Flexible or Floating Exchange Rate

advertisement

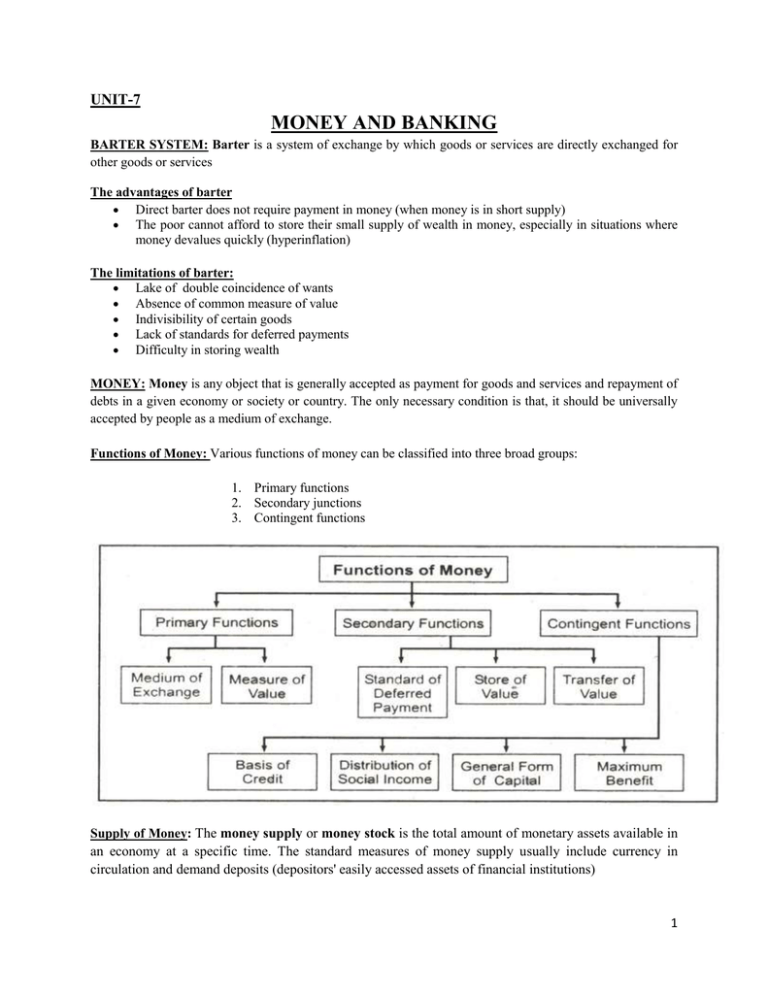

UNIT-7 MONEY AND BANKING BARTER SYSTEM: Barter is a system of exchange by which goods or services are directly exchanged for other goods or services The advantages of barter Direct barter does not require payment in money (when money is in short supply) The poor cannot afford to store their small supply of wealth in money, especially in situations where money devalues quickly (hyperinflation) The limitations of barter: Lake of double coincidence of wants Absence of common measure of value Indivisibility of certain goods Lack of standards for deferred payments Difficulty in storing wealth MONEY: Money is any object that is generally accepted as payment for goods and services and repayment of debts in a given economy or society or country. The only necessary condition is that, it should be universally accepted by people as a medium of exchange. Functions of Money: Various functions of money can be classified into three broad groups: 1. Primary functions 2. Secondary junctions 3. Contingent functions Supply of Money: The money supply or money stock is the total amount of monetary assets available in an economy at a specific time. The standard measures of money supply usually include currency in circulation and demand deposits (depositors' easily accessed assets of financial institutions) 1 Ms = C + DD The money supply of a country consists of currency and bank money i.e. demand deposit (DD). Currency: banknotes and coins held by the public. Bank money: The net demand deposits or net balance held in checking (current) accounts and savings accounts. Net Balance = Total Balance – Withdrawal at Fortnight Basis COMMECIAL BANK: A financial institution that provides services, such as accepting deposits, giving loans, credit creation etc. under certain provisions. Money Creation by Commercial Banking System: Commercial bank money (money created in the banking system through borrowing and lending) referred to as checkbook money. A bank can lend parity to its surplus reserves. However, the whole banking system can lend and create credit up-till a multiple of its nominal surplus funds deposits. The deposit multiplier is based upon the required reserve which is the foundation of credit creation. The required reserve ratio is given as: RRr RR = = RR DD RRr x DD Where RR is the required cash reserves with banks, RRr is the required reserve ratio and DD is the demand deposits of banks. Or DD = 1 x RR RRr Where 1 / RRr, is the reciprocal of the percentage ratio and is termed as the deposit multiplier. It is also known as money supply multiplier or money multiplier. CENTRAL BANK: Central bank is the supreme monetary institution, which is at the apex of the monetary and banking structure of a country. It is the central monetary authority, which manages the currency and credit policy of the country and functions as a banker to the government as well as to the commercial banks. The Reserve Bank of India (RBI) is India's central bank. It was established on 1 April 1935. Functions of Central Bank 1. Monopoly of currency notes issue 2. Banker, agent and advisor to the Government (both the central and state) 3. Banker to the bankers 4. Lender of the last resort 5. Controller & Custodian of the foreign exchange reserves 6. Maintaining the external value of domestic currency 7. Ensures the internal value of the currency 8. Fight against economic crisis and ensures stability of Indian economy. 2 UNIT – 9 GOVERNMENT BUDGET AND ECONOMY GOVERNMENT BUDGET: The estimation of governmental expenditures and revenues for the ensuing fiscal year is called government budget or general budget. Main Objectives of Government Budget: 1. 