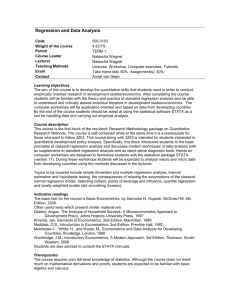

umecrw-20-3

advertisement

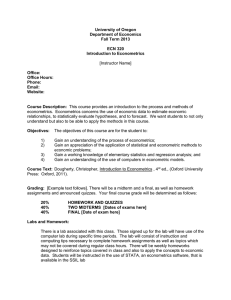

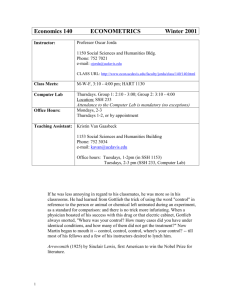

+ Bristol Business School Academic Year: 09/10 Assessment Period: August Assessment Type: Referral Coursework Module Leader: Module Number: Module Name: Word Limit: Tony Flegg UMECRW-20-3 Econometrics …. Coursework Submission Date and Time: Assignments are to be submitted by 2pm Monday 16 August 2010 at the assignment boxes near Cribs coffee shop (2B corridor). Please be aware that there is NO 24hr or 10 day window this year. If you wish to post your assignment, we recommend that you post it via Recorded Delivery and obtain proof of the date and time of posting. Your work must be in the post by the deadline. Deadline: Monday 16 August 2010 14:00 Assignment Instruction: UMECRW-20-3 ECONOMETRICS REFERRED ASSIGNMENT AUGUST 2010: Part I (60 marks) Introduction This part of the referred coursework is concerned with using regression analysis to analyse the determinants of demand for butter and margarine in Great Britain. You will be making use of a database specially constructed for this purpose. It contains annual data for the period 1956–96 on the prices and quantities consumed of butter and margarine, the retail price index for all food and an index of real personal disposable income per head. Your main task is to develop an appropriate econometric demand function for both of these commodities, using data for the subperiod 1970–94. After examining your results in detail, you are asked to forecast the consumption of both commodities up to 1996. Section 1: The Estimation of Alternative Demand Functions (20 marks) Use Microfit and the data file BUT96.FIT to construct alternative linear demand functions for both butter and margarine, using OLS and data for the subperiod 1970–94 (see page 3). Choose no more than four of your regressions for purposes of discussion (two models for each commodity). A summary of your results must be presented in tabular form in the body of your report, with the full results of your modelling included in an appendix. You should make full use of the available Microfit commands to produce a correlation matrix for the estimation period, plots of residuals, fitted and observed values of the regressand, etc. Cross-reference the results in the appendix with those in your summary table. In this table, show standard errors in parentheses beneath the regression coefficients, followed by t ratios in bold type. At the bottom of the table, report R2, R 2 , the standard error of the regression, the D.W. statistic, Durbin's h (if applicable), along with the four χ 2 diagnostic test statistics. To avoid charges of spurious accuracy, round all figures appropriately. Include a glossary giving precise definitions of the variables (including units of measurement). Provide a rationale for the inclusion of the various regressors in your demand functions and comment briefly on the process whereby you arrived at these particular regressions. Are the signs of the regression coefficients in accordance with theoretical expectations? Section 2: Goodness of Fit (5 marks) Explain the rationale and derivation of Theil's adjusted R2 and Amemiya's modified R2. Are they in agreement as to the best model? If not, why not? Does the standard error of the regression give the same ranking of models as Theil's R 2 ? If so, is this merely a coincidence? Section 3: Other Considerations (15 marks) Apart from goodness of fit, what additional considerations should be borne in mind when selecting a regression equation? In the light of these considerations, is the equation yielding the best fit in this instance still the most satisfactory one? Section 4: Using the Wrong Explanatory Variables (15 marks) Carefully explain the theoretical consequences of (i) excluding a relevant regressor and (ii) including an irrelevant one. Illustrate your answer by referring to your regression results. Section 5: Alternative Functional Forms (15 marks) Re-estimate your preferred linear demand function in log-linear, exponential and hyperbolic forms. Present your results in tabular form as in Section 1. Obtain estimates of the price and income elasticities of demand in 1980 and 1994 for each non-linear model and compare the results with the corresponding figures for your best linear model. Which model, if any, do you regard as the most satisfactory for each commodity? Section 6: Interpretation of Regression Coefficients (10 marks) Using, for each commodity, your preferred linear or non-linear regression equation, carefully explain how the results can be interpreted. Illustrate your answer diagrammatically. Comment on the statistical reliability of the results. Section 7: Intertemporal Stability of Coefficients (10 marks) Now re-estimate your preferred demand functions for each commodity, using data for two appropriate subperiods. Perform an appropriate statistical test to see whether it is reasonable to treat the period 1970–94 as a whole. Carefully explain the rationale of the test you decide to employ. Comment on your findings. Section 8: Forecasting (10 marks) Use your preferred regression models to forecast consumption of butter and margarine in the two post-estimation years. How well do your models perform? Try to explain any discrepancies between forecasted and observed consumption. With hindsight, how could you have improved your models? Suggested References Lecture notes and handouts plus: Dougherty, Introduction to Econometrics, 2nd ed., pp. 60–2, 105–9, 128– 32, 149–60, 170–4, 191–3, 196–208, 219, 334–42, 346–8, 355–62 Gujarati, Essentials of Econometrics, 2nd ed., pp. 218–28, 239–50, 313– 36, 377–91, 405–24 Kennedy, A Guide to Econometrics, 4th ed., pp. 73–83, 121–4, 183–9, 221– 6, 288–92 Maddala, Introduction to Econometrics, 2nd ed., especially pp. 88–101, 161–77, 229–32, 269–80 Maddala, Introduction to Econometrics, 3rd ed., especially pp. 159–76, 228–30, 245–7, 479–88 Studenmund, Using Econometrics: A Practical Guide, 5th ed., especially chapters 3, 69, 11 Thomas, Modern Econometrics, pp. 237–44, 260–9, 296–307, 339–48, 354–9, 361–8 Verbeek, A Guide to Modern Econometrics, 2nd ed., chapter 3 Notes of Guidance: Please see page 6 of the module handbook. Deadline: late August 2010 (exact date not yet determined). Submit your work via the BBS assignment boxes near Cribbs café. Tony Flegg May 2010 APPENDIX Names and description of variables included in BUT96.FIT 1 QB 2 QM 3 PB 4 PM 5 RPIAF 6 INC 100) 7 RPB 8 RPM 9 A 10 TIME Quantity of butter Quantity of margarine Average yearly price of butter Average yearly price of margarine Retail price index for all food (1980 = 100) Index of real personal disposable income per head (1980 = Real price of butter [(PB RPIAF) 100] Real price of margarine [(PM RPIAF) 100] Intercept (column of ones) linear trend starting in 1970 Note: Quantities are grams per person per week; prices are in pence per kilogram. Note: The data file can be accessed via Tony’s folder on the network and on Blackboard under Assignments. UMECRW-20-3 ECONOMETRICS REFERRED ASSIGNMENT AUGUST 2010: Part II (40 marks) The Microfit file UKCON.FIT, to be found in the Microfit TUTOR datasets and in the Assignment folder on Blackboard, contains 161 quarterly observations on consumer expenditure and disposable income in the UK for the period 1956Q1 to 1995Q1. You are required to investigate and model the behaviour of real consumers’ expenditure (SEASONALLY ADJUSTED) and to provide forecasts of this expenditure for a fourquarter period. The relevant dependent variable name in this dataset is C. You should aim to develop optimal forms of TWO unconstrained models, optimality being determined by the standard statistical diagnostics as well as forecasting performance. The first is to be a linear regression model using only (as required) time trends and lagged values of the dependent variable as possible regressors, i.e. essentially an AR model. The second model will incorporate further behavioural explanatory variables (as included in the dataset) in current and/or lagged form, i.e. essentially an ARDL model. In both instances, you may wish to consider functional transformations of some or all of the variables used and you will need to experiment to determine the optimal model of each type. You should not use any form of alternative estimation method e.g. Koyck or Almon approaches. You should write a brief summary report outlining the exploratory, modelling and analytical work undertaken. An essential part of this work is a clear explanation of the way in which you have developed your optimal model. You should provide a comparative appraisal of your two optimal models, indicating which you think performs best and for what reason(s). Assessment will be based upon content, structure, clarity of explanation, use of language and presentation. You should include a summary table of your results in the text and supporting Microfit printout, plots, etc. in the appendices. ALL pages must be numbered and cross-referencing used where necessary. The report should not exceed 1000 words (excluding footnotes, bibliography and appendices). It is essential that your report is independently written and represents your understanding and perception of the models used. Be aware of the university’s rules relating to plagiarism. COURSEWORK HELP, ADVICE AND MORAL SUPPORT? I will be available for all but a week or so in July and August by email and phone to answer queries about progress and direction. I can be contacted by email on chris.webber@uwe.ac.uk or on 07979-547932 (mobile), including evenings up to 7.00 pm but not weekends, please. Chris Webber May 2010 Deadline: late August 2010 (exact date not yet determined). Submit your work via the BBS assignment boxes near Cribbs café.