Civils Previous Questions

advertisement

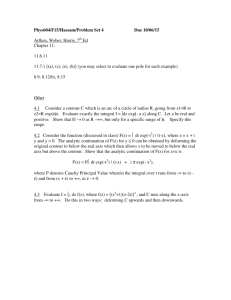

KALAM IAS INSTITUTE CIVILS PREVIOUS PAPERS Agriculture 1. India has experienced persistent and high food inflation in the recent past. What could be the reasons? (2011) a) I only b) 2 only c) Both 1 and 2 d) Neither 1 nor 2 1. Due to a gradual switchover to the cultivation of commercial crops, the area under the cultivation of food grains has steadily decreased in the last five years by about 30%. 4. Consider the following statements: 2. As a consequence of increasing incomes, the consumption patterns of the people have undergone a significant change. 2. The Union Ministry of Consumer Affairs, Food and Public Distribution has launched the National Food Security Mission. (2009) 3. The food supply chain has structural constraints. Which of the statements given above are correct? Which of the statements given above is/are correct? a) 1 and 2 only b) 2 and 3 only c) I and 3 only d) 1, 2 and 3 2. In India, which of the following have the highest share in the disbursement of credit to agriculture and allied activities ? (2011) a) Commercial Banks b) Cooperative Banks c) Regional Rural Banks d) Microfinance Institutions 1. The Commission for Agricultural Costs and Prices recommends the Minimum Support Prices for 32 crops. (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 5. Which of the following pairs about India’s economic indicator and agricultural production (all in rounded figures) are correctly matched? (2008) 1. GDP per capita (current prices): Rs 37,000 2. - Rice: 180 million tons 3. Wheat: 75 million tons 3. Consider the following statements: (2010) 1. The Union Government fixes the Statutory Minimum Price of sugarcane for each sugar season. 2. Sugar and sugarcane are essential commodities under the Essential Commodities Act. Which of the statements given above is/are correct? Select the correct answer using the code given below: Codes: a) 1, 2 and 3 b) 1 and 2 only c) 2 and 3 only d) 1 and 3 only Explanations 1. b. Exp: Though there is pressure on agricultural land, but the area has not declined by 30 percent. In fact, total area under foodgrain crops during the last five years has been between 120 and 124 million hectares. Yearly increase and decrease in various crops can be seen due to weather conditions but overall there is no decline in total cropped area under food segment. Increase in price is due to lower growth rate of production as compared to rising demand. The growth rate of demand has been higher because of rise in income and supply side management constraints. 2. a. Exp: Commercial banks had total outstanding loans of Rs 285,799 crore which is 74% of the total loans given by the three lending institutions- commercial banks, RRBs, and cooperative banks. Microfinance institutions total lending to agriculture and allied activitieswas less than the amount given by the commercial banks. 3. a. Exp:The Central Government fixes the Statutory Minimum Price of sugarcane for each sugar season. Sugar is an essential commodity under the Essential Commodities Act, but not sugarcane. 4. d. Exp: The CACP recommends the support price for 24 crops. The National Food Security Mission is implemented by ministry of agriculture. Ref: Wizard Current Affairs for PT 2009, pg. no. 81 5. c. Exp: Rice production is estimated to be around 95 million tons. Ref: Wizard Current Affairs for Prelim 2008, Pg No. 19. Export & Imports 1. Which one of the following groups of items is included in India’s foreignexchange reserves? (2013) a) Foreign-currency assets, Special Drawing Rights (SDRs) and loans from foreign countries b) Foreign-currency assets, gold holdings of the RBI and SDRs c) Foreign-currency assets, loans from the World Bank and SDRs d) Foreign-currency assets, gold holdings of the RB1 and loans from the World Bank 2. Which of the following would include Foreign Direct investment in India? (2012) 1. Subsidiaries of foreign companies in India 2. Majority foreign equity holding in Indian companies 3. Companies exclusively fmanced by foreign companies 4. Portfolio investment Select the correct answer using the codes given below: (a) 1,2,3and4 (b) 2 and 4 only (c)1 and 3 only (d)1,2 and 3 only 3. Despite having large reserves of coal, why does India import millions of tonnes of coal? (2012) 1. It is the policy of India to save its own coal reserves for future, and import it from other countries for the We sent use. 2. Most of the power plants in India are coalbased and they are not able to get sufficient supplies of coal from within the country. 3. Steel companies need large quantity of coking coal which has to be imported. Which of the statements given above is/are correct? (a) 1 only (b) 2 and 3 only (c) 1 and 3 only (d)1,2 and 3 4. In terms of economy, the visit by foreign nationals to witness the XIX Common Wealth Games in India amounted to (2011) a) Export b) Import c) Production d) Consumption Explanations 1. b. Exp:lndia’s for4gnhange 8ermes comprise Fo.ign Currer, Assets (FCAs), gold, Special Dwiag Rights (SDRs) and Reserve Tranche Position (RTP) in the IMF. 2. d. E.q,: FDI means foreign capital in the form of equity inflow with stake. Portfolio investment (like Fli) has no say in the management. a) 1 and 2 only b) 3 only c) 2 and 3 only d) 1, 2 and 3 2. Among other things, which one of the following was the purpose for which the Deepak Parekh Committee was constituted? (2009) (a) To study the current socio-economic conditions of certain minority communities (b) To suggest measures for financing the development of infrastructure (c) To frame a policy on the production of genetically modified organisms (d) To suggest measures to reduce the fiscal deficit in the Union Budget Miscellaneous 1. To obtain full benefits of demographic dividend, what should India do? (2013) 3. b. a) Promoting skill development 4. a. Exp: Any visit of foreigners mean utilization of our goods and services during their stay in the country and they will be paying for these goods and services. This is exports of goods and services and in the process earning of foreign exchange. Infrastructure 1. The SEZ Act, 2005 which came into effect in February 2006 has certain objectives. In this context, consider the following: (2010) b) Introducing more social security schemes c) Reducing infant mortality rate d) Privatization of higher education 2. Economic growth in country X will necessarily have to occur if (2013) a) there is technical progress in the world economy b) there is population growth in X c) there is capital formation in X 1. Development of infrastructure facilities 2. Promotion of investment from foreign sources 3. Promotion of exports of services only Which of the above are the objectives of this Act? d) the volume of trade grows in the world economy 3. The Multi-dimensional Poverty Index developed by Oxford Poverty and Human Development Initiative with UNDP support covers which of the following? (2012) 1. Deprivation of education, health, assets and services at household level 2. Purchasing power parity at national level 3. Extent of budget deficit and GDP growth rate at national level Select the correct answer using the codes given below: a) 1 only b) 2 and 3 only c) 1 and 3 only d) 1, 2 and 3 4. Consider the following specific stages of demographic transition associated with economic development (2012) 1. Low birthrate with low death rate 2. High birthrate with high death rate 3. High birthrate with low death rate Select the correct order of the above stages using the codes given below: a) 1,2,3 b) 2,1,3 c) 2,3,1 d) 3,2,1 5. Which of the following can aid in furthering the Government’s objective of inclusive growth? (2011) b) deficit financing takes place c) only exports take place d) neither exports nor imports take place 7. With what purpose is the Government of India promoting the concept of “Mega Food Parks”? (2011) 1. To provide good infrastructure facilities for the food processing industry 2. To increase the processing of perishable items and reduce wastage. 