2. 3. 4. Allocation of resources Redistributive activities Economic stability Management of public enterprises Components of Government Budget: Revenue budget: Estimated statement of revenue receipt and revenue expenditure. It covers the current receipts and running expenditure. Capital budget: Estimated statement of capital receipt and capital expenditure. It covers the creation and disposal of assets and liabilities. 3 CLASSIFICATION OF RECEIPTS Revenue receipts: The receipts that neither create liabilities nor reduce the assets of government. It include proceeds of taxes and other duties levied by the Government, interest & dividends on investment made by the Govt., & Fees and other receipts for services rendered by the Govt. Capital receipts: The receipts that either create liabilities or reduce the assets of government. The main items of capital receipts of loans raised by the Govt. from the public, borrowings from the RBI, loans from abroad, recovery of loans & also proceeds from the disinvestment of Govt. equity in public enterprises. CLASSIFICATION OF EXPENDITURE Revenue expenditure: The expenditure that neither create assets nor reduce the liabilities of government. Revenue Expenditure is meant for normal running of Govt. departments and various services, interest charges on debt incurred by the Govt. and subsidies, grants given by the Govt. etc. Broadly speaking, the expenditure that does not result in creation of assets is treated as revenue expenditure. Capital expenditure: The expenditure that either create assets or reduce the liabilities of government. Capital Expenditure includes the payments for acquisition of assets like land, building, machinery, equipment etc., and also investment in shares & loans given by the Govt. MEASURES OF GOVERNMENT BUDGETARY DEFICITE Revenue Déficit : Revenue deficit is the difference between the revenue expenditure and the revenue receipts (the recurring income for the government). When a country runs a revenue deficit it means that the government is unable to meet its running expenses from its recurring income. Revenue Deficit = [Revenue Expenditure] – [Revenue Receipts] = [Revenue Plan Expenditure + Revenue Non Plan Expenditure] – [Net Tax Revenue + Non Tax Revenue] Fiscal Deficit: Fiscal deficit is essentially the difference between what the government spends and what it earns. The fiscal deficit is the difference between the government's total expenditure and its total receipts (excluding borrowing). Fiscal Deficit = [Total Expenditure] – [Total Revenue Receipts + Capital Receipts (excluding borrowing & other liabilities)] = [Total Expenditure] – [Total Revenue Receipts + Capital Receipts (including recovery of loans & sale of assets)] Primary Deficit: The primary deficit is the fiscal deficit less interest payments. Primary deficit indicates how much of the government borrowing are going to meet expenses other than interest payment. Primary Deficit = Fiscal Deficit – Interest Payment 4 UNIT- 10 BALANCE OF PAYMENT (BOP) BALANCE OF PAYMENT (BOP): A record of all economic activity that flows between residents of a country and residents of the rest of the world in a given period of time, where all values are in terms of the country’s own currency. COMPONENTS OF BOP: I. THE CURRENT ACCOUNT 1. Visible accounts Trade in goods 2. Invisible accounts Trade in services Investment income (It is known as 'IPDS' or interest, profit and dividends) 3. Unilateral transfers Government transfers Transfers made by other sectors (The transfer of assets by individuals to foreign bank accounts.) II. THE