Which of the following is a liability?

advertisement

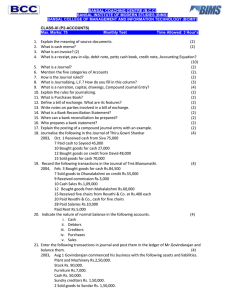

The Islamic University of Gaza Faculty of Commerce Accounting Department Review Questions Accounting Principles (1) 1 Question One Each of these multiple choice questions has four suggested answers, (A), (B), (C) and (D). you should read each question and then decide which choice is best, either (A) or (B) or (C) or (D). 1. Which of the following statements in incorrect? a. Assets – Capital = Liabilities. b. Liabilities + Capital = Assets. c. Liabilities + Assets = Capital. d. Assets – Liabilities = Capital. 2. Which of the following is not an assets? a. Buildings. b. Cash balance. c. Accounts receivable. d. Loan from K. Harris. 3. Which of the following is a liability? a. Machinery. b. Accounts payable for goods. c. Motor vehicles. d. Cash at bank. 4. Given the following, what is the amount of capital? Assets: premises $20,000: Inventory $8,500, Cash $100. Liabilities: Accounts payable $3,000, Loan from A. Adams $4,000: a. $21,100 b. $21,600 c. $32,400 d. $21,400 5. Which of the following is correct? a. Profit does not alter capital. b. Profit reduces capital. c. Capital can only come from profit. d. Profit increases capital. 2 Question Two: Enter the following transactions in the books of A. Yazji, then balance the accounts and extract a trial balance at 30 September 2014. Sept 1 Sept 2 Sept 4 Sept 5 Sept 6 Sept 8 Sept 11 Sept 12 Sept 15 Sept 20 Sept 22 Sept 26 Sept 27 Sept 28 Sept 30 Started business with $10,000 in the bank. Withdrew $2,000 from the bank and paid into the cash. Bought goods for cash $550. Bought goods on credit from T. Ghazal $800, K. Qishta $930 Bought furniture costing $2000 from Modern Furniture. A cash payment of $500 was made immediately; the remainder will be paid later. Paid insurance $1,800 by cheque. Bought stationery for $200 by cheque from Al Sharq Bookshop. Sold goods on credit to S. Hasan $600, A. Abdullah $920. Returned goods to K. Qishta $130. S. Hasan returned goods for $100. Received cash $300 from S. Hasan, and $ 130 from F. Ali. Cash sales $240. Paid by cheque $500 to T. Ghazal, and $400 to K.Qishta. Paid $150 cash for electricity and water expense. Withdrew $100 cash for private use. Q.3 Record the following details for the month of October 2006 and the balance off the bank account. 2006 Oct. Oct. Oct. Oct. Oct. Oct. Oct. Oct. Oct. Oct. Oct. Oct. Oct. 1 3 5 6 7 11 17 18 20 21 23 26 28 Started with $ 5,000 in the bank Bought goods on credit from: T Ahmed $160; J Ali $230 Cash sales $540 Paid rent by cheque$20 Paid taxes by cheque $190 Sold goods on credit to S Yousif $320; K Abdallah $1,170 Paid wages by cash $ 400 We returned goods to: T Ahmed $ 40 Goods were returned to us by K Abdallah $170 Bought motor van on credit from U Z Motors $500 We paid the following by cheques:T Ahmed $ 120; J Ali $230 Received a loan of $ 400 cash from Palestine ltd Received cheque form: S. Yousif $320 3 Oct. Oct. 30 Proprietor brings a further $3000 into the business, by a payment into the business bank account. 31 The proprietor took cash for himself $50 Q.4 Redraft the Bank Account given in your answer to Q.3 in three- column ledger style account. Q. 5 Record the following transactions in the Journal for the month of October 2009 and Post to the Cash account. 2009 Oct. 1 Ali yousef decides to open a new business, he invests $15,000 cash in the business. Oct. 3 Bought goods on credit from: H Ahmed $160; K Ali $230 Oct. 5 Cash sales $540 Oct. 6 Paid rent by cheque $200. Oct. 7 Expenses paid in cash for September are store rent $600; employees' salaries' $900, and utilities $200 Oct. 11 Sold goods on credit to W Auob $320; K Abdallah $1,170 Oct. 17 Ali yousef withdraws $300 in cash from the business for his personal use. Oct. 18 We returned goods to: H Ahmed $ 40 Oct. 20 Goods were returned to us by K Abdallah $170 Oct. 21 Bought motor van on credit from Motors Ltd $500 Oct. 23 We paid the following by cheques: H Ahmed $ 120; K Ali $230 Oct. 26 Received a loan of $ 4000 cash from Palestine Bank 4 Oct. 28 Received cheque form: W Auob $320 Oct. 30 Bought a new Car for the business for $3500 paid $1500 in cash and the remaining amount by