3. To provide emerging and eco-friendly food processing technologies to entrepreneurs. Select the correct answer using the codes given below: a) 1 only b) 1 and 2 only c) 2 and 3 only d) 1,2 and 3 8. Microfinance is the provision of financial services to people of low-income groups. This includes both the consumers and the self-employed. The service/services rendered under microfinance is/are: (2011) 1. Credit Facilities 2. Saving Facilities 1. Promoting Self-Help Groups 3. Insurance Facilities 4. Fund Transfer Facilities 2. Promoting Micro, Small and Medium Enterprises Select the correct answer using the codes given below the lists: 3. Implementing the Right to Education Act a) 1 only b) 1 and 4 only Select the correct answer using the codes given below: c) 2 and 3 only d) 1,2,3 and 4 a) 1 only b) 1 and 2 only c) 2 and 3 only d) 1,2and3 1. The Commonwealth has no charter, treaty or constitution 6. A “closed economy” is an economy in which (2011) a) the money supply is fully controlled 9. Consider the following statements: (2010) 2. All the territories/countries once under the British empire (jurisdictionfiule/mandate) automatically joined the Commonwealth as its members Which of the statements given above is/are correct? human resource creation. All the three are tools to attain inclusive growth. a) 1 only b) 2 only c) Both 1 and 2 d) Neither 1 nor 2 6. d. Exp A closed economy means no relationship (give or take/import and export) from other countries. Explanations 1. a. Exp: Demographic dividend means getting the benefit of high percentage of working age population in the process of economic development. But it is possible only if youth and working age population is skilled and trained to take up economic activities. 2. c. Exp:Technical prcgress in the world may not benefit the country X. Similarly, trade growth in the world economy may not benefit the country X if it is not able to export more. Even growth in population without growth in other resources necessary for growth will not support economic growth. But most likely, capital formation in the country will induce economic activities and economic growth in the country X. 3.a. Exp: The MPI has three dimensions: health, education and standard of living. These three dimensions have been measured using 10 parameters. Each dimension is equally weighted. Each parameter within a dimension is also equally weighted. Education: Each dimension is equally weighted at 1/6. Health: Each indicator is weighted equally weighted at 1/6. Standard of Living: Each indicator is equally weighted at 1/18. 4. c. Exp: In the First phase, it is high birth rate and high death rate. After beginning of the development process, death rate starts declining first and followed by birth rate after some time. 5.d. Exp: All the methods are for helping in employment generation, income generation or 7. d. Exp: The purpose of the mega food parks is to provide infrastructure facilities to a number of units located at one place. The objective is to boost food processing industry in the country to reduce wastage of perishable goods and also make the country competitive in world market on the basis of quality as well as price by the use of latest technologies. 8. d. Exp: Microfinance that is being provided in India right now is concentrated on credit facility only, though the SHG programme of banks are also providing saving facilities with the credit facility. But the wider concept is to provide all the facilities mentioned in the options 9.a. Exp: Conferences of British and colonial Prime Ministers had occurred periodically since 1887, leading to the creation of the Imperial Conferences in 1911 . The formal organisation of the Commonwealth developed from the Imperial Conferences, where the independence of the self-governing colonies and especially of dominions was recognised. Thus, present Commonwealth has not been created out of any treaty, charter or constitution. Among the fomer British protectorates and mandates, those that never became members of the Commonwealth are Egypt, Iraq, Transjordan, Palestine, Sudan, Kuwait Bahrain, Oman ,Qatar, and the United Arab Emirates. National Income 1. The national income of a country for a given period is equal to the (2013) a) total value of goods and services produced by the nationals b) sum of total consumption and investment expenditure options give half the definition each. But out of the two possible answers, (a) is more probable. c) sum of personal income of all individuals 2. d. 2. In the context of Indian economy, consider the following statements: (2011) 3. b. Exp: With the growth of the economy, there is increase in employment and income levels. This increases demand in the economy and there is demand pull inflation in a growing economy. 1. The growth rate of GDP has steadily increased in the last five years. 2. The growth rate in per capita income has steadily increased in the last five years. Which of the statements given above is/are correct? a) 1 only b) 2 only c) Both 1 and 2 d) Neither 1 nor 2 3. Economic growth is usually coupled with (2011) a) Deflation b) Inflation c) Stagflation d) Hyperinflation d) money value of final goods and services produced 4. With reference to Indian economy, consider the following statements: (2010) 1. The Gross Domestic Product (GDP) has increased by four times in the last 10 years 2. The percentage share of Public Sector in GDP has declined in the last 10 yearsWhich of the statements given above is! are correct?• 4.b. Exp:GDP in 2000-01 was Rs 19.2 lakh crore which increased to Rs 58 lakh crore in 2009-10. Wth 6.7% growth rate in 2009-10, it is nearly three times the GDP in 2000-01. With the rapid growth of the private sector after 1991, the share of public sector in GDP has gone down. Programmes 1. With reference to National Rural Health Mission, which of the following are the jobs of ‘ASHA’, a trained conununity health worker? (2012) I. Accompanying women to the health facility for antenatal care checkup 2. Using pregnancy test kits for early detection of pregnancy 3. Providing information on nutrition and immunization 4. Conducting the delivery of baby a) 1 only b) 2 only Select he correct answer using the codes given below: c) Both 1 and 2 d) Neither I nor 2 a) 1, 2 and 3 only b) 2 and 4 only c) 1 and 3 only d) 1,2,3 and 4 Explanations 1 . a. E,p: National income of a country is the money value of all final goods and services produced by the nationals. In the question, options (a) and (d) may be correct but both the 2. The endeavour of ‘Janani Suraksha Yojana’ Programme is (2012) 1. to promote institutional deliveries 2. to provide monetary assistance to the mother to meet the cost of delivery 3. to provide for wage loss due to pregnancy and confinement Which of the statements given above is/are correct? (a) 1 and 2 only (b) 2 only (c) 3 only (d)1,2 and 3 3. How does the National Rural Livelihood Mission seek to improve livelihood options of rural poor? (2012) 1. By setting up a large number of new manufacturing industries and agribusiness centres in rural areas 2. By strengthening ‘self-help groups’ and providing skill development 3. By supplying seeds, fertilizers, diesel pumpsets and micro-irrigation equipment free of cost to farmers Select the correct answer using the codes given below: a) 1 and 2 only b) 2 only c) 1and 3 only d) 1,2 and 3 4. Consider the following: (2012) 1. Hotels and restaurants 5. How do !)istrict Rural Development Agencies (DRDAs) hem in the reduction of rural poverty in India? (2012) 1. DRDAS act as Panchyati Raj Institutions in certain Specified backward regions of the country 2. DRDAs undertake area-specific scientific study of the causes of poverty and malnutrition and prepare detailed remedial measures. 3. DRDAs secure inter-sectoral and interdepartmental coordination and cooperation for effective implementation of anti-poverty programmes. 4. DRDAS watch over and ensure effective utilization of the thnds intended for anti-poverty programmes: given above is/are correct? (a) ,2 and 3 only (b) 3 and 4 only (c) 4 only (d) 1, 2, 3 and 4 Which of the statements 6. Among the following who are eligible to benefit from the “Mahatma Gandhi National Rural Employment Guarantee Act”? (2011) a) Adult members of only the scheduled caste and scheduled tribe households b) Adult members of below poverty line (BPL) households 2. Motor transport undertakings c) Adult members of house holds of all backward communities 3. Newspaper establishments d) Adult members of any household 4. Private medical institutions 7. An objective of the National Food Security Mission is to increase the production of certain crops through area expansion and productivity enhancement in a sustainable manner in the identified districts of the country What are those crops? (2010) The employees of which of the above can have the ‘Social Security’ coverage under Employees’ State Insurance Scheme? (a) 1,2 and 3 only (b) 4 only (c)1,3 and 4 only (d)1,2,3 and 4 a) Rice and wheat only b) Rice, wheat and pulses only c) Rice, wheat, pulses and oil seeds only d) Rice, wheat, pulses, oil seeds and vegetables 8. With reference to the schemes launched by the Union Government, consider the following statements: (2009) 1. Ministry of Health and Family Welfare launched the Rashtriya Swasthya Bima Yojana. 