TILA Outline - Utah's Credit Unions

advertisement

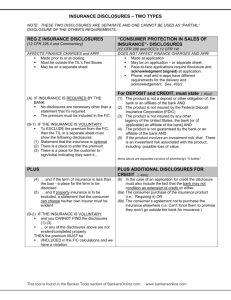

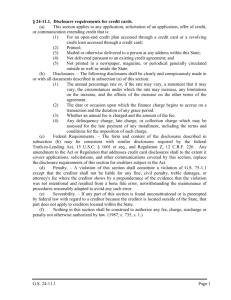

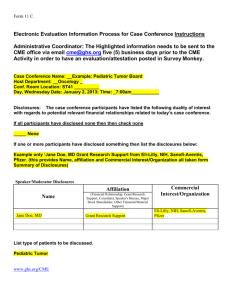

The Truth In Lending Act Introduction Requires the full and fair disclosure of credit terms Most commonly violated regulation Has evolved beyond being a disclosure regulation Enormous Scope: o 7 Subparts o 52 Sections o 14 Appendices o Staff Commentary Exemptions Non-consumer credit (for example, credit extended to other than a natural person or extended primarily for a business, commercial or agricultural purpose). Amount financed is more than $50,000 (except credit secured by real property). Certain student loans that are made, insured, or guaranteed pursuant to a program authorized under the Higher Education Act of 1965. Key Definitions Annual Percentage Rate Measure of the cost of credit including interest and finance charges expressed as yearly rate. Business Day Any day the creditor’s offices are open to the public for carrying on substantially all of its business functions. (For rescission it’s every calendar day except Sunday and federal holidays) 1 The Truth In Lending Act Closed-end Credit All credit that is not open-end credit. Usually involves a one-time advance of funds with a fixed repayment schedule. Open-end Credit Consumer credit extended under a plan that includes the following three features: 1. Repeated transactions 2. Imposition of a finance charge 3. Re-useable Finance Charge The cost of consumer credit as a dollar amount. Open-End Credit Timing of Open-End Disclosures Event Application Disclosures Table of Credit Card Terms Home Equity Plan Disclosure and Booklet Before First Transaction or at Consummation Initial Disclosure Statement Rescission Notice After Consummation Periodic Statement Billing Rights Notice Change in Terms Credit Card Renewal Notice 2 The Truth In Lending Act General Disclosure Rules Clear, conspicuous, in writing, in a form the member may keep Model forms required Initial Disclosures Finance charge Other charges Voluntary Credit Insurance, Debt Cancellation, or Debt Suspension Premiums Security interests Statement of billing rights Additional Disclosures for Home Equity Plans A statement of the conditions under which the credit union can terminate the plan or change the terms. The payment information for both the draw period and the repayment period. A statement that negative amortization may occur. A statement of any transaction requirements. A statement regarding tax implications. A statement that the APR imposed under the plan does not include costs other than interest. The variable-rate disclosures and an example of the repayment schedule based on a $10,000 outstanding balance. 3 The Truth In Lending Act Table Disclosures for Non-HELOC Loans APRs Annual or other periodic fees Fixed finance charges Transaction charges Grace period Balance computation method Fees Required insurance, debt cancellation or debt suspension For credit card accounts, a reference to the Web site established by the FRB and a statement that members may obtain on the Web site information about shopping for and using credit cards Billing error rights reference Rescission Applies when credit union will retain or acquire a security interest (usually in the form of a mortgage) in a member’s principal dwelling. Steps for rescission: 1. Give required disclosures 2. Give rescission notice 3. Delay line access and deed recording for three business days 4 The Truth In Lending Act Periodic Statement Content All Open-end accounts: Previous balance Identification of transactions Credits Periodic rates Balance on which finance charge computed Amount of finance charge and other charges Grace period Address for notice of billing errors Closing date of billing cycle New balance Non-HELOC Accounts Only: Formatting requirements Change-in-terms and increased penalty rate Deferred interest or similar transactions Credit Cards Only: Due date and late payment costs Repayment disclosures Change in Terms 15 days for HELOCs 45 days for non-HELOC accounts (formatting requirements apply) 5 The Truth In Lending Act Credit CARD Act Requirements Limitations on increasing annual percentage rates (APRs), fees, and charges Opt-in for over-the-limit charges Fee limitations (number, type and amount) Special rules for marketing open-end credit to college students Special rules for handling payments Evaluation