Slides Part II

advertisement

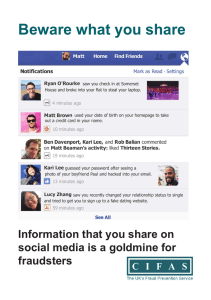

SWINDLERS AND CONS IN STATE GOVERNMENT A Case Study of Payment Card Fraud STATE PAYMENT CARD PROGRAM State Payment Card Program In June 2007, Policy 29 went into effect Made the State Payment Card the preferred method of payment Small-value purchases under $2,000 For Business Purposes Only Meant to improve vendor relations by accelerating payment process Does not require bid solicitation Does not require state issued purchase orders THE FRAUD Payment cards were improperly used by state employees in management positions to buy items for personal use Fraudsters were allowed to: Determine needed items to purchase Place orders for the items Personally obtain items Pay for items with a state payment card Disguise personal items as legitimate work related HOW WE GOT INVOLVED New Business Owner Life savings to buy business Did not know much about running the business Depended on current management in day-to-day operations After learning the business and determining that fraud was occurring the new owner Obtained attorney Attorney was former Assistant DA Contacted Special Investigations THE STATE PLAYERS State Department “A” State Department “B” Maintenance Manager Facilities Manager 30 Year Employee 10 Year Employee No Oversight No Oversight Made All the Decisions Made All the Decisions No One Questioned No One Questioned THE BUSINESS PLAYERS Former Business Owner Current Business Owner Store Management Store Employees THE SCHEME State employees colluded with former business owner and other store employees to obtain tax free items for personal use and charged items to their state issued payment card Business owner charged up to 150 percent mark up on purchases made by the state employees State taxpayers paid for fraudsters to operate their side businesses and complete personal home improvement projects WHAT WE DID Time sensitive (former management found out) Obtained records from current business owner Review of relevant documents Surveillance of homes, private businesses, state properties Interviews STATE DEPARTMENT “A” The Swindler INVOICE REFLECTS “BOXES” RECEIPT FOR SPEAKERS SPEAKERS FOR HOME USE SPEAKER BOXES FOR NEW HOME INVOICE FOR “ICE MAKER” CHANGED TO “120 VOLT” NONCOMMERCIAL ICEMAKER OTHER ITEMS DISGUISED Pressure washer motor (that he wanted back) Fog lights for his personal off-road vehicle CB radio and antenna Gallons and gallons of paint used for his side business Painting supplies Non-commercial refrigerators Received cash for returned items bought with payment card SURVEILLANCE/INTERVIEWS Work areas Interviews with staff Physical review of various work facilities INTERVIEW WITH SUBJECT Two investigators and department management Obtained confession Subject “A” admitted to theft and collusion with former business owner STATE DEPARTMENT “B” The Con INVOICE FOR LIGHT BULBS PERSONAL VEHICLE TIRES ALUMINUM GUTTERS VOIDED GUTTERS VOIDED AGAIN GUTTERS CHANGED TO “FLUSH VALVE KITS” LOWES RECEIPT FOR GUTTERS SURVEILLANCE Car House/Home Improvements Work Interviews with staff ITEMS DISGUISED AS LEGITIMATE Tools Tree cutting equipment Flooring material Lumber Pressure washer Garage doors INTERVIEW WITH SUBJECT Two investigators and Director of Internal Audit Appearance Obtained confession Subject “B” admitted to theft and collusion with former business owner Undertone of blackmail SIGNS OF FRAUDULENT ACTIVITY Vague item descriptions on invoices Items that don’t seem like logical purchases Unusual items purchased Use of a middle man to purchase items that could be bought directly with the payment card Split invoices Items that should have been purchased through another department Internal control issues REAL RISKS OF NO OVERSIGHT Split invoices Personal purchases disguised as legitimate work related purchases Personal items returned for cash Use of middleman to inflate costs (huge markups) Guaranteed business from state government WHERE THE TWO CASES DIFFER By Department and District Attorney’s Office DEPARTMENT ACTION State Department “A” Department was terminating with or without confession Two letters – one if he confessed – one if he didn’t confess Confiscated accrued annual leave Coded fraudster “not for rehire within the state” Prosecuted State Department “B” Moved the fraudster to another building Assigned a new supervisor Procurement privileges revoked Fraudster harassed former building facilities staff DISTRICT ATTORNEY ACTION State Department “A” Prosecuted Plead guilty Two years plus supervised probation Ordered restitution “We appreciate the opportunity to have represented the Department” State Department “B” Since the department declined to terminate employment with the subject we have decided not to prosecute KEYS TO PREVENTING FRAUD Upper management should be responsible and check for appropriate purchases on the front-end Provide training for the employee Ensure the integrity of the employee Ensure segregation of duties Back-end monitoring of purchases Zero tolerance COMPTROLLER’S ACTION Sent an immediate action notice to all state departments to review vendor purchases Required state departments to report the results of their review back to our office State contacted all vendors and reminded each that it was inappropriate to present gifts to state employees QUESTIONS? Melinda S. Crutchfield, CFE Division of State Audit Comptroller of the Treasury Melinda.Crutchfield@cot.tn.gov (615) 747-5308