2. Ministry ofTextiles launched the Rajiv Gandhi Shilpi Swasthya Bima Yojana. Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 Explanations 1. a. Exp:ASHA is not trained to conduct the delivery of baby. 2.a. Exp: Janarii Suraksha Yojana Programme is to promote institutional deliveries and to provide monetary assistance to the mother to meet the cost of delivery. 3. a. Exp: NRLM may have twofold strategy for poverty alleviation and rural prosperity. In the first stage of 4 to 5 years, NRLM may totally focus on promoting SHGs and SHG federations and financial inclusion. In the second stage the SHG federations may be assisted to promote livelihood organizations such as commodity cooperatives, producer companies, etc 4.d. Exp: The ESI Act applies to any premises/precincts, where 10 or more persons are employed. The “appropriate Government” State or Central is empowered to extend the provisions of the ESI Act to various classes of establishments, industrial, commercial, agricultural orotherwise in nature. Under these enabling provisions, most of the State Governments have extended the ESI Act to certain specific classes of establishments, such as, Medical and Educational Institutes, shops, hotels, restaurants, cinemas, preview theatres, motor transport undertakings, newspaper and advertising establishments etc., employing 10 or more persons. 5.b. Exp: DADA cannot act as PRI under any circumstances, nor they are the implementing agencies. 219. d. Exp Adult members of all rural households are eligible for benefit under the MGNREGA, provided they are registered with the village panchayat and have job cards issued. 6. b. Exp:The target is to increase production of rice, wheat and pulses by 10, 8 and 2 million tones respectively. 7. d. Exp:Rashtriya Swasthya Bima Yojana was launched by ministry of Labour and Employment. Rajiv Gandhi Shilpi Swasthya Bima Yojana was launched by Commissioner of Handicrafts. 8. d. Exp:Rashtriya Swasthya Bima Yojana was launched by ministry of Labour and Employment. Rajiv Gandhi Shilpi Swasthya Bima Yojana was launched by Commissioner of Handicrafts. Reforms & Liberalisation 1. In the last one decade, which one among the following sectors has attracted the highest Foreign Direct Investment inflows into India? (2004) a) Chemicals other than fertilizers b) Services sector c) Food processing d) Telecommunication 2. Consider the following statements: (2004) 1. The Oil Pool Account of Government of India was dismantled with effect from 1 April 2002 2. Subsidies on PDS kerosene and domestic LPG are borne by Consolidated Fund of India 3. An expert committee headed by Dr RA Mashelkar to formulate a national auto fuel policy recommended Lhat Bharat State-il Emission Norms should be applied throughout the country by 1 April, 2004 Which of the statements given above are correct? c) Both 1 and 2 d) Neither 1 nor 2 5. The Government holding in BPCL is (2003) a) more than 70% b) between 60% and 70% c) between 50% and 60% d) less than 50% 6. Consider the following statements: (2002) a) land2 c) land3 The objectives of the National Renewal Fund set up in b) 2and3 d) l,2and3 February 1992 were 3. Consider the following statements: (2003) 1. The maximum limit of shareholding of Indian promoters in private sector banks in India is 49% of paid up capital. 1. to give training and counselling for workers affectd by retrenchment or VRS. 2. redeployment of workers Which of these statements is/are correct? 2. Foreign Direct Investment upto 49 per cent from all sources is permitted in private sector banks in India under the automatic route. a) Neither 1 nor.2 b) Both I and 2 c) 1 only d) 2 only Which of these statements is/are correct? 7. With reference to Power Sector in India, consider the following statements: (2002) a) Only 1 c) Both 1 and b) Only 2 d) Neither 1 nor 2 4.With reference to Government of India’s decisions regarding Foreign Direct Investment (FDI) during the year 200 1-02, consider the following statements: (2003) 1. Out of the 100% FDI allowed by India in tea sector, the foreign firm would have to disinvest 33% of the equity in favour of an Indian partner within four years. 2. Regarding the FDI in print media in India, the single largest Indian shareholder should have a holding higher than 26%. Which of these statements is/are correct? a) Only I b) Only 2 1. Rural electrification has been treated as a Basic Minimum Service under the Prime Minister’s Gramodaya Yojana 2. 100 percent Foreign Direct Investment in power is allowed without upper limit 3. The Union Ministry of Power has signed a Memoranda of Understanding with 14 States Which of these statements is/are correct? a) 1 only b) 1 and 2 c) 2 and 3 d) 3 only 8. The largest share of Foreign Direct Investment (1997-2000) went to (2001) a) Food and food-product sector b) Engineering sector 7. Food processing industries (3.72%) c) Electronics and electric equipment sector 8. Drugs and Pharmaceuticals (3.21%) d) Services sector 9. Cement and Gypsum products (2.57%) 9.Which of the following committees examined and suggested Financial Sector reforms? (2001) 10. Metallurgical industries (2.13%) a) Abid Hussain Committee b) Bhagwati Committee c) Chelliah Committee d) Narasimham Committee 10. Economic liberalisation in India started with (2000) a) substantial changes in industrial licensing policy b) the convertibility of Indian rupee c) doing away with procedural formalities for foreign direct investment d) significant reduction in tax rates Explanations 1. d. Exp: Sectors attracting highest FDI during August 1991 to September 2005, in their descending order are as follows: 1. Electrical equipments (including computer software and electronics) (16.62%) 2. Transportation Industry (10.39%) 3. Telecommunications (radio paging, cellular mobile, basic telephone services) (9.60%) 4. Services Sector (Finance and non-financial) (9.53%) 5. Fuels (Power + oil refinery) (8.49%) 6. Chemicals (other than ftrtilizers) (5.92%) 2. a. Exp: The oil pool acccunt has been wound up with effect from 01 .04.2002. The Government of India Issued (on 30th March 2002) 6.96 per cent oil companies’ Government of India special bonds 2009 amounting to 9000 crore, to the Oil Companies in lieu of a part of the estimated outstanding claims of the Oil Companies on the oil coordination committee as on March 31, 2002. The balance outstanding of the oil companies will be liquidated subsequently by issue of further special government bonds. As per “PDS Kerosene and Domestic LPG subsidy scheme 2002”, a flat rate of subsidy per selling unit was approved to be given to public sector Oil Marketing companies. This subsidy was equal to the difference between the cost price and the issue price per selling unit as on March 31,2001 and was tobe phased out in three to five years. The Oil Marketing companies were to adjust the retail selling prices of these products in line with international prices during the year. In order to compensate the public sector oil marketing companies on account of their mounting under recoveries, over and above the amount allowed as direct subsidy, budget 2005-06 provided an additional Rs 5750 crore oil bonds. Bharat stage II norms were to be applied from April 2005. 3. b. Ref:lndia Year Book 2003 4. b. Exp:The compulsory disinvestments required is 26% in favour of Indian partner within 5 yrs. Ref: Wizard Current Affairs for Prelim 2003 5. b Exp: After acquisition of two Burma-shell companies in January 1976, the name of Burma-shell Refineries Limited was changed to Bharat Refineries Limited on February 12, 1976. The name of company was changed to Bharat Petroleum Corporation Limited (BPCL) from August 1,1977 as it was a integrated refining and marketing company. The company is engaged in processing of crude oil in its refinery at Mumbai and storage, distribution and marketing of petroleum products in the country. The government holding in BPCL is between 60% and 70%. 6. c. Exp: NRF was to provide resou,es for employment generation schemes in both the organised and unorganized sectors. It had 3 component: Employment Generation Fund, the National Renewal Grant Fund to deal with RVS and the Insurance Fund for Employees to cater compensation needs of the employees in future. It was abolished in August 2000. 7.b. E’p:PM’s Gramodaya Yojana deals in health, primary education, drinking water, housing, rural roads. In power sector there is no upper limit for FDI. Ref: India Year Book 2002. 