here - Gmu - George Mason University

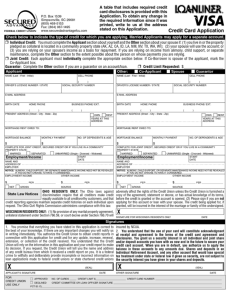

advertisement

The Economics of Consumer Lending Todd J. Zywicki Professor of Law George Mason University School of Law Research Fellow, James Buchanan Center Program on Politics, Philosophy, and Economics Overview Substantive Regulation of Consumer Credit Alternatives to Substantive Regulation Consumer Credit Issues in the United States Macroeconomic Effects of Consumer Credit Substantive Regulation Effect of Regulation: Intended Consequences Effect of Regulation: Unintended Consequences Term Substitution/Repricing Product Substitution Rationing Dynamic Effects and Competition Term Repricing Interest Rate Fixed or Variable Annual Fee Quality (Benefits, Hours, Customer Service) Price of Goods Points Term Collateral Costs Insurance Downpayment Balloon Prepayment Penalty Grace Period Default & Foreclosure Product Substitution Product Substitution Rationing Historical Evidence Redistribution Effects Empirical Evidence on Effects of State “Anti-Predatory Lending” Laws Rationing “Predatory Lending Laws Can Cause Headaches,” Parma Sun Post (July 10, 2003): When David Sanderson recently applied to a lender for a second mortgage, he was denied for an unusual reason. Undeterred, he went to another lender and was denied again. Same thing happened at a third institution. In all three cases, he was given the same reason for the denial—the lenders thought he lived in Cleveland and claimed that the city’s anti-predatory lending law prevented them from giving him the loan he needed. *** Since Cleveland’s anti-predatory lending law caps interest charges, some lenders don’t give second mortgages or home-equity loans to Cleveland residents having potential credit risks. But Sanderson lives in Fairview Park, a small, inner-ring suburb west of Cleveland. “When we were applying for loans, the companies would key in our zip code, and Cleveland would come up,” he said.*** Desperate for a solution, Sanderson contacted his suburb’s City Hall. Fairview Park Mayor Eileen Patton wrote a letter on his behalf, verifying he was a resident of the suburb. “Her inquiry into the matter must have accomplished something, because we received a call from one of the companies that initially turned us down, and offered to finance us,” Sanderson said. “Sometimes it pays to e-mail the mayor.” Patton said she and City Council have received similar requests from six other residents who encountered the same problem as Sanderson’s. Dynamic Effects Term Substitution, Nonstandardized Terms, & Competition Annual Fees & Competition Retail Market & E-Commerce Wealth Accumulation Substantive Regulation: Conclusion General Consensus of Economists that substantive regulation Ineffective and Counterproductive in Light of Unintended Consequences Alternative Regulatory Regimes Disclosure Education Markets and Common Law Disclosure Regime: Pros Pros Market Failure: Information Costs/Asymmetry Standardization: Comparative Shopping Better than Substantive Regulation (Usury): Attempts to improve, rather than supplant market process Safe Harbor Disclosure Regime: Cons Cons Standardization: Inability to Tailor Information to Consumers, One Size Doesn’t Fit All Clutter/Information Overload Raises Costs of Finding Information You Want: Benefits, Transactors, Frequent Flyer Cards Risk of Political/Normative Disclosures: What Consumers Should Care About Term Substitution Safe Harbor: Technical Compliance, Lawyerly Disclosures Typical “Schumer Box” Disclosure (Reg Z, Appendix G) Annual percentage rate (APR) for purchases 2.9% until 11/1/00. Other APRs Cash-advance APR: 15.9% Balance-transfer APR: 15.9% Penalty rate: 23.9%. See explanation below.* Variable-Rate Information Your APR for purchase transactions may vary. The rate is determined monthy by adding 5.9% to the Prime Rate** Grace period for repayment of balances of purchases 25 days on average Method of computing the balance for purchases Average daily balance (excluding new purchases) Annual fees None Minimum finance charge $.50 Transaction fee for cash advances: Balance-transfer fee: Late-Payment fee: Over-the-credit-limit fee: 3% of the amount advanced *Explanation of Penalty **The Prime Rate used to determine your APR is the rate published in ___ on the __ day of the prior month After that, 14.9% 3% of the amount transferred $25 $25 Standardization: Other Disclosures Found in Schumer Box International transactions 3% of the U.S. dollar amount of the transaction, whether originally made in U.S. dollars or converted from a foreign currency. Different rates for bank customers Your APR may vary. Preferred Pricing:1 For Chase Banking Relationship Accounts - Purchases and Balance Transfers/Balance Transfer Checks: For both outstanding and new purchases and balance transfers the non-introductory rate is determined monthly for accounts with Elite Pricing by adding 3.99% (or 7.99% for accounts with Premium Pricing), to the Prime Rate.3 For all purchases from account opening, and for both outstanding and new balance transfers after 3 months for accounts with Standard Pricing, the rate is determined monthly by adding 14.99% to the Prime Rate.3 For Chase Credit Card Accounts Only - Purchases and Balance Transfers/Balance Transfer Checks: For both outstanding and new purchases and balance transfers the non-introductory rate is