people to act in a certain way. 12. The positive that can come from a decision when one weighs the good vs. the bad. 1. Mixed Economy a. An action or activity done for a fee 2. Traditional Economy b. A mixed economy which is closest to the command model. 3. Capitalism c. Buying items with cash, credit or debit cards occurs in this type of Market. 4. Authoritarian Socialism d. Economy where the individual makes all of the decisions. 5. Trade-off e. A mixed economy which is closest to the market model. 6. Services f. Tangible items that can be bought and sold. 7. Resource Market g. Doing economic activities based on the past 8. Exchange h. All economies are parts of the major models. 9. Command Economy i. In the process known as ___ people trade one thing to obtain another. 10. Product Market j. The sacrifice of one thing (time, money, etc.) for another thing. 11. Market Economy k. In a ____ people exchange their resources for money. (ex: job, rent) 12. Goods l. Economy where the government makes all the decisions. Part 2 Supply and Demand 1. This Law says that sellers will offer more at higher prices and less at lower prices. 2. Two goods that are consumed together, like peanut butter and jelly. 3. The tendency for consumers to substitute a lower priced good for a higher priced good. 4. A chart of the quantities of a good or service that will be purchased at each price. 5. The idea that your satisfaction from consuming an item begins to decrease as you have more of that item. 6. Producers will offer more at higher prices because they want to increase this. 7. Two goods that can be used in place of each other, like butter and margarine. 8. When people buy more or less based on how much money they have. 9. This Law says that buyers will consume more items at lower prices than at higher prices. 10. A chart of the quantities of a good or service that will be sold at each price. 11. The point where anyone not willing to make a deal is removed or cleared from the market. 12. Examples of the Determinants of Demand or Supply. 1. Equilibrium Price a. quantity supplied is greater than the quantity demanded 2. Shortage b. taxes, subsidies or regulations that can affect supply. 3. Demand Curve c. balanced quantity where consumers and producers agree. 4. Environment d. Must have items that can affect demand. 5. PPC e. determinant that says where you live, hot/cold, etc. affects your demand. 6. Equilibrium Quantity f. factors other than price that can affect the demand or supply. 7. Supply Curve g. language of the market system 8. Surplus h. line that slopes upward from left to right. 9. Determinants of S/D i. price where buyers and sellers agree. 10. Government policies j. line that slopes downward from left to right. 11. Prices k. In exists when the quantity demanded is greater than the quantity supplied 12. Fads or Preferences l. Economic model that shows a range of production options. Part 3 Personal Finance 1. determined by taking your assets and then subtracting your liabilities. 2. A percentage of a company’s profits issued to a stockholder. 3. safe investment where you agree to not touch your money for a certain period of time; from 6 months to 5 years. 4. Interest that is calculated only on the original amount. 5. where an individual would go to buy stock in more established companies like General Motors or Nike. 6. If you sell a stock for a higher price than what you purchased it for. 7. borrower’s pledge of an item of value to the lender in order to secure a loan. 8. safe investment that allows you easy access to your money and is insured by the Federal government. 9. The time between when you purchase an item and the number of days that you have to pay it back. 10. interest that is earned on both the principal and the additional interest that the money has earned. 11. If you sell a stock for a lower price than what you purchased it for. 12. Stock trades are conducted by a computer on this exchange. 1. assets a. using a credit card to withdraw money from an ATM 2. Capacity b. a share of ownership in a company. 3. Bull c. decrease in the value of an asset over time. 4. interest d. people are optimistic and believe that the market will increase in value. 5. stock e. resource that an individual or company believe will increase in value. 6. Bear f. the fee for the use of money over time. 7. liabilities g. the debts or obligations that are owed by an individual or company 8. overdraft protection h. an individual’s ability to repay a loan. 9. principal i. people are pessimistic and believe that the market will decrease in value. 10. conditions j. the initial amount borrowed or still remaining on a loan. 11. Cash advance k. money the bank will loan you if you spend more than your credit limit 12. depreciation l. the purpose of the loan, what you are going to purchase with the money. Part 4 Measuring the Economy 1. GDP per capita 2. Underground Economy. 3. .”Black Market” 4. Inflation loser. 5. Civilian Labor Force. 6. Business cycle. 7. Seasonal Unemployment. 8. Recession. 9. Net Exports. 10. Inflation winner. 11. Structural unemployment. 12. “off the books activities” 1. Unemployment rate a. the total value of all finished goods and services in a nation in one year 2. Inflation b. part of GDP that includes exports of goods and services. 3. Consumption (C) c. unemployment that is caused by a downturn in the economy. 4. Investment (I) d. part of GDP that includes spending by all levels of government. 5. Deflation e. decrease in the average price level of all goods and services. 6. Cyclical Unemployment f. percentage of the civilian labor force that is unemployed. 7. CPI g. part of GDP that includes imports of goods and services 8. Government (G) h. measures the average change in prices paid by urban consumers. 9. GDP i. part of GDP that includes spending by businesses. 10. M j. increase in the average price level of all goods and services 11. X k. part of GDP that includes household spending 12. Frictional Unemployment m. unemployment when an individual is looking for their first job Part 5 The Government’s role in the Economy 1. State and local taxes 2. Federal Taxes 3. Progressive tax 4. Regressive tax 5. Flat tax 6. Fiscal policy 7. Monetary policy 8. Federal Reserve 9. Government goods and services 10. Transfer Payments 11. Roles of the Federal Reserve 12. Discount rate 13. Reserve Requirement 14. Open Market Activities 15. Expansion 16. Contraction Part 6 Identity Theft 1. Spam 2. Digital footprint 3. Phishing websites 4. Skimming 5. Pharming 6. Text message scam or Twitter scam 7. P2P File Sharing 8. Spyware 9. Email spoofing 10. Malware 11. Cookies 12. Identify fraud