8. b. Exp: In 2000, the largest share of FDI went to engineering sector to the tune of around 30% of total FDI. During 2005-06, maximum FDI was attracted by Electrical Equipments (including computer software and electronics) to the tune of around 16.62% of the total FDI. 9. d. Exp: Narasimham committee was constituted on August 14, 1999 to advise on financial reforms in Banking Sectors. Abid Hussein Committee — on small scale industries. Chelliah Committee — Tax Reforms 10. a. Eo:The BoP crisis of 1991-92 forced the government open up the Indian economy. It first made substantial changes in industrial licensing to attract foreign capital to ensure capital for development. Ref.Datta-Sundaram Employment 1. Disguised means (2013) unemployment generally a) large number of people remain unemployed b) alternative employment is not available c) marginal productivity of labour is zero d) productivity of workers is low 2. Consider the following statements in respect of the National Rural Employment Guarantee Act, 2005 : (2006) 1. Under the provisions of the Act, 100 days of employment in a year to every household whose adult members volunteer to do unskilled manual work has become a fundamental right. 2. Under the provisions of the Act, women are to get priority to the extent that one-half of persons who are given employment are women who have asked for work. Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 Explanations 1. c. Exp: Disguised unemployment refers to a situation where more people are employed that required. So the extra people are actually not contributing to the work. Technically speaking, their marginal productivity is zero. 2. a. Exp: Pilority to women: Women will get priority and 1 /3rd beneficiaries under the programme are to be women Ref: Pg 56 of Wizard Current Affairs for Prelim 2006. Industry 1. What is/are the recent policy intiative(s) of Government of India to promote the growth of manufacturing sector? (2012) 1. Setting up of National Investment and Manufacturing zones 2. Providing the benefit of ‘single window clearance’ 3. Establishing the Technology Acquisition and Development Fund Select the correct answer using the codes given below: a) 1 only b) 2 and 3 only c) 1 and 3 only d)1,2 and 3 2. Why is the Government of India disinvesting its equity in the Central Public Sector Enterprises (CPSEs)? (2011) 1. The Government intends to use the revenue earned from the disinvestment mainly to pay back the external debt. 2. The Government no longer intends to retain the management control of the CPSEs. Which of the statements given above is/ are correct? a) 1 only b) 2 only c) Both 1 and 2 d) Neither 1 nor 2 3. Which one of the following is not a feature of Limited Liability Partnership firm? (2010) a) Partners should be less than 20 b) Partnership and management need not be separate c) Internal governance may be decided by mutual agreement among partners d) It is corporate body with perpetual succession 4. Consider the following statements: (2009) 1. MMTC Limited is India’s largest international trading organization. 2. Neelachal Ispat Nigam Limited has been set up by MMTC jointly with the Government of Orissa. Which of the statements given above islare correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 5. Which of the following are public sector undertakings of the Government of India? (2008) 1. Balmer Lawrie and Company Ltd. 2. Dredging Corporation of India 3. Educational Consultants of India Ltd. Select the correct answer using the code given below: Code: a) 1 and 2 only b) 2 and 3 only c) 1 and 3 only d) 1,2 and 3 Explanations 1. d. 2. c. Exp:’ Eight Core Industries included in lip are — Cement, Fertilizers. Natural Gas, Refinery products, coal, crude oil, steel and electricity. 3. d. Exp: Since 2004, the declared objective of disinvestment is to increase resources for social sector spending and restructuring of PSEs. The declared policy is to retain the management control and sell only upto 49% equity. 4. a. Exp: Maximum limit of partners is 20 in case of partnership firms and not LLPs. 5. c. Ref. Wizard Current Affairs for PT 2009, pg. no. 128 International Economy 1. Regarding the international Monetary Fund, which one of the following statements is correct? (2011) a) It can grant loans to any country b) It can grant loans to only developed countries c) It grants loans to only member countries d) It can grant loans to the central bank of a country 2. Consider the following actions which the Government can take: (2011) 1. Devaluing the domestic currency. b) Fil helps in increasing capital availability in general, while FDI only targets specific sectors c) FDI flows only into the secondary market, while Fil targets primary market d) FIT is considered to be more stable than FDI 4. In order to comply with TRIPS Agreement, India enacted the Geographical Indications of Goods (Registration & Protection) Act, 1999. The difference/differences between a “Trade Mark” and a Geographical Indication is/are (2010) 1. A Trade Mark is an individual or a cortipany’s right whereas a Geographical Indication is a community’s right 2. A Trade Mark can be licensed whereas a Geograpnical Indication cannot be licensed 3. A Trade Mark is assigned to the manufactured goods whereas the Geographical Indication is assigned to the agricultural goods/products and handicrafts only Which of the statements given above is/are correct? 2. Reduction in the export subsidy. a) 1 only 3. Adopting suitable policies which attract greater FDI and more funds from FlIs. b) 1 and 2 only c) 2 and 3 only d) 1,2 and 3 a) 1 and 2 b) 2 and 3 5. In the context of the affairs of which of the following is the phrase “Special Safeguard Mechanisms” mentioned in the news frequently? (2010) c) 3 only d) 1and 3 a) United Nations Environment Programme Which, of the above action! actions can help in reducing the current account deficit? 3. Both Foreign Direct Investment (FDI) and Foreign Institutional Investor (FlI) are related to investment in a country. Which one of the following statements best represents an important difference between the two? (2011) a) Fli helps bring better management skills and technology, while FDI only brings in capital b) World Trade Organization c) ASEAN- India Free Trade Agreement d) G-20 Summits 6. A great deal of Foreign Direct Investment (FDI) to India comes from Mauritius than from many major and mature economies like UK and France. Why? (2010) a) India has preference for certain countries as regards receiving FDI 10. Stiglitz Commission established by the President of the United Nations General Assembly was in the international news. The commission was supposed to deal with (2010) b) India has double taxation avoidance agreement with Mauritius a) The challenges posed by the impending global climate change and prepare a road map c) Most citizens of Mauritius have ethnic identity with India and so they feel secure to invest in India b) The workings of the global financial systems and to explore ways and means to secure a more sustainable global order d) Impending dangers of global climatic change prompt Mauritius to make huge investments in India c) Global terrorism and prepare a global action plan for the mitigation of terrorism 7. Consider the fdllowing countries: (2010) d) Expansion of the United Nations Security Council in the present global scenario 1. Brazil 11. As regards the use of international food safety standards as reference point for the dispute settlements, which one of the following does WTO collaborate with? (2010) 2. Mexico 3. South Africa According to UNCTAD, which of the above is/are categorized as “Emerging Economies”? a) Codex Alimentarius Commission a) 1only b) 1 and 3 only b) International Federation of Standards Users c) 2 and 3 only d) 1,2 and 3 c) International Organisation for Standardization 8. With reference to BRIC countries, consider the following statements: (2010) 1. At present, China’s GDP is more than the combined GDP of all the three other countries 2. China’s population is more than the combined population of any two other countries Which of the statements given above is/are correct? a) 1 only b) 2 only c) Both 1 and 2 d) Neither 1 nor 2 9. Which of the following is/are treated as artificial currency? a) ADR b) 2 only c) SDR d) Both ADR and SDR d) World Standards Cooperation 12. As a result of their annual survey, the National Geographic Society and an international polling firm GlobeScan gave India top rank in Greendex 2009 score. What is this score? (2010) a) It is a measure of efforts made by different countries in adopting technologies