determined monthly for accounts with Elite Pricing by adding 4.99% (or 8.99% for accounts with Premium Pricing), to the Prime Rate.3 For all purchases from account opening, and for both outstanding and new balance transfers after 3 months for accounts with Standard Pricing, the rate is determined monthly by adding 14.99% to the Prime Rate.3 Cash Advances/Cash Advance Checks for all accounts: The rate is determined monthly by adding 15.99% to the Prime Rate (not less than 19.99% for accounts with Elite and Premium Pricing, or not less than 23.99% for accounts with Standard Pricing).3 Non-Preferred Pricing/Default APR - For all balances for all accounts: The rate is determined monthly and is up to the Prime Rate plus 23.99%.3 Education Government Programs: Assessment Purpose of Education? Prevent Fraud Make Market Work Better North Carolina Experiment Market and Contract Market is a form of regulation (common law fraud part of market ordering) 2 Markets: Credit Information About Credit: Economics of Information Sources of Information Lenders: Incentives to Provide Relevant Info to Consumers, Advertising v. Disclosures Indirect Information: Klein & Leffler Third-Parties: Consumer Reports, Bankrate.com Newspapers: ex., International Conversion Fees Behavioral Economics and Substantive Regulation New Justifications for Substantive Regulation: Consumers are Stupid Imperfect Self-Control Underestimation Hypothesis Hyperbolic Discounting Overestimation of Repayment Underestimation of Forgetfulness Credit Card Issuers Prey on These Biases Irrational Consumers? Are Consumers Really that Stupid? Agarwal, Chomsisengphet, Liu, and Souleles Consumers generally choose correctly Learning Errors fall as cost of errors rises Errors smaller than transaction costs and benefits Revolvers More Likely to Know Interest Rates and Shop on Interest Rates Brown & Plache Revolvers more likely to select higher annual fee/lower interest rate trade-off Nonrevolvers more likely to carry rewards program cards and charge more Revolvers more likely to shift to debit cards (No float benefit) Irrational Consumers? Consumer Interest Rates, Washington DC, August 25, 2006 11 10 Interest Rate 9 8 7 6 5 Personal Loan Credit Cards Home Equity Loan New Car Loan Macroeconomic Effects Is Greater Access to Credit Causing an Epidemic of “Overindebtedness”? See Todd J. Zywicki, Bankruptcy and Personal Responsibility: Bankruptcy Law and Policy in the Twenty-First Century (Forthcoming 2007, Yale U. Press) Substitution Effect Non-Mortgage DSR 0.08 0.06 0.05 0.04 Non-Revolving Plus Revolving 0.03 Nonrevolving DSR 0.02 0.01 Revolving DSR Year 20 02 q3 19 98 q4 19 95 q1 19 91 q2 19 87 q3 19 83 q4 0 19 80 q1 Proportion of Income 0.07 Consumer Credit & Mortgages Debt Service Ratio by Type of Debt: 1980-2006 0.12 0.1 Nonrevolving DSR Revolving DSR 0.08 Mortgage DSR 0.06 Total DSR 0.04 0.02 Year 20 02 q3 19 98 q4 19 95 q1 19 91 q2 19 87 q3 19 83 q4 0 19 80 q1 Proportion of Income 0.14 Growth in Net Wealth Household Net Worth Net Worth (Billions) 60000 50000 40000 30000 20000 10000 0 1 4 3 2 1 4 3 2 1 4 3 2 1 4 3 2 1 4 3 2 Q - -Q -Q -Q -Q -Q -Q -Q -Q -Q -Q -Q -Q -Q -Q -Q -Q -Q -Q -Q 52 9 54 9 57 9 60 9 63 9 65 9 68 9 71 9 74 9 76 9 79 9 82 9 85 9 87 9 90 9 93 9 96 9 98 0 01 0 04 9 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 2 2 Year Household Net Wealth Median Net Worth by Income Ranges Net Worth (in Thousands) 1000 900 Median Net Worth All Households 800 Lowest Quintile 700 Second Quintile 600 500 Third Quintile 400 Fourth Quintile 300 200 80-89.9% 100 90-100% 0 1989 1992 1995 1998 2001 2004 Household Net Wealth Median Net Worth by Income Ranges (Lowest Quintiles) Median Net Worth (in Thousands) 100 90 80 70 Median Net Worth All Households 60 Lowest Quintile 50 Second Quintile 40 30 Third Quintile 20 10 0 1989 1992 1995 1998 2001 2004 Mean Net Wealth (In Thousands) 1989 1992 1995 1998 2001 2004 272.6 245.7 260.8 327.5 422.9 448.2 <20% 36.1 43.4 54.7 55.4 56.2 72.6 20-39.9 96.3 84.6 97.4 111.5 122.7 122 40-59.9 148.5 133.3 126 146.6 173.3 193.8 60-79.9 199.3 185.4 198.5 238.3 313.2 342.8 80-89.9 326.1 297.1 316.8 377.1 487 485 90-100 1438.4 1226 1338 1793.9 2410.9 2534.4 All 19 65 19 67 19 69 19 71 19 73 19 75 19 77 19 79 19 81 19 83 19 85 19 87 19 89 19 91 19 93 19 95 19 97 19 99 20 01 20 03 20 05 Home Ownership Home Ownership Percentage 70 69 68 67 66 65 64 63 62 61 60 Change in Homeownership Home Ownership by Race 75 70 65 White 60 Black Hispanic 55 Asian 50 45 20 05 20 04 20 03 20 02 20 01 20 00 19 99 19 98 19 97 19 96 40 Causes of Rising Ownership Federal Reserve Bank San Francisco (Nov. 3, 2006): “We find that… it is likely that much of the increase is due to innovations in the mortgage finance industry that may have helped a large number of households buy homes more easily than they could have a decade ago.” Market Failure and Regulation What is the purported market failure? Is Credit Different from Other Goods and Services? Computers, cars, etc. Schizophrenia of Current Approach: Making Market Work Better versus Market Working Too Well Disclosure a Back Door for Substantive Regulation, i.e., “If people only knew…” Summing Up Every Form of Regulation has Costs and Benefits No evidence that consumers are “drowning in debt” No evidence of systematic consumer irrationality Need a Serious Model of Consumer Behavior and Market Process