cheque. Oct. 31 Ali Yousef took cash for himself $500. Question 6: Sea company had the following transactions at December 2009. Dec. 1 Starting business with $50,000 cash capital. Dec. 3 Cash register sales total $43,200 , which includes an , 8% sales tax. Dec. 5 Sold $20,000 of goods to LG Company, terms 2/10 , n /30 . Dec. 15 Received payment in full from LG Company for balance due . Dec. 15 One of the accounts receivable written off in November was from J. Hamdan , who pays the amount due, $14,000 , in cash . Dec. 15 Purchased equipment on account from WHM Co. for $26,000. Dec. 16 Purchased goods from New look Company for $18000 terms (2/10 n /30) FOB shipping point . Dec. 17 Paid freight costs of $800 on goods purchased from New look Co. Dec. 18 Returned damaged goods to New look Company and was granted a $4,000 allowance . Dec. 26 Paid the amount due to New Look Co. in full . Dec. 27 Issued $50,000 , 11% , 10 – year convertible bonds. The bonds sold at face value and pay semiannual interest on January 1 and July 1. Dec. 31 Paid December salaries $15300. Instructions : 1- Journalize the December transactions (20 Mark) . 2- Post the entries to cash account only and balance off this account (5 Marks) . Question 7 The following are selected transactions of Gaza company: Jan. 1 Invested $50,000 cash in the business. Jan. 2 Purchased merchandise on account from LG company, $30,000 , terms 2/10 , n/30. FOB shipping point . 5 Feb. 1 Issued a 9% , 2-month, $30,000 note to LG in payment of account. April 1 Paid in cash face value and interest on LG note . July 1 Purchase equipment from ANB company paying $11,000 in cash and signing a 10% , 9 month, $40,000 note . July 5 Paid fright costs of $900 on merchandise purchased from LG company. Aug. 3 Sold merchandise to LBC company $1200, terms 2/10 , n/30 . Aug. 10 Received credit of $200 from LBC company for merchandise that was returned . Aug. 13 Received cash payments from LBC company in settlement of their account . Oct. 9 Hire five employees to begin work on Nov. 1 Each employee is to receive a weekly salary of $700. Nov. 1 The owner of Gaza Company withdrew $500 cash for personal use. Nov. 5 Purchased Machinery for $12,000 paying $5000 in cash and the balance on account. Dec. 15 Sold accounts receivable of $8000 to Palestine Bank. The Bank assesses a service charge of 2% of the amount of receivables sold. Dec. 20 Sold merchandise for cash totaling $43,200 which includes 8% sales taxes. Dec. 31 Recognized interest expense for 6 month on ANB company note. Instructions: a) Prepare journal entries for the listed transactions and events. b) Post to cash account only and balance off this account. Question 8 2015 March 1 2 5 8 12 18 22 31 Started business with $ 15,000 cash. Paid $ 9,000 of opening cash into a bank account for the business. Bought office equipment on credit from Modern Equipment Ltd for $ 2,000. Bought a delivery van paying by cheque $ 6,000. Took $100 from the bank and paid into the cash. Paid Modern Equipment $1,500 cash. Received loan by cheque from Sami & Bros. $ 2,600. Paid the amount owing to Modern Equipment Ltd. Instructions : Journalize the March transactions. 6 Exercises 1. The following transactions relate to Said & Co, an accounting firm, during the month of November 2015. You are required to record these transactions in the journal of the firm. Nov. 1 2 2 3 4 7 11 17 29 30 Started business with $2,000 cash at bank. Withdrew $1,000 from the bank for business use. Hired a secretary at a salary of $1,000 per month. Purchased $800 of supplies on account from Modern Bookshop. Paid office rent for the month $500 cash. Completed an accounting task for a client and billed him $2,300 for services provided. Received $3,500 advance on a management consultancy engagement from a client. Received cash $1,200 for services completed for Palm Co. Paid Secretary her salary for the month. Paid half the balance due to Modern Bookshop. 