for reducing carbon footprint b) It is a measure of environmentally sustainable consumer behaviour in different countries c) It is an assessment of programmes/schemes undertaken by different countries for improving the conservation of natural resources d) It is an index showing the volume of carbon credits sold by different countries d) UN Climate Change Conference, Copenhagen, 2009 13. In the context of bilateral trade negotiations between India and European Union, what is the difference between European Commission and European Council? (2010) 16. The International Development Association, a lending agency, is administrated by the (2010) 1. European Commission represents the EU in trade negotiations whereas European Council participates in the legislation of matters pertaining to economic policies of the European Union 2. European Commission comprises the Heads of State or government of member countries whereas the European Council comprises of the persons nominated by European Parliament. Which of the statements given above is/are correct? a) International Bank for Reconstruction & Development b) International Fund for Agricultural Development c) United Nations Development Programme d) United Nations Industrial Development Organization 17. NAMA-11(Name-11) group of countries frequently appears in the news in the context of the affairs of which one of the following? (2009) a) Nuclear Suppliers Group a) 1 only b) 2 only b) World Bank c) Both1 and 2 d) Neither 1 nor 2 c) World Economic forum 14. Which one of the following is not related to United Nations? (2010) a) Multilateral Investment Guarantee Agency b) International Finance Corporation c) International Centre for Settlement of Investment Disputes d) Bank for International Settlements 15. The United Nations Framework Convention on Climate Change (UNFCCC) is an international treaty drawn at (2010) a) United Nations Conference on the Human Environment, Stockholm, 1972 b) UN Conference on Environment and Development, Rio de Janeiro, 1992 c) World Summit on Sustainable Development, Johannesburg, 2002 d) World Trade Organization Explanations 1. c. Exp: IMF grants loans to only member countries. The current membership is 187. The IMF works to foster global growth and economic stability. It provides policy advice and financing to members in economic difficulties and alsoorks vith developing nations tohelpthem achieve macroeconomic stability and reduce poverty. 2. d. Ep:There can be an effect on current account deficit if capital account inflow is more. So the probable answer is (d). Though statement (3) is wrong, the examiner might have chosen option (d). 3. b. Exp:FDI is direct investment in productive assets, while Fil is investment in financial securities. FDI can enter only in those sectors in which FDI is allowed while Fli enters into the financial market which is of general nature and no specific industry or sector is involved. Fil is volatile by nature, while FDI is considered more stable. (particularly South Africa). Emphasizing the fluid nature of the category political scientist Ian Bremmer defines an emerging market as “a country where politics matters at least as much as economics to the markets.” 4. b. Exp: Trade mark is a right of a company or manufacturer while geographical indication is related with a particular area. It applies to the products which are area specific like particular variety of mango produced in specific area in a country. Geographical Indications (Cl) are like trade marks, except that they are indicators of a geographical area. They can belong to any goods or products whether natural, agricultural or manufacturing. Examples of Gis are basmati rice, champagne, swiss watches etc. GIs are area specific as an identity, so it can not be licensed. 8. b. Exp: GDP of BRIC countries: China $ 4.326 trillion; India 1.217 trillion; Brazil $ 1.612 trillion and Russia $ 1 .607 trillion. Population: China 134.57 million; India 119.8 million; Arazil 19.37 million and Russia 14.08 million. 5. b. Exp: SSM (Special Safeguard Mechanism) is a provision in the WTO to provide safeguard to member countries against surge in imports. It was a major issue in 2008 when the WTO talks failed to progress due to lack of unanimity on the issue. 6. b. Exp: India has a double tax avoidance treaty with Mauritius. Investors from Mauritius are exempted from tax in India and the tax rates arevery low in Mauritius. So it is favourable for investors to get registered in Mauritius and then invest in India as an entity from Mauritius. This investment is not from Mauritius but through Mauritius. 7. d. Exp: Emerging markets are nations with social or business activity in the process of rapid growth and industrialization. Currently, there are 28 emerging markets in the world, with the economies of China and India considered to be the two largest. Examples of emerging markets include China, India, some countries of Latin America (particularly Argentina, Brazil, Chile, Mexico, Colombia and Peru), some countries in Southeast Asia, most countries in Eastern Europe, Russia, some countries in the Middle East (particularly in the Persian Gulf Arab State) and parts of Africa 9. c. Exp: SDR is the currency of IMF while ADR/GDR are financial instruments. 10. b. Exp: In the wake of the global financial and economic crisis, the President of the UN General Assembly, Miguel d’Escoto Brockmann, set up a commission of experts chaired by Nobel Prize Laureate Joseph Stiglitz, whose mandate was to reflect on the causes of the crisis, assess its impacts on all countries and suggest adequate responses to avoid its recurrence and restore global economic stability. 11. a. Exp: The Codex Alimentarius Commission was created in 1963 by FAQ and WHO to develop food standards, guidelines and related texts such as codes of practice under the Joint FAQ/WHO Food Standards Programme. The main purposes of this Programme are protecting health of the consumers and ensuring fair trade practices in the food trade, and promoting coordination of all food standards work undertaken by international governmental and nongovernmental organizations. 12. b. Exp: National Geographic and the international polling firm GlobeScan have just conducted their second annual study measuring and monitoring consumer progress toward environmentally sustainable consumption in 17 countries around the world. Consumer Greendex, is a scientifically derived sustainable consumption index of actual consumer behavior and material lifestyles across these countries. The Greendex is comparable across the selection of countries representing both the developed and developing world. - International Bank for Reconstruction and Development to provide assistance on concessionary terms to the poorest countries. 13. a. Exp: The European Council is the institution of the European Union (EU) responsible for defining the general political direction and priorities of the Union. It comprises the heads of state or government of EU member states, along with its President and the President of the Commission. 17. d. Exp: NAMA-1 1 is a group of countries for negotiations on reduction of import duty on industrial goods. Ref. Wizard Current Affairs for PT 2009, pg. no. 124 The European Commission is the executive body of the European Union. The body is responsible for proposing legislation, implementing decisions, upholding the Unions treaties and the general day-today running of the Union. 1. The Reserve Bank of India regulates the commercial banks in matters of (2013) The Commission operates as a cabinet government, with 27 Commissioners. 14. d. Exp: Multilateral Investment Guarantee Agency (MIGA) is a specialized agency of the United Nations, formed in 1988, with headquarters in Washington, D.C. International Finance Corporation (IFC) is a specialized agency of United Nations (UN), affiliated with but legally separate from the International Bank for Reconstruction and Development (World Bank), founded in 1956, headquartered in Washington, D.C. International Center for Settlement of Investment Disputes (ICSID) is a specialized agency of the United Nations. A member of the World Bank Group, it was formed in 1966 and has its headquarters in Washington, D.C. 15. b. Exp: The United Nations Framework Convention on Climate Change (UNFCCC or FCCC) is an international environmental treaty produced at the United Nations Conference on Environment and Development (UNCED), informally known as the Earth Summit, held in Rio de Janeiro from 3 to 14 June, 1992. 