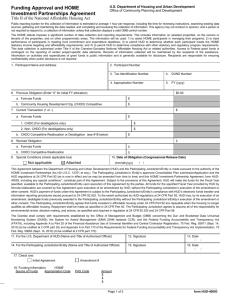

2016-2017 home development

advertisement