draft - Ministry of Labour and Small Enterprise Development

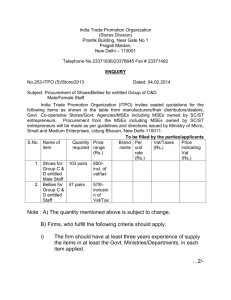

advertisement