16. a. Exp: The International Development Association (IDA) is the part of the World Bank group. It is an agency administered by the Money & Banking 1. Liquidity of assets 2. Branch expansion 3. Merger of banks 4. Winding-up of banks Select the correct answer using the codes given below: a) 1 and 4 only b) 2, 3 and 4 only c) 1, 2 and 3 only d) 1, 2, 3 and 4 2. An increase in the Bank Rate generally indicates that the (2013) a) Market rate of interest is likely to fall b) Central Bank is no longer making loans to commercial banks c) Central Bank is following an easy money policy d) Central Bank is following a tight money policy 3. Priority Sector Lending by banks in India constitutes the lending to (2013) a) agriculture b) micro and small enterprises c) weaker sections d) All of the above 4. A rise in general level of prices may be caused by (2013) 1. an increase in the money supply c) 1 and 3 only d) 1, 2 and 3 2. a decrease in the aggregate level of output 7.Consider the following statements : (2013) 3. an increase in the effective demand 1. Inflation benefits the debtors. Select the correct answer using the codes given below. 2. Inflation benefits the bondholders. a) 1 only b) 1 and 2 only Which of the statements given thcwe is/are correct? c) 2 and 3 only d) 1, 2 and 3 a) 1 only b) 2 only c) Both 1 and 2 d) Neither 1 nor 2 5.Which one of the following is likely to be the most inflationary in its effect? (2013) a) Repayment of public debt b) Borrowing from the public to finance a budget deficit c) Borrowing from banks to finance a budget deficit d) Creating new money to finance a budget deficit 6. Supply of money remaining the same when there is an increase in demand for money, there will be (2013) a) a fall in the level of prices b) an increase in the rate of interest c) a decrease in the rate of interest d) an increase in the level of income and employment 112.Which of the following grants/grant direct credit assistance to rural households? (2013) 8. Consider the following liquid assets : (2013) 1. Demand deposits with the banks 2. Time deposits with the banks 3. Savings deposits with the banks 4. Currency The correct sequence of these assets in the decreasing order of liquidity is a) 1-4-3-2 b) 4-3-2-1 c) 2-3-1-4 d) 4-1-3-2 9. In the context of Indian economy, ‘Open Market Operations’ refers to (2013) a) borrowing by scheduled banks from the RBI b) lending by commercial banks to industry and trade 1. Regional Rural Banks c) purchase and sale of government securities by the RB! 2. National Bank for Agriculture and Rural Development d) None of the above 3. Land Development Banks 10. Which of the following measures would result in an increase in the money supply in the economy? (2012) Select the correct answer using the codes given below. a) 1 and 2 only b) 2 only 1. Purchase of government securities from the public by the Central Bank 2. Deposit of currency in commercial banks by the public 3. Borrowing by the government from the Central Bank 4. Sale of government securities to the public by the Central Bank Select the correct answer using the codes given below: (a) 1 only (b) 2 and 4 only (c) 1 and 3 (d) 2,3 and 4 11. The Reserve Bank of India (RBI) acts as a bankers’ bank. This would imply which of the following? (2012) 1. Other banks retain their deposits with the RBI. 2. The RB! lends funds to the commercial banks in times of need. 3. The RBI advises the commercial banks on monetary matters. Select the correct answer using the codes given below: (a) 2, and 3 only (b) 1 and 2 only (c) 1 and 3 only (d) 1,2 and 3 12. Consider the following statements: The price of any currency in international market is decided by the (2012) 1. World Bank 2. Demand for goods/services provided by the country concerned 3. Stability of the government of the concerned country 4. Economic potential of the country in question Which of the statements given above are correct? (a)1,2,3and4 (b) 2 and 3 only (c) 3 and 4 only (d) 1 and 4 only 13. The basic aim of Lead Bank Scheme is that (2012) (a) big banks should try to open offices in each district (b) there should be stiff competition among the various nationalized banks (c) individual banks should adopt particular districts for intensive development (d) all the banks should make intensive efforts to mobilize deposits 14. A rapid increase in the rate of inflation is sometimes attributed to the “base effect”. What is “base effect”? (2011) a) It is the impact of drastic deficiency in supply due to failure of crops b) It is the impact of the surge in demand due to rapid economic growth c) It is the impact of the price levels of previous year on the calculation of inflation rate d) None of the statements (a), (b) and (c) given above is correct in this context 15. Why is the offering of “teaser loans” by commercial banks a cause of economic concern? (2011) 1. The teaser loans are considered to be an aspect of sub-prime lending and banks may be exposed to the risk of defaulters in future. 2. In India, the teaser loans are mostly given to inexperienced entrepreneurs to set up manufacturing or export units. Which of the statements given above is/are correct? a) 1 only b) 2 only ‘c) Both 1 and 2 d) Neither 1 nor 2 16. The lowering of Bank Rate by the Reserve Bank of India leads to (2011) c) Both 1 and 2 d) Neither 1 nor 2 a) More liquidity in the market 20. In the context of Indian economy, consider the following pairs: (2010) b) Less liquidity in the market Most appropriate description c) No change in the liquidity in the market Fall in stockprices d) Mobilization of more deposits by commercial banks Fall in growth rate Fall in GDP 17. Which of the following terms indicates a mechanism used by commercial banks for providing credit to the government? (2010) Which of the pairs given above is/are correctly matched? a) Cash Credit Ratio a) 1 only b) 2 and 3 only b) Debt Service Obligation c) 1 and 3 only d) 1, 2 and 3 c) Liquidity Adjustment Facilities 21. In India, the interest rate on savings accounts in all the nationalized commercial banks is fixed by (2010) d) Statutory Liquidity Ratio 18. Which one of the following statements is an appropriate description of deflation? (2010) a) It is a sudden fall in the value of a currency against other currencies b) It is a persistent recession in both the financial and real sectors of economy c) It is a persistent fall in the general price level of goods and services d) It is a fall in the rate of inflation over a period of time 19. With reference to the Non-banking Financial Companies (NBFCs) in India, consider the following statements: (2010) a) Union Ministry of Finance b) Union Finance Commission c) Indian Banks’ Association d) None of the above 22. When the Reserve Bank of India announces an increase of the Cash Reserve Ratio, what does it mean? (2010) a) The commercial banks will have less money to lend b) The Reserve Bank of India will have less money to lend c) The Union Government will have less money to lend 1. They cannot engage in the acquisition of securities issued by the government d) The commercial banks will have more money to lend 2. They cannot accept demand deposits like Savings Account 23. In India, which of the following is regulated by th& Forward Markets Commission? (2010) Which of the statements given above is/are correct? a) 1 only b) 2 only a) Currency Futures Trading b) Commodities Futures Trading c) Equity Futures Trading d) Both Commodities Futures and Financial Futures Trading 24. With reference to the institution of Banicing Ombudsman in India, which one of the statements is not correct? (2010) Term 1. Melt down 1. Purchase and sale of shares and securities on behalf of customers. 