Frappier Russell 10 H-1B Cap Neg

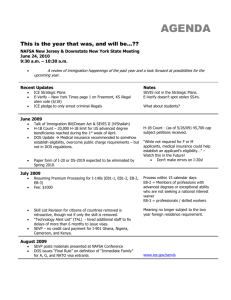

advertisement