2. Write up the following transactions in the books of S. Hassan, a retailer. July 1 2 3 4 5 7 8 10 11 14 17 20 21 23 25 31 Started business with $5,000 in the bank and $1,000 cash. Bought stationery by cheque $80. Bought goods on credit from T. Samir $2,100 Sold goods for cash $430 Paid insurance by cash $300 Bought office equipment on credit from J. Computers, $1,700. Paid for motor expenses by cheque $45 Sold goods on credit to Bader $650 Returned goods to T. Samir $500. Paid wages by cash $210 Paid rent by cheque $250. Received cheque $600 from Bader. Paid J. Computers by cheque $1,000. Bought stationery on credit from News Ltd. $125. Sold goods on credit to F. Tareq $650 Paid News Ltd by cheque $125. 3. Dr. Raed is a dentist. During the first month of the operation of his business, the following transactions occurred. Dec 1 1 2 3 4 5 Invested $10,000 cash to start business. Paid office rent for the month $200 by cheque. Withdrew $3,000 from the bank for office use. Purchased dental supplies on account from Gaza Dent $5,000. Provided dental services to various customers $6,600 cash. Paid $6,000 cash into the bank. 7 6 7 8 9 31 Received $1,000 cash advance from K. Walid for dental services. Received $2,000 cash for services completed and delivered to Salem. Paid salaries $3,000 cash to employees. Paid $1,900 to Gaza Dent on account. Withdrew $300 for private use. 4. Write up the following transactions in the journal of F. Fawzi Feb 1 2 3 4 5 6 7 10 13 15 20 21 24 28 Started in business with$10,000 cash in the bank and $2,000 cash at hand. Bought goods on credit from J. Baron $830, D. Mahmoud $610. Paid rent in cash $100. Bought goods for cash $270. Bought stationery from Perfect Stationer’s and paid by cheque $120. Sold goods on credit to D. Tawfiq $470; B. Haroun $380; K. Falah $410. Paid wages in cash $170. We returned goods to D. Mahmoud $210. B. Haroun returned goods to us $38. Paid insurance in cash $100. Bought van on credit from B. Blank $8,000. Paid motor expenses $220. Received part of amount owing from K. Falah $210. Paid by cheque: J. Baron $500; D. Mahmoud $200. 5. Write up the following transactions in journal of Fathi, a fishmonger. April 1 2 3 4 5 6 7 10 13 15 16 18 25 30 Started business with $11,000 in the bank and $1,500 cash. Bought goods on credit: J. Fisher $800; D. Miller $600; P. Alan $500. Bought goods for cash $400. Paid rent in cash $100. Bought stationery paying by cheque $60. Sold goods on credit: D. Tawfiq $730; B. Hassan $300; K. Falah $400. Paid wages in cash $160. Returned goods to D. Miller $100. B. Hassan returned goods $45. Paid insurance in cash $200. Bought van on credit from B. Black $8,000. Paid motor expenses in cash $42. Received part of amount owing from K. Falah by cheque $200. Paid by cheque: J. Fisher $300; D. Miller $200; P. Alan $400. 6. Enter the following transactions in the journal of Hammad, a service firm. May 1 2 3 Proprietor invested $5,000 cash as a start-up capital. Hired two employees to work in the business. They will each be paid a salary of $1,000 per month. Paid rent $2,000 cash on a warehouse. 8 4 5 6 7 8 10 11 31 Purchased furniture and equipment costing $1,200 from Modern Furniture Ltd. Paid $600 immediately and the remainder to be paid later. Paid $800 cash for an insurance policy. Purchased basic office supplies for $50 cash. Total revenue earned $10,000: $8,000 cash and $2,000 on account. Paid suppliers $900 for accounts payable due. Received $400 from customers in payment of accounts receivable. Received utility bills in the amount of $260 to be paid next month. Paid the salaries for the employees hired on May 2. . 7- Abeer is a licensed accountant. During the first month of operation of her business, the following events and transactions occurred. March 1 2 3 10 11 13 20 Paid in cash $4,000 cash to start the business. Paid office rent for the month, cash $900. Purchased office supplies for cash $1,000. Provided accounting services on account to Trust Insurance Co. $1,000. Received $950 cash advance from Modern Stores for accounting services to be performed during the next three months. Received $2,000 cash for accounting services completed for Said, a wholesaler. Withdrew $300 for personal use. Prepare the journal entries to record the above transactions and post them to the ledger. 8- Write up the necessary journal entries to record the following transactions and then post them to the respective ledger accounts. March 1 Started business with cash $16,000. 