2. Acting as executors and trustees of wills. Which of the statements given above is/ are correct? a) 1 only b) 2 only c) Both 1 and 2 d) Neither 1 nor 2 27. With reference to India, consider the following statements: (2010) 2. Recession 3. Slow down a) The Banking Ombudsman is appointed by the Reserve Bank of India b) The Banking Ombudsman can consider complaints from Non-Resident Indians having accounts in India c) The orders passed by the Banking Ombudsman are final and binding on the parties concerned d) The service provided by the Banking Ombudsman is free of any fee 25. With reference to India, consider the following: (2010) 1. Nationalization of Banks 2. Formation of Regional Rural Banks 3. Adoption of villages by Bank Branches Which of the above can be considered as steps taken to achieve the “financial inclusion” in India? a) 1 and 2 only b) 2 and 3 only c) 3 only d) l,2and3 26. Consider the following statements: (2010) The functions of commercial banks in India include 1. The Wholesale Price Index (WPI) in India is available on a monthly basis only 2. As compared to Consumer Price Index for Industrial Workers (CPI(IW)), the WPI gives less weight to food articles Which of the statements given above is, are correct? a) 1 only b) 2 only c) Both 1 and 2 d) Neither 1 nor 2 28. Consider the following statements: In India, taxes on transactions in Stock Exchanges and Futures Markets are (2010) 1. levied by the Union 2. collected by the States Which of the statements given above is/are correct? a) 1 only c) Both 1 and 2 b) 2 only d) Neither 1 nor 2 29. In the parlance of financial investments, the term ‘bear’ denotes (2010) a) An investor who feels that the price of a particular security is going to fall b) An investor who expects the price of particular shares to rise c) A shareholder or a bondholder who has an interest in a company, financial or otherwise d) Any lender whether by making a loan or buying a bond Explanations 1. d. Exp:The balance of payments of country is a systematic record of transaction between a country and rest of the world. It is not only exports. It is also not the transaction between the governments only. It is also not the capital movement only 2. d. Exp: An Increase in bank rate means that the banks will get loan from the central bank at higher rate which will increase the cost of funds for the banks forcing them to raise their lending rates. It is called monetary tightening 3. d. Eo:Areas under priority sector lending are notfied by the RBI in India. As per the current gdeiines of RBi, aN the above areas are included in the list of priority sector landing. 4. d. Exp: Increase in money supply will reduce the purchasing power of money as more money will be chasing lesser goods and wiI4 cause prices to rise. It is a monetary reason of price rise. Less availability of goods due to lower output or faster increase in demand without increase in suppLy causes demand pull inflation/ price rise. 5. d. Exp: New money into the economy will increase the money supply which will be inflationary. In case deficit financing without creating money, the money supply remains the same. 6. b. Exp: In case of any financial or physical asset, if demand increase without corresponding increase in supply, the price increases. Interest is the price of money which will increase if there is increase in demand for it without corresponding increase in supply. 7. c. Exp: Inflation redces the actual value of money repaid by the debtor. So, in real terms, the debtor is the gainer as he is repaying less in real terms to the lender. Bondholders get a fixed return and inflation reduces the real value of the money that the bondholders get at the time of redemption of the bond. So, the bondholder is a looser during higher inflation rates 8. d. Exp: Liquidity means cash or near cash. Closer to the cash more is the liquidity. Currency is in the form of cash and it is the most liquid. Time deposits with banks can not be immediately converted into cash, so they are least liquid among the optionsgiven. Demand deposits include savings bank deposits as well as current account deposits. Current account deposits are more liquid than savings bank deposits. 9. c. Exp: ‘Open Market Operations’ is an act of buying and selling of securities by the RBI. Generally, the government securities are used for open market operations by the RBI 10.a. Exp: There is no recommendation regarding creation of jobs by the 13th Finance Commission. Also devolution to local bodies in the form of grants is fixed at Rs.87.519 but there is no specified percentage of central taxes to arrive at this number. 11. d. Exp: The RBI performs all the three functions for commercial banks. 12. b Exp: World Bank provides financial help for development projects. It has nothing to do with the price of any currency. Economic potential of the country in question is a long term factor that may affect the flow of capital but it will not affect price of the currency which is a short term phenomenon. 13. c. Exp : Lead bank scheme was started in 1969 to coordinate the activities of nationalized banks for development of banking facilities in particular districts. 14. c. Exp :Inflation rate is calculated as the change in average price levels with respect to previous year is the base for calculating the change. If last year, the price rise was sharper as compared to the current year, the inflaction rate will be falling. general it is fall in GDP. Slowdown means reduction in the growth rate of GDP 15.a. Exp:Teaser loans are loans are loans in which for the first couple of years, rate of interest is concessional (sub-prime) but after that it becomes normal which is higher as compared to the initial rate. Consequently, borrowers may face difficulty in repayment, once the EMI increase due to higher rates of interest. In India these loans were offered by banks in housing segment. Melt down is the term used for weakness in the financial markets which implies security prices 1 6 . c. lowering of bank rate means that banks can borrow at lower rate from the RBI and this may lead to lowering of interest rates in the banks. At lower interest rates, there will be less incentive to the depositors and banks will mobilize fewer resources through deposits. Also, rates affect the lending rates while ratios (CRR and SLR) affect liquidity in the banking system. 17. d. Exp: SLR (Statutory Liquidity Ratio) is the ratio used by the RBI as a monetary tool. Banks prefer to keep a part of the prescribed ratio in the form of treasury bills, thus financing the government short term borrowing 18.b. 19. b. Exp: Non-Banking Finance Company(NBFC) is a company registered under the companies Act, 1956 and is engaged in the business of loans and advances, acquisition at shares/stock/bonds/debentures/securities issued by government or local authority or other securities of marketable nature, lessing, hirepurchase, insurance business, chit business. NBFCs are finance companies but not banks and are thus not allowed to function as bank but to take deposits in other forms like fixed deposits. They are not allowed to open savings bank accounts and are not members of the cleaning houses. 20. a. Exp:Recession means negative growth in GDP for two consecutive quarters but in 21. d. Exp: Interest rate on saving bank account is fixed by the RBI 22. a. Exp: Increase in CRR means that the banks have to deposit more with the RBI and will have less to lend to the borrowers. 23. b. Exp: Forwards Market Commission is the regulator of commodity futures market. For financial markets, the role is performed by the SEBI. 24. C. Exp: If one is not satisfied with the decision passed by the Banking Ombudsman, one can approach the appellate authority against the Banking Ombudsmen’s decision. Appellate Authority is vested with a Deputy Governor of the RBI. One can also explore any other recourse and/or remedies available to him/her as per the law. The bank also has the option to file an appeal before the appellate authority under the scheme. 25. d. Exp: All the steps targeted financial inclusion in one way or the other. Nationalisation targeted expansion of bank branches in rural areas and also a control on concentration of economic powers in the hands of few. RRBs were planned to cater to the needs of the rural areas. 26.b. Exp: Commercial banks are not directly engage in capital market. Capital market is the primary concern of Investment Banks. They act as executors and trustees of wills of their clients. by 27. c. Exp: Earlier WPI was available on weakly basis. Last year it was changed to monthly basis. Weight of food items- WPI — food articles — 15.402% and food products — 11 .538% Consumer Price Index for Industrial Workers (CPI(IW) - 57% 28. a. Exp: The tax was introduced as StT and CU which are central taxes. 29. a. Exp: Bears are the investors who expect the prices of securities to fall and they sell the securities ad buy again when the prices actually fall. Planning 1. Which of the following can be said to be essentially the parts of ‘Inclusive Governance’? (2012) 1. Permitting the Non-Banking Financial Companies to do banking 2. Establishing effective District Planning Committees in all the districts 3. Increasing the government spending on public health 4. Strengthening the Mid-day Meal Scheme Select the correct answer using the codes given below: a) 1 and 2 only b) 3 and 4 only c) 2,3 and 4 only d) 1,2,3 and 4 2, Inclusive growth as enunciated in the Eleventh-Five Year Plan does not include one of the following: (2010) a) Reduction of poverty b) Extension of employment opportunities c) Eight Plan d) Tenth Plan 3. During which Five Year Plan was the Emergency clamped, new elections took place and the Janata Party was elected? (2009) (a) Third (b) Fourth (c) Fifth (d) Sixth 4. Consider the following statements regarding Indian Planning: (2009) 1. The Second Five-Year Plan emphasized on the establishment of heavy industries. 