Introduction to Economics of Strategy

advertisement

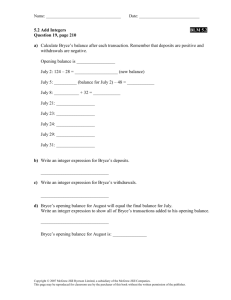

Strategy & Economics: Introduction to Economic Rents and Competitive Advantage MANEC 387 Economics of Strategy David J. Bryce David J. Bryce What is Strategy? • A planned sequence of actions to achieve a goal or result • Sequences of moves and countermoves among competitors where each is trying to achieve a more favorable position relative to others • A pattern in a stream of decisions David J. Bryce What is the Goal of Strategy in Business? • To secure sustained profit for the firm • In economics, profit is defined as π = R – C – OC (Profit = Revenue – Costs – Opportunity Cost of assets) • Contrast to Accounting Profit: πacc = R – C David J. Bryce How to Secure Profit? Exploit the Conditions of Imperfect Competition Perfect Competition • Numerous sellers and buyers unable to affect price • Perfect Information • Homogenous products • No barriers to entry or exit; mobile resources Zero Economic Profits Imperfect Competition • • • • Few competitors, numerous suppliers and buyers Asymmetric Information Heterogeneous Products Barriers to entry Positive Economic Profits (also referred to as supernormal profit) David J. Bryce The Structure of Industries Threat of new Entrants Bargaining Power of Suppliers Competitive Rivalry Threat of Substitutes From M. Porter, 1979, “How Competitive Forces Shape Strategy” David J. Bryce Bargaining Power of Customers Barriers to Entry What factors keep potential competitors out? • Scale economies – e.g., aerospace industry • Scope economies Industry – e.g., retailing • Capital requirements A – e.g., aerospace industry B C D • Switching costs – e.g., Windows operating system • Access to distribution – e.g., soft drinks • Product Complexity – e.g., supercomputers, microprocessors • Entry deterring regulations – e.g., Tobacco David J. Bryce Nature and Focus of Rivalry Why industries are more or less “competitive”? • Factors Industry – Industry growth rates • Where to secure growth A – Exit barriers • e.g., specialized assets, emotional barriers B C – Fixed costs • e.g. capacity increments Competitive rivalry can focus on many factors, including price, quality, technology, features, service, etc. David J. Bryce – Lack of product differentiation • e.g. differences in functionality, performance – Switching costs – Number of competitors Threat of Substitutes What alternatives are available to customers Industry A C B D • Direct substitution with the same functionality – diesel vs gas engines – DirecTV vs cable Customers • Eliminating need for product – water meters vs flat rate David J. Bryce Supplier or Buyer Power How can my suppliers or customers extract value? Supplier Power Buyer Power • Supplier concentration – Few vs many suppliers • Supplier volume – Large vs small purchase • Buyer concentration – Few vs many customers • Volume of purchases – Large vs small purchase • Product differences – Dependence on unique • Available alternative products – Competitive products • Threat of backward integration – Ability to become a decisions features • Threat of forward integration – Ability to become competitor • Switching costs – Limitations on ability to change suppliers David J. Bryce decisions competitor • Switching costs – Threat of switching suppliers How Industry Structure Influences Profitability 100 80 Percent of Market 60 99 Others (>10,000) 40 20 0 1 Farmers 5-10% ROE David J. Bryce 20 Others (>10) 4 Green Giant 17 Campbell 25 Swanson 34 Stouffer ConAgra Frozen Entree Makers 20-25% ROE 90 3 2 Others (>1000) American Kroger 4 Safeway Food Retailers 8-12% ROE Successful strategies should: • Minimize buyer power – (e.g., build customer loyalty) • Offset supplier power – (e.g., alternative source(s)) • Avoid excessive rivalry – (e.g., attack emerging vs entrenched segments) • Raise barriers to entry – (e.g., make preemptive investments) • Reduce the threat of substitution – (e.g., incorporate their benefits) David J. Bryce Economic Rents • Strategists especially seek a kind of profit called economic rent • Economic rent is the excess received over the minimum amount that justifies (or pays for) the resource, operation, function, activity, or asset • Economic rent may be positive when economic profits are zero due to the opportunity cost of rent earning assets (but only when OC is producing actual returns) • A portion of accounting profit is usually economic rent David J. Bryce Example • Suppose two firms in an industry own their land outright • Firm A is located near a major railroad and can ship products for $10,000 a year less than Firm B, which is 100 miles distant. • Economic Rent on the land is $10,000 per year ($10,000 is what Firm B would be willing to pay (OC) for the land less Firm A’s zero cost to pay for its land this period—the rent goes to Firm A in lower costs) • Thus, Firm A earns rent of $10,000 on its land David J. Bryce Example (continued) Revenue Firm A Firm B R R Cost – (C – $10,000) –C Accounting Profit R – C + $10,000 πacc Opportunity Cost – $10,000 –0 Economic Profit π π Economic Rent $10,000 0 David J. Bryce The Relationship between Rent and Economic Profit • When a valuable asset can be sold, the opportunity cost of its use is its sale price (less costs incurred) – Thus, OC = Economic Rent and – The firm earns normal economic profit π + rent = R – C – OC + OC π = R – C – OC • When an asset cannot be sold, it has no OC – Thus, rents increase the revenue of the firm (or reduce its costs) and positive economic profit ensues π + rent = (R + Rent) – C – (OC=0) π = R –C David J. Bryce Rent Recap • When opportunity costs are persistently lower than the rents earned on