of consumer’s ability to pay Allocation of payments Internet posting of credit card agreements Reevaluation of rate increases Marketing and Advertising Form of Disclosures Clear and conspicuous Legible Reasonably understandable Actually available terms 6 The Truth In Lending Act Trigger terms A description of the circumstances under which a finance charge will be imposed, or how it is to be determined APR Periodic rate Grace period The amounts of any other charges The fact that the credit union will acquire a security interest in the property being purchased or in other property identified by item or type A statement outlining the member’s billing rights and the credit union’s responsibilities. Home equity plan information Additional Required Disclosures Any minimum, fixed, transaction, activity, or similar charge Any periodic rate that may apply, expressed as an annual percentage rate Variable rate information Membership or participation fees Misleading terms APRs referred to as “fixed” unless a time period is also mentioned “Free Money” Promotional rates must list a time period 7 The Truth In Lending Act Home Equity Line of Credit Trigger Terms In addition to open-end trigger terms, trigger terms for HELOCs also include any statement of a payment term. Additional disclosures for HELOCs include: Any loan fee that is a percentage of the credit limit under the plan and an estimate of any other fees the credit union imposes for opening the plan, stated as a single dollar amount or a reasonable range. The periodic rate, if any, used to compute the finance charge, expressed as an annual percentage rate. The maximum annual percentage rate that may be charged if it is a variable-rate plan. Other HELOC Advertising Rules Special variable rate information if the ad contains an introductory rate not based on the index and margin used to determine future rate changes Balloon Payment information Tax Implications Promotional Rate information Alternative Disclosures for Television or Radio Advertisements Credit Card Applications and Solicitations Special disclosures apply to credit card applications and solicitations including new Schumer box disclosures. Disclosures differ depending on how they are presented: Direct mail electronic Telephone Applications and solicitations available to the general public Electronic communications (email, text) 8 The Truth In Lending Act Closed-End Credit Disclosures and Notices Clearly and conspicuously In writing In a form that the consumer may keep Grouped together Segregated from everything else Timing Before consummation of a loan Early disclosures required for certain mortgage loans 9 The Truth In Lending Act Contents Identity of the creditor The amount financed Itemization of the Amount Financed Finance Charge Annual Percentage Rate Variable-Rate Information Payment Schedule Total of payments Total sales price Demand feature Prepayment Late payment Security interest Certain security interest charges Contract reference Assumption policy Required deposit Maximum interest disclosure for variable-rate mortgage loans 10 The Truth In Lending Act Special Disclosures Reverse mortgage loans High-rate, high-fee mortgage loans (Section 32 loans) Mortgage Disclosure Improvement Act (rules for mortgages) Notice of purchase, assignment or transfer (mortgages) Loan originator compensation and steering (mortgages) Private education loans Rescission Applies when credit union will retain or acquire a security interest (usually in the form of a mortgage) in a member’s principal dwelling. Steps for rescission: 1. Give required disclosures 2. Give rescission notice 3. Delay loan funding and deed recording for three business days Marketing and Advertising Terms advertised must be actually available The “annual percentage rate” (or APR) must be used whenever a rate is disclosed Disclosures must be legible and reasonably understandable Trigger terms The amount or percentage of any down payment The number of payments or the period of repayment The amount of any payment The amount of any finance charged The amounts of any other charges you might The fact that the credit union will take a security interest in any asset 11 The Truth In Lending Act Additional Disclosures The amount or percentage of the down payment The terms of repayment The “annual percentage rate,” using that term For an APR that may be increased after consummation, a statement to that effect. 12