2. The Third Five-Year Plan introduced the concept of import substitution as a strategy for industrialization. Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 placed within the domain of private and multinational sectors b) with markets assuming a central place, the role of central planning in many sectors has been ren4ered redundant c) the focus of planning has shifted to sectors like human resource development, infrastructure, population control and welfare d) the nation’s priorities have shifted away from industrial development to rural development c) Strengthening of capital market Explanations d) Reduction of gender inequality 101. In the context of India’s Five Year Plans, a shift in the pattern of industrialization, with lower emphasis on heavy industries and more on infrastructure begins in (2010) a) Fourth Plan b) Sixth Plan 1. d. 2. c. Exp: Poor people don’t participate in the capital market. 3 . b. Exp: Industrial sector was given more weightage from second five year plan to fifth five year plan. Since the sixth five year plan, allocation for industrial sector has been reduced in favour of infrastructure. c) 2,3 and 4 4. e: Emergency was clarnpeci in 1975 and new elections took place in 1977. Thefifth plan period was 1974-79. Ref: Wizard Current Affairs for PT 2009, pg. no. 106, Wizard April2009 Issue, pg. no. 84. 4. Which of the following is/are among the noticeable features of the recommendations of the Thirteenth Finance Commission? (2012) 103.c. Exp: Main objective of second pia was rapid industrial4saticn which was based on hea inciiatries. Main objective of third plan was self reliance which was based on import substitution. Ref: Wizar.d Current Affairs for PT 209, pg. no. 105,106 Public Finance 1. In India, deficit financing is used for raising resources (2013) a) Economic development b) Redemption of public debt c) Adjusting the balance of payments d) Reducing the foreign debt 2. The balance of payments of a country is a systematic record of (2013) a) All import and export transactions of a country during a given period of time, normally a year b) Goods exported from a country during a year c) Economic transaction between the government of one country to another d) Capital movements from one country to another 3. Which of the following constitute Capital Account? (2013) 1. Foreign Loans 2. Foreign Direct Investment 3. Private Remittances 4. Portfolio Investment Select the correct answer using the codes given below. a) 1,2 and 3 b) l,2 and 4 d) 1,3 and 4 1. A design for the Goods and Services Tax, and a compensation package linked to adherence to the proposed design 2. A design for the creation of lakhs of jobs in the next ten years in consonance with India’s demographic dividend 3. Devolution of a specified share of central taxes to local bodies as grants Select the correct answer using the codes given below: a) 1 only b) 2 and 3 only c) 1 and 3 only d) 1, 2 and 3 5. Under which of the following circumstances may ‘capital gains arise? (2012) 1. When there is an increase in the sales of a product 2. When there is a natural increase in the value of the property owned 3. When you purchase a painting and there is a growth in its value ue to increase in its popularity Select the correct answer using the codes given below: (a) 1 only (b) 2 and 3 only (c) 2 only (d)1,2 and 3 6. Which one of the following statements appropriately describes the “fiscal stimulus”? (2011) a) It is a massive investment by the Government in manufacturing sector to ensure the supply of goods to meet the demand surge caused by rapid economic growth b) It is an intense affirmative action of the Government to boost economic activity in the country c) It is Government’s intensive action on financial institutions to ensure disbursement of loans to agriculture and allied sectors to promote greater food production and contain food inflation d) It is an extreme affirmative action by the Government to pursue its policy of financial inclusion 7. Which one of the following is not a feature of “Value Added Tax”? (2011) a) It is a multi-point destination-based system of taxation b) It is a tax levied on value addition at each stage of transaction in the productiondistribution chain c) It is a tax on the final consumption of goods or services and must ultimately be borne by the consumer d) It is basically a subject of the Central Government and the State Governments are only a facilitator for its successful implementation 8. Which on of the following was not stipulated in the Fiscal Responsibility and Budget Management Act, 2003? (2010) a) Elimination of revenue deficit by the end of the fiscal year 2007-0 8 b) Non-borrowing by the central government from Reserve Bank of India except under certain circumstances c) Elimination of primary deficit by the end of the fiscal year 200 8-09 d) Fixing government guarantees in any financial year as a percentage of GDP 9. Consider the following actions by the Government: (2010) 1. Cutting the tax rates 2. Increasing the government spending 3. Abolishing the subsidies In the context of economic recession, which of theabove actions can be considered a part of the “fiscal stimulus” package? a) 1 and 2 only c) I and 3 only b) 2 only d) 1, 2 and 3 10. With reference to the National Investment Fund to which the disinvestment proce.ds are routed, consider the following statements: (2010) 1. The assets in the National Investment Fund are managed by the Union Ministry of Finance 2. The National Investment Fund is to be maintained within the Consolidated Fund of India 3. Certain Asset Management Companies are appointed as the fund managers 4. A certain proportion of annual income is useJ for financing select social sectors Which of the statements given above’ is/are correct? a) 1 and 2 b) 2 only c) 3 and 4 d) 3 only 11. In India, he tax proceeds of which one of the following as a percentage of gross tax revenue has significant declined in the last five years? (2010) a) Service tax b) Personal income tax c) Excise duty d) Corporation tax Explanations 1.d. Exp: An Increase in bank rate means that the banks will get loan from the central bank at higher rate which will increase the cost of funds for the banks forcing them to raise their lending rates. It is called monetary tightening. 2. a. Exp: The balance of payments of country is a systematic record of transaction between a country and rest of the world, It is not only exports. It is also not the transaction between the governments only. It is also not the capital movement only. 3. b. Exp: Private remittances are included in the current account 4. a. Exp:There is no recommendation regarding creation of jobs by the 13th Finance Commission. Also devolution to local bodies in the form of grants is fixed at Rs. 87,519 but there is no specified percentage of central taxes to arrive at this number. 5. b. Exp: Capital gains refer to increase in the values of assets. In case of 2 and 3, there is increase in the value of assets — property and painting. 6. b. Exp Fiscal stimulus basically means use of fiscal tools to boost demand in the economy if the economy is facing the problem of deficiency in demand. The fiscal tooIs are: reduction in tax rates and higher spending by the government. In both the cases the purchasing power of the people will increase and boost demand in the economy. 7.d. Exp: Value Added Tax is levied in the whole production and distribution chain. In India, CENVAT is a VAT —based tax and levied by the central government but state level VAT is levied by the state governments. 8. c. Exp: In the FRBM Act, the target has been set for reduction in revenue deficit and fiscal deficit only and not for primary deficit 9. a. Exp: In the fiscal stimulus package either taxes are reduced or government spending is increased to increase the purchasing power of the people 10. c. Exp: UTI,SBI and LIC AMCs to act as fund managers; 75 p.c.of income from the fund will go to social sector. 11. c. Exp: Excise duty rates have been gradually lowered in the past few years as a measure to help the producers more competitive in the world market by reduction in the price. At the same time with expansion of services in the service tax net and growing economy and income other tax revenues have improved.