CAPITAL ACCOUNT Direct investment Portfolio investment Other investment (it includes short-term 'hot money' banking flows & net government borrowing from foreigners) Borrowings Official reserves (This refers to the reserves of gold and foreign currencies) DEFICIT IN THE ACCOUNTS BOP = Current account balance + Capital account balance BOP is always balanced i.e. BOP = 0 Current account + Capital account = 0, Hence; - Current account = Capital account. If a country has a deficit on the current account (more imports than exports, etc) then it must have an equal and opposite surplus on the capital account (and vice versa). While the BOP has to balance overall, surpluses or deficits on its individual elements can lead to imbalances between countries. In general there is concern over deficits in the current account. Countries 5 with deficits in their current accounts will build up increasing debt or see increased foreign ownership of their assets. FOREIGN EXCHANGE RATE Foreign exchange rate (also known as exchange rate, forex rate, FX rate) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency (domestic currency) in terms of another currency (foreign currency). Fixed Exchange Rate A country's exchange rate system under which the government or central bank ties the official exchange rate to another country's currency (or the price of gold). Also known as pegged exchange rate. The purpose of a fixed exchange rate system is to maintain a country's currency value within a very narrow band. Fixed rates provide greater certainty for exporters and importers. This also helps the government maintain low inflation, which in the long run should keep interest rates down and stimulate increased trade and investment. Flexible or Floating Exchange Rate The exchange rate in which the value of the currency is determined by the free market. That is, a currency has a floating exchange rate when its value changes constantly depending on the supply and demand for that currency, as well as the amount of the currency held in foreign reserves. 6 An advantage to a floating exchange rate is that it tends to be more economically efficient. However, floating exchange rates tend to be more volatile depending on the particular currency. A currency with a floating exchange rate may undergo currency appreciation or currency depreciation, depending on market fluctuations. A floating exchange rate is also called a flexible exchange rate. Managed Floating Exchange Rate: A floating exchange rate in which a government intervenes at some frequency to change the direction of the float by buying or selling currencies. Often, the local government makes this intervention, but this is not always the case. Strictly speaking, even a central bank's intervention to raise or lower interest rates could be considered a managed float. However, because most floating currencies manage their regimes with occasional central bank involvement, the term applies mainly to frequent or dramatic interventions. A managed float is also known as a dirty float. EXCHANGE RATE DETERMINATION IN FREE MARKET Under a flexible or floating exchange rate the value of a country’s currency changes frequently, even by the minute. The market rate will depend on the demand for, and supply of, that currency in the forex markets. When there is no intervention in the free market operations by a government agency a “clean float” is said to exist. 7 There are many different exchange rates. The above examples illustrate how an appreciation (increase in value) or depreciation (decrease in value) of the Rupee against the US dollar has been created by changes in demand and supply conditions. 8