assets, positive economic profit can be sustained • But how can opportunity costs be lower than rents? • Answer: When assets (or resources) cannot be sold • But when can resources not be sold? • Answer: When markets for rent-earning assets are inefficient or fail David J. Bryce Why Markets for Assets May Fail • The source of the rent cannot be precisely identified by external or sometimes even internal observers • Separating the assets from the context of the firm renders them useless or significantly impairs their usefulness or value • The assets encounter Arrow’s Information (knowledge) Paradox: – A potential buyer of information must know what the information is in order to assess its worth. But once the buyer knows enough to assess its worth, he is in possession of the essentials, which he has acquired without cost. • Therefore, the “assets” never go up for sale (OC is near 0), but they earn positive rents David J. Bryce Examples of ‘Assets’ that May be Subject to Market Failure • A complex social process among scientists at a pharmaceutical firm that, along with good science, leads to consistent innovation in new drug discovery • The knowledge that Intel applies at its wafer fabrication facilities to keep defects low • The exclusive relationships that Coca-Cola Company has with its bottlers that keep others from utilizing the bottlers’ resources • Wal-Mart’s location in small, rural communities in which no other entering competitors could attract a remaining market large enough to be profitable We refer to such “assets” as Strategic Assets David J. Bryce Definition: Competitive Advantage • When a firm earns positive economic profit, the firm possesses a competitive advantage • Reminder: How is positive economic profit secured? • Answer: By earning rents on assets that are subject to market failure • Thus, strategy is about creating assets that are subject to market failure or otherwise exploiting the conditions of failed (imperfect) markets David J. Bryce Definition: Sustainable Competitive Advantage (SCA) • Earning positive economic profit in the presence of attempts by others to imitate or substitute the firm’s source of competitive advantage David J. Bryce The Cornerstones of Competitive Advantage Four conditions must be met: 1. Resource Heterogeneity 2. Ex Post limits to competition 3. Imperfect resource mobility 4. Ex Ante limits to competition Following discussion draws liberally from M. Peteraf, 1992, The Cornerstones of Competitive Advantage David J. Bryce Ex Post Limits Heterogeneity to Competition Rents Rents Sustained Sustained Competitive Advantage Rents sustained within the firm Imperfect Mobility David J. Bryce Rents not offset by costs Ex Ante Limits to Competition Appendix • Detailed descriptions of the cornerstones of competitive advantage David J. Bryce Resource Heterogeneity • Resources are the tangible and intangible assets of the firm: – Tangible: Plant, equipment, fax machines, human resources, etc. – Intangible: Employee knowledge, goodwill, patents, team-embodied skills, etc. • To be the source of SCA, these resources must be substantively different from other resources and must be limited in supply • The way the firm “gets things done” must also differ from others; firms must perform different activities than rivals or perform similar activities in different ways David J. Bryce Two types of rent may be earned on heterogenous resources • Ricardian Rent – Rents earned on scarce resources—those that are insufficient to supply all the demand for their services; – Resources may be “fixed” (e.g. land), or “quasi-fixed” (e.g. unique team skills) • Monopoly Rent – Rents earned by restricting the output produced from resources; the full supply of the resource is not utilized – Resources must nevertheless be heterogenous and unavailable or inaccessible by others to earn monopoly rents David J. Bryce Ex Post Limits to Competition • Regardless of the type of rent earned, the condition of heterogeneity must be preserved to maintain SCA • How? After a firm gains a superior position and is earning rents, there must be limits to competition for those rents • There are two primary limiting factors: – Imperfect Imitability – Imperfect Substitutability • Mechanisms that limit imitation include property rights, causal ambiguity, producer learning, buyer search costs, buyer switching costs, reputation, etc. • We’ll talk much more about substitutability later David J. Bryce Imperfect Resource Mobility • This is the market failure idea—resources are immobile or imperfectly mobile when markets are inefficient – Immobile: Markets completely fail—assets are of no value outside the firm – Imperfectly Immobile: Value is lessened when assets are transferred but not obliterated • We provided examples of the types of assets that are subject to market failure earlier; these resources may also be considered imperfectly mobile • Remember—opportunity costs on these assets are lower than the value of the asset to the firm, which creates positive economic profit David J. Bryce Ex Ante Limits to Competition • Prior to any firm’s establishing a superior resource position, there must be limited competition for that position • To conceptualize this, consider the alternative: – Suppose a large number of firms simultaneously perceive a new opportunity; – By competing amongst themselves to acquire the resources needed for that opportunity, they will bid up the cost of entering until post-entry economic profit is zero • Thus, firms must either be systematically better informed than others about the future value of opportunities or be lucky enough to stumble upon an opportunity before its value is widely known David J. Bryce