1 Bought furniture and equipment $700. 2 Bought goods on credit from Young $400. 3 Paid rent by cash $780. 5 Paid $12,000 of the cash of the business into a bank account. 6 Sold goods on credit to D. Anbar $210. 12 Bought stationery $55 cash. 13 Cash sales $340. 15 Goods returned by Young $150. 17 Sold goods to Harper $320. 19 Paid Young by cheque $200. 22 Harper returned returned goods $32. 28 Cash purchases $50. 29 Bought van paying by cheque $3,800. 30 Paid motor expenses $52 cash. 31 Bought office computer $800 by cheque. 31 Paid salaries by cheque $1,000. 31 Proprietor brings in $2,000 cash as additional capital. 9 9- Record the following transactions relating to a carpet dealer for the month of November 2015 in the journal of the firm and then post them to the ledger. Nov 1 Started business with $15,000 in the bank. 2 Bought goods on credit from Ismail $290; Bassam $1,200; Rami $600. 3 Cash sales $530. 5 Paid rent by cheque $400. 7 Sold goods on credit to: Basel $85; Falah$450; Jamal $320. 9 Paid wages in cash $210. 10 Returned goods to Ismail $90; Rami $100. 11 Goods returned by Basel $5; Falah $50. 21 Bought van for proprietor’s personal use by cheque $3,000. 25 Received cheques from Basel $100; Jamal $150. 27 Proprietor brings in additional capital $800 cash. 31 Paid salaries by cheque $1,000. 10- Barcelona Sports Services was formed in September 2013. The following transactions took place during the first month: Sep 1 2 4 6 8 11 15 20 28 30 The Company invested $50,000 cash. Hired two employees to work for the Company. They will each be paid a salary of $2,000 per month. Signed a rental agreement for an office building and paid $24,000 cash. Purchased furniture and equipment costing $30,000. A cash payment of $10,000 was made immediately; the remainder will be paid in six months. Paid $1,800 cash for a one-year insurance policy on the building. Purchased office supplies for $1,500 on account. Total revenues earned were $20,000: $8,000 cash and $12,000 on account. Received $3,000 from customers in payment of accounts receivable. Paid $300 cash for electricity and water expense. Paid salaries for the two employees hired on Sept 2. You are required to prepare the necessary journal entries to record the above events; and to post the journal entries to the Ledger accounts. 11- Prepare the journal entries necessary to record the following transactions in the books of General Trading Co. May 1 2 3 4 5 Purchased merchandize on account from Success Co for $3,800. Paid freight charges $150 cash in respect of the above purchase. Returned to Success Co merchandize costing $300 for being unsatisfactory. Purchased merchandize for cash $2,000 from Female Accountants Inc. Returned to Female Accountants Inc. merchandize costing $300 and obtained a refund. 10 7 9 10 11 12 14 20 Purchased Office Furniture for cash $900. Paid the balance due to Success Co. Sold goods on credit to Excellence Co. on credit for $4,000. Cost $3,000. Sold goods on credit to Arab Supplies Inc. for $1,600. The cost of the goods $1,200. Paid $100 cash for the delivery of the above goods. Arab Supplies Inc. returns merchandize, selling price $200. Arab Supplies settles the promissory note. 12- Enter the following transactions in the books of A. Yazji, then balance the accounts and extract a trial balance at September 2015. Sept 1 2 4 5 6 8 11 12 15 20 22 26 27 28 30 Started business with $10,000 in the bank. Withdrew $2,000 from the bank and paid into the cash. Bought goods for cash $550. Bought goods on credit from T. Ghazal $800, K. Qishta $930 Bought furniture costing $2000 from Abu Louz Modern Furniture. A cash payment of $500 was made immediately; the remainder will be paid later. Paid insurance $1,800 by cheque. Bought stationery for $200 by cheque from Al Sharq Bookshop. Sold goods on credit to S. Hasan $600, A. Abdullah $920. Returned goods to K. Qishta $130. S. Hasan returned goods for $100. Received cash $300 from S. Hasan, and $ 130 from F. Ali. Cash sales $240. Paid by cheque $500 to T. Ghazal, and $400 to K.Qishta. Paid $150 cash for electricity and water expense. Withdrew $100 cash for private use. 13- Prepare the journal entries necessary to record the following transactions in the Books of Success Inc. and post the same to the ledger of the firm. Oct. 1 2 3 4 5 7 9 9 10 10 11 Purchased merchandize on account from Good Students Co for $3,800. Paid freight charges $150 cash in respect of the above purchase. Returned to Good Students Co merchandize costing $300 for being unsatisfactory. Purchased merchandize for cash $2,000 from Female Accountants Inc. Returned to Female Accountants Inc. merchandize costing $400 and obtained a refund. Purchased Office Furniture for cash $900. Paid the balance due to Good Students Co. Sold goods on credit to Excellence Co. on credit for $4,800. Sold goods on credit to Arab Supplies Inc. for $1,600. Paid $100 cash for the delivery of the above goods. Arab Supplies Inc. returns merchandize $200. 11 31 Success Inc decides to write off $200 of the amount due from Excellence Co. as uncollectable. 14- Record the following transactions relating to Hanan, a grocer, for the month of December 2015 and extract a trial balance as at 31 December 2015. Dec 1 2 3 4 5 6 7 8 9 10 11 12 12 13 14 15 16 29 30 31 Started business with $20,000 cash. Put $8,000 of the cash into a bank account in the name of the firm. Bought goods for cash $340. Bought goods on credit from Dareen $800; Hoda $930; Samia $160. Bought stationery on credit from Basma Ltd $90. Sold goods on credit to Tamer $270; Firyal $240; Sanabel $320; Tamara $240. Paid rent by cheque $200. Bought fixtures on credit from Excellent Furniture Ltd. $700. Paid salaries in cash $600. Returned goods to Hoda $30; Samia $40. Bought van by cheque $6,400. Received loan from Bara $2,000 by cheque. Goods returned by Tamer $70; Sanabel $20. Cash sales $150. Sold goods on credit to Firyal $120; Tamara $410. Paid the following by cheque: Hoda $900; Samia $110. Received cheques from Firyal $370; Tamara $200. Hanan brings in additional capital $2,000 cash. Hanan withdraws cash for personal use $500. Received $600 cash from Sanabel $300. 15- Enter the following transactions of an antiques shop in the accounts and extract a trial balance as at 30 November 2015. Nov 1 Started business with $8,000 in the bank. 2 Bought goods on credit from Fadi $550; Bayan $540; Lamis $600. 3 Cash sales $610. 4 Paid wages in cash $120. 6 Sold goods on credit to Sana $295; Basem $420; Talal $640. 9 Bought goods on credit from Bayan $320; Rami $1,200. 10 Bought goods for cash $120. 12 Bought office furniture on credit from Stop Ltd $740. 17 Paid Bayan by cheque $700. 18 Returned goods to Lamis $100. 21 Paid stop Ltd a cheque for $740. 24 Talal paid his account by cheque $600. 27 Returned goods to Fadi $20. 30 Jamil lent us $1,000 in cash. 30 Bought van paying by cheque $6,450. 12 16- You are required to open the books of F. Bader, a trader, via the journal to record the assets and liabilities and then to record the following transactions for the month of May. A trial balance is to be extracted as on 31 May 2015. May, 2015 1 2 3 4 5 7 9 11 12 13 14 16 19 20 24 30 31 Assets: Premises $30,000; Van $5,000; Fixtures $800; Inventory $6,000; accounts Receivable: B. Muhsen $140; F. Lamia $300; Cash at Bank $6240; Cash in hand $560. Liabilities: Accounts Payable; S. Hani $215; J. Barhoum $640. Paid rent by cheque $400. Goods bought on credit from: S. Hani $145; D. Mabrouk $206; W. Tala $94 R. Faten $66. Goods sold on credit to: J. Walid $112; T. Kamal $164; F. Sami $208; J. Ali $91; P. Salman $242; F. Lamia $90. Paid for motor expenses in cash $60. Cash drawings by proprietor $150 for personal use. Goods sold on credit to: T. Kamal $68; J. Fadel $131. Goods returned to us by: J. Walid $32; F. Sami $48. Withdrew $100 from the bank and paid into Cash. Bader withdrew inventory costing $200 for private use. Bought another van on credit from Abed Motors Ltd. $5,000. The following paid us their accounts by cheque less 5% cash discount: B. Muhsen; F. Lamia; J. Walid; F. Sami. Goods returned by Bader to R. Faten $6; Mabrouk $56; Tala $24. Paid $200 from Cash into Bank. The following accounts were settled by Bader by cheque less 5% cash discount: S. Hani; J. Barhoum; R. Faten. Purchased office computer from Modern Computers Ltd and paid by cheque $1,400. Paid Abed Motors Ltd their account by cheque. Good Luck 13