Contents Page 1 – Exam pointers Page 2 – Representative

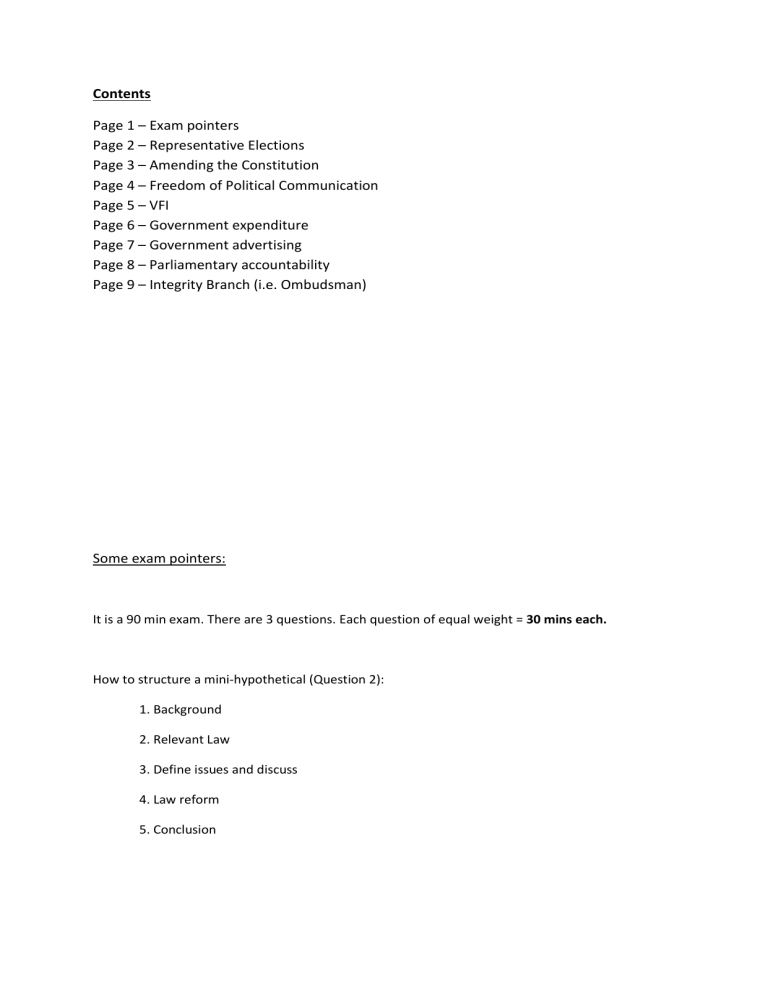

Contents

Page 1 – Exam pointers

Page 2 – Representative Elections

Page 3 – Amending the Constitution

Page 4 – Freedom of Political Communication

Page 5 – VFI

Page 6 – Government expenditure

Page 7 – Government advertising

Page 8 – Parliamentary accountability

Page 9 – Integrity Branch (i.e. Ombudsman)

Some exam pointers:

It is a 90 min exam. There are 3 questions. Each question of equal weight = 30 mins each.

How to structure a mini-hypothetical (Question 2):

1. Background

2. Relevant Law

3. Define issues and discuss

4. Law reform

5. Conclusion

Representative Elections (McKinlay’s Case) (s7 & 24) (Roach v Electoral Commissioner)

Generally, the High Court has been a reluctant reviewer of electoral legislation.

McKinlay’s Case

Facts:

The High Court was asked to consider the question of whether the Constitution required adherence to the principle of ‘one vote, one value’.

This was in regards to an allowed 20% difference in size between electoral boundaries.

Decision 4:1:

S 7 and 24 ‘chosen by the people' implied an outer limit against gross disparities, but 20% was fine.

Roach v Electoral Commissioner

Facts:

Amendments made in 2006 that prevented all prisoners from voting were challenged, as was previous legislation preventing all prisoners serving a sentence of 3 years or greater from voting.

Decision 4:2:

Majority held that the right to vote was constitutionally protected. Universal suffrage was long established; anything less was not a choice by the people as required by s 7 and 24 of the

Constitution.

Removing right to vote for serious misconduct was acceptable (hence the previous legislation was valid); however imprisonment failed as a method of identifying serious criminal misconduct when looking at short-term sentences.

Therefore the current legislation was invalid, previous legislation valid.

Amending the Constitution (s 128)

A referendum may be proposed by either house of Federal Parliament. The opposite house must pass the bill unamended. It then goes to the Australian people. The test is –

1. A majority of electors in a majority of states (four out of six);

2. A majority of all electors across Australia (including electors in territories)

This is known as the ‘double majority’. One issue is that the State’s cannot propose a referendum, likely because the founding fathers saw the Senate back then as a ‘State’s House’.

Some terms which were discussed…

Direct democracy: people have a direct say.

Representative democracy: people vote for someone to represent their interests.

A referendum falls somewhere between the two. Direct say but electors themselves are unable to propose one.

Freedom of Political Communication (s 7 & 24) (ACTV v Commonwealth)

ACTV v Commonwealth

Facts:

The purpose of the legislative in question in the ACTV case prohibited (with some exceptions) political advertisements on TV or radio during the lead-up period to a state or federal election. The aim of the legislation was to bring about political equality by limiting the cost of advertising and thus also perhaps limiting corruption. Instead, the TV companies would provide registered political parties with a specified amount of free air time.

Reasoning by the majority, 5:2 – It is a 5 part process:

1. The High Court first looked at sections 7 and 24 of the Constitution. They both say ‘directly chosen by the people’.

2. The court then derived from these statements the notions of representative democracy.

That is, the people directly elect representatives to look after their interests.

3. In order to have a representative democracy, you need to be able to hold the people representing your interests accountable.

4. There needs to be a two-way communication between those electing the represented and those representing to have any accountability.

Decision

5. Therefore, there is a sneakily hidden implied right to freedom of political communication within the Constitution.

The HCA found an implied right to freedom of political communication in s 7 & 24 of the

Constitution. The proposed legislation was deemed invalid.

What to do if there is a question on limiting political donations

Method 1: If giving money to advertising is okay, giving to party and expressing my personal preference is clearly implied as well.

Method 2: ‘Directly chosen by the people’ (s 7 & 24) -- > Representative democracy -- >

Accountability -- > Communication with electors --- > Freedom of association

* Both methods were advocated by Allan in the tute. He also said to read ACTV before the exam.

Vertical Fiscal Imbalance (VFI) (s 96 – tied grants), (s 51 – legislative powers of the parliament)

Commonwealth gets 82% of taxation revenue but only has 50% of spending responsibilities. States are meant to maintain most public services and facilities (at least in theory); therefore they need money from the Federal government.

Benefits of VFI: Enabling national policies (e.g. Education) and vertical competitive federalism.

Problems: Eroding federal division of powers, including accountability.

Tied grants power (s 96)

Commonwealth may fund money to states with conditions attached and into areas where they may not have the power under s 51.

Federal government can also spend money directly (e.g. Universities). This type of funding was challenged unsuccessfully in Pape’s case.

Government Expenditure (Combet v Commonwealth), (s 81 & 83 – appropriations power),

(Pape v Commissioner of Taxation)

Combet v Commonwealth

Facts:

Challenge against the lawfulness of the Federal Government's use of public funds to advertise the new Workchoices laws.

Reasoning by the majority, 5:2:

Under section 81 of the Constitution, all monies raised by the executive government of the commonwealth must “be appropriated for the purposes of the Commonwealth in the manner and subject to the charges and liabilities imposed”.

Furthermore, section 83 of the constitution forbids the drawing of money from the commonwealth except under “appropriation made by law”.

The government had stated what the funds were being used for and it was not the job of the courts to decide whether government policy would result in its stated goals. Budget appropriations are essentially a parliamentary political matter.

Decision: Advertising government policy using public funds is lawful under the appropriation.

Pape v Commissioner of Taxation

Facts:

Mr Pape challenged the $900 stimulus package arguing that it was not supported by the taxation power in the Constitution. The Commonwealth argued it was supported by the appropriations power under s 81.

Decision by majority of 6:1:

S 81 & 83 not sources of power to spend. They are used to regulate/require the executive to draw money via some act of parliament. Mr Pape lost but this case but the case cast doubt on the breath of direct power to spend.

*If a VFI question were to appear on the exam, it would likely touch on the issues of Federalism too.

Government Advertising (ACTV v Commonwealth) (Combet v Commonwealth)

Government advertising is all about balancing propaganda vs. information.

It can pose a risk to political equality (that is a more or less equal playing field for both the government/opposition).

ACTV v Commonwealth provides a solid justification for government advertising, but not a legal entitlement. Furthermore, there is a strong difference between an implied DUTY and an implied

RIGHT.

Combet v Commonwealth essentially emphasises that the courts are unlikely to get involved provided that the spending is made under an appropriation.

*Allan heavily emphasised Questions 1- ‘Does government advertising pose a risk to political equality?’ and Q7 (a) – ‘In

May 2010, the Rudd government invoked paragraph 5 of the guidelines to bring forward a campaign promoting its taxation policy, especially the super mining profits tax. Did it have a ‘compelling reason’ to do so?’ during the Tutorial 9 tute.

Parliamentary Accountability

Accountability: Oversight, Some Transparency, Consequences

Oversight over Legislation (Limited)

Debates, perhaps inquiry into bill

Senate scrutiny committee

Oversight over Administration

General debate

Question time

Committee inquiries

Grievances (specific or general constituency concerns)

Conventional sanctions

Minister resignation for misleading Parliament

Power to summon public servants, even Ministers staff, but not members of other House

Integrity Branch (for PPL’s purposes – the Ombudsman)

Ombudsman Pros

Free

Less formal than legal action

Independent

Degree of expertise and knowledge

Can deal with neglect/rudeness

Ombudsman Cons

Discretion not to investigate

Independence also means no complaint control

No binding remedies

Large workload

Ombudsman department is an independent executive agency. They are answerable to parliament and are hard to remove (long tenure).

What if the ombudsman could make binding decisions?

Politicised

Formal

Increased costs

May need an appeal mechanism?

*The probability of the integrity branch being examined is enormous